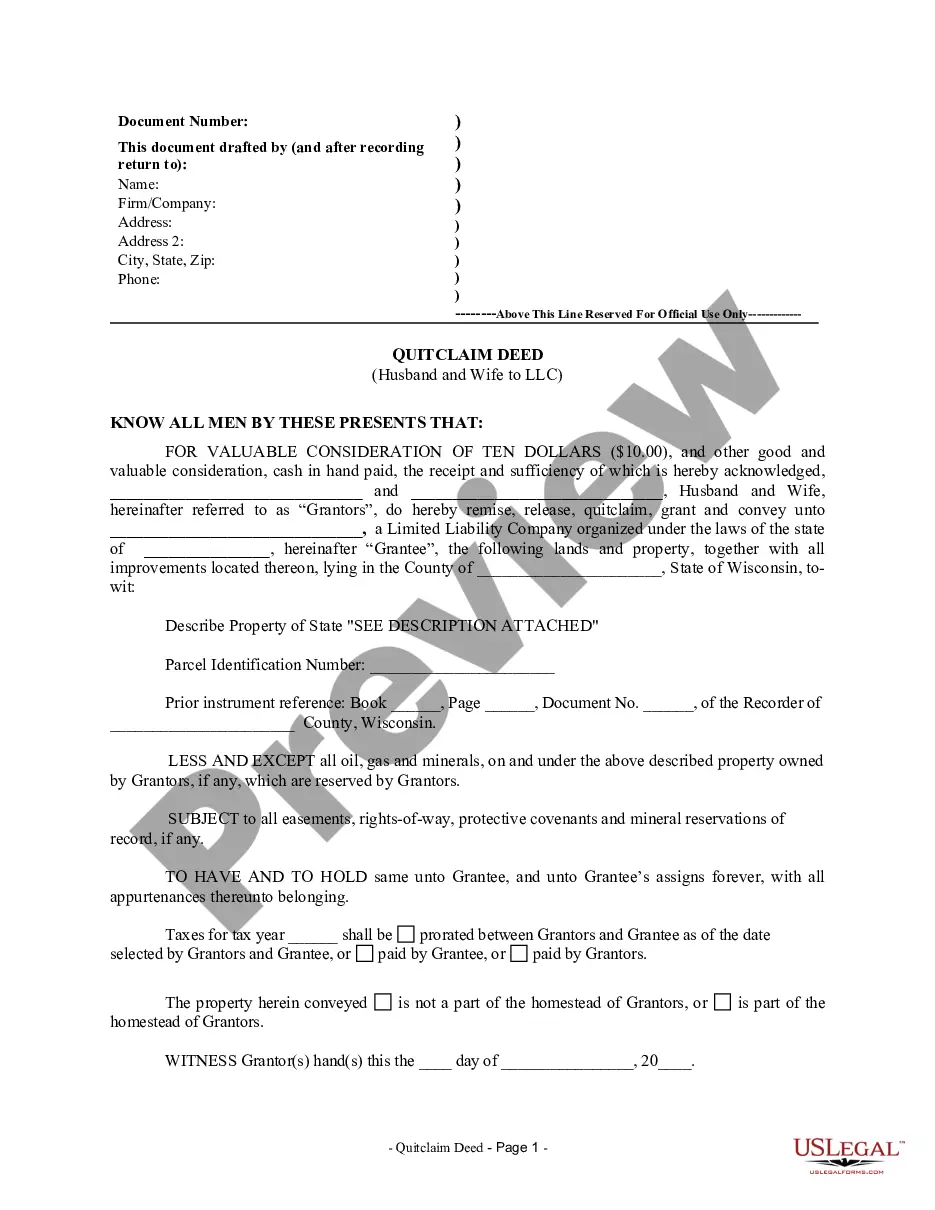

Wisconsin Quitclaim Deed from Husband and Wife to LLC

Definition and meaning

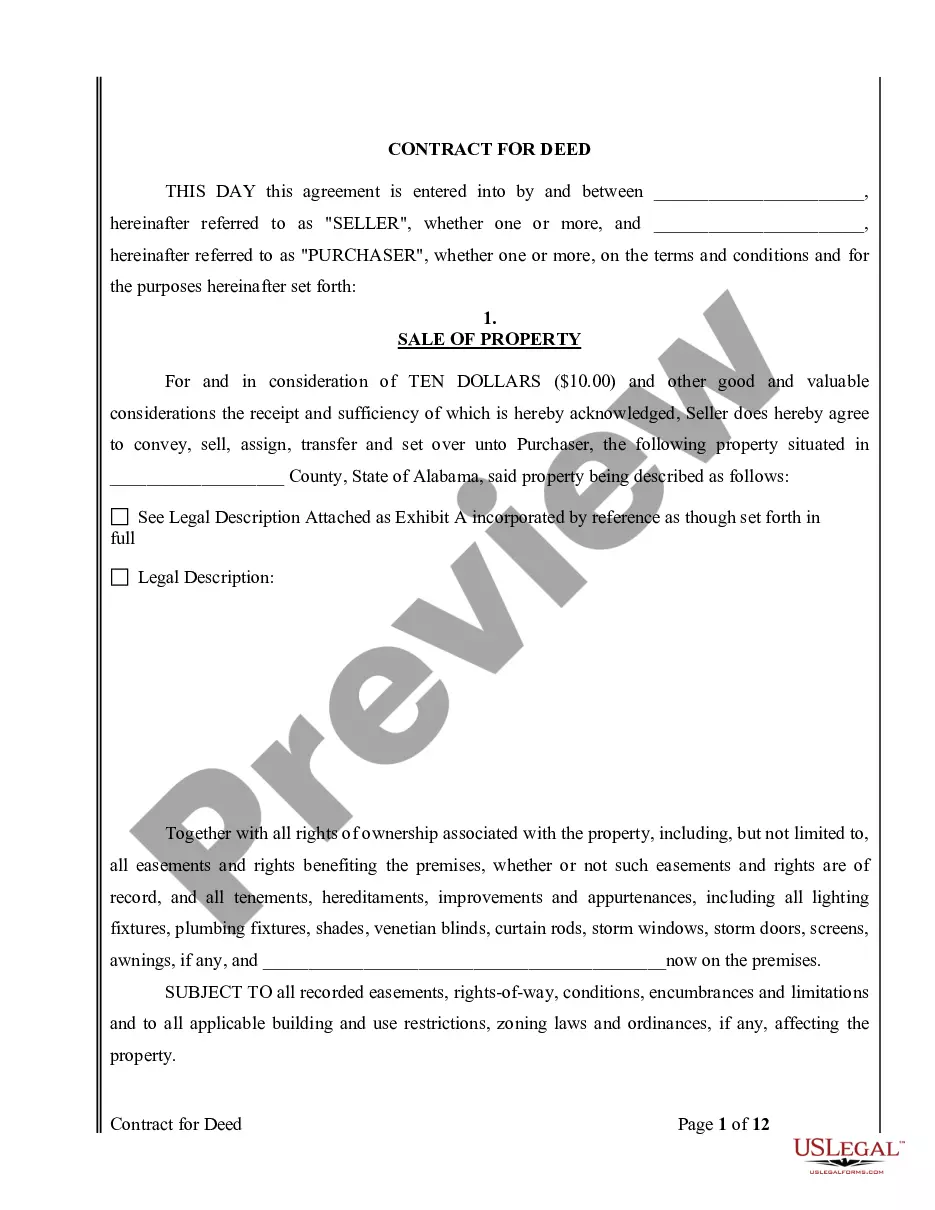

A Wisconsin Quitclaim Deed from Husband and Wife to LLC is a legal document used to transfer ownership of property from a married couple to a Limited Liability Company (LLC). This type of deed offers a way for property owners to relinquish their claim on the property, thereby transferring their rights to the LLC without guaranteeing the validity of the title. It is typically used in situations where the owners want to convert personal property to business ownership or for other strategic reasons.

Who should use this form

This form is ideal for couples who own real estate and wish to transfer their ownership to a newly formed or existing LLC. It is particularly useful for those looking to protect their assets, simplify estate transactions, or facilitate business operations. Anyone considering this transfer should seek legal advice to ensure it aligns with their financial and familial goals.

Key components of the form

A Wisconsin Quitclaim Deed typically includes the following key components:

- Names of the Grantors (the owners) and Grantee (the LLC)

- Consideration amount, often nominal such as ten dollars

- Description of the property being conveyed

- Parcel Identification Number (PIN) for precise identification

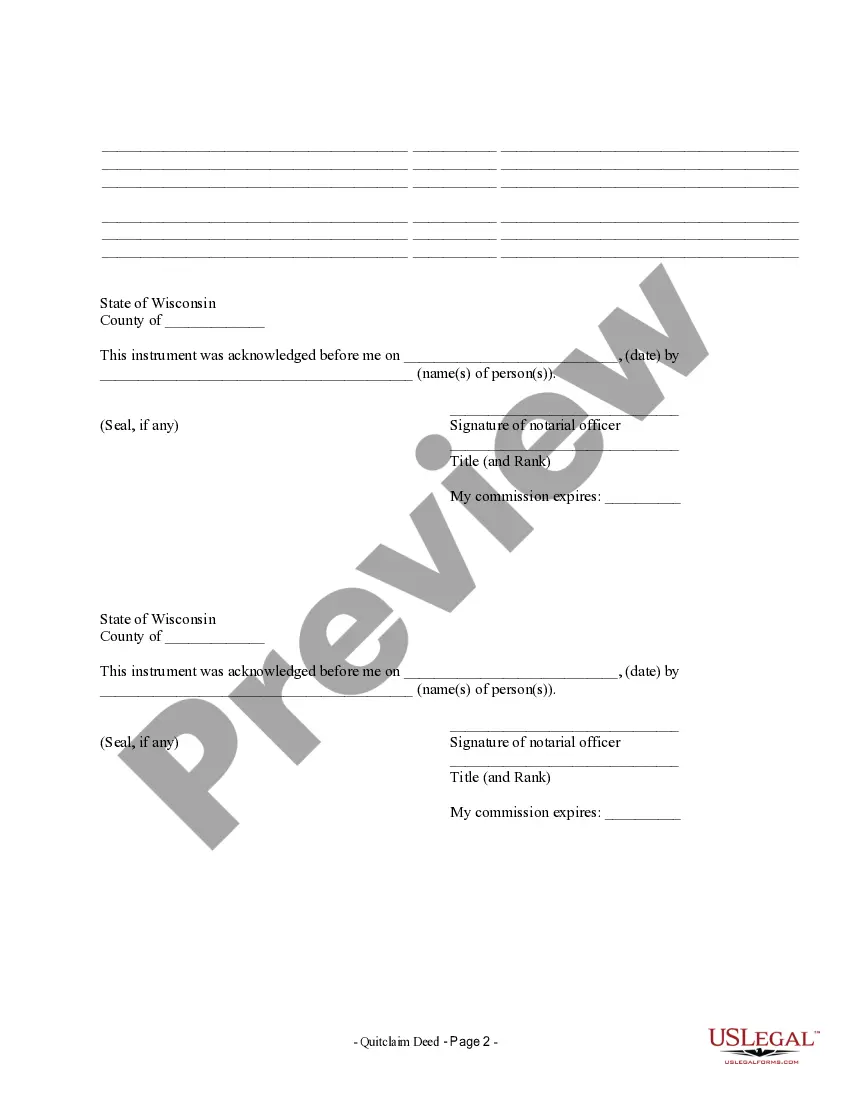

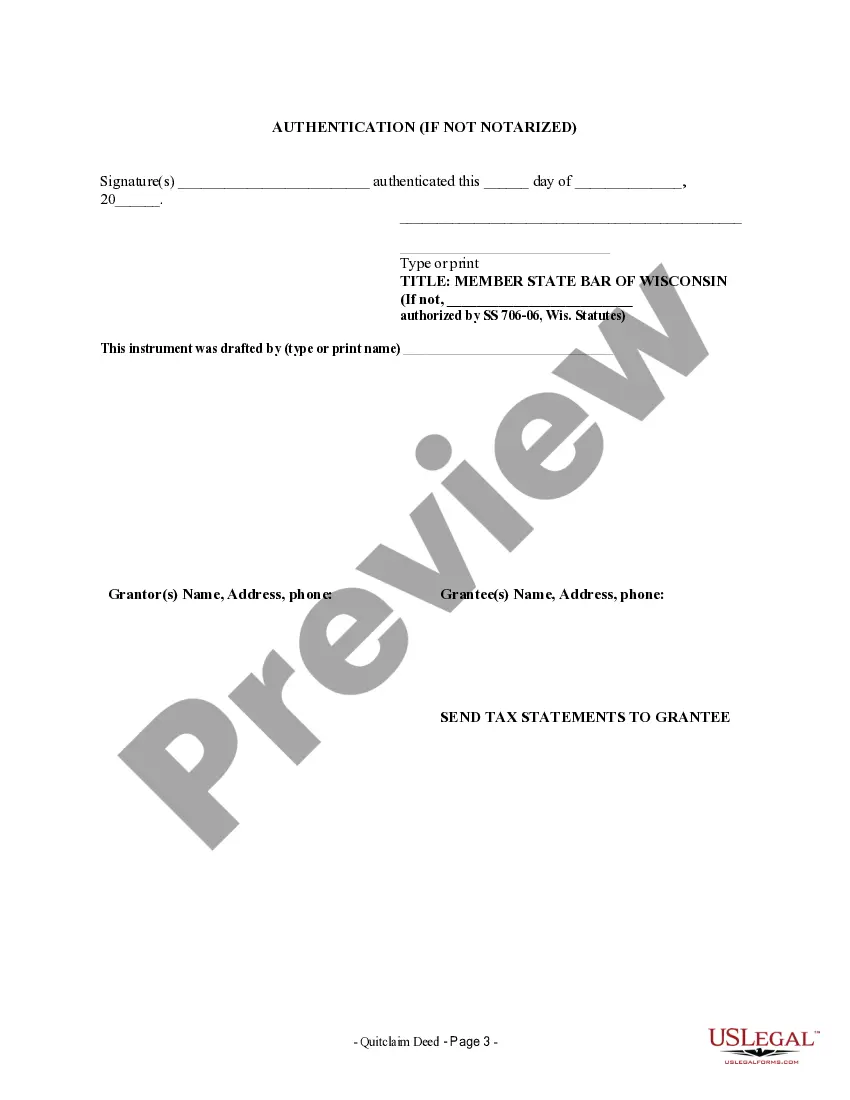

- Notary section for authentication

- Signature lines for Grantors and notarization details

Each of these elements is crucial for the legal validity of the deed, and careful attention should be paid to ensure accurate completion.

How to complete a form

To complete the Wisconsin Quitclaim Deed from Husband and Wife to LLC, follow these steps:

- Begin by entering the names of the Grantors (the husband and wife).

- Write the name of the Grantee (the LLC) to which the property is being transferred.

- Include a clear description of the property, preferably as stated in prior deeds.

- Fill in the Parcel Identification Number for easy reference.

- State the consideration amount (often $10) and any other valuable considerations.

- Provide necessary signatures in front of a notary public.

- Ensure that all relevant sections are completed, including the notary acknowledgment.

Always review the completed form for accuracy and compliance with state regulations.

Common mistakes to avoid when using this form

When completing a Wisconsin Quitclaim Deed, several common mistakes can occur:

- Failing to include a complete property description.

- Not providing the Parcel Identification Number.

- Omitting signatures or not having the signature acknowledged by a notary.

- Incorrectly stating the consideration amount.

- Forgetting to reference any existing prior instruments related to the property.

To avoid these errors, consider consulting with a legal professional before submission.

Benefits of using this form online

Utilizing an online service to complete a Wisconsin Quitclaim Deed offers several benefits, including:

- Accessibility — the form can be completed at any time, from anywhere.

- Guided instructions and templates that reduce the risk of errors.

- Immediate access to downloadable versions for quick printing and filing.

- Potential cost savings compared to hiring a lawyer for document preparation.

These advantages make online resources a practical option for users looking to manage their property transfers efficiently.

Form popularity

FAQ

A quitclaim deed will remove the out-spouse (or departing spouse) from the title to the property, effectively relinquishing their equity or ownership in the home. The execution of a quitclaim deed is typically a requirement of a divorce settlement in order to complete the division of assets.

The good news is that, though it may not be an attractive option to many buyers, you can still sell the property normally. The title will still have been transferred to you. The quitclaim deed affects ownership and the name on the deed, but it does not affect the name on the mortgage.

A Quitclaim Deed must be notarized by a notary public or attorney in order to be valid.Consideration in a Quitclaim Deed is what the Grantee will pay to the Grantor for the interest in the property.

The quitclaim deed only transfers the type of title you own. Deed transfers of any kind impact only the ownership and do not change or affect any mortgage on the property.

Usually, taking off names from the deed must be agreed upon by the parties/owners involved. If in case that you don't have a consent from the person whose name is to be removed, it could be a more complex situation. You'd need to get a legal advice on this and consult a lawyer.

You can actually draw up a quitclaim deed on your own without a lawyer, though you should visit a notary public and get the form notarized. As with the creation of other legal documents, like a last will and testament, you may be able to find a quitclaim deed form online that you can easily fill out.

Based on that interpretation, it shouldn't ruin your credit if you signed over the condo with a quitclaim deed. Most sellers who do this sort of financing don't report to the credit bureaus unless they do a lot of buying and selling of properties to people who can't qualify for mortgages on their own.

A quitclaim deed is a poor way to give legal ownership of a property back to a previous owner -- or to transfer it to anyone except those close to you -- because there is no guarantee that your ownership interest is valid and uncontested. The other party likely will insist on a grant deed or a warranty deed.

Using a quitclaim bill of sale can have benefits for both seller and buyer. A seller is able to sell the property without having to ensure the title is clear. They sell it without guarantees, so if, for example, there is a lien against the property, that lien passes with the property to the buyer.

A quitclaim deed is often used if the grantor is not sure of the status of the title (whether it contains any defects) or if the grantor wants no liability under the title covenants.