Missouri Franchisee Closing Questionnaire

Description

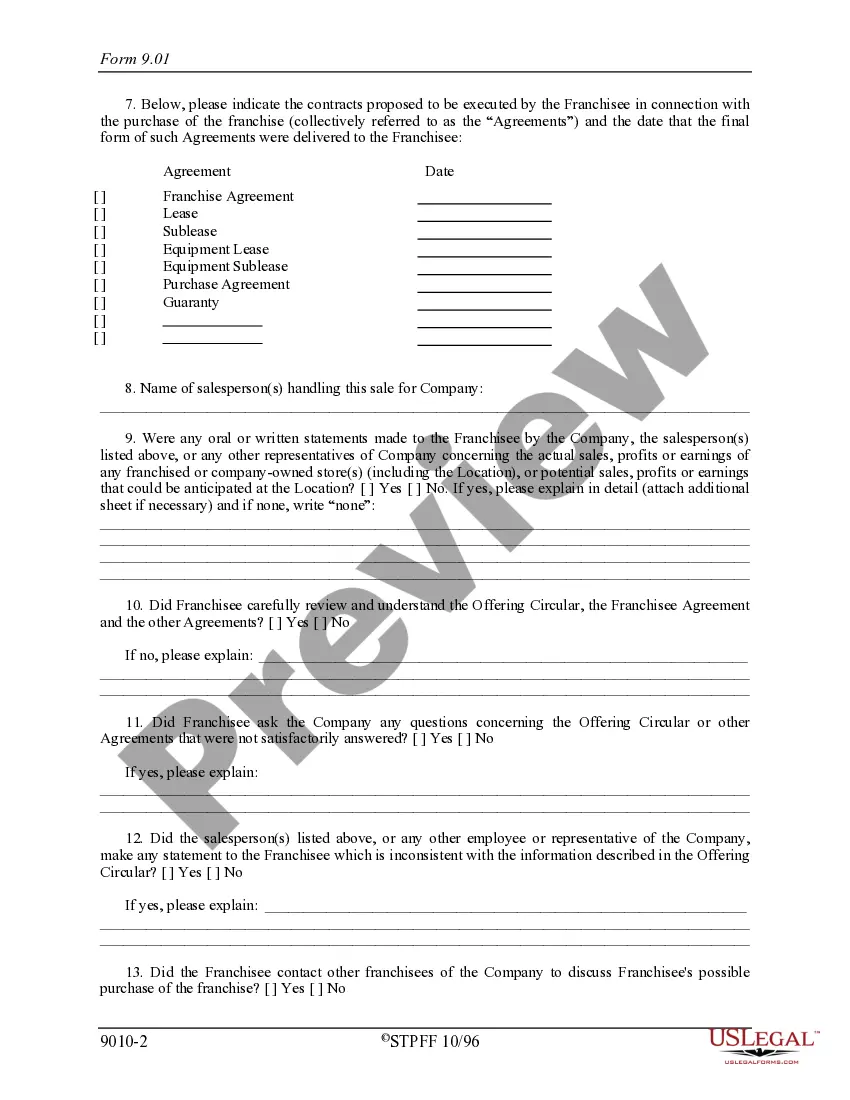

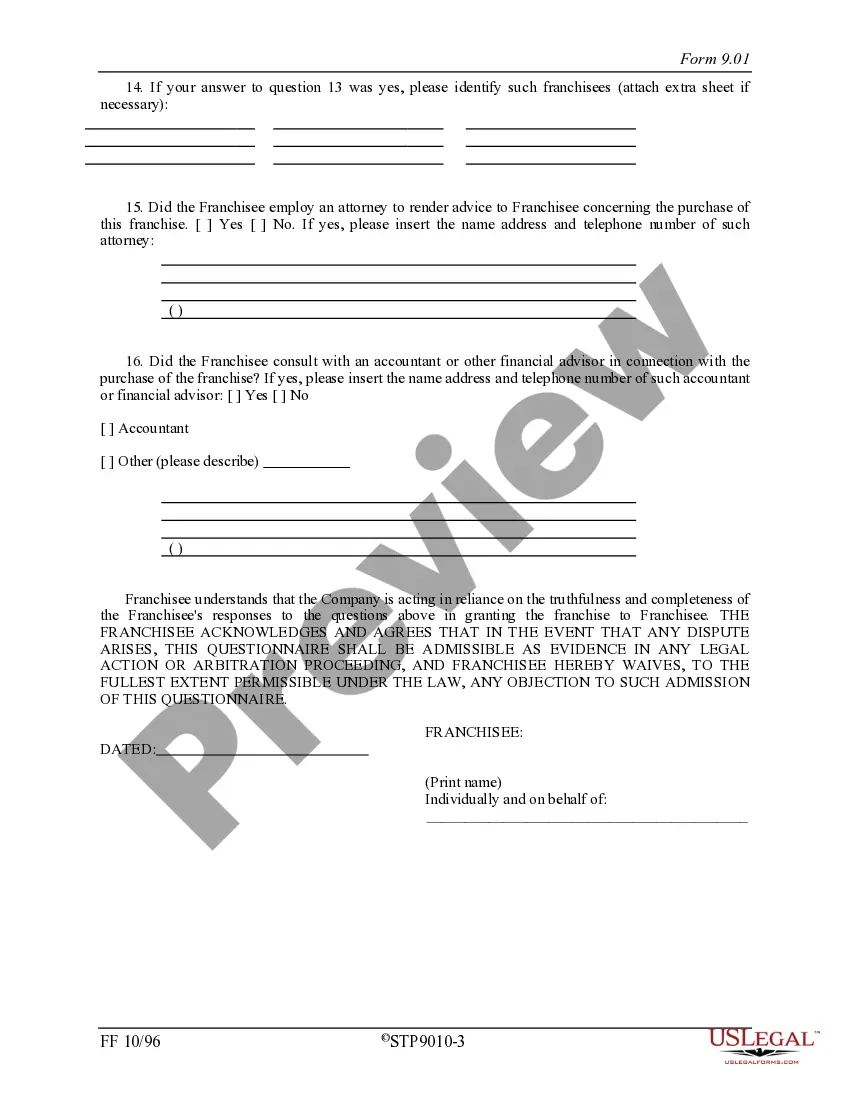

How to fill out Franchisee Closing Questionnaire?

Are you currently in a position in which you will need papers for both organization or specific functions nearly every time? There are plenty of legitimate papers themes accessible on the Internet, but getting kinds you can rely on is not simple. US Legal Forms provides thousands of form themes, such as the Missouri Franchisee Closing Questionnaire, which can be created to satisfy state and federal needs.

When you are previously acquainted with US Legal Forms site and get a merchant account, basically log in. Following that, you may acquire the Missouri Franchisee Closing Questionnaire format.

Should you not provide an bank account and need to begin to use US Legal Forms, abide by these steps:

- Find the form you need and ensure it is to the right city/area.

- Utilize the Preview switch to review the form.

- Look at the description to actually have chosen the proper form.

- In case the form is not what you are searching for, take advantage of the Lookup discipline to get the form that suits you and needs.

- When you find the right form, just click Get now.

- Select the pricing plan you need, submit the specified details to generate your money, and buy your order utilizing your PayPal or Visa or Mastercard.

- Decide on a hassle-free file format and acquire your backup.

Locate all of the papers themes you possess bought in the My Forms menu. You can obtain a further backup of Missouri Franchisee Closing Questionnaire any time, if necessary. Just click the needed form to acquire or print out the papers format.

Use US Legal Forms, one of the most substantial variety of legitimate varieties, in order to save some time and steer clear of blunders. The service provides expertly made legitimate papers themes which can be used for an array of functions. Make a merchant account on US Legal Forms and start creating your life a little easier.

Form popularity

FAQ

Missouri has a 4.0 percent corporate income tax rate. Missouri has a 4.225 percent state sales tax rate, a max local sales tax rate of 5.763 percent, an average combined state and local sales tax rate of 8.33 percent. Missouri's tax system ranks 11th overall on our 2023 State Business Tax Climate Index.

For Missouri residents, forms to complete the dissolution of a company can be found on the Missouri Secretary of State's website(opens in new window). For-profit corporations need to complete Articles of Dissolution by Voluntary Action, Request for Termination and Resolution to Dissolve.

Missouri State Income Tax LLCs with default status or S-corp status will pay state income tax on the business' revenue on their personal income tax forms. Most LLCs will pay 5.3% on all taxable income over $8,968 (plus $291). If your LLC makes less than $8,968, you will likely qualify for a lower income tax percentage.

Certificate of Admission/Good Standing The fee for each certificate is $15. Certificates will be sent out within approximately 3 business days. Certificates will be mailed via first class mail unless express mail is checked below.

For LLCs electing to be taxed as corporations, Form MO-1120 must be filed in Missouri. A single-member LLC that is considered disregarded for federal taxation purposes must report income and expenses accrued by the LLC on the member's tax return. In Missouri, a state tax identification number is required.

How do I apply for a tax clearance? Complete Form 943PDF Document a Request For Tax Clearance and submit it to the Department of Revenue's Tax Clearance Unit. Once the form is completed and signed by a corporate officer it can be mailed or faxed to the tax clearance unit.

Missouri franchise tax is paid by all corporations doing business in the state. Companies required to pay the tax must file Form MO-1120 or Form MO-1120S when paying their tax bill. Missouri has been collecting franchise tax from businesses since 1970.

If the LLC is a corporation, normal corporate tax rules will apply to the LLC and it should file a Form 1120, U.S. Corporation Income Tax Return. The 1120 is the C corporation income tax return, and there are no flow-through items to a 1040 or 1040-SR from a C corporation return.