Washington Form of Certificate of Designations, Preferences and Rights of Series C Convertible Preferred Stock

Description

How to fill out Form Of Certificate Of Designations, Preferences And Rights Of Series C Convertible Preferred Stock?

Are you in the position in which you need to have documents for both company or individual functions nearly every day? There are a variety of authorized papers templates accessible on the Internet, but finding kinds you can depend on isn`t effortless. US Legal Forms delivers 1000s of type templates, such as the Washington Form of Certificate of Designations, Preferences and Rights of Series C Convertible Preferred Stock, that happen to be composed to meet federal and state demands.

When you are previously familiar with US Legal Forms internet site and also have an account, basically log in. After that, it is possible to down load the Washington Form of Certificate of Designations, Preferences and Rights of Series C Convertible Preferred Stock web template.

Should you not have an account and want to start using US Legal Forms, adopt these measures:

- Obtain the type you need and make sure it is for your appropriate metropolis/county.

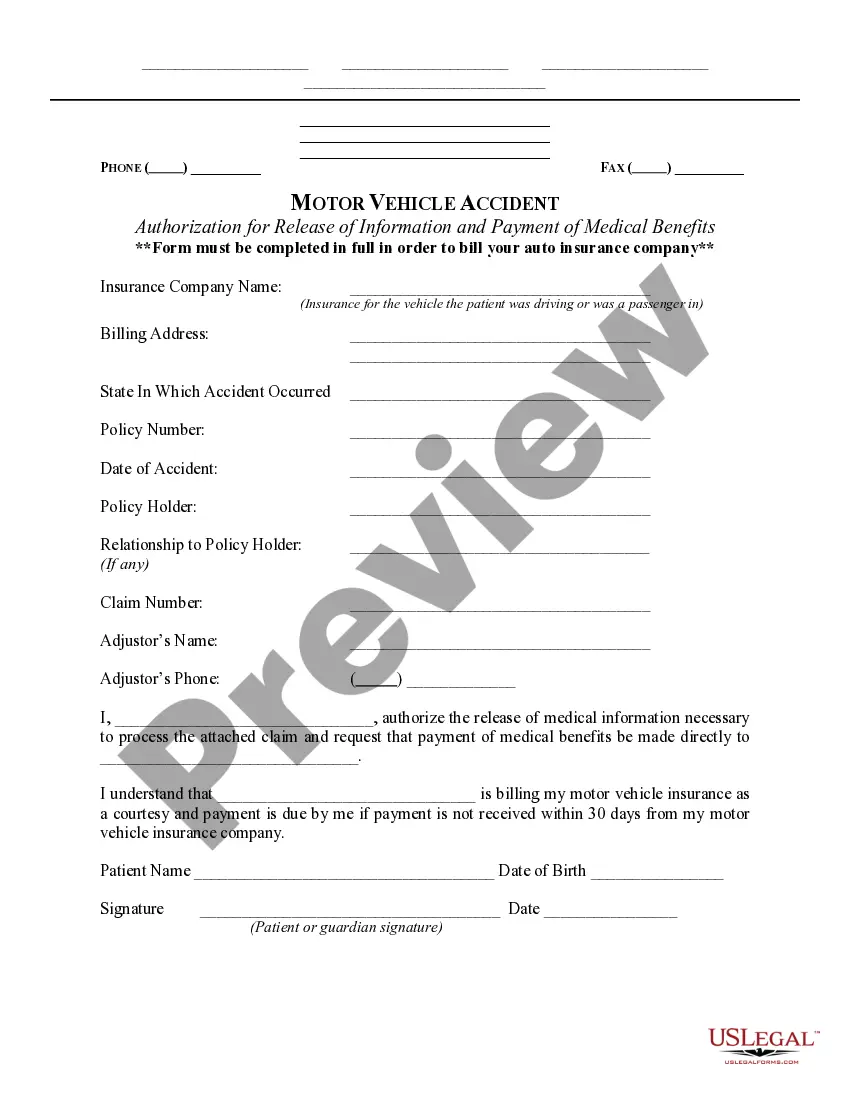

- Use the Review button to examine the shape.

- Read the explanation to ensure that you have selected the right type.

- In the event the type isn`t what you`re trying to find, utilize the Research field to discover the type that fits your needs and demands.

- Whenever you discover the appropriate type, click Acquire now.

- Select the rates prepare you want, fill out the desired information and facts to produce your bank account, and buy an order using your PayPal or bank card.

- Decide on a handy data file structure and down load your version.

Get all the papers templates you have bought in the My Forms food selection. You can aquire a extra version of Washington Form of Certificate of Designations, Preferences and Rights of Series C Convertible Preferred Stock at any time, if required. Just select the needed type to down load or printing the papers web template.

Use US Legal Forms, one of the most considerable assortment of authorized kinds, to conserve time and avoid faults. The service delivers expertly produced authorized papers templates that you can use for a range of functions. Generate an account on US Legal Forms and initiate creating your lifestyle easier.

Form popularity

FAQ

Series C funding typically comes from venture capital firms that invest in late-stage startups, private equity firms, banks, and even hedge funds. This is the point in the startup lifecycle where major financial institutions may choose to get involved, as the company and product are proven.

A certificate which contains a copy of the board resolution setting out the powers, designations, preferences or rights of a class or series of a class of stock of a corporation (typically a series of preferred stock) if they are not already contained in the certificate of incorporation of the corporation.

Series C Convertible Preferred Stock means the Series C Convertible Redeemable Preferred Stock, par value $. 01 per share, of the Company, having the same voting rights as the Class A Common Stock determined on an as converted basis.

Series C Preference Shares means the number of shares of Parent Common Stock obtained by adding (a) the number of shares of Parent Common Stock equal to the product of (i) the number of shares of Series C Preferred Stock outstanding immediately prior to the Effective Time, multiplied by (ii) the quotient of (A) the sum ...

Similar to previous stages of financing, the series C round primarily relies on raising capital through the sale of preferred shares. The shares are likely to be convertible shares. They offer holders the right to exchange them for common stock in the company at some date in the future.

Convertible preferred stock offers the investor the benefits of both preferred stock and common stock. Investors get the stability, liquidation priority, and higher dividends of preferred stock, but they also have the option to convert their shares into common stock later if they believe that the price will go up.

What Is a Class C Share? Class C shares are a class of mutual fund share characterized by a level load that includes annual charges for fund marketing, distribution, and servicing, set at a fixed percentage. These fees amount to a commission for the firm or individual helping the investor decide on which fund to own.

In Series C rounds, investors inject capital into successful businesses in an effort to receive more than double that amount back. Series C funding focuses on scaling the company, growing as quickly and successfully as possible. One possible way to scale a company could be to acquire another company.