Washington Current Expenditures of Individual Debtors - Schedule J - Form 6J - Post 2005

Description

How to fill out Current Expenditures Of Individual Debtors - Schedule J - Form 6J - Post 2005?

Are you currently within a position in which you need to have files for either company or specific uses just about every day time? There are a variety of legitimate file layouts available on the Internet, but getting versions you can depend on isn`t effortless. US Legal Forms offers thousands of kind layouts, like the Washington Current Expenditures of Individual Debtors - Schedule J - Form 6J - Post 2005, that are composed to fulfill state and federal requirements.

Should you be currently knowledgeable about US Legal Forms website and have a merchant account, simply log in. After that, you are able to obtain the Washington Current Expenditures of Individual Debtors - Schedule J - Form 6J - Post 2005 web template.

Unless you provide an bank account and would like to start using US Legal Forms, abide by these steps:

- Discover the kind you want and make sure it is for your right area/region.

- Make use of the Review button to examine the shape.

- Read the explanation to ensure that you have chosen the appropriate kind.

- When the kind isn`t what you`re trying to find, make use of the Look for area to discover the kind that suits you and requirements.

- If you get the right kind, click Purchase now.

- Pick the prices program you would like, complete the necessary details to create your account, and purchase an order using your PayPal or bank card.

- Choose a practical file formatting and obtain your backup.

Get every one of the file layouts you possess purchased in the My Forms menu. You may get a extra backup of Washington Current Expenditures of Individual Debtors - Schedule J - Form 6J - Post 2005 any time, if required. Just go through the essential kind to obtain or print out the file web template.

Use US Legal Forms, one of the most extensive variety of legitimate kinds, in order to save time as well as avoid mistakes. The support offers professionally created legitimate file layouts which can be used for an array of uses. Make a merchant account on US Legal Forms and commence generating your way of life easier.

Form popularity

FAQ

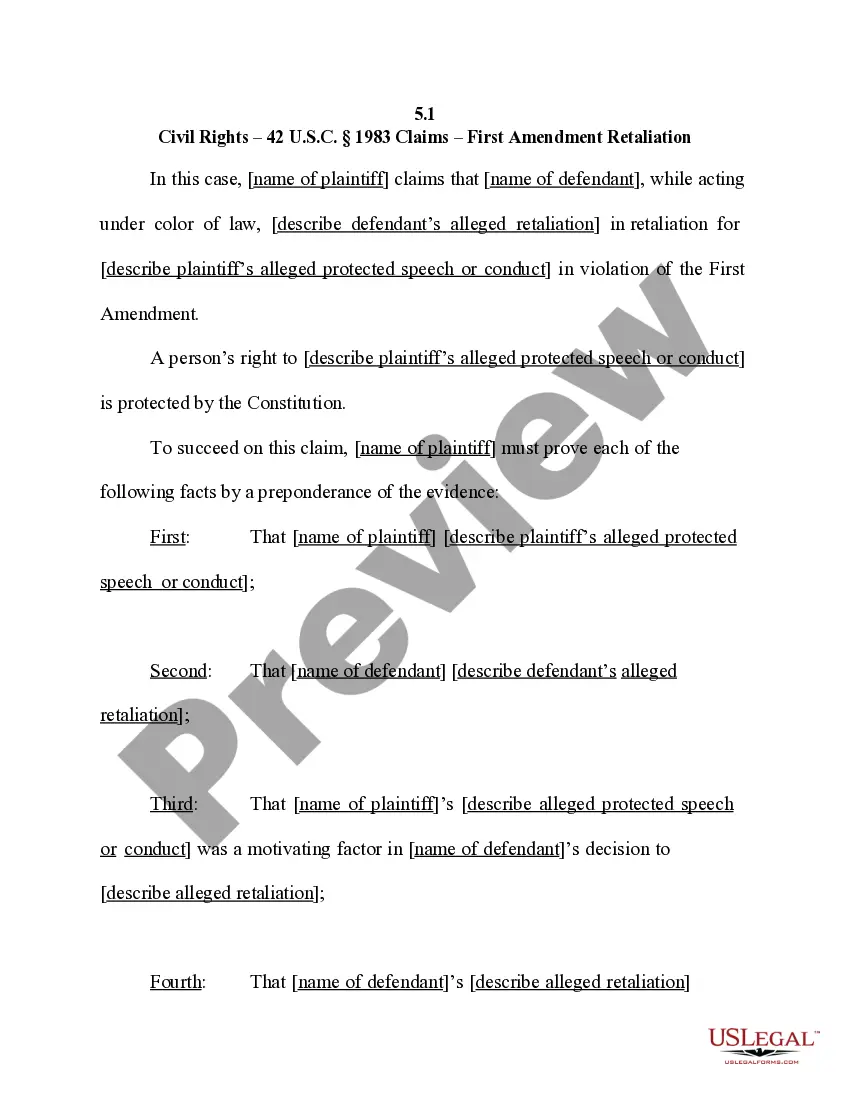

Official Form 106I (Schedule I) is the form where you disclose your monthly household income. Official Form 106J (Schedule J) is the form where you disclose your current household monthly expenses. At the end of Schedule J, you will subtract your income from your expenses.

Key Takeaways. Debtors are individuals or businesses that owe money, whether to banks or other individuals. Debtors are often called borrowers if the money owed is to a bank or financial institution, however, they are called issuers if the debt is in the form of securities.

Income averaging for farmers and fishermen provides a way to balance an income tax burden over several years, reducing the effects of both lean and bounty years. Schedule J is the Internal Revenue Service form used when you want to average your fishing or farming income.

This is an Official Bankruptcy Form. Official Bankruptcy Forms are approved by the Judicial Conference and must be used under Bankruptcy Rule 9009.

Background. A chapter 13 bankruptcy is also called a wage earner's plan. It enables individuals with regular income to develop a plan to repay all or part of their debts. Under this chapter, debtors propose a repayment plan to make installments to creditors over three to five years.