A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes using a document designed to falsely imply that it issued from a state or federal source or creates a false impression as to its source, authorization or approval.

Washington Notice to Debt Collector - Falsely Representing a Document's Authority

Description

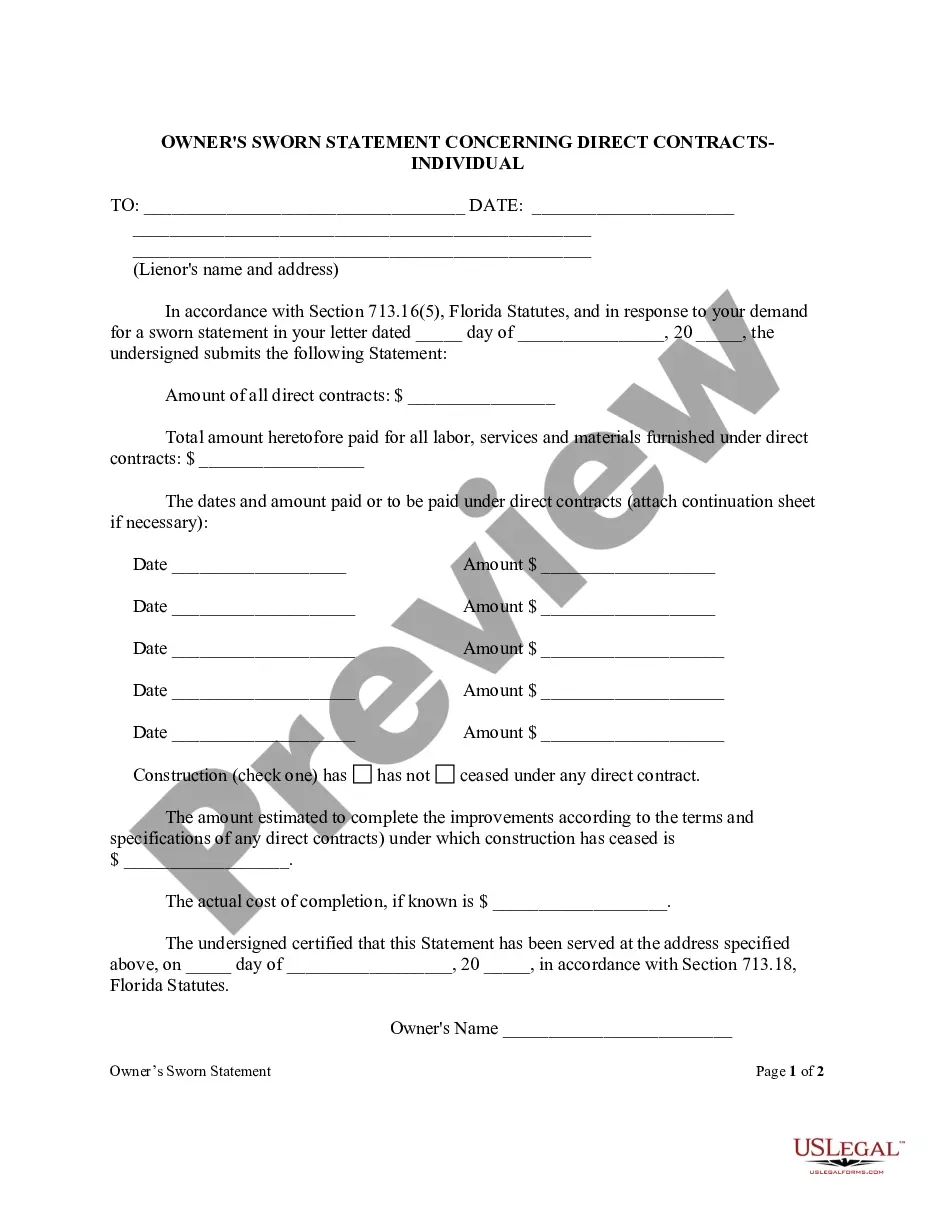

How to fill out Notice To Debt Collector - Falsely Representing A Document's Authority?

Selecting the optimal legal document design can pose a challenge.

Undoubtedly, there are numerous templates accessible online, but how can you acquire the legal document you need.

Utilize the US Legal Forms website. This service provides a vast array of templates, including the Washington Notice to Debt Collector - Falsely Representing a Document's Authority, which can be utilized for both business and personal needs.

First, ensure you have selected the correct document for your city/state. You can review the form with the Preview button and read the form description to confirm it suits your needs.

- All forms are reviewed by professionals and comply with state and federal regulations.

- If you are already registered, Log Into your account and click on the Download button to obtain the Washington Notice to Debt Collector - Falsely Representing a Document's Authority.

- Use your account to browse the legal forms you have purchased in the past.

- Navigate to the My documents tab in your account to retrieve another copy of the documents you need.

- If you are a new user of US Legal Forms, here are simple steps to follow.

Form popularity

FAQ

The creditor has to prove who the borrower is These include: Where there is a dispute as to the identity of the borrower or hirer or as to the amount of the debt, it is for the firm (and not the customer) to establish, as the case may be, that the customer is the correct person in relation to the debt.

In Washington, the statute of limitations on debt collection lawsuits is six years after the date of default or last payment on the debt account. Once a debt is past the statute of limitations, debt collectors can still attempt to collect on these debts, but they cannot file a collection lawsuit.

Many people are surprised to learn that debt collectors can sue debtors for the balance of any outstanding debt. Many times, debt collection agencies will bring a lawsuit for breach of contract because when individuals don't pay the debt they agreed to pay.

Debt collection agencies don't have any special legal powers. They can't do anything different to the original creditor. Collection agencies will use letters and phone calls to contact you. They may contact by other means too, such as text or email.

You are not obliged let a debt collector into your home and they don't have the right to take goods away. It's very important to understand that a debt collector is not the same as an enforcement agent or bailiff. Debt collectors have no special legal powers.

ResponsibilitiesKeep track of assigned accounts to identify outstanding debts.Plan course of action to recover outstanding payments.Locate and contact debtors to inquire of their payment status.Negotiate payoff deadlines or payment plans.Handle questions or complaints.Investigate and resolve discrepancies.More items...

Debt collectors are legally required to send you a debt validation letter, which outlines what the debt is, how much you owe and other information. If you're still uncertain about the debt you're being asked to pay, you can send the debt collector a debt verification letter requesting more information.

Debt collectors are generally prohibited under federal law from using any false, deceptive, or misleading misrepresentation in collecting a debt. The federal law that prohibits this is called the Fair Debt Collection Practices Act (FDCPA).

The court can make an order that the employer deduct an amount from the debtor's salary (emoluments attachment order) and pay it towards his debt. If the debtor has money in a savings or investment account, an application can be made whereby the bank is order to pay the amount directly over to the creditor.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.