Washington Proxy Statement - University National Bank and Trust Co.

Description

How to fill out Proxy Statement - University National Bank And Trust Co.?

US Legal Forms - among the biggest libraries of lawful kinds in America - provides a variety of lawful record web templates you can acquire or print. Utilizing the internet site, you will get thousands of kinds for organization and specific functions, sorted by types, says, or keywords.You will find the newest models of kinds just like the Washington Proxy Statement - University National Bank and Trust Co. within minutes.

If you already have a registration, log in and acquire Washington Proxy Statement - University National Bank and Trust Co. from your US Legal Forms collection. The Obtain button will appear on every single kind you see. You get access to all previously saved kinds inside the My Forms tab of your respective accounts.

If you want to use US Legal Forms the first time, here are easy directions to obtain started off:

- Be sure you have picked out the right kind for your city/area. Click on the Review button to check the form`s information. Look at the kind description to actually have chosen the proper kind.

- In case the kind does not suit your demands, use the Lookup area at the top of the display screen to obtain the one which does.

- If you are satisfied with the form, verify your option by visiting the Acquire now button. Then, opt for the rates program you favor and offer your credentials to register on an accounts.

- Approach the transaction. Utilize your charge card or PayPal accounts to accomplish the transaction.

- Choose the file format and acquire the form on the device.

- Make changes. Load, revise and print and indicator the saved Washington Proxy Statement - University National Bank and Trust Co..

Every single format you included in your bank account does not have an expiry day and is also yours for a long time. So, in order to acquire or print one more backup, just proceed to the My Forms segment and click on the kind you will need.

Get access to the Washington Proxy Statement - University National Bank and Trust Co. with US Legal Forms, probably the most considerable collection of lawful record web templates. Use thousands of professional and status-specific web templates that meet your company or specific demands and demands.

Form popularity

FAQ

Financial Corporation, Washington Trust Bank has assets exceeding $11 billion and currently has 42 branches and offices in Idaho, Oregon, and Washington.

Proxies allow users to use an account (it can be in cold storage or a hot wallet) less frequently but actively participate in the network with the weight of the s in that account. Proxies are allowed to perform a limited amount of actions related to specific substrate pallets on behalf of another account.

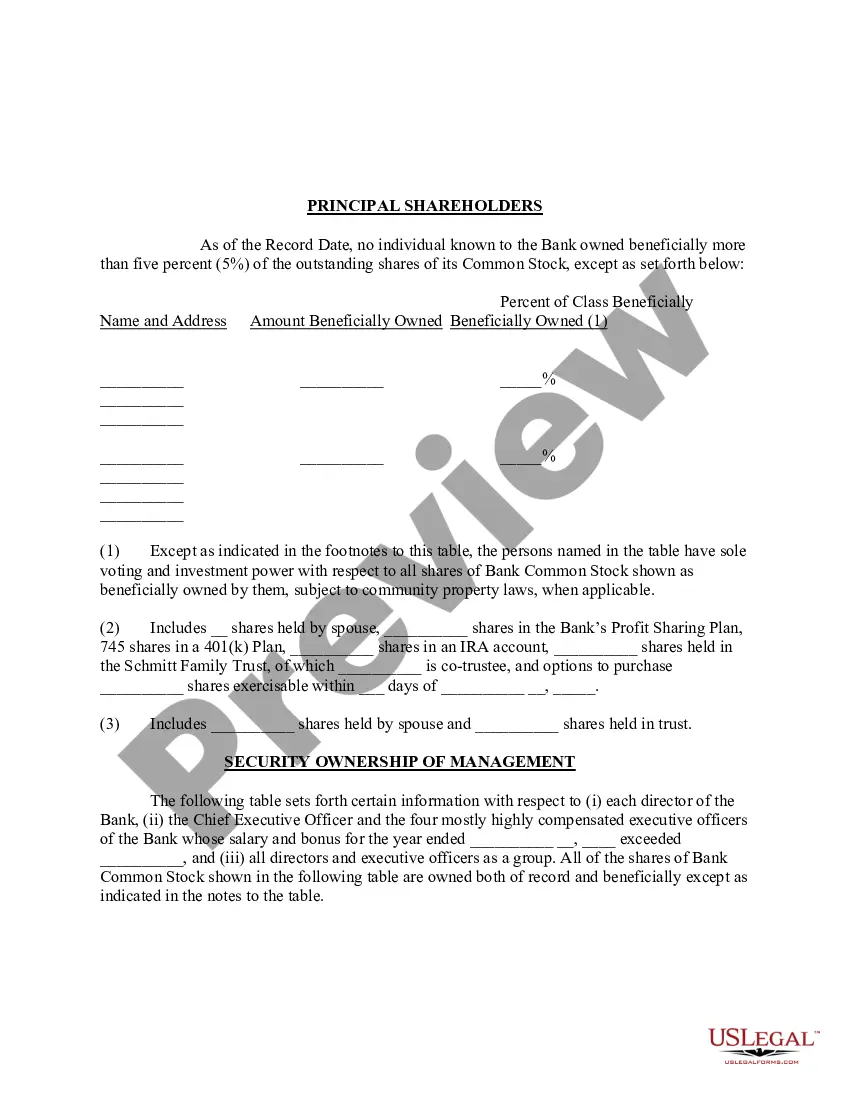

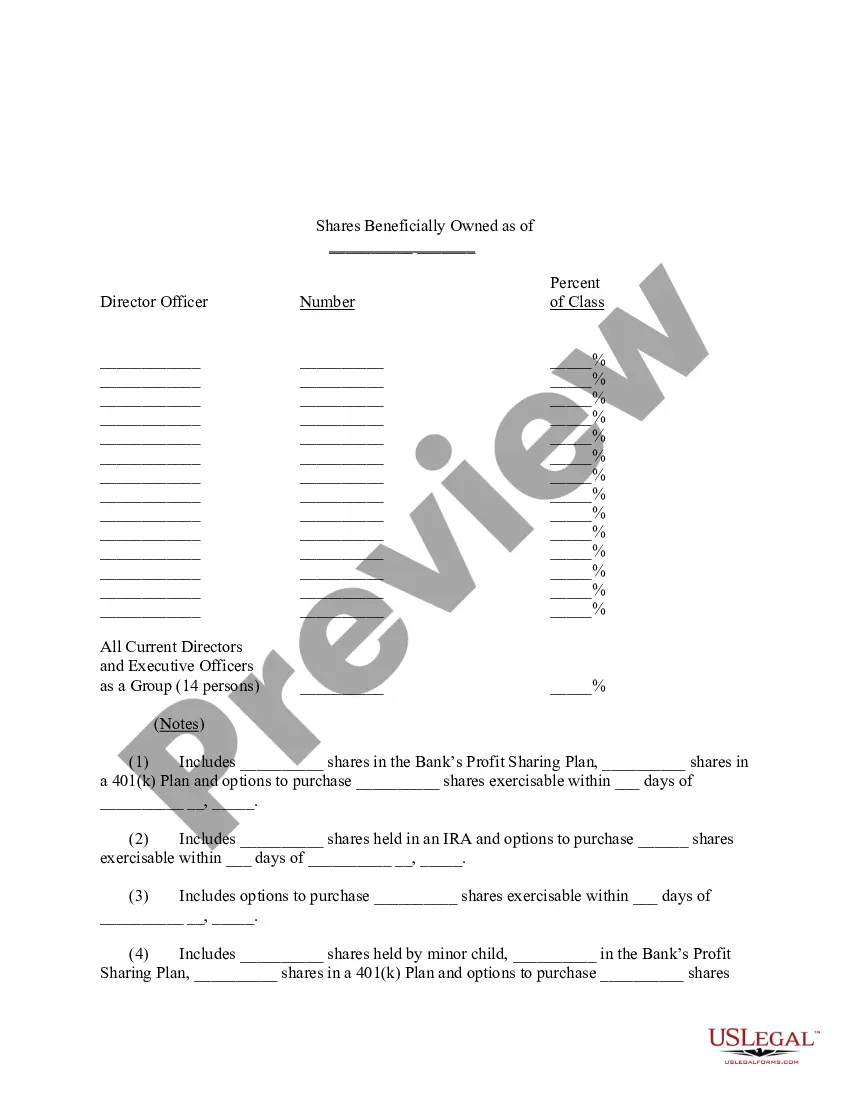

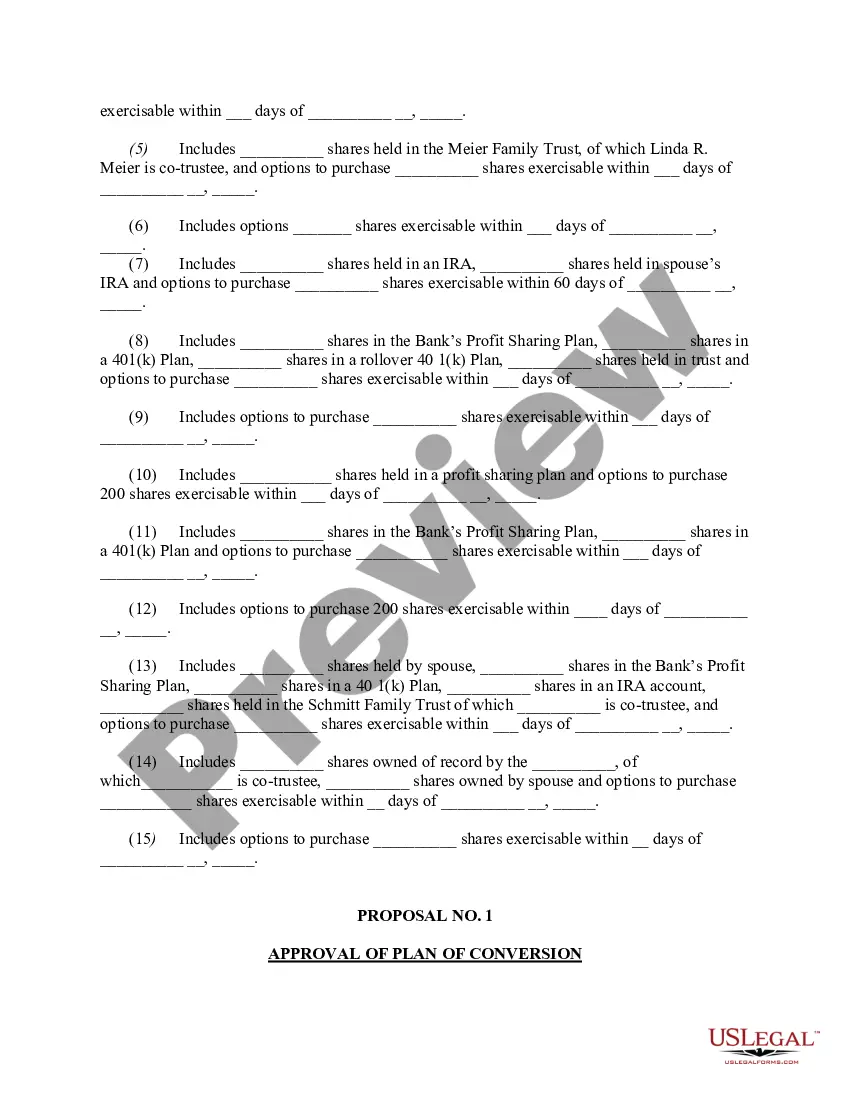

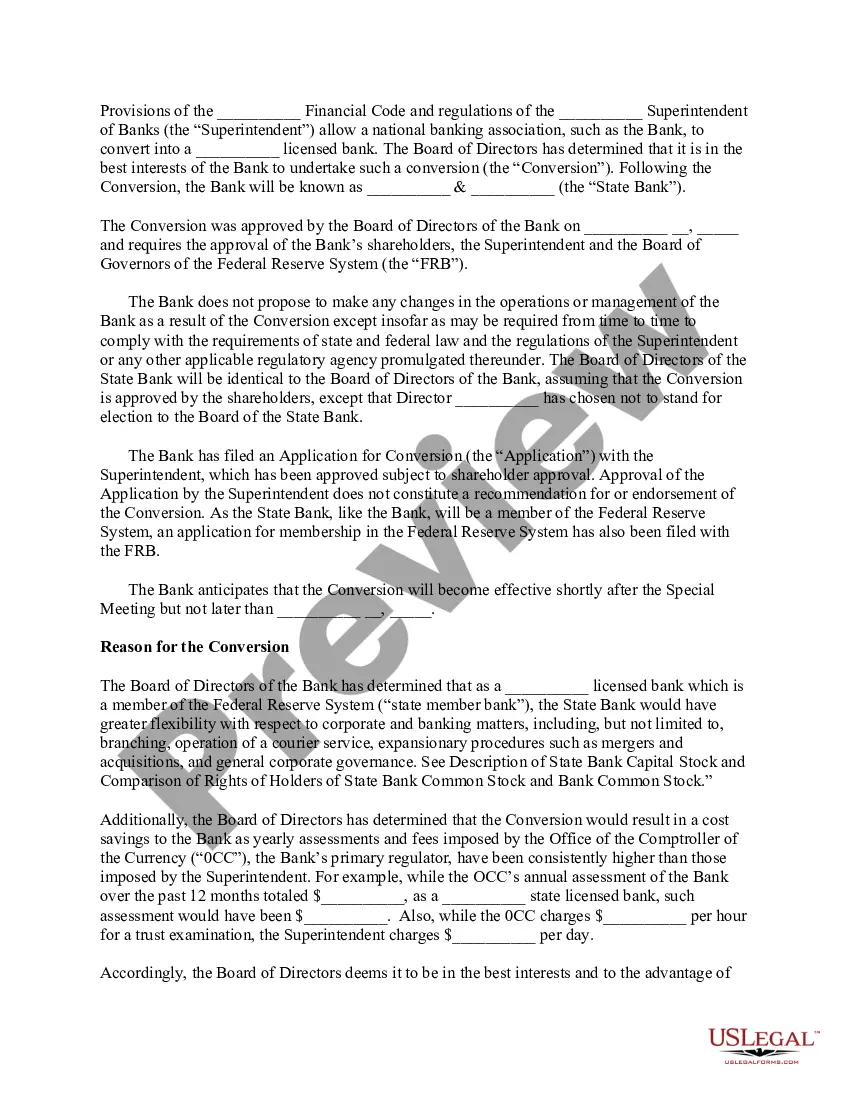

Proxy statements are documents that the Securities and Exchange Commission requires companies to give to shareholders so they can weigh in on important company issues. Proxy statements offer shareholders information about changes on the board and other important decisions the board needs to make.

Filling out a voting proxy form is necessary in order to be able to have someone vote on your behalf in an election or referendum. Proxy voting, the act of having some else vote on your behalf, is often allowed in specific circumstances.

Proxies make payments simpler by doing away with the need to know beneficiary bank details ? all you need is their mobile number or email address. QR codes for paying businesses are another example of proxies - you don't need to know bank details, just scan the code and the payment will reach its destination.