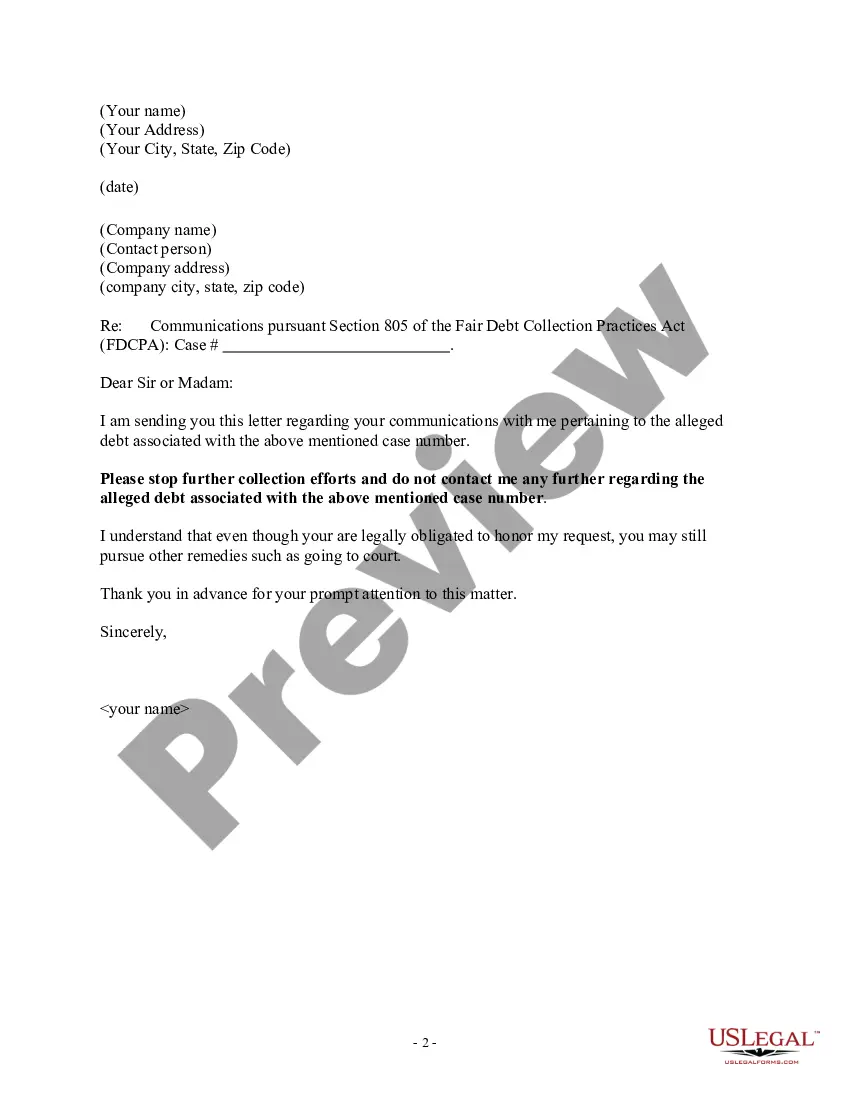

Washington Notice of Violation of Fair Debt Act - Notice to Stop Contact

Description

How to fill out Notice Of Violation Of Fair Debt Act - Notice To Stop Contact?

Selecting the appropriate legal document template can be challenging.

Clearly, there are numerous formats accessible online, but how will you locate the proper form you require.

Utilize the US Legal Forms website. The service offers thousands of templates, including the Washington Notice of Violation of Fair Debt Act - Notice to Stop Contact, which can be utilized for business and personal purposes.

You can view the form using the Preview button and read the form details to confirm it is suitable for you.

- All the forms are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to retrieve the Washington Notice of Violation of Fair Debt Act - Notice to Stop Contact.

- Use your account to search for the legal forms you have acquired previously.

- Visit the My documents tab of your account and obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have selected the correct form for your city/county.

Form popularity

FAQ

In Washington, the statute of limitations on debt collection lawsuits is six years after the date of default or last payment on the debt account. Once a debt is past the statute of limitations, debt collectors can still attempt to collect on these debts, but they cannot file a collection lawsuit.

This means that debt collectors cannot harass you in-person at your work. However, a debt collector, like a credit card company, may call you at work, though they can't reveal to your co-workers that they are debt collectors. If you ask the debt collector not to contact you at work, by law they must stop.

How much interest can collection agencies charge? Collection agencies can collect 12% interest annually on debts.

What are debt collectors not allowed to do?Contact you at your workplace or via social media.Give you incorrect or misleading information.Contact you outside the hours of 8am-9pm on working days or at all on weekends and holidays.Tell other people such as family about your debt situation.More items...

Debt collection agencies may take you to court on behalf of a creditor if they have been unable to contact you in their attempts to recover a debt. Before being threatened by court action, the debt collection agency must have first sent you a warning letter.

This means that debt collectors cannot harass you in-person at your work. However, a debt collector, like a credit card company, may call you at work, though they can't reveal to your co-workers that they are debt collectors. If you ask the debt collector not to contact you at work, by law they must stop.

A debt collector has to send you a written statement outlining the specifics of your debt that is in collection. Within five days of contacting you, a debt collector must send you this written notice with the amount of money you owe and the name of the original creditor.

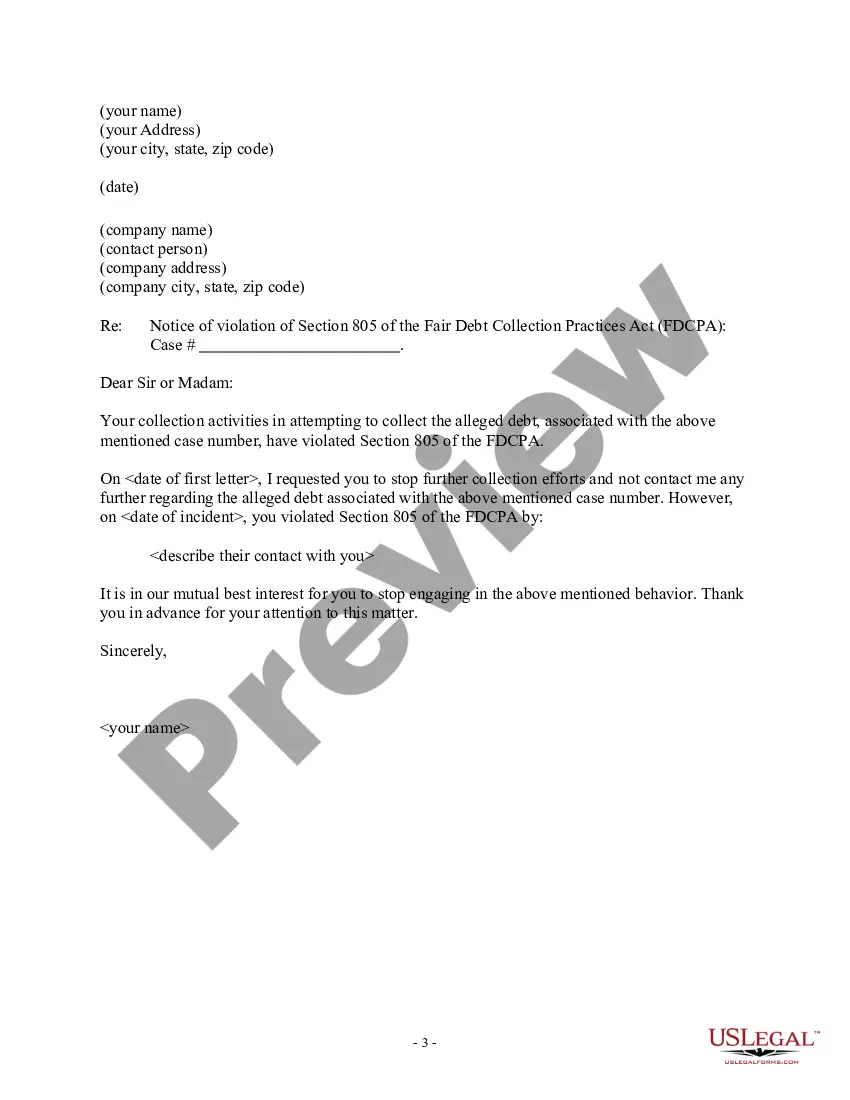

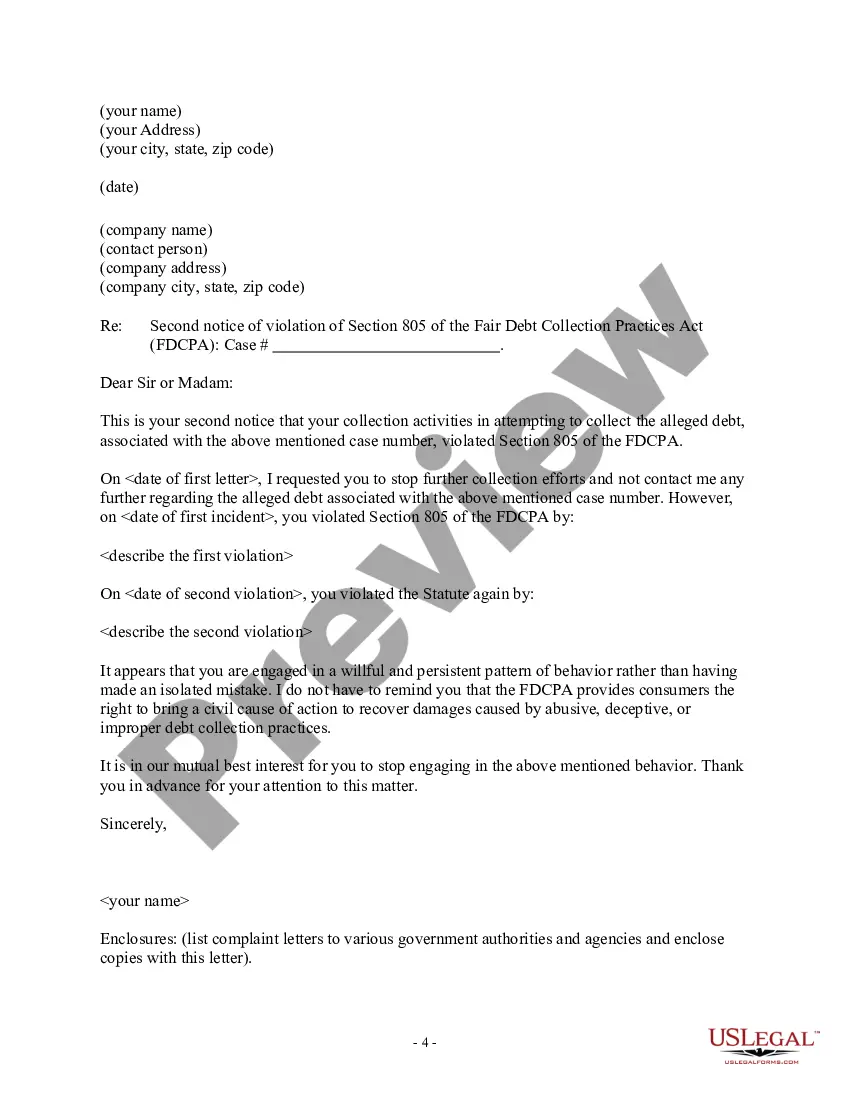

If a debt collector violates the FDCPA, you may sue that collector in state or federal court. You can even sue in small claims court. You must do this within one year from the date on which the violation occurred.

In Washington, the statute of limitations on debt collection lawsuits is six years after the date of default or last payment on the debt account. Once a debt is past the statute of limitations, debt collectors can still attempt to collect on these debts, but they cannot file a collection lawsuit.

Can a Debt Collector Email Me at Work? Generally, under the CFPB's final rule, a debt collector can't communicate or attempt to communicate with you by sending an email to an email address that the debt collector knows is a work email address, subject to some exceptions.