You can dedicate several hours online searching for the appropriate legal document template that fulfills the local and national requirements you need. US Legal Forms offers a vast array of legal forms that are reviewed by experts.

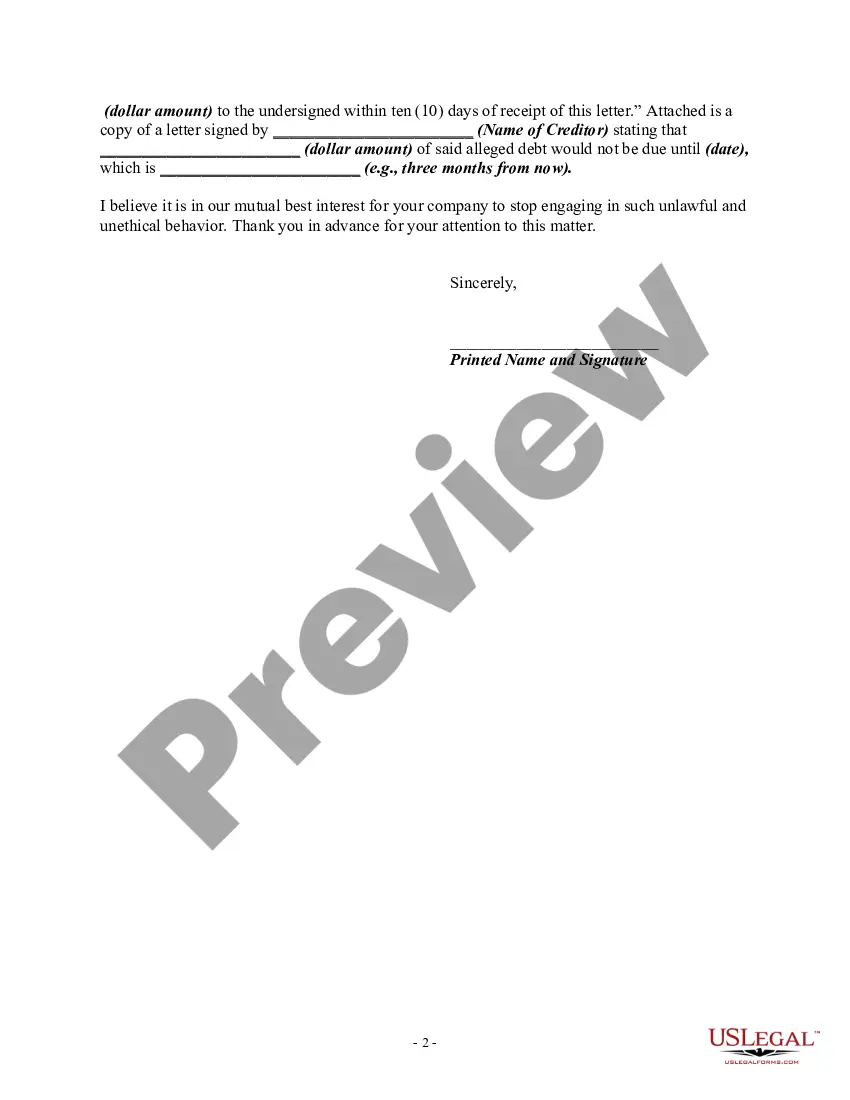

You can easily obtain or create the Washington Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities - Using False Representation or Deceptive Means to Collect a Debt - Incorrectly Claiming that the Full Amount of a Consumer's Debt is Owed When it is Not with my help.

If you possess a US Legal Forms account, you may Log In and then click the Download button. After that, you can complete, modify, produce, or sign the Washington Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities - Using False Representation or Deceptive Means to Collect a Debt - Incorrectly Claiming that the Full Amount of a Consumer's Debt is Owed When it is Not. Every legal document template you purchase is yours to keep forever.

If you'd like to find another version of the form, use the Search field to locate the template that meets your needs and requirements. Once you have found the template you wish to use, click Get now to proceed. Choose the payment plan you desire, enter your information, and register for a free account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal document. Choose the file format of the document and download it to your device. You can edit the document if needed. You can complete, modify, sign, and print the Washington Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities - Using False Representation or Deceptive Means to Collect a Debt - Incorrectly Claiming that the Full Amount of a Consumer's Debt is Owed When it is Not. Download and print thousands of document templates using the US Legal Forms website, which offers the best selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- To obtain an additional copy of any purchased form, go to the My documents section and click the related button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the region/city of your choice. Check the form description to confirm you have selected the right template.

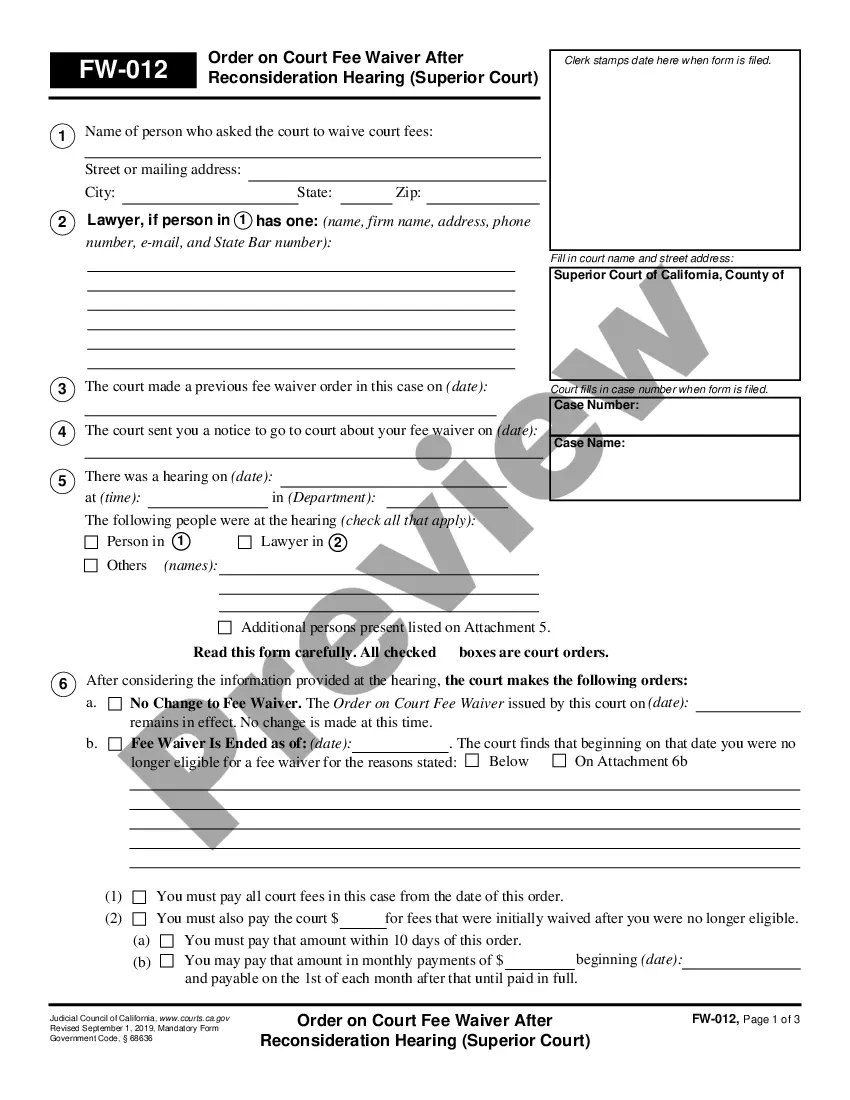

- If available, use the Review button to examine the document template as well.