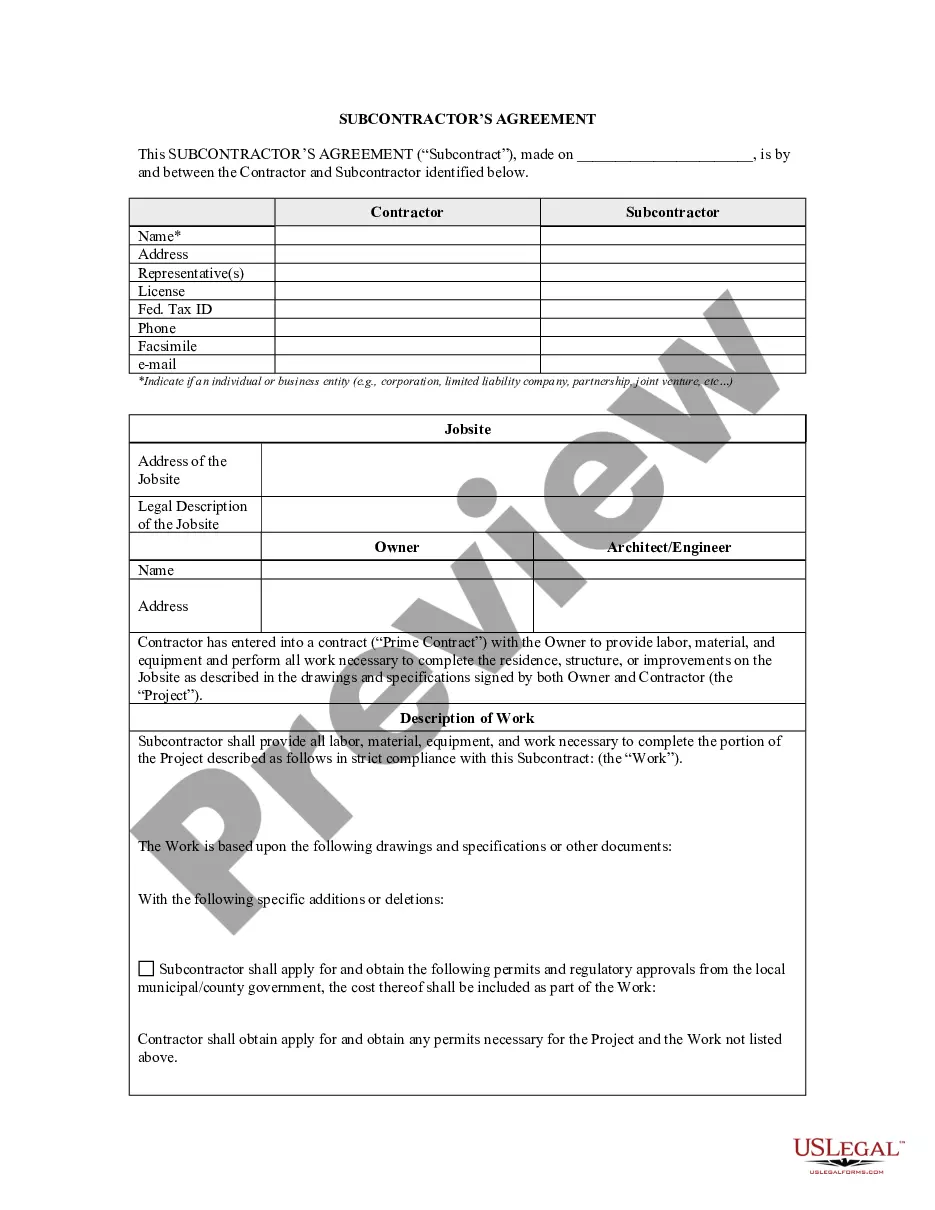

Wisconsin Subcontractor's Agreement

About this form

The Subcontractor's Agreement is a legal document that outlines the terms and conditions under which a subcontractor will perform work for a contractor on a specific project. This form clarifies the responsibilities and obligations of both parties, ensuring clear communication throughout the project. Unlike general construction contracts, this agreement specifically addresses subcontracted work, making it essential for ensuring that project details such as payment terms and work schedules are explicitly understood and agreed upon by all parties involved.

Key parts of this document

- Identification of the parties involved in the agreement.

- Description of the work to be completed by the subcontractor.

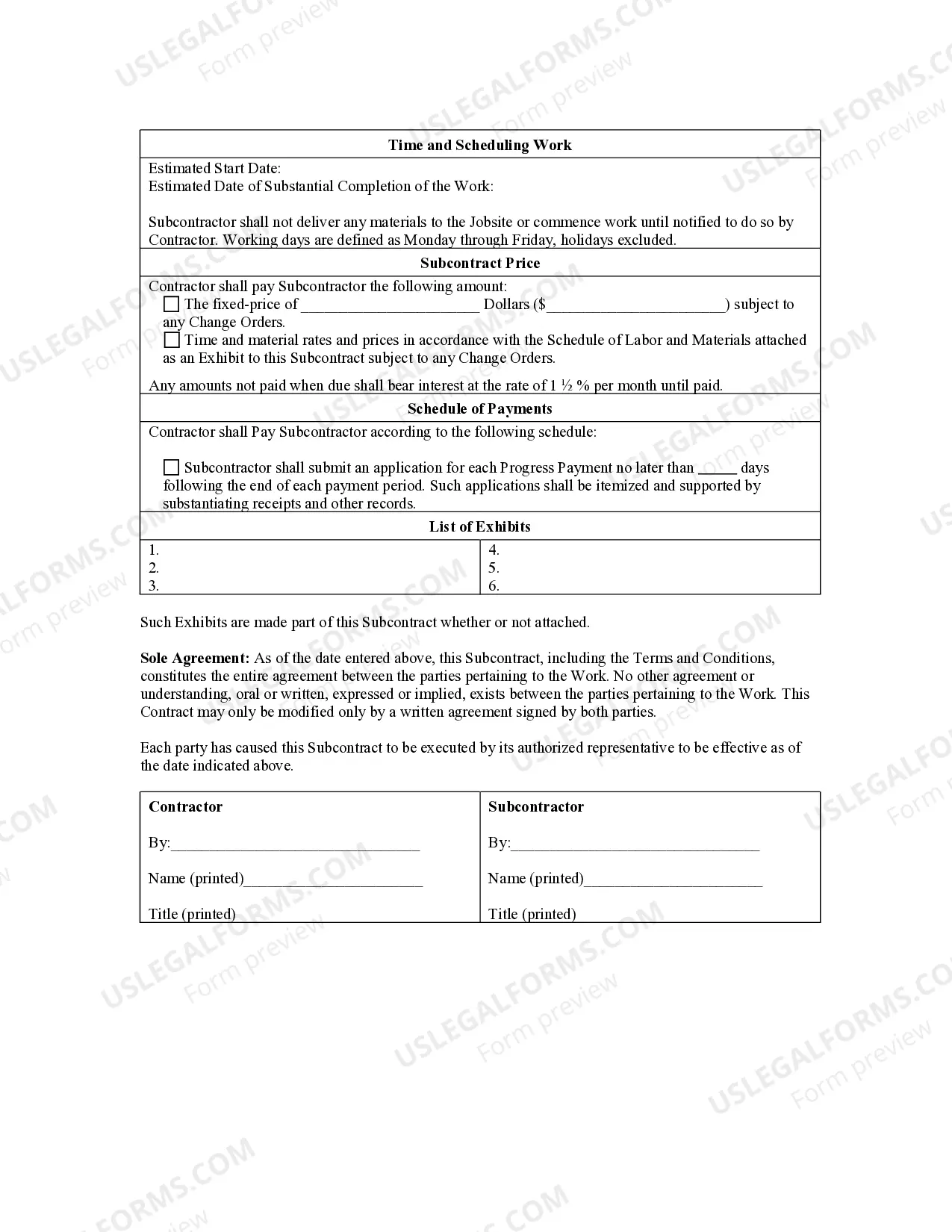

- Payment terms including fixed-price agreements and schedules for payment.

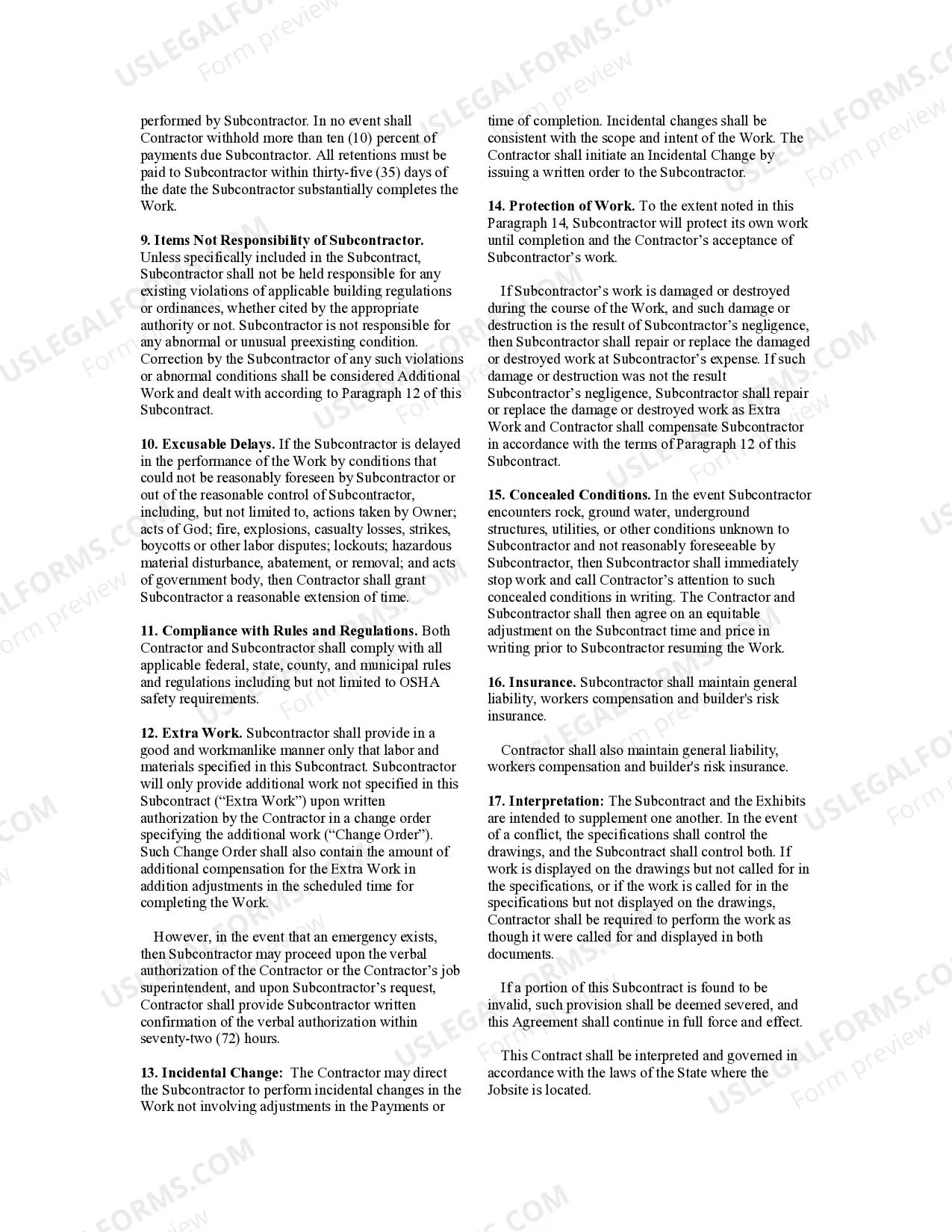

- Provisions for handling delays, including both excusable and non-excusable delays.

- Dispute resolution procedures, including arbitration guidelines.

- Insurance requirements for the subcontractor.

When to use this document

This form should be used in various scenarios, including when a contractor hires a subcontractor to handle a specific portion of a construction project. It is appropriate to use when clear terms regarding payment, work scope, and dispute resolution are needed to prevent misunderstandings. This agreement is particularly useful for ensuring that both parties are legally protected and that expectations are clearly articulated prior to the commencement of work.

Who can use this document

This agreement is designed for:

- General contractors who hire subcontractors for construction projects.

- Subcontractors seeking to formalize their work agreements with contractors.

- Construction companies looking to ensure all legal obligations are met.

- Individuals or entities engaging in construction contracts who require a clear understanding of their roles and responsibilities.

Instructions for completing this form

- Identify the parties involved by entering the names and contact information of the contractor and subcontractor.

- Specify the jobsite where the work will take place.

- Describe the work to be performed in detail, including any specific materials or labor required.

- Enter the agreed-upon payment amount and schedule for payment and any conditions for change orders.

- Both parties should review and sign the agreement, ensuring all information is accurate and complete.

Is notarization required?

This form usually doesn’t need to be notarized. However, local laws or specific transactions may require it. Our online notarization service, powered by Notarize, lets you complete it remotely through a secure video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to specify the work scope clearly, which can lead to disputes later.

- Not detailing the payment schedule or conditions for payment, leaving the terms ambiguous.

- Overlooking the inclusion of critical dispute resolution processes, such as arbitration.

- Not signing the agreement, making it unenforceable.

Why use this form online

- Convenient access to professionally drafted legal forms without the need for a lawyer.

- Editability allows customization to fit specific project requirements easily.

- Immediate availability for download and use, streamlining the contract preparation process.

- Reliable format that adheres to legal standards, reducing the chances of errors.

Looking for another form?

Form popularity

FAQ

Subcontracting is the practice of assigning, or outsourcing, part of the obligations and tasks under a contract to another party known as a subcontractor. Subcontracting is especially prevalent in areas where complex projects are the norm, such as construction and information technology.

Scope of the Project. Timing for Completion: Duration of Work Clause. Payment and Billing Clause. Independent Contractor Notice. Non-Disclosure Agreement. Non-Complete Clause. Work for Hire Inclusion. Responsibilities for Insurance for Accidental Damages.

A subcontractor is a worker who is not your employee. You give a Form 1099 to a subcontractor showing the amounts you paid him. The subcontractor is responsible for keeping his or her own records and paying his or her own income and self-employment taxes.

Subcontractor agreements outline the responsibilities of each party, to ensure that if a claim were to arise, the responsible party is accountable. A subcontractor agreement provides protection to the company that hired the vendor or subcontractor by transferring the risk back to the party performing the work.

A subcontractor has a contract with the contractor for the services provided - an employee of the contractor cannot also be a subcontractor.

A subcontractor agreement is a contract between contractors or project managers and subcontractors. This solidifies any agreement between the two parties and assures work. Subcontractors should read the subcontractor agreement and assure specifics to protect themselves from unfair risk.

Start with procurement standards. Execute all subcontracts prior to starting your projects. Help those who help you. Award the job to the lowest fully qualified bidder. Use contract scope checklists. Make sure you have tight clauses. Meet to review the proposed subcontract.

Each subcontractor should complete Form W-9 before they begin any work. On the form, the subcontractor identifies their business structure type (sole proprietorship, corporation, etc.). Form W-9 also asks for the subcontractor's name and Taxpayer Identification Number (TIN).