Washington Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets

Description

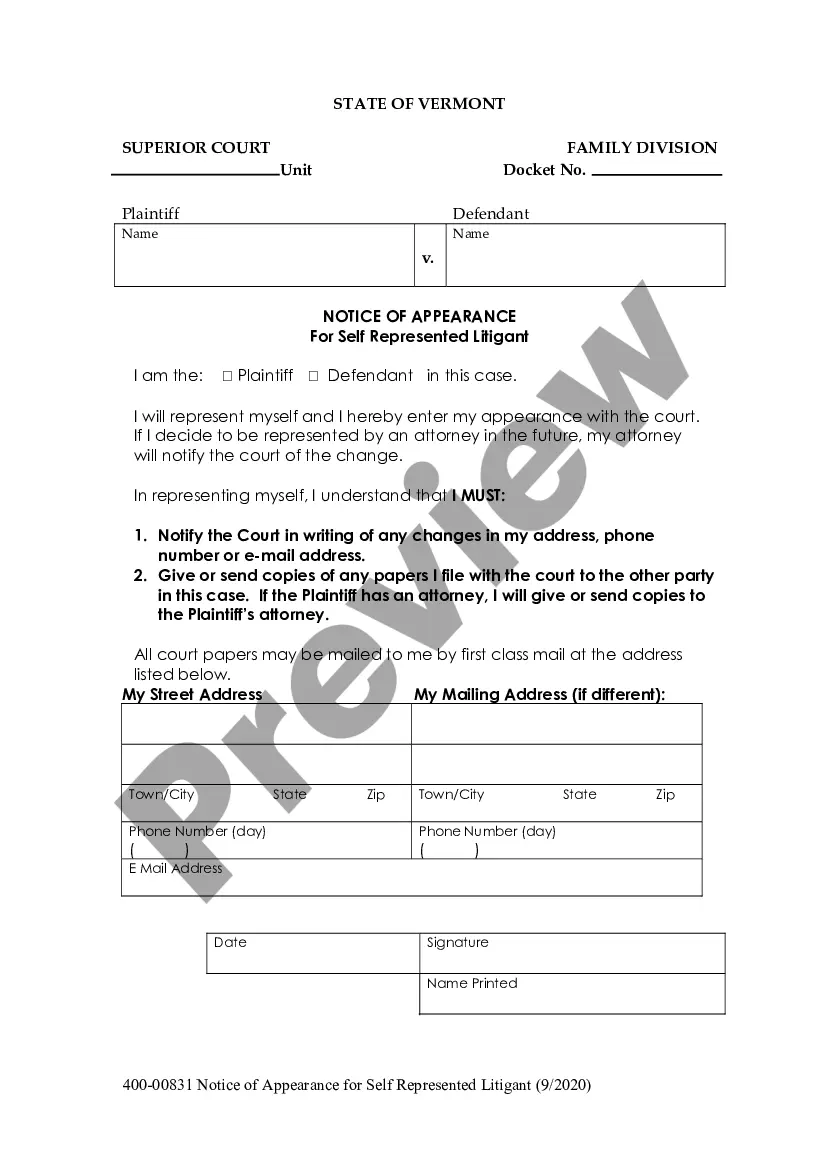

How to fill out Agreement For Sale Of All Assets Of A Corporation With Allocation Of Purchase Price To Tangible And Intangible Business Assets?

Selecting the appropriate legal document format can be challenging.

Clearly, there are numerous templates available online, but how do you find the legal form you need.

Utilize the US Legal Forms website. The platform offers a vast array of templates, including the Washington Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets, which you can use for both business and personal purposes.

You can browse the form using the Review option and examine the form description to confirm it’s the correct one for you.

- All forms are reviewed by professionals and comply with state and federal requirements.

- If you are already registered, Log In to your account and click the Acquire button to access the Washington Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets.

- Use your account to review the legal forms you have previously purchased.

- Navigate to the My documents section of your account and download another copy of the document you require.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have selected the appropriate form for your region.

Form popularity

FAQ

In Washington state, the buyer typically pays the excise tax associated with the purchase of business assets. This tax is based on the selling price of the assets and is an important consideration during negotiations. Utilizing the Washington Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets can help clarify which party is responsible for these tax implications upfront, providing transparency in the transaction.

Transferring assets to a business involves creating a formal agreement that lists the assets and outlines the terms of the transfer. You should also update any records related to asset ownership and valuation. The Washington Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets serves as a great tool to ensure all transfers are documented properly, minimizing future disputes.

Purchasers of corporate assets may avoid successor liability if they acquire the assets through a legally structured agreement that clearly delineates the terms of the sale. The Washington Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets can help establish a clear boundary regarding liability, depending on how the transaction is structured. However, consulting legal advice is essential to navigate this complex topic effectively.

Yes, you can transfer assets to your company, either for compensation or as a contribution to capital. It is crucial to document this transaction accurately to comply with legal and tax requirements. Implementing the Washington Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets can provide a clear structure for this transfer, ensuring all aspects are considered.

Transferring assets from an individual to a company requires documentation that specifies the assets being transferred. You can create a formal agreement, detailing all terms and conditions involved. By utilizing the Washington Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets, you create a comprehensive legal framework that protects both parties and facilitates a seamless transfer.

To transfer shares from an individual to a company, the individual must execute a stock transfer form and provide it to the company. This process also involves updating the company’s stock ledger to reflect the new ownership. Utilizing the Washington Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets can ensure that the share transfer is well-documented, smooth, and compliant with state regulations.

The process of asset transfer involves identifying the assets, preparing the necessary documents, and executing the transfer agreements. When using the Washington Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets, you can effectively outline both tangible and intangible assets in your agreement. This agreement simplifies the process by providing clarity on asset valuation and ownership transfer.

In Washington state, the seller typically bears the responsibility for paying reet at the closing of a real estate transaction. However, this obligation can be negotiated as part of the sale terms, especially when structured under the Washington Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets. Clear agreements will mitigate any confusion later.

Transferring business ownership in Washington state requires proper documentation and adherence to state laws. Using the Washington Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets helps streamline this process by ensuring all assets are accounted for. Additionally, consulting a legal expert can safeguard your interests and facilitate a smoother transfer.

Reet tax in Washington state varies but is generally set between 1.28% and 3.0% based on the sales value of the property. When engaging in transactions under the Washington Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets, it is vital to factor this tax into your purchase price assessments. Being prepared for these costs will help you avoid surprises during closing.