Washington Medical Representative Agreement - Self-Employed Independent Contractor

Description

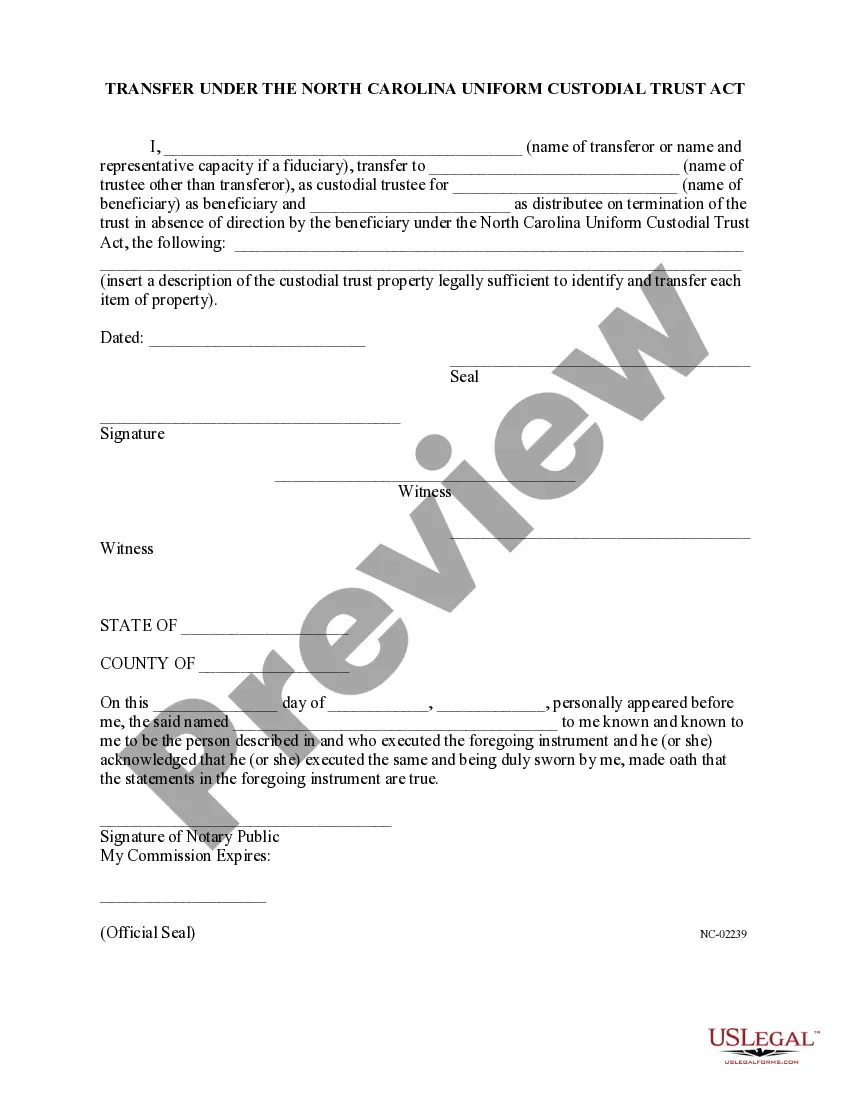

How to fill out Medical Representative Agreement - Self-Employed Independent Contractor?

It is feasible to spend hours online searching for the appropriate legal template that aligns with the federal and state requirements you need.

US Legal Forms offers numerous legal documents that are assessed by experts.

You can obtain or create the Washington Medical Representative Agreement - Self-Employed Independent Contractor through my services.

First, ensure you have selected the correct template for the region/area of your choice. Review the form description to verify that you have chosen the right document. If available, use the Preview button to examine the format as well.

- If you already possess a US Legal Forms account, you may Log In and click on the Download button.

- Subsequently, you may complete, edit, create, or sign the Washington Medical Representative Agreement - Self-Employed Independent Contractor.

- Every legal template you acquire is yours permanently.

- To obtain an additional copy of the acquired form, navigate to the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

Form popularity

FAQ

Yes, a medical director can operate as an independent contractor under a Washington Medical Representative Agreement - Self-Employed Independent Contractor. This arrangement allows the medical director to maintain flexibility and control over their work while fulfilling specific responsibilities for healthcare organizations. By utilizing a well-structured agreement, both parties can clarify roles and expectations, ensuring compliance with relevant laws and regulations. For those considering this path, platforms like uslegalforms provide templates and resources to create effective contracts that protect your interests.

Writing an independent contractor agreement starts with identifying the key elements such as the parties involved, project specifics, and payment terms. Make sure to reference the Washington Medical Representative Agreement - Self-Employed Independent Contractor framework, as it guides essential terms. Once you have drafted the agreement, it's wise to have it reviewed by a legal professional to ensure it aligns with legal standards and adequately protects your interests.

Filling out an independent contractor agreement involves detailing the scope of work, payment terms, and deliverables. Be specific about the terms related to the Washington Medical Representative Agreement - Self-Employed Independent Contractor, as clarity fosters a positive work relationship. After drafting the agreement, both parties should review it carefully before signing to ensure mutual understanding.

To fill out a declaration of independent contractor status form, start by clearly stating your personal information, including your name, address, and contact details. Next, outline the nature of your work relationship according to the Washington Medical Representative Agreement - Self-Employed Independent Contractor guidelines. It's important to sign the declaration to confirm your understanding and commitment to your independent contractor status.

Independent contractors should fill out several important forms, primarily focusing on the IRS Form W-9 for tax purposes. Additionally, if you are a Washington Medical Representative Agreement - Self-Employed Independent Contractor, you might need a state-level registration form. It's crucial to ensure that all forms are completed accurately, as they help maintain compliance and document your independent status.

Yes, an independent contractor is considered self-employed. This classification includes individuals who work for themselves and manage their own business activities. By entering into a Washington Medical Representative Agreement - Self-Employed Independent Contractor, you formalize your status and responsibilities as an independent contractor. This agreement helps establish your rights and obligations in a business arrangement.

A sales representative can indeed be an independent contractor. Many companies prefer this arrangement to reduce overhead costs and maintain flexibility. When structured under a Washington Medical Representative Agreement - Self-Employed Independent Contractor, both the company and the sales representative can clearly define their relationship and responsibilities. This clarity can help avoid potential misunderstandings and legal issues.

Yes, sales representatives can be classified as 1099 independent contractors. This classification often allows companies to contract with sales reps without taking on the responsibilities associated with permanent employees. By establishing a Washington Medical Representative Agreement - Self-Employed Independent Contractor, both parties can clarify their working arrangement and obligations. This structure can offer flexibility and tax advantages for sales reps.

Yes, an independent contractor can act as an agent under certain circumstances. In a Washington Medical Representative Agreement - Self-Employed Independent Contractor, the independent contractor may have the authority to make decisions or take actions on behalf of a company. This arrangement often depends on the specific terms outlined in the agreement. It is important to consult legal advice to understand the role clearly.

In Washington state, independent contractors typically need a business license, depending on their work type and location. When entering a Washington Medical Representative Agreement - Self-Employed Independent Contractor, confirming local regulations is essential for compliance. Establishing a business license not only legitimizes your operations but also helps in building client trust. Platforms like USLegalForms provide resources to help you understand licensing requirements to operate legally and effectively.