Washington Second Warrant Agreement by General Physics Corp.

Description

How to fill out Second Warrant Agreement By General Physics Corp.?

US Legal Forms - one of the largest libraries of legitimate kinds in the United States - offers a wide range of legitimate record templates it is possible to obtain or print out. While using internet site, you can find a large number of kinds for business and person functions, sorted by types, suggests, or key phrases.You will discover the latest variations of kinds such as the Washington Second Warrant Agreement by General Physics Corp. in seconds.

If you have a membership, log in and obtain Washington Second Warrant Agreement by General Physics Corp. through the US Legal Forms library. The Down load key will appear on each develop you see. You get access to all earlier saved kinds from the My Forms tab of your account.

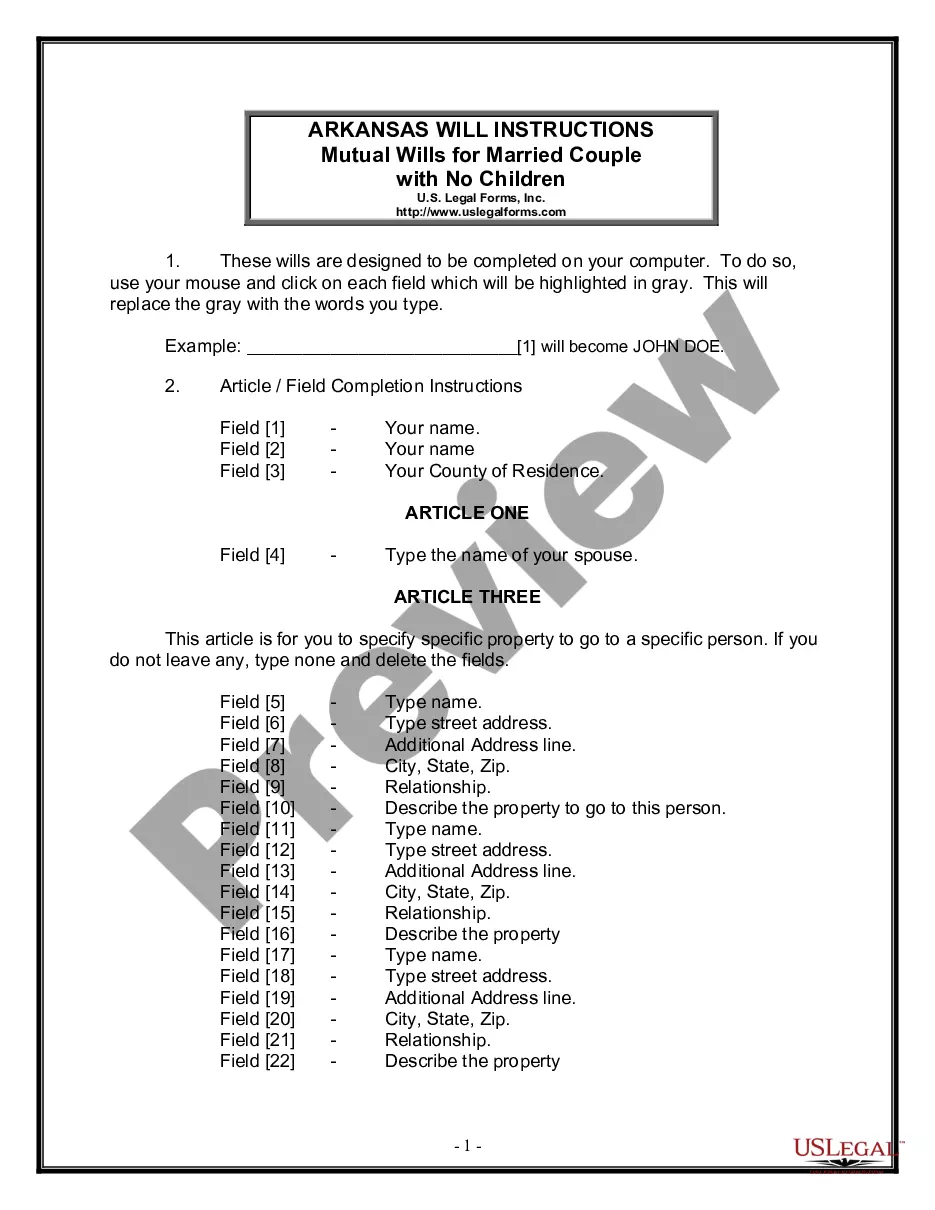

In order to use US Legal Forms the very first time, listed below are straightforward recommendations to obtain started:

- Be sure to have picked the proper develop for your town/state. Go through the Preview key to analyze the form`s information. Browse the develop description to ensure that you have chosen the proper develop.

- In the event the develop does not suit your specifications, use the Research field near the top of the display screen to find the one that does.

- Should you be happy with the form, validate your choice by clicking the Buy now key. Then, opt for the prices program you want and give your qualifications to register to have an account.

- Method the transaction. Use your bank card or PayPal account to perform the transaction.

- Choose the formatting and obtain the form on your product.

- Make changes. Fill out, revise and print out and indicator the saved Washington Second Warrant Agreement by General Physics Corp..

Every format you put into your bank account does not have an expiry day which is your own property eternally. So, if you would like obtain or print out one more version, just proceed to the My Forms area and click on around the develop you want.

Gain access to the Washington Second Warrant Agreement by General Physics Corp. with US Legal Forms, probably the most extensive library of legitimate record templates. Use a large number of specialist and status-distinct templates that meet your business or person requirements and specifications.

Form popularity

FAQ

Warrants and call options are both types of securities contracts. A warrant gives the holder the right, but not the obligation, to buy common shares of stock directly from the company at a fixed price for a pre-defined time period.

What Is Warrant Coverage? Warrant coverage is an agreement between a company and one or more shareholders where the company issues a warrant equal to some percentage of the dollar amount of an investment. Warrants, similar to options, allow investors to acquire shares at a designated price.

A warrant is an agreement between two parties ? the ?issuer? (i.e., a company) and the ?holder? of the warrant ? that entitles the holder to purchase the issuer's stock at a specified price within a certain time frame.

A warrant agreement is an agreement to purchase stock, also called a stock warrant. The agreement provides one party the right to purchase a company's stock at a specific price and at a specific date.

Companies often issue stock warrants by attaching the warrant to a bond or other security that they use to raise capital. The warrant helps attract investors and also represents potential future capital for the issuing company.