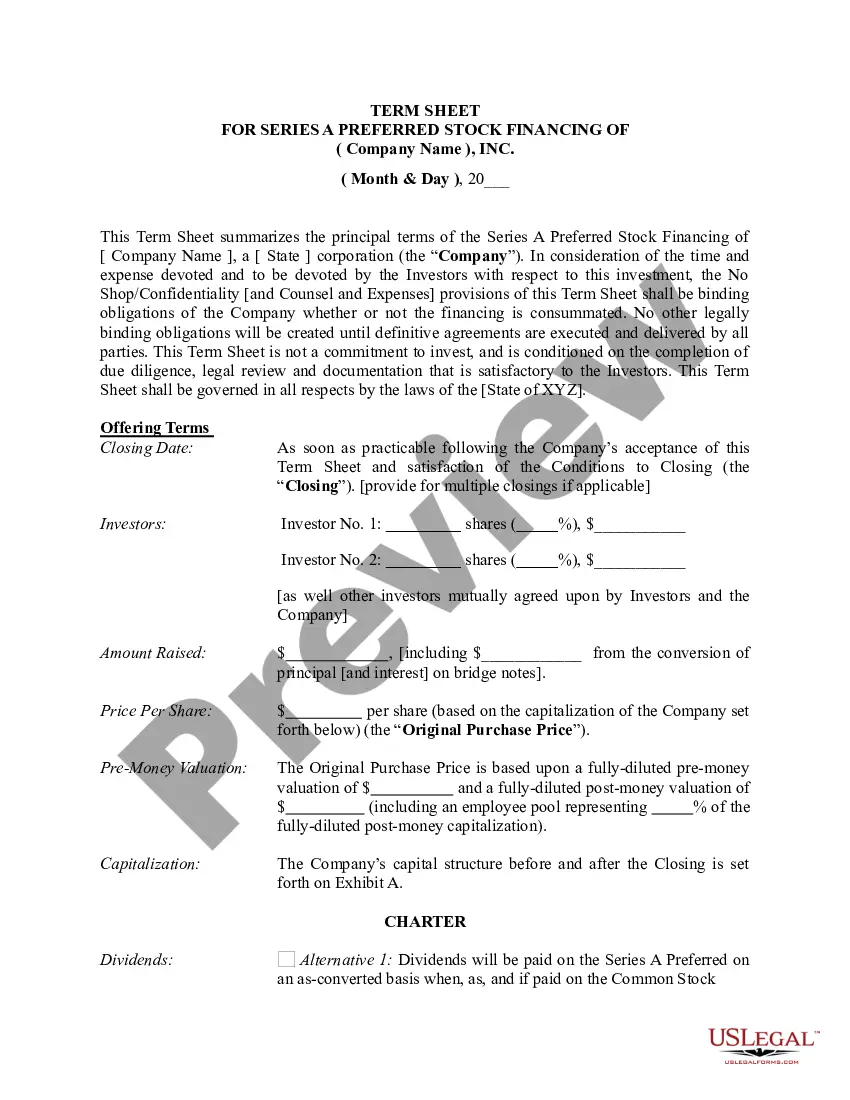

Washington Term Sheet - Series A Preferred Stock Financing of a Company

Description

The Term Sheet is not a commitment to invest, and is conditioned on the completion of the conditions to closing set forth.

How to fill out Term Sheet - Series A Preferred Stock Financing Of A Company?

If you need to complete, obtain, or produce authorized file web templates, use US Legal Forms, the biggest selection of authorized kinds, that can be found on the web. Take advantage of the site`s basic and practical look for to obtain the documents you want. Different web templates for company and person purposes are sorted by groups and says, or keywords. Use US Legal Forms to obtain the Washington Term Sheet - Series A Preferred Stock Financing of a Company within a few clicks.

Should you be already a US Legal Forms consumer, log in for your bank account and click on the Obtain button to obtain the Washington Term Sheet - Series A Preferred Stock Financing of a Company. You can even entry kinds you in the past saved in the My Forms tab of your own bank account.

If you use US Legal Forms initially, refer to the instructions below:

- Step 1. Make sure you have chosen the form for that appropriate metropolis/country.

- Step 2. Use the Review option to examine the form`s articles. Do not forget to see the description.

- Step 3. Should you be unhappy using the kind, make use of the Lookup industry at the top of the display screen to discover other versions of your authorized kind design.

- Step 4. When you have discovered the form you want, go through the Acquire now button. Select the costs program you like and add your credentials to sign up to have an bank account.

- Step 5. Procedure the purchase. You may use your charge card or PayPal bank account to accomplish the purchase.

- Step 6. Choose the format of your authorized kind and obtain it on your system.

- Step 7. Complete, revise and produce or signal the Washington Term Sheet - Series A Preferred Stock Financing of a Company.

Each and every authorized file design you acquire is your own property for a long time. You might have acces to each kind you saved inside your acccount. Go through the My Forms portion and choose a kind to produce or obtain yet again.

Remain competitive and obtain, and produce the Washington Term Sheet - Series A Preferred Stock Financing of a Company with US Legal Forms. There are many expert and condition-specific kinds you can utilize for your company or person requires.

Form popularity

FAQ

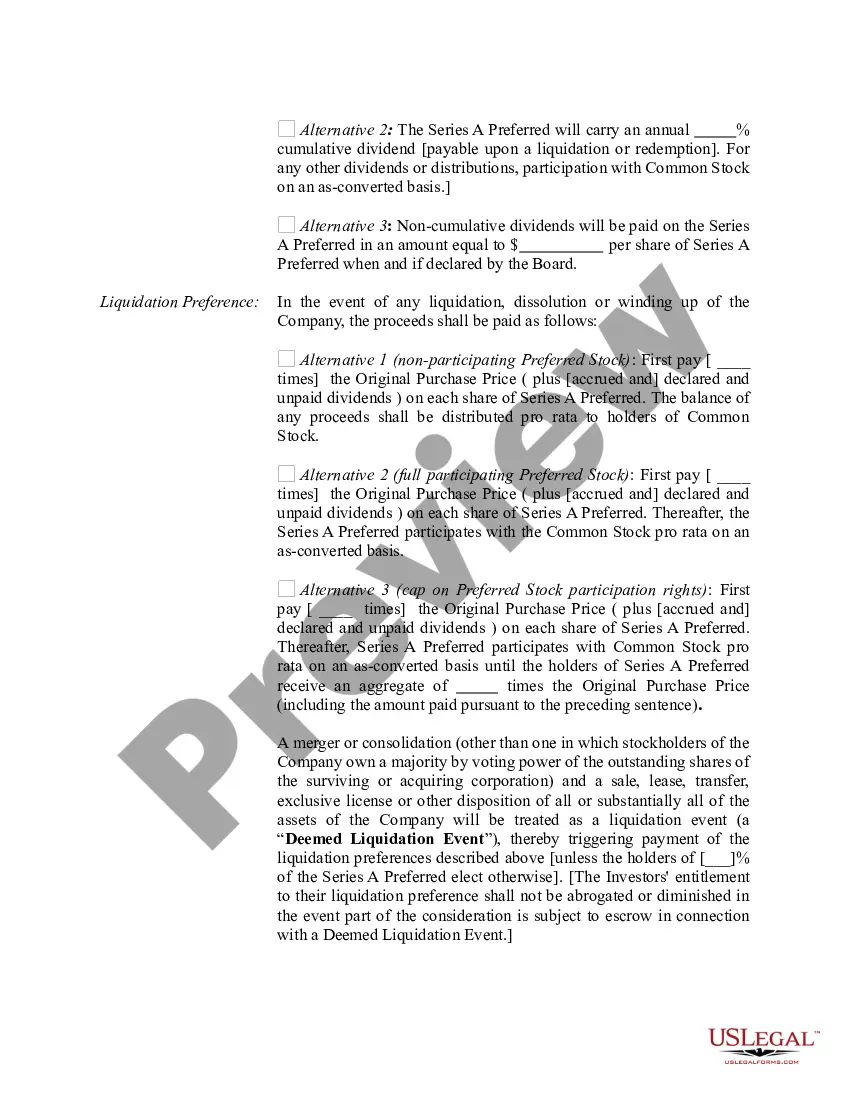

The main disadvantage of owning preference shares is that the investors in these vehicles don't enjoy the same voting rights as common shareholders. 1 This means that the company is not beholden to preferred shareholders the way it is to traditional equity shareholders.

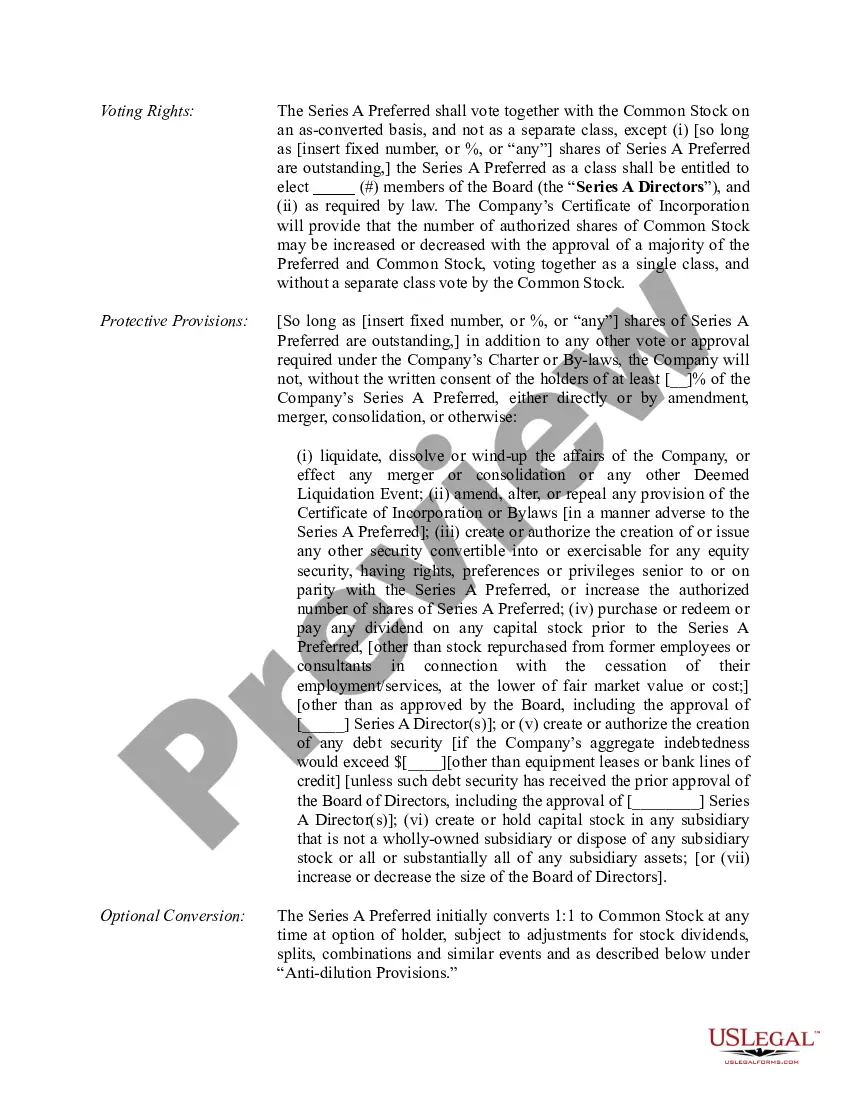

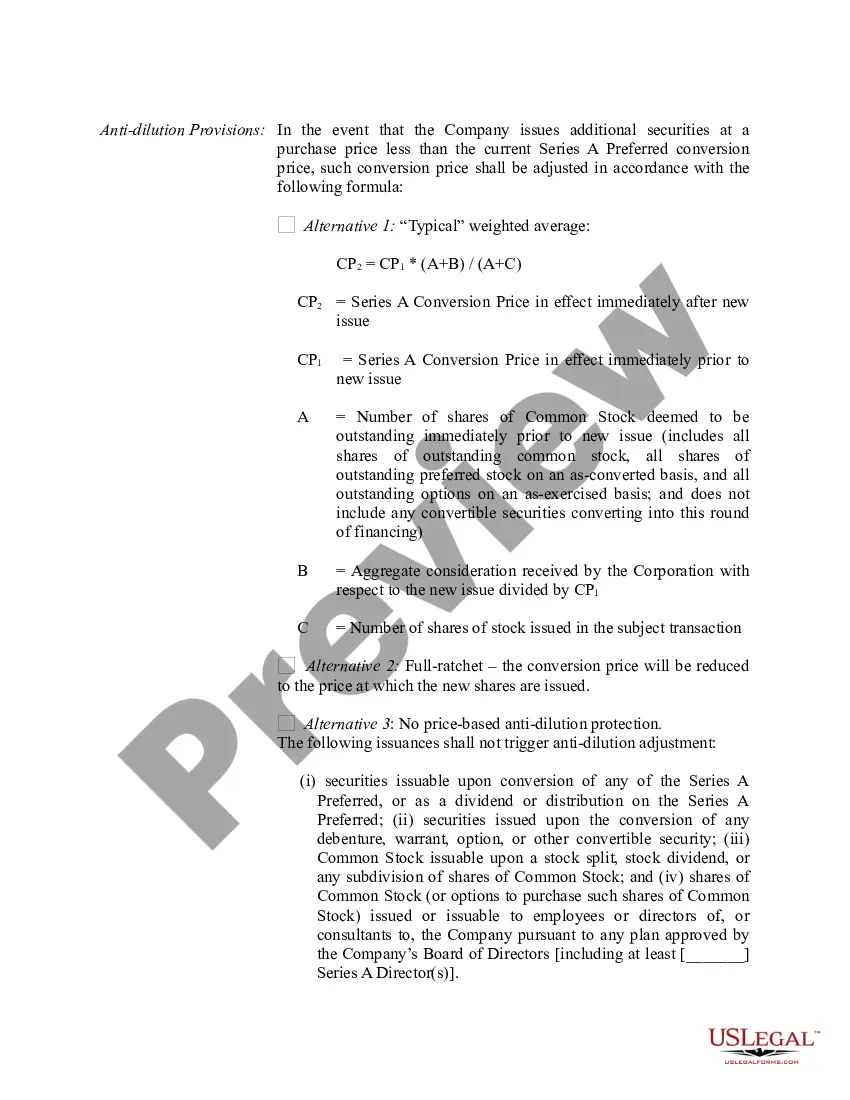

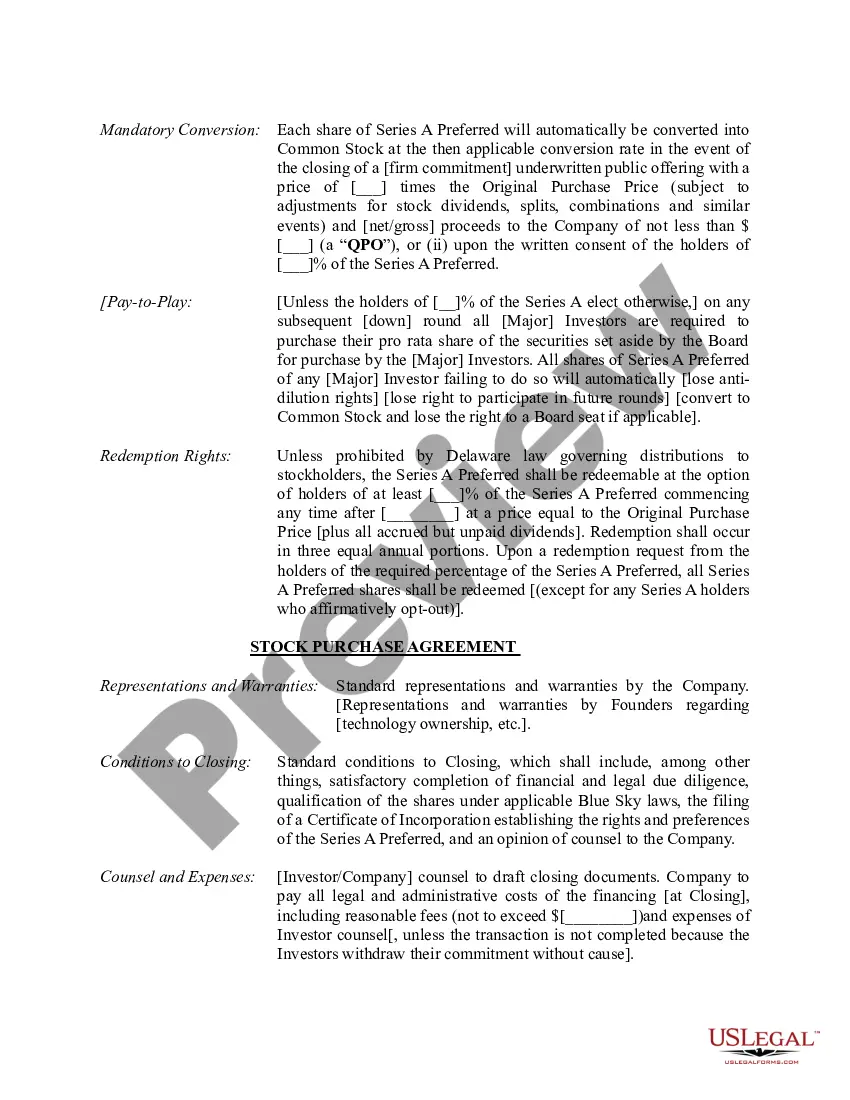

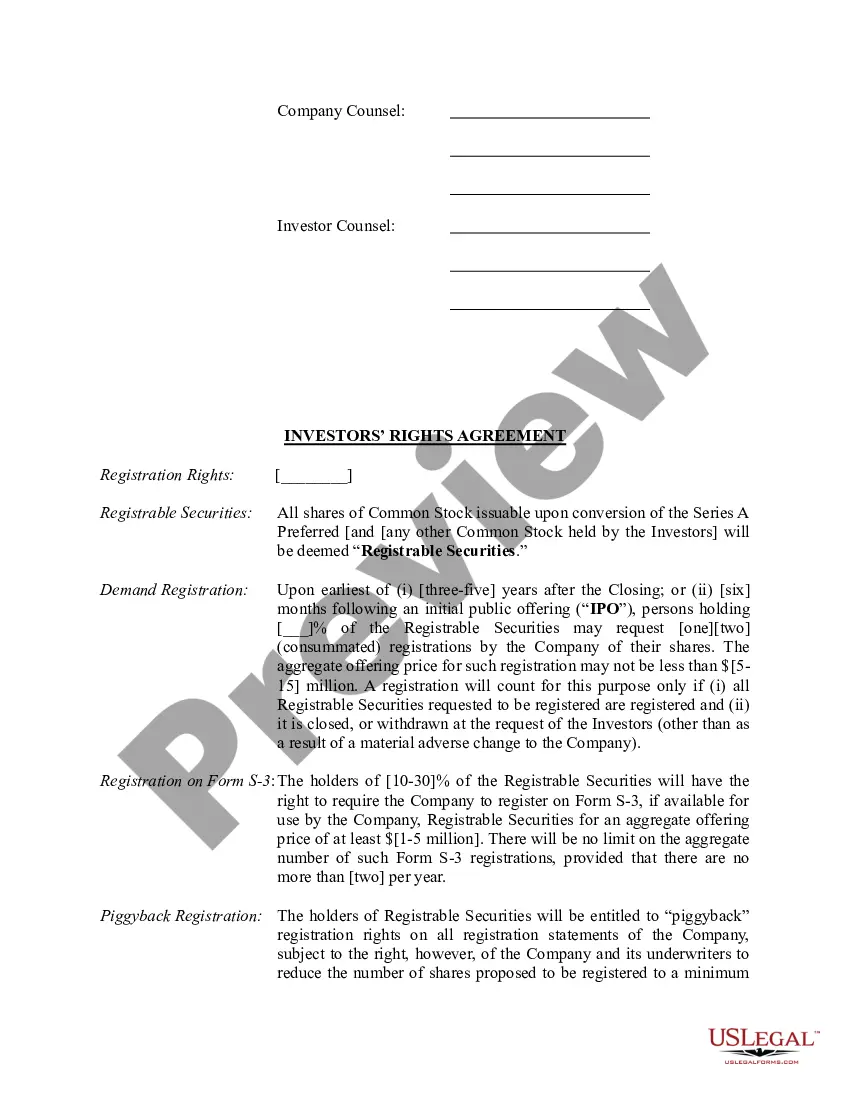

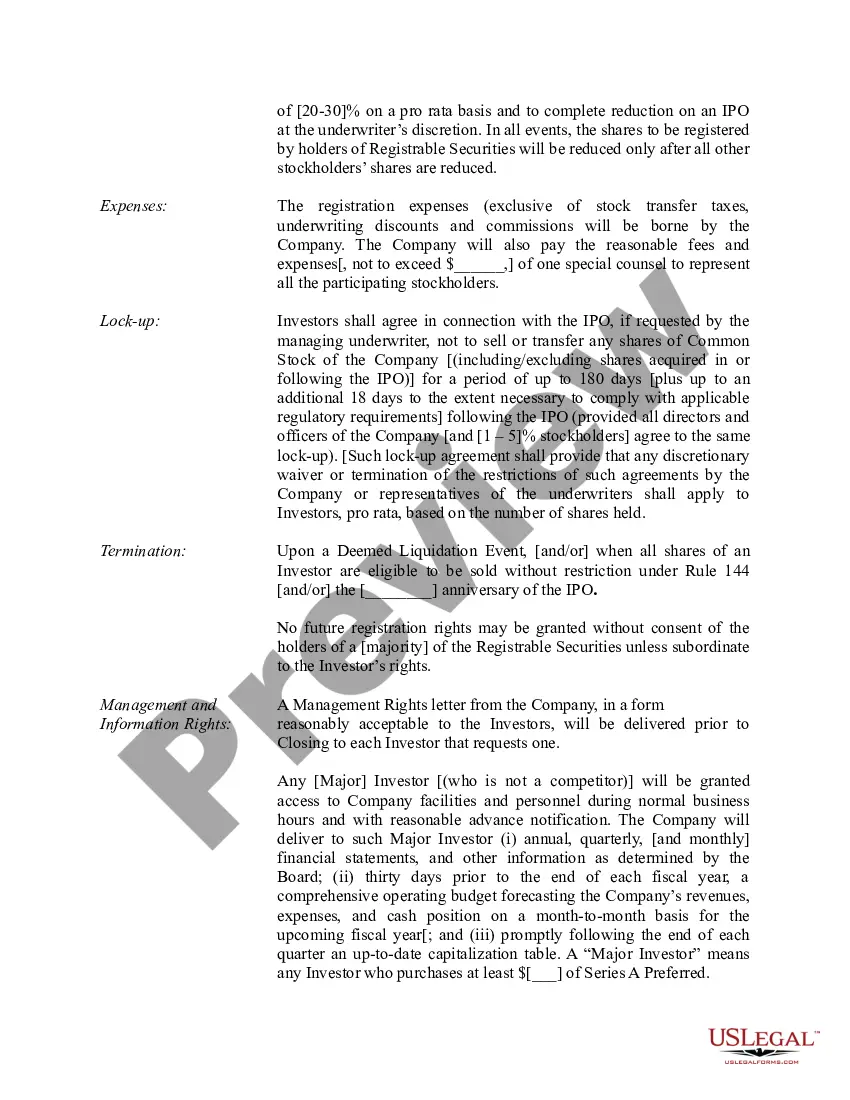

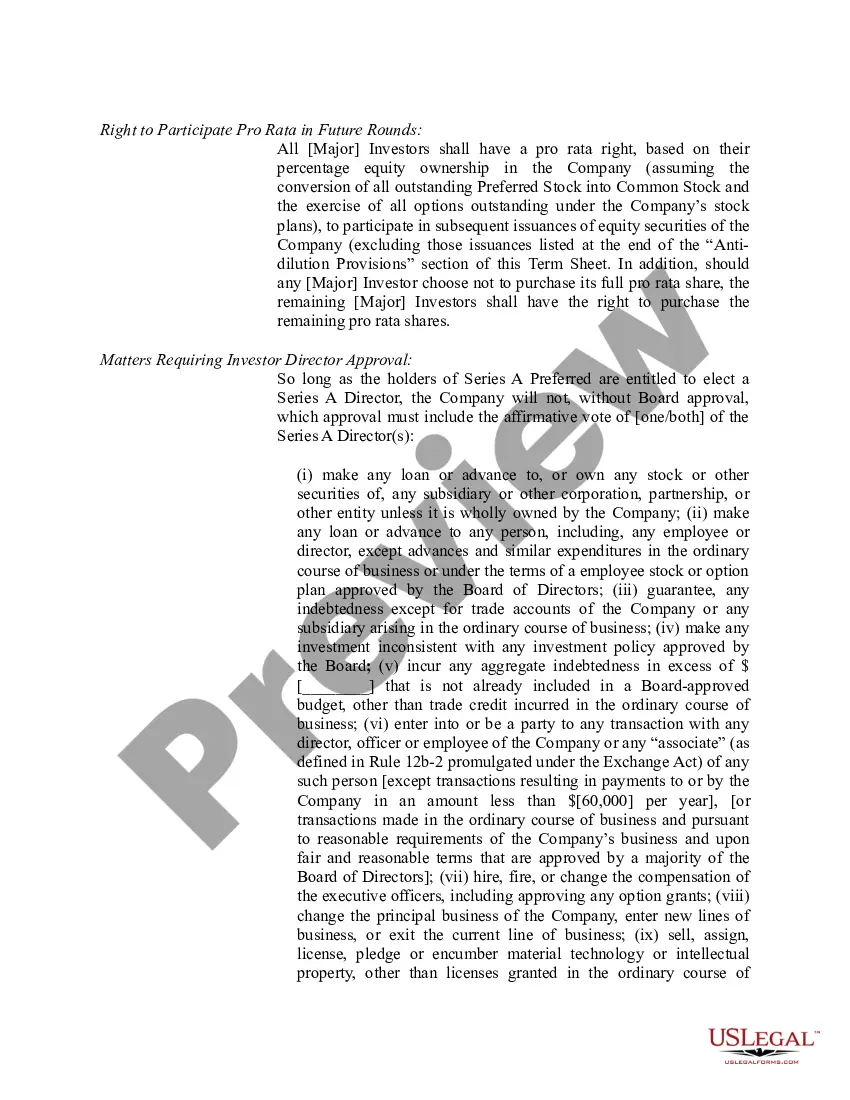

Term sheets for venture capital financings include detailed provisions describing the terms of the preferred stock being issued to investors. Some terms are more important than others. The following brief description of certain material terms divides them into two categories: economic terms and control rights.

A Preference Shares Investment Term Sheet also sets out the parties' preliminary thoughts on certain provisions to be included in a Shareholders' Agreement, which will be executed at completion of the investment and which will protect the company's or the shareholder's interests.

Preferred stock is a type of stock that has characteristics of both stocks and bonds. Like bonds, preferred shares make cash payouts, often at a higher yield than bonds, while offering higher dividend returns and less risk than common stock.

The first round of stock offered during the seed or early stage round by a portfolio company to the venture investor or fund. This stock is convertible into common stock in certain cases such as an IPO or the sale of the company.

In Series B investors provide capital to a company in exchange for the latter's preferred shares. The majority of the deals include anti-dilution provisions like in the series A. This means that a company usually sells preferred shares that do not provide its holders with voting rights.

On the pro side, some of the best reasons to consider preferred stock include: Consistent dividend income, with fixed payout amounts and payment dates. First priority to receive dividend payouts ahead of common stock shareholders or creditors. Potential for larger dividends, compared to common stock shares.

In finance, a class A share refers to a share classification of common or preferred stock that typically has enhanced benefits with respect to dividends, asset sales, or voting rights compared to Class B or Class C shares.

Preferred shareholders have priority over a company's income, meaning they are paid dividends before common shareholders. Common stockholders are last in line when it comes to company assets, which means they will be paid out after creditors, bondholders, and preferred shareholders.

Redeemable preferred stock is a type of preferred stock that includes a provision allowing the issuer to buy it back at a specific price and retire it. Also known as callable preferred stock, redeemable preferred stock can be advantageous for issuers because it gives them more financial flexibility.