Washington Agreement to Remove House

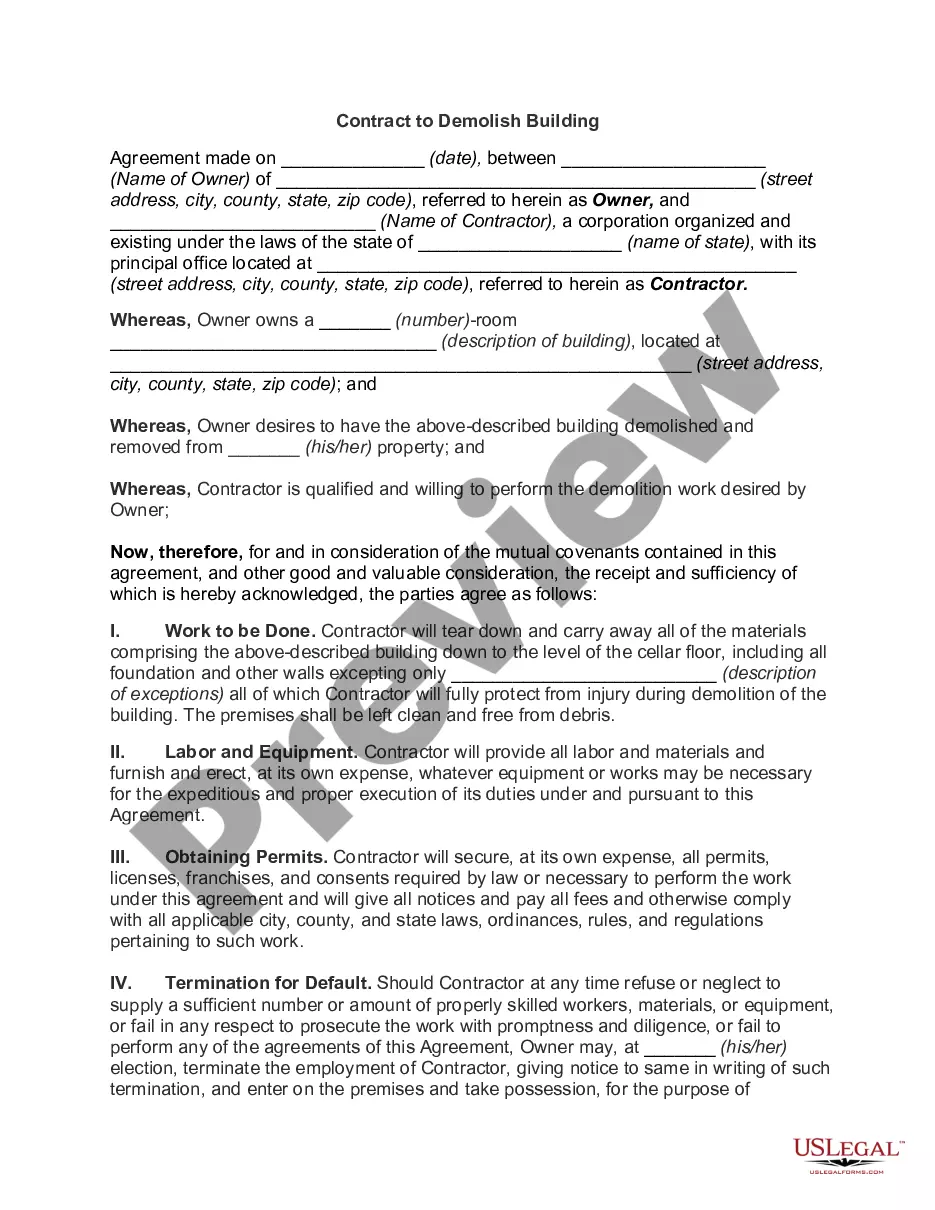

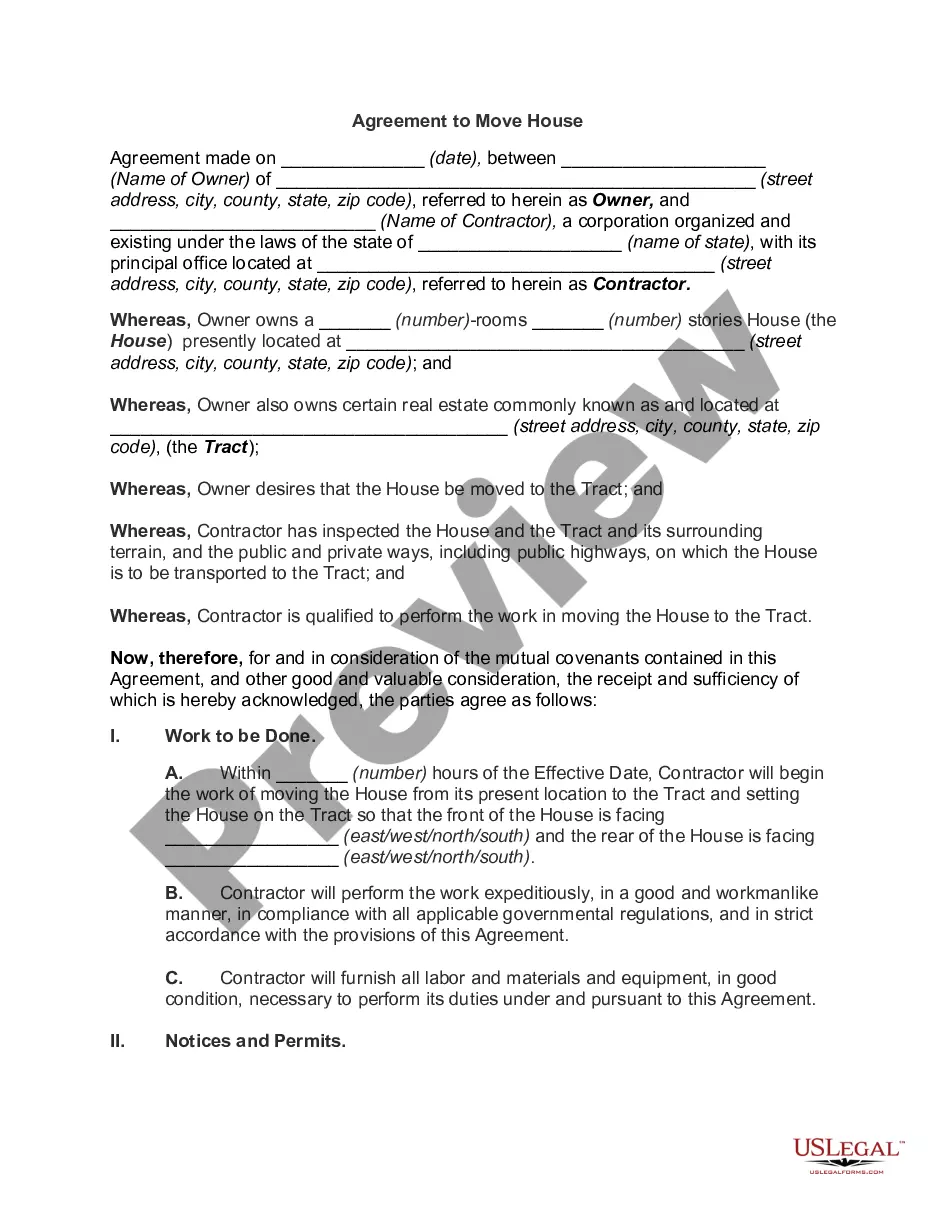

Description

How to fill out Agreement To Remove House?

Selecting the appropriate legitimate document template can be a challenge.

Obviously, there are numerous designs available online, but how can you obtain the legal form you require.

Make use of the US Legal Forms website.

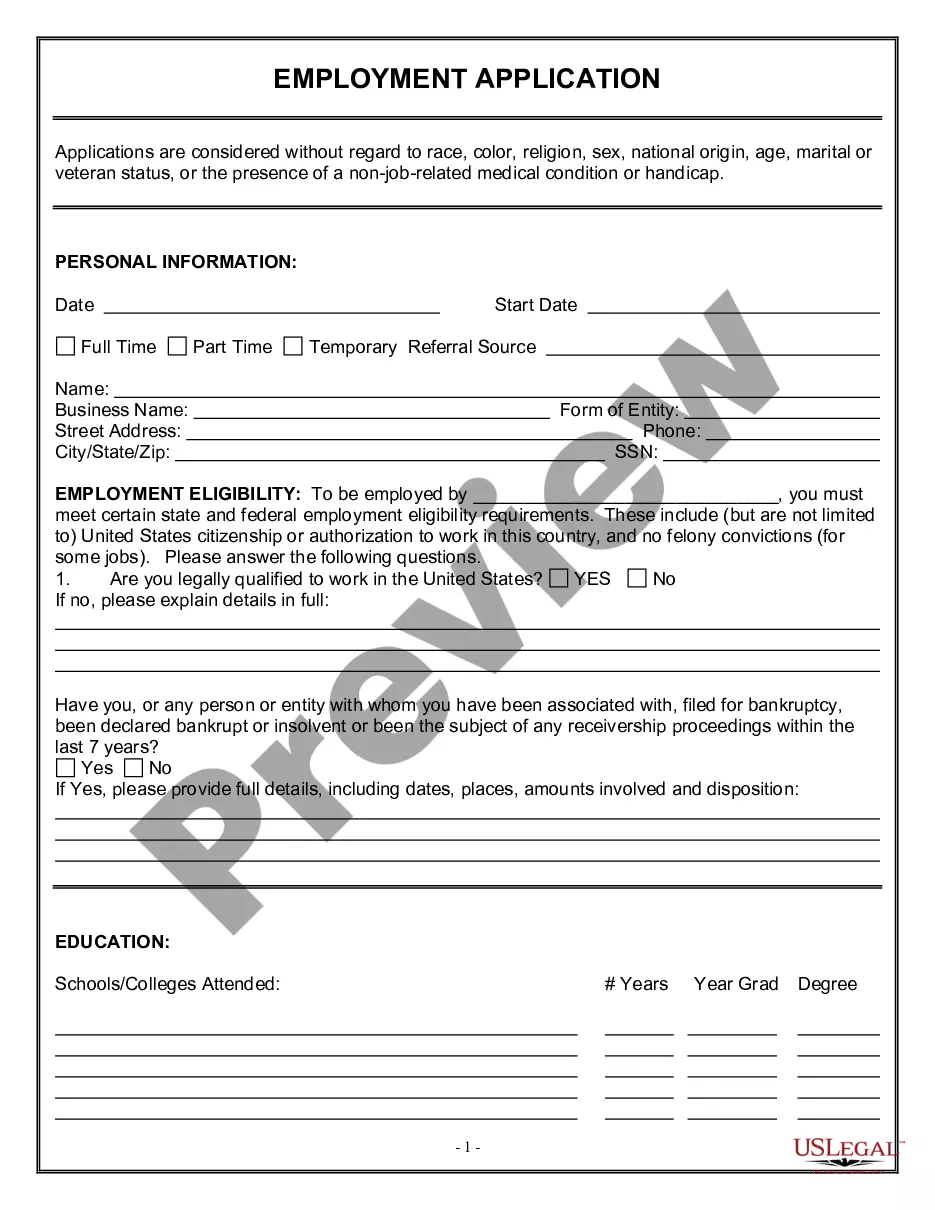

First, ensure you have selected the correct document for your city/county. You can view the form using the Preview option and read the form description to verify it is right for you. If the form does not meet your needs, use the Search area to find the appropriate document. Once you are confident the form is correct, click on the Acquire now button to obtain the document. Choose the payment plan you prefer and enter the required information. Create your account and process your order using your PayPal account or credit/debit card. Select the file format and download the legal document template to your device. Complete, modify, and print the obtained Washington Agreement to Remove House. US Legal Forms is the largest repository of legal documents where you can find a range of paper templates. Utilize the service to download professionally crafted documents that comply with state regulations.

- The service offers a multitude of templates, including the Washington Agreement to Remove House, which can be utilized for both business and personal purposes.

- All of the forms are reviewed by experts and adhere to state and federal regulations.

- If you are already registered, Log In to your account and click on the Obtain button to retrieve the Washington Agreement to Remove House.

- Utilize your account to search for the legal documents you have purchased previously.

- Go to the My documents tab in your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps you can follow.

Form popularity

FAQ

Until both parties have come to an agreement on all the contract terms and actually signed the purchase agreement such that you're in contract, neither of you are legally bound to anything, and you can withdraw your offer without any problem.

A Purchase Order (PO) can be cancelled as long as approval by the vendor is received, there are no matched or paid invoices on the PO and goods have not been received.

Can you back out of buying a house before closing? In short: Yes, buyers can typically back out of buying a house before closing. However, once both parties have signed the purchase agreement, backing out becomes more complex, particularly if your goal is to avoid losing your earnest money deposit.

An unconditional contract means there are no preconditions. The buyer and the seller are legally obliged to follow through with the sale you can't back out.

The short answer is yes, a buyer or seller can back out of a home sale. Usually, the buyer has more ways to back out of a deal, as it's rare and more difficult for a seller to change their mind. When a house is for sale, buyers are the ones who present offers to sellers and their offers usually include contingencies.

If a buyer does decide to back out, the seller can argue that they are entitled to keep the deposit and sue the buyer for the loss in value of the property on a resale. The consequences for a buyer breaching its contract can be substantial and far exceed the initial deposit.

Remember, there is no cooling off period for real estate contracts made in Western Australia unless the parties agree to have one inserted into the contract. Remember, if you decide to engage a settlement agent or solicitor to carry out the settlement process, you can indicate who that person is on the O & A.

Can you back out of buying a house before closing? In short: Yes, buyers can typically back out of buying a house before closing. However, once both parties have signed the purchase agreement, backing out becomes more complex, particularly if your goal is to avoid losing your earnest money deposit.

One of the most common remedies chosen by buyers after a breach of contract by the seller is a lawsuit for damages for nondelivery. These suits occur if the seller fails or simply refuses to deliver the goods that were promised in the contract.

You can terminate the agreement by giving a notice to the buyer stating that you are no more interested to sell the property since he has not paid any advance amount towards the consideration of sale so far. Consult a local lawyer and take decision as per his further advise after seeing the agreement paper.