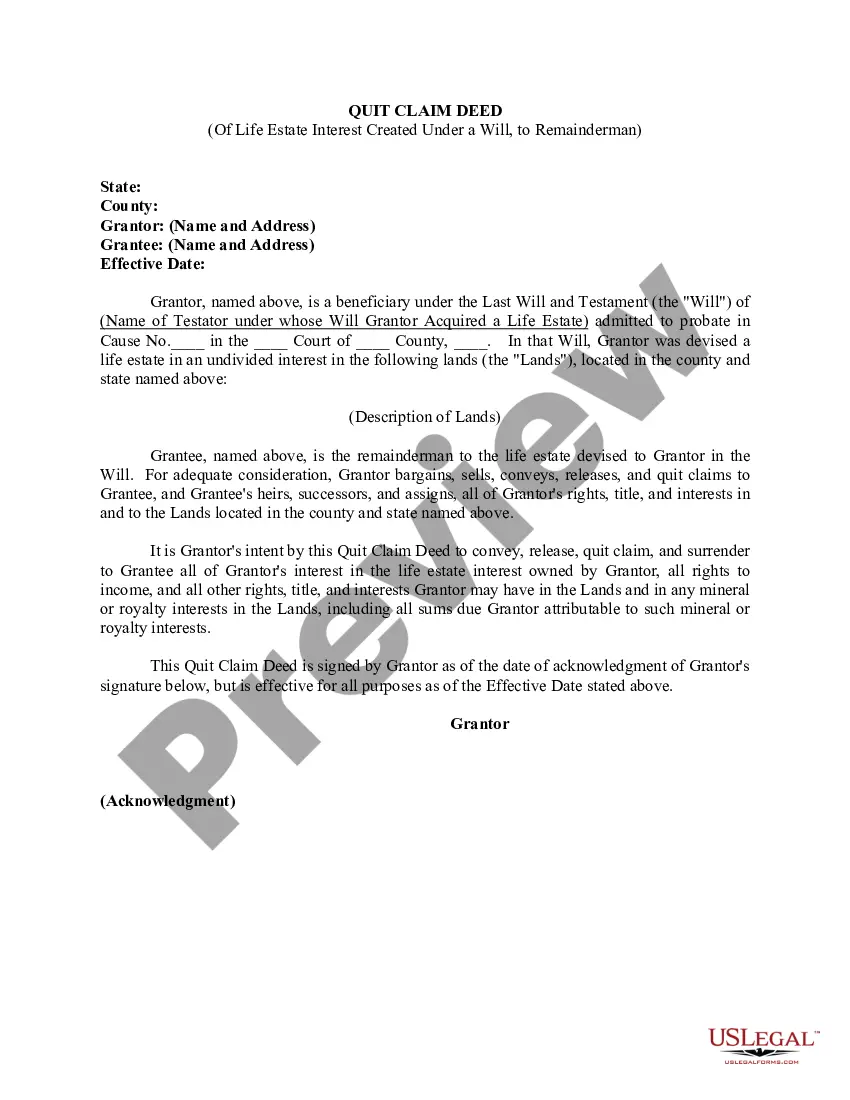

Washington Quitclaim Deed of Life Estate Interest Created Under A Will, to the Remainderman

Description

How to fill out Quitclaim Deed Of Life Estate Interest Created Under A Will, To The Remainderman?

If you need to comprehensive, down load, or print out legal file themes, use US Legal Forms, the most important variety of legal varieties, that can be found on the Internet. Make use of the site`s simple and handy look for to obtain the documents you will need. Numerous themes for company and specific reasons are categorized by classes and says, or keywords. Use US Legal Forms to obtain the Washington Quitclaim Deed of Life Estate Interest Created Under A Will, to the Remainderman in just a number of click throughs.

When you are previously a US Legal Forms consumer, log in in your account and click on the Obtain switch to find the Washington Quitclaim Deed of Life Estate Interest Created Under A Will, to the Remainderman. You can even access varieties you previously acquired within the My Forms tab of the account.

If you work with US Legal Forms the very first time, refer to the instructions under:

- Step 1. Be sure you have selected the form to the proper area/nation.

- Step 2. Use the Preview choice to look over the form`s content material. Do not forget about to learn the information.

- Step 3. When you are not satisfied using the type, make use of the Lookup field towards the top of the display to locate other variations from the legal type web template.

- Step 4. When you have found the form you will need, select the Buy now switch. Pick the rates prepare you like and add your qualifications to register for an account.

- Step 5. Process the purchase. You should use your bank card or PayPal account to finish the purchase.

- Step 6. Choose the structure from the legal type and down load it on the system.

- Step 7. Full, revise and print out or sign the Washington Quitclaim Deed of Life Estate Interest Created Under A Will, to the Remainderman.

Every single legal file web template you buy is the one you have for a long time. You possess acces to each and every type you acquired in your acccount. Go through the My Forms portion and decide on a type to print out or down load once more.

Contend and down load, and print out the Washington Quitclaim Deed of Life Estate Interest Created Under A Will, to the Remainderman with US Legal Forms. There are thousands of skilled and status-distinct varieties you may use for your company or specific requirements.

Form popularity

FAQ

An exception to the rule that terminable interests do not qualify for the marital deduction is qualified terminable interest property (QTIP). QTIP is property in which the surviving spouse has a qualifying income interest for life and the executor elects on the estate tax return to treat the property as a QTIP (Sec.

There is no simple way to reverse a life estate because a life estate deed is a legal transfer of the title of a property. This is legally binding and the transaction is complete when the life estate is executed. Essentially, in order to reverse a life estate both parties would need to agree to make it happen.

A life estate may limit the transferability of the property, as the life tenant can only sell or transfer their interest in the property for the duration of their life or the designated measuring life.

In the event of the death of a remainderman before the life tenant dies, the remainderman's interest may pass to the deceased remainderman's estate or possibly to the surviving joint remaindermen, depending upon how the joint remainder interests were set up in the will, trust, or deed.

There is no simple way to reverse a life estate because a life estate deed is a legal transfer of the title of a property. This is legally binding and the transaction is complete when the life estate is executed. Essentially, in order to reverse a life estate both parties would need to agree to make it happen.

Life estates, terms for years, annuities, patents, and copyrights are therefore terminable interests. However, a bond, note, or similar contractual obligation, the discharge of which would not have the effect of an annuity or term for years, is not a terminable interest.

Life estates. (1) "Life estate" means an ownership interest in real property only during the lifetime of a specified person. (2) Subject to subsection (3) of this section, a life estate is an available resource, unless it is either excluded or unavailable under chapter 182-512 WAC.

A terminable interest is one that ends at some specified time. For example, a husband might leave his wife the use of a residence, but specify that the residence shall pass to the husband's children at the spouse's death.