Washington Software Sales Agreement

Description

How to fill out Software Sales Agreement?

You can spend hours online searching for the valid document template that meets the federal and state requirements you need.

US Legal Forms offers thousands of valid forms that can be reviewed by experts.

It's easy to download or print the Washington Software Sales Agreement from the service.

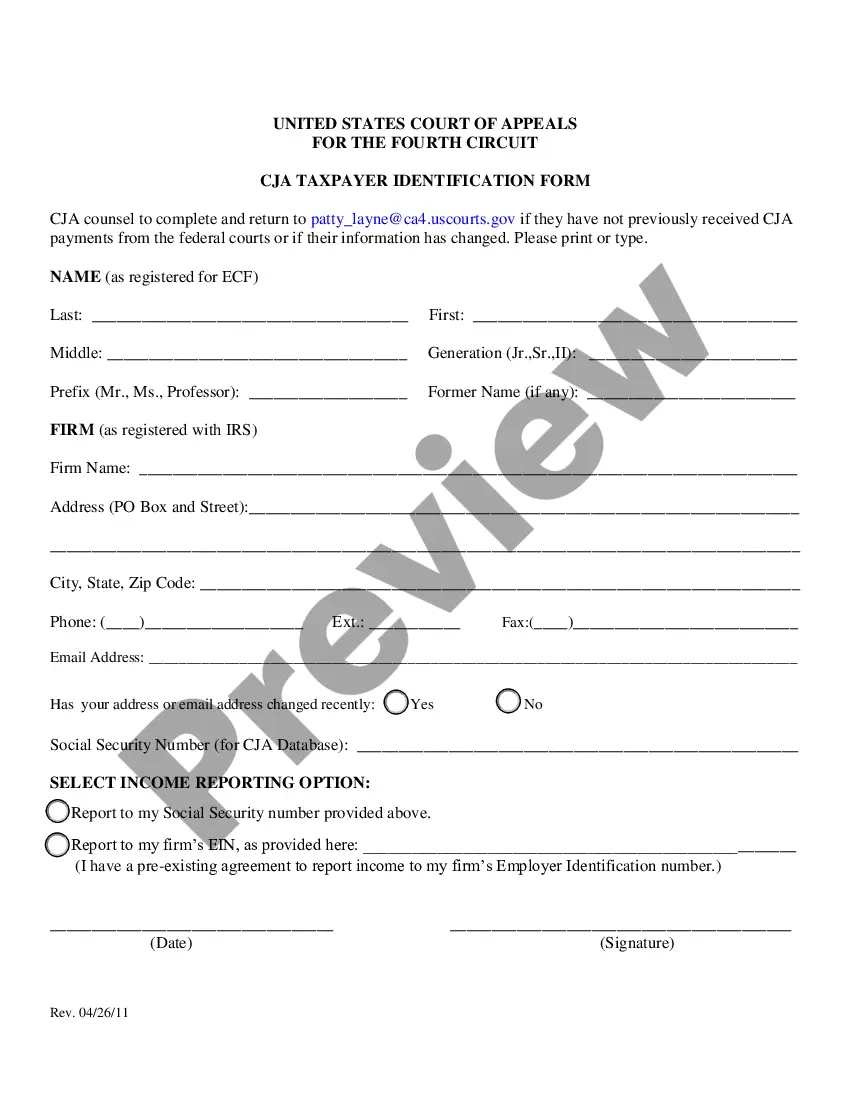

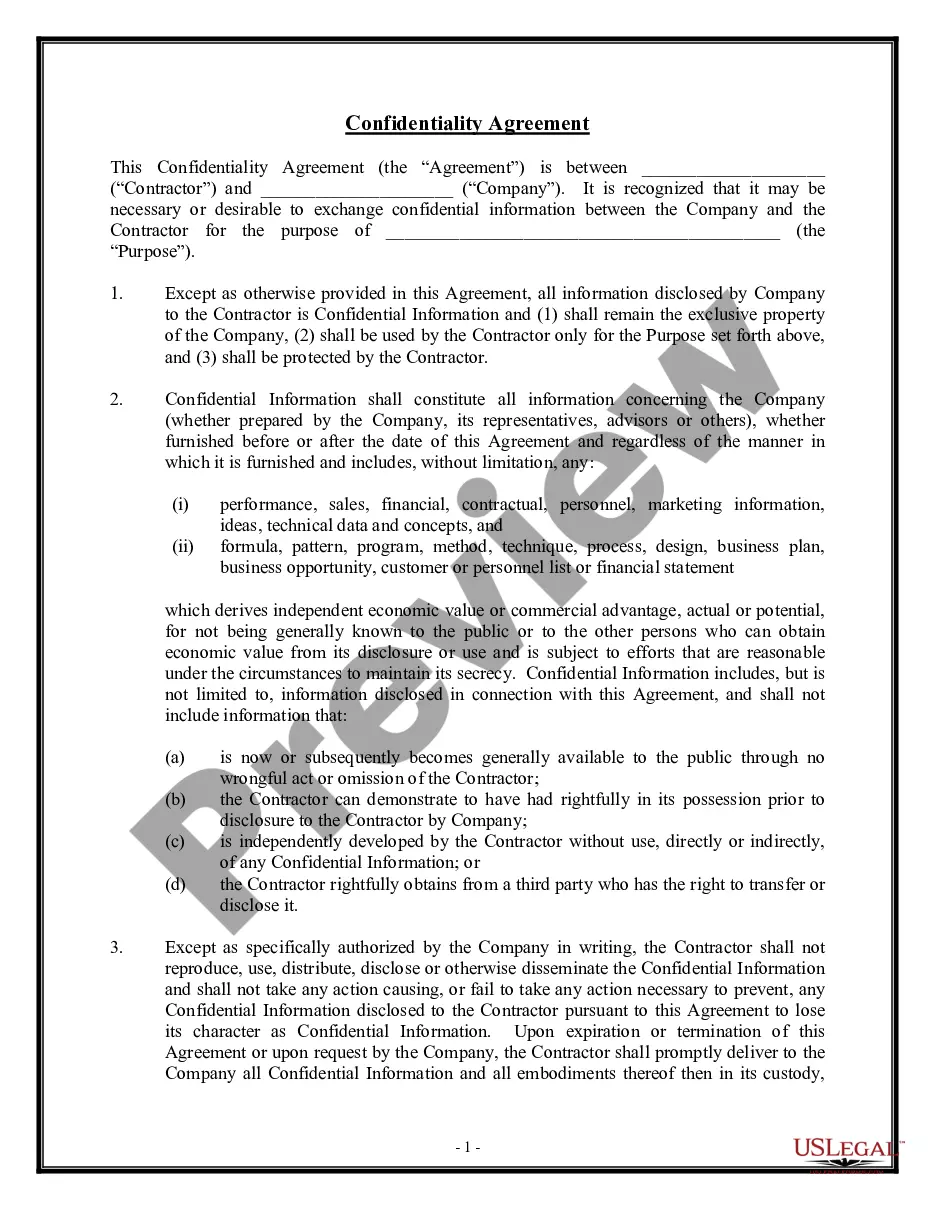

If available, use the Preview button to review the document template as well.

- If you have a US Legal Forms account, you can Log In and click the Obtain button.

- After that, you can complete, edit, print, or sign the Washington Software Sales Agreement.

- Each valid document template you acquire is yours permanently.

- To get another copy of any purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your region/city of choice.

- Read the form outline to make sure you have chosen the right form.

Form popularity

FAQ

Multiple points of use in Washington State refers to the taxation scenario where a service or software is used in more than one location. This is especially relevant for businesses that provide services under a Washington Software Sales Agreement, as the tax may apply based on the locations where the product is used. Understanding this concept helps businesses comply with tax regulations effectively.

Software-as-a-Service products The definition of SaaS sometimes falls in the gray area of digital service. Washington DC does tax SaaS products, but check the website to confirm that the definition firmly applies to your service.

Digital goods purchased for a business purposeIf a business purchases a digital good (only digital goods, NOT digital automated services or remote access software) for business purposes, then the purchase is exempt from sales tax.

Goods that are subject to sales tax in Washington include physical property, like furniture, home appliances, and motor vehicles. The purchase of prescription medicine, groceries and gasoline are tax-exempt. Some services in Washington are subject to sales tax.

If an online class is live and the instructor and students can engage in real-time participation and interaction, Washington retail sales tax typically doesn't apply to the charges for the course. However, if real-time participation and interaction isn't possible, charges for the class are usually taxable.

Sales of canned software - delivered on tangible media are subject to sales tax in Washington. Sales of canned software - downloaded are subject to sales tax in Washington. Sales of custom software - delivered on tangible media are exempt from the sales tax in Washington.

But, in most, it's a mixed bag. California exempts most software sales but taxes one type: canned software delivered on tangible personal property an actual object you can touch or hold, such as a disc. Nebraska taxes most software sales with the exception of one type: SaaS.

Should your business charge sales tax on SaaS in Washington? SaaS is generally always taxable in Washington. Washington refers to SaaS as remotely accessed software (RAS) and says: RAS is prewritten software provided remotely.

Is your online course taxable? Generally speaking, an online course is taxable if it's pre-recorded, automated, or includes downloadable materials. Of course, the fifty states and their respective tax policies can contain a lot of individual rules and exceptions.

Online Classes that Include Tangible Personal PropertyIn most states, tangible personal property like books or clothing is taxable. However, both clothing and textbooks are non-taxable in some states.