Washington Broker Agreement - Self-Employed Independent Contractor

Description

How to fill out Broker Agreement - Self-Employed Independent Contractor?

Have you ever been in a situation where you require documentation for both professional or personal reasons almost all the time.

There are numerous authentic document templates available online, but finding trustworthy ones is challenging.

US Legal Forms offers thousands of form templates, such as the Washington Broker Agreement - Self-Employed Independent Contractor, which can be filled out to comply with state and federal regulations.

Utilize US Legal Forms, the most extensive collection of legitimate forms, to save time and avoid errors.

The service provides properly designed legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Washington Broker Agreement - Self-Employed Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct state/area.

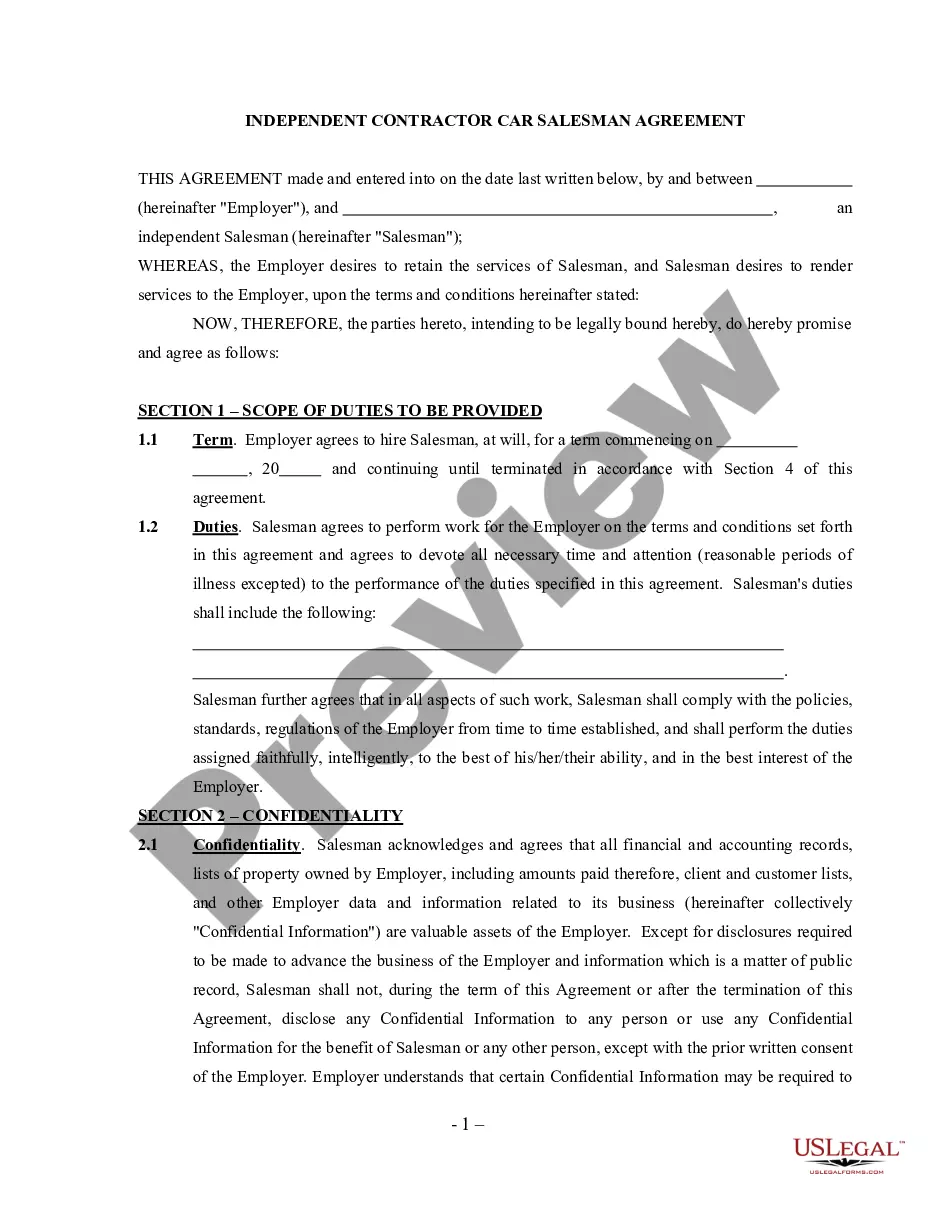

- Use the Preview button to review the form.

- Check the details to confirm you have selected the correct form.

- If the form isn’t what you’re looking for, use the Search field to find the form that meets your needs.

- Once you find the right form, click Get now.

- Select the pricing plan you want, provide the necessary details to create your account, and pay for your order using your PayPal or credit card.

- Choose a convenient document format and download your version.

- Access all the document templates you have purchased in the My documents section. You can acquire another copy of the Washington Broker Agreement - Self-Employed Independent Contractor at any time, if needed. Just open the required form to download or print the document template.

Form popularity

FAQ

An independent contractor typically needs to fill out the IRS Form W-9 to provide their taxpayer information. Additionally, under the Washington Broker Agreement - Self-Employed Independent Contractor, other forms may be required to comply with state regulations. Consider using platforms like USLegalForms for easy access to templates and guidance. This will help you navigate the necessary paperwork with confidence.

To fill out a declaration of independent contractor status form, begin by gathering necessary information such as your name, address, and business details. Clearly state your work relationship and specify your role under the Washington Broker Agreement - Self-Employed Independent Contractor. Review the form for accuracy and completeness. Finally, submit the finished form to ensure proper classification as an independent contractor.

To create an independent contractor agreement, you need to start by outlining the key elements of the arrangement, including the scope of work, payment terms, and deadlines. Be sure to include details specific to the Washington Broker Agreement - Self-Employed Independent Contractor to ensure compliance with local laws. Utilizing platforms like USLegalForms can simplify this process, providing templates tailored to your needs. With the right approach, you can create a comprehensive agreement that protects both parties.

Typically, brokers are not classified as independent contractors since they often own their businesses and manage other agents and contractors. However, in some cases, a broker might hire themselves out as a consultant, thus qualifying as an independent contractor. The terms of the Washington Broker Agreement - Self-Employed Independent Contractor should address these distinctions to prevent confusion.

Yes, an independent contractor can function as an agent, especially in the real estate industry. This dual role allows them to represent clients while maintaining flexibility in their work. When creating a Washington Broker Agreement - Self-Employed Independent Contractor, it is essential to define the scope of their responsibilities clearly.

A broker must provide certain essential resources, including access to training, support, and necessary tools to help independent contractors succeed. Depending on the agreement, brokers might also supply marketing materials or administrative assistance. Having a solid Washington Broker Agreement - Self-Employed Independent Contractor can clarify these provisions.

A broker can require independent contractors to meet specific performance standards, comply with local laws, and adhere to the terms outlined in their agreement. This might include maintaining licenses, reporting earnings, or providing regular updates on business activities. A clear Washington Broker Agreement - Self-Employed Independent Contractor helps establish these expectations upfront.

Recent federal regulations for independent contractors focus on clarifying their classification and ensuring fair labor practices. These rules emphasize the importance of the nature of the work relationship rather than merely labeling someone an independent contractor. Therefore, a well-structured Washington Broker Agreement - Self-Employed Independent Contractor can help delineate these aspects effectively.

Yes, an independent contractor is considered self-employed. This classification means they operate their own business, handle their own taxes, and are not entitled to employee benefits. Understanding this relationship is vital, particularly when drafting a Washington Broker Agreement - Self-Employed Independent Contractor.

The legal requirements for independent contractors often include having a written agreement, paying self-employment taxes, and managing their own business expenses. In a Washington Broker Agreement - Self-Employed Independent Contractor, both parties must outline the terms of the relationship clearly. It is essential to ensure compliance with local regulations to avoid potential legal issues.