Washington Computer Repairman Services Contract - Self-Employed

Description

How to fill out Computer Repairman Services Contract - Self-Employed?

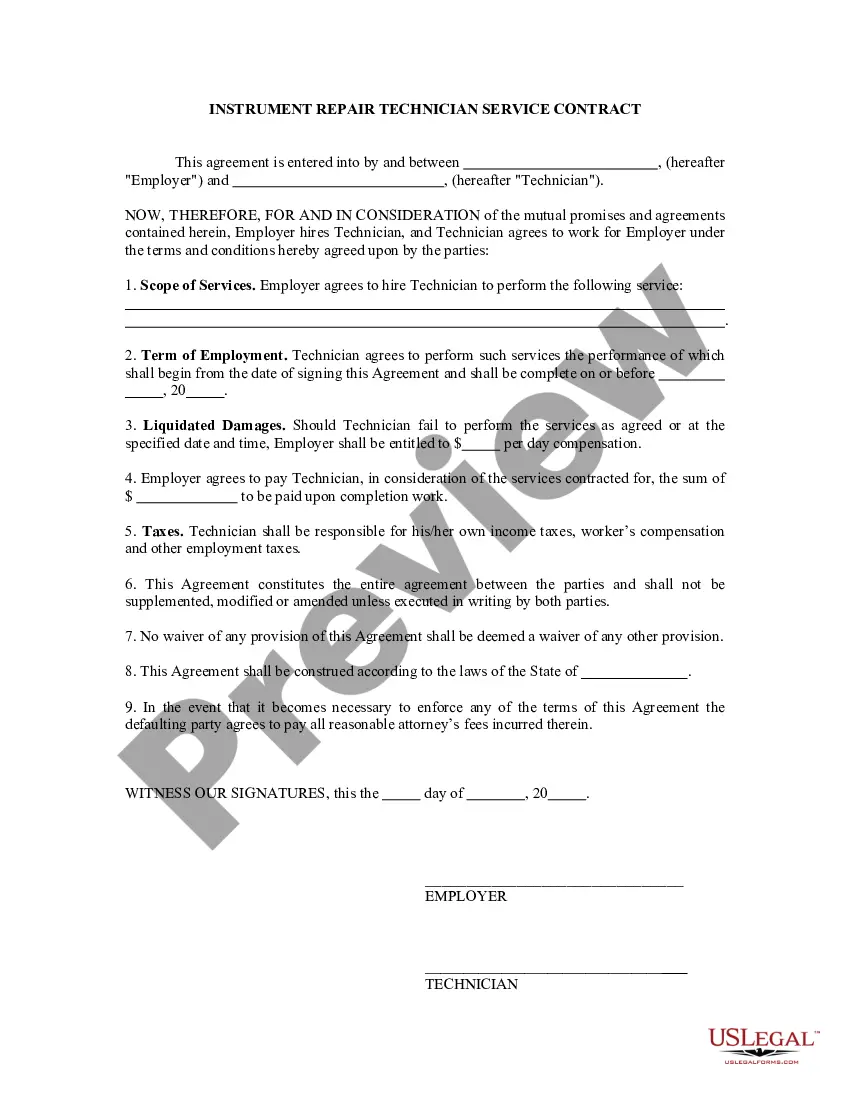

Selecting the correct authorized document template can be a challenge. Of course, there are numerous templates available online, but how can you locate the legal form you require? Utilize the US Legal Forms website. The platform offers thousands of templates, including the Washington Computer Repairman Services Agreement - Self-Employed, suitable for both business and personal needs. All the templates are reviewed by experts and comply with state and federal regulations.

If you are already a member, sign in to your account and click the Download button to obtain the Washington Computer Repairman Services Agreement - Self-Employed. Use your account to review the legal documents you have previously purchased. Visit the My documents section of your account to acquire another copy of the document you need.

If you are a new user of US Legal Forms, here are simple instructions to follow: First, ensure you have selected the correct form for your region. You can preview the form using the Preview button and read the form description to confirm it is right for you. If the form does not meet your requirements, use the Search field to find the appropriate form. Once you are sure the form is suitable, click the Get now button to obtain the form.

- Choose the pricing plan you prefer and enter the required information.

- Create your account and pay for the order with your PayPal account or Visa or Mastercard.

- Select the file format and download the legal document template onto your device.

- Complete, edit, print, and sign the downloaded Washington Computer Repairman Services Agreement - Self-Employed.

- US Legal Forms is the largest repository of legal documents where you can find various document templates.

- Make use of the service to download professionally crafted paperwork that meet state criteria.

Form popularity

FAQ

Yes, a self-employed person can certainly have a contract. In fact, a Washington Computer Repairman Services Contract - Self-Employed helps define the scope of work, payment terms, and responsibilities for both parties. Having a detailed contract protects your rights and clarifies expectations, making your professional relationships smoother and more transparent. Therefore, consider using legal resources like USLegalForms to create a well-structured contract that meets your specific needs.

Indeed, independent contractors in Washington state generally need a business license. This requirement supports compliance with local laws and promotes trust with clients. If you are involved in creating a Washington Computer Repairman Services Contract - Self-Employed, having a business license strengthens your position. Consider consulting platforms like uslegalforms to find the necessary documentation and simplify your licensing process.

It is often necessary to register your business as an independent contractor, particularly if you want to operate legally within Washington state. When working under a Washington Computer Repairman Services Contract - Self-Employed, registration helps you manage your business more effectively. This step can also enhance your professional image and ensure that you meet any local regulatory requirements.

Yes, as an independent contractor in Washington state, you usually need a business license, especially if you are engaging with clients and generating income. This requirement applies to those working under contracts like the Washington Computer Repairman Services Contract - Self-Employed. A business license not only provides legitimacy but also helps you follow state laws, making your operations smooth and lawful.

The independent contractor rule clarifies the distinct relationship between contractors and clients, particularly regarding taxes and employment rights. This rule emphasizes that independent contractors maintain control over how they perform their services. To align with a Washington Computer Repairman Services Contract - Self-Employed, it's essential to understand this rule. It ensures you remain legally compliant and properly categorized in your business dealings.

In Washington state, you typically need a business license once your activities consistently generate income. If you plan to regularly perform services, such as under a Washington Computer Repairman Services Contract - Self-Employed, getting a business license is pivotal. This helps you comply with local regulations and enhances your credibility with clients. Always check local city regulations for specific requirements.

To work as an independent contractor, you must comply with federal and state regulations. Start by obtaining the necessary tax identification number, which the IRS requires for tax purposes. Next, familiarize yourself with the specific requirements for the Washington Computer Repairman Services Contract - Self-Employed. You can navigate these steps more smoothly by using resources available on platforms like uslegalforms.

Independent contractors in Washington must adhere to specific legal requirements outlined in their Washington Computer Repairman Services Contract - Self-Employed. First, ensure you have a valid business license and any necessary permits for operating legally. Additionally, you must report your income accurately and handle your own taxes. While not an employee under most laws, it is vital to maintain a clear distinction between your role and that of traditional employees to avoid legal complications.

Yes, even if you only hire 1099 employees, you should consider workers' comp insurance in Washington. It provides essential protection for injuries that might occur on the job, regardless of the employment status of your workers. Protecting your business with a Washington Computer Repairman Services Contract - Self-Employed also means ensuring compliance with state regulations. This coverage can shield you from potential financial liabilities and help maintain a secure work environment.

As an independent contractor working under a Washington Computer Repairman Services Contract - Self-Employed, it is crucial to have the right insurance. General liability insurance protects you from claims related to property damage or bodily injury. Additionally, consider obtaining professional liability insurance, which covers claims of negligence or mistakes in your work. This coverage not only safeguards your business but also builds trust with your clients.