Washington Release and Surface Damages Agreement Entered into Prior to Drilling

Description

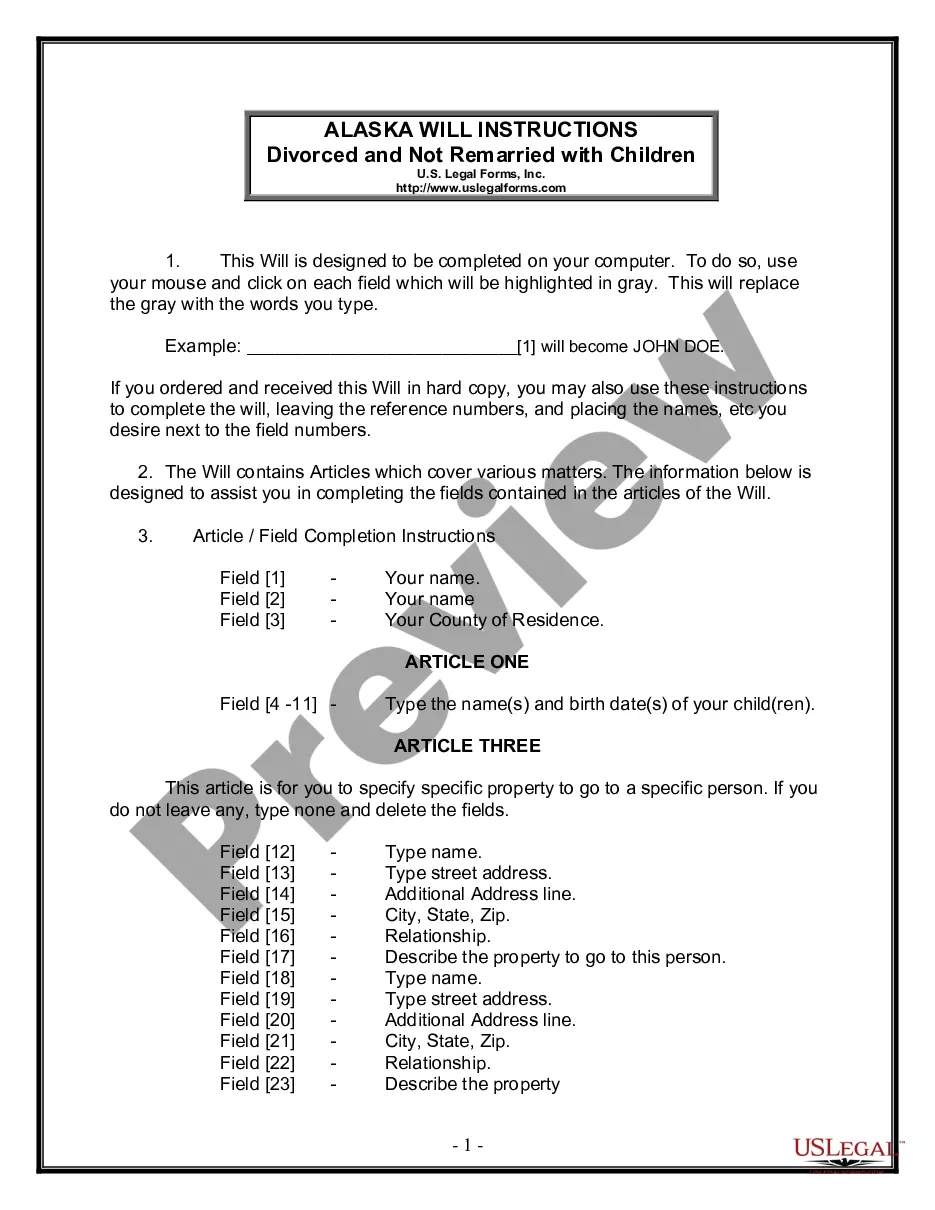

How to fill out Release And Surface Damages Agreement Entered Into Prior To Drilling?

Are you within a place in which you will need papers for either business or specific uses nearly every day? There are a lot of authorized document themes available online, but discovering kinds you can depend on isn`t easy. US Legal Forms provides a huge number of form themes, much like the Washington Release and Surface Damages Agreement Entered into Prior to Drilling, which are written to fulfill state and federal needs.

In case you are currently acquainted with US Legal Forms web site and possess your account, just log in. Afterward, you are able to download the Washington Release and Surface Damages Agreement Entered into Prior to Drilling design.

Unless you come with an bank account and want to begin to use US Legal Forms, adopt these measures:

- Obtain the form you will need and make sure it is for that right town/area.

- Make use of the Review switch to review the form.

- Look at the information to actually have selected the correct form.

- If the form isn`t what you`re trying to find, use the Search industry to obtain the form that meets your needs and needs.

- Whenever you find the right form, click Acquire now.

- Pick the prices program you desire, submit the necessary info to produce your account, and pay for the transaction with your PayPal or Visa or Mastercard.

- Decide on a convenient file formatting and download your duplicate.

Locate all of the document themes you might have bought in the My Forms food selection. You may get a extra duplicate of Washington Release and Surface Damages Agreement Entered into Prior to Drilling whenever, if required. Just click on the necessary form to download or print the document design.

Use US Legal Forms, the most considerable assortment of authorized types, to conserve time and avoid errors. The services provides expertly made authorized document themes that you can use for a variety of uses. Make your account on US Legal Forms and begin producing your way of life easier.

Form popularity

FAQ

Royalties on private lands are influenced by state rates. They generally range from 12?25 percent. Before negotiating royalty payments on private land, careful due diligence should be conducted to confirm ownership. Mineral ownership records are often outdated.

Generally, the standard royalty rates for authors is under 10% for traditional publishing and up to 70% with self-publishing.

A surface use agreement, which is also sometimes referred to as a land use agreement, is an agreement between the landowner and an oil and gas company or an operator for the use of the landowner's land in the development of the oil and gas.

The royalty percentage is usually 12.5% to 15% but can change based on regional regulations or negotiations. Types of Leases: There are different types of oil and gas leases, and they affect royalty calculations differently.

Some of the changes were mandated by the 2022 Inflation Reduction Act, which directs the Interior Department to increase the royalty rates paid by companies that drill on public lands to 16.67 percent from 12.5 percent, and to increase the minimum bid at auctions for drilling leases to $10 per acre from $2 per acre, ...

Oil leases are agreements between an oil and gas company known as the lessee and mineral owners known as a lessor, in which the lessor grants the lessee the permission to explore, drill, and produce those minerals for a specified period known as a primary term or as long as the minerals continue to be productive.

If the lessee is engaged in drilling operations at the expiration of the primary term of the lease,[9] the lease term will be extended for an additional two years if certain requirements are met. [10] Actual drilling operations that penetrate the earth are required.

? Any landowner may drill a well on their property. Well drilling costs $15 to $25 per foot for the drilling process only.