This office lease states the conditions of the annual rental rate currently specified to be paid by the tenant (the "Base Rent"). This shall be used as a basis to calculate additional rent as of the times and in the manner set forth in this form to be paid by the tenant.

Washington Consumer Price Index

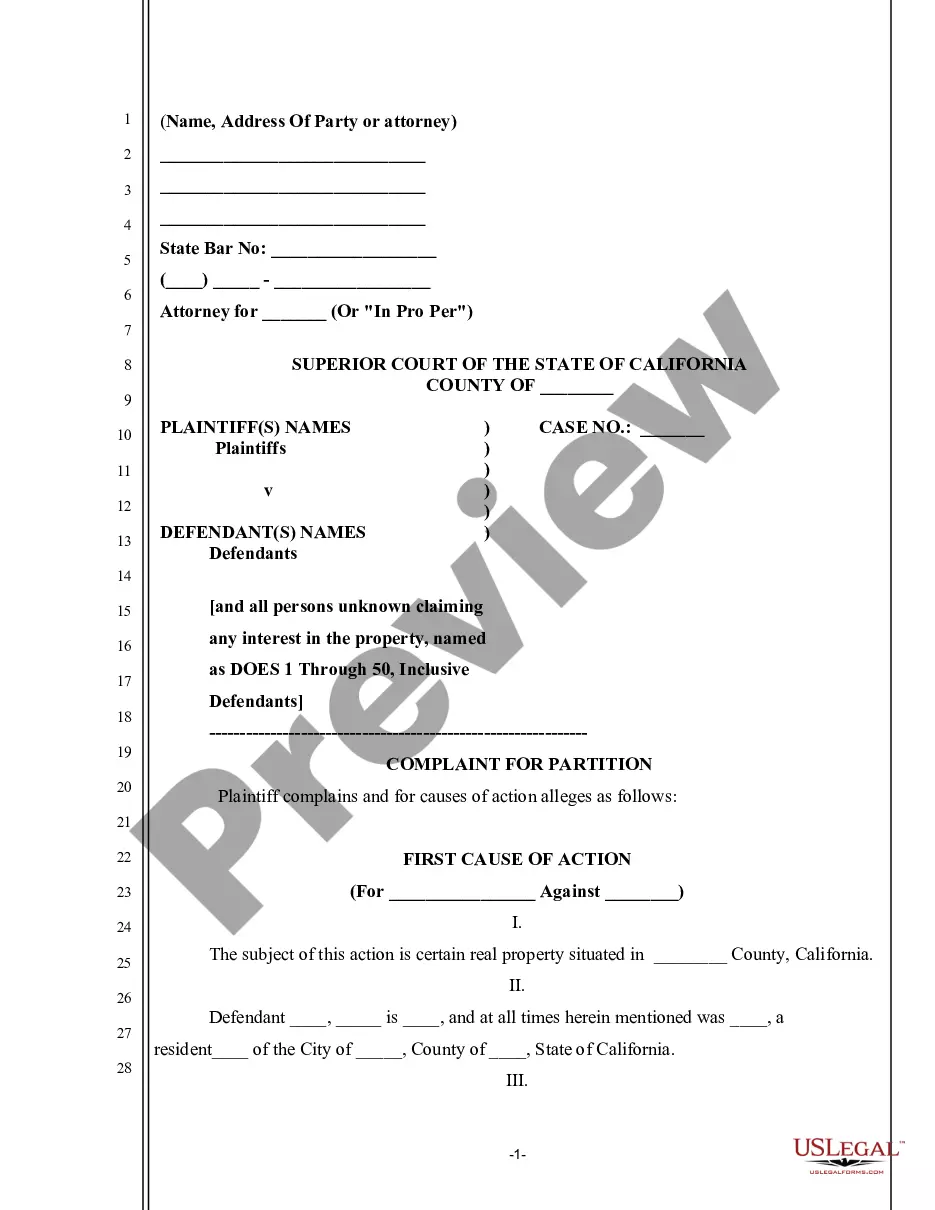

Description

How to fill out Consumer Price Index?

Are you currently within a situation the place you need to have documents for sometimes enterprise or individual reasons virtually every working day? There are plenty of lawful document themes available on the net, but getting types you can depend on isn`t effortless. US Legal Forms offers thousands of form themes, just like the Washington Consumer Price Index, that are published to meet state and federal needs.

When you are previously familiar with US Legal Forms web site and possess a merchant account, just log in. After that, it is possible to obtain the Washington Consumer Price Index format.

Should you not offer an bank account and need to start using US Legal Forms, abide by these steps:

- Get the form you want and ensure it is for your proper area/state.

- Take advantage of the Review switch to check the shape.

- Look at the description to actually have selected the right form.

- In the event the form isn`t what you`re searching for, use the Lookup industry to discover the form that fits your needs and needs.

- If you obtain the proper form, just click Get now.

- Pick the rates plan you desire, submit the required details to generate your money, and buy an order utilizing your PayPal or charge card.

- Select a hassle-free data file structure and obtain your backup.

Find all of the document themes you may have bought in the My Forms food list. You may get a extra backup of Washington Consumer Price Index any time, if necessary. Just go through the needed form to obtain or print the document format.

Use US Legal Forms, one of the most extensive selection of lawful kinds, in order to save time as well as stay away from mistakes. The assistance offers appropriately created lawful document themes which you can use for an array of reasons. Generate a merchant account on US Legal Forms and begin creating your way of life easier.

Form popularity

FAQ

The headline CPI rose 1.2% in Q3 2023, taking the annual rate of inflation 0.6ppt lower to 5.4%. The Q3 CPI surprised slightly to the upside, with the markets expecting a rise of 1.1% QoQ and 5.3% YoY. Trimmed mean inflation, the RBA's favourite underlying inflation gauge, was also higher than expected.

The monthly CPI indicator rose 4.9% over the year to July 2023, down from 5.4% in the previous month. This was a downside surprise to market participants, who expected a decline to 5.2%. The headline CPI (unadjusted) rose 0.8% in Q2 2023, taking the annual rate of inflation 1.0ppt lower to 6.0%.

Prices in the Washington-Arlington-Alexandria area, as measured by the Consumer Price Index for All Urban Consumers (CPI-U), advanced 1.3 percent for the 2 months ending in September 2023, the U.S. Bureau of Labor Statistics reported today. (See table A.)

Consumer Price Index, Los Angeles area ? September 2023 MonthAll itemsAll items less food and energyDec 20224.94.5Jan 20235.84.5Feb 20235.14.5Mar 20233.74.333 more rows

The June 2023 quarterly Consumer Price Index (CPI) data released today shows that Perth's inflation rate has dropped to 4.9 per cent across the year to June 2023 ? the lowest of Australia's capital cities and below 6 per cent nationally.

Seattle-Bellevue-Everett, WA Data SeriesApr 2023Aug 202312-month % change5.32.6Consumer Price Index: Seattle-Tacoma-Bellevue, WACPI-U, All items(4)338.487344.449CPI-U, All items, 12-month % change(4)6.95.432 more rows