California Charitable Remainder Inter Vivos Unitrust Agreement

Description

How to fill out Charitable Remainder Inter Vivos Unitrust Agreement?

If you intend to finish, save, or print sanctioned document templates, utilize US Legal Forms, the top collection of legal forms, available online.

Employ the site's straightforward and convenient search function to locate the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Every legal document template you purchase is yours indefinitely. You have access to each form you downloaded within your account. Choose the My documents section and select a form to print or download again.

Be proactive and download, and print the California Charitable Remainder Inter Vivos Unitrust Agreement with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- Use US Legal Forms to find the California Charitable Remainder Inter Vivos Unitrust Agreement in just a few clicks.

- If you are currently a US Legal Forms user, Log In to your account and then click the Acquire button to obtain the California Charitable Remainder Inter Vivos Unitrust Agreement.

- You can also access forms you previously downloaded from the My documents section of your account.

- If this is your first time using US Legal Forms, follow the guidelines below.

- Step 1. Ensure you have selected the form for the correct city/state.

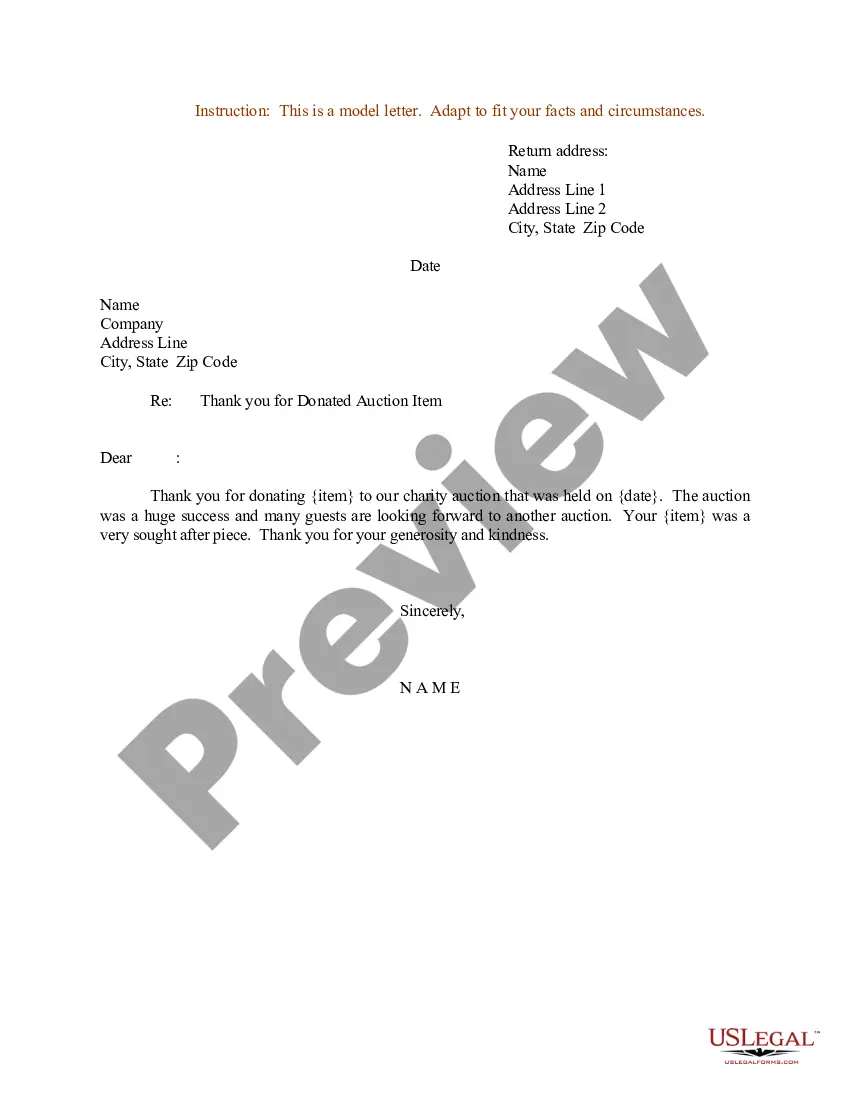

- Step 2. Use the Preview option to review the form's content. Remember to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search box at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have located the necessary form, click the Acquire now button. Choose the payment plan you prefer and enter your details to create an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it onto your device.

- Step 7. Fill out, modify, and print or sign the California Charitable Remainder Inter Vivos Unitrust Agreement.

Form popularity

FAQ

A compelling example of a CRUT, or Charitable Remainder Unitrust, is when an individual donates real estate to a California Charitable Remainder Inter Vivos Unitrust Agreement. The trust sells the property and reinvests the proceeds, generating income for the donor or beneficiaries. After a specific period, the remaining assets in the trust go to a selected charity, fulfilling both personal financial and charitable goals. This arrangement allows the donor to support a cause while receiving potential tax benefits and a steady income stream.

Setting up a charitable remainder trust is a straightforward process. First, you need to decide on the type of trust that fits your needs, such as a California Charitable Remainder Inter Vivos Unitrust Agreement. Next, you'll work with a qualified attorney or financial planner to draft the trust document, specifying beneficiaries and the charitable organization to receive the remainder. Finally, make sure to fund the trust, so it can begin providing you with income while benefiting your chosen charity.

The rules governing a California Charitable Remainder Inter Vivos Unitrust Agreement include specific guidelines around the percentage payout to income beneficiaries, which must be at least 5% but not exceed 50% of the trust's value. Additionally, the trust must distribute at least a portion of its income each year to qualify as a charitable remainder trust. It's vital to adhere to these regulations to maintain tax benefits and fulfill charitable commitments. For comprehensive guidance, consider utilizing the resources available on uslegalforms.

Yes, a California Charitable Remainder Inter Vivos Unitrust Agreement typically requires filing Form 1041, which is the U.S. Income Tax Return for Estates and Trusts. This form allows you to report the income earned by the trust and any distributions made to beneficiaries. Accurate completion of Form 1041 is essential for maintaining the tax-exempt status of the charitable remainder trust. Legal assistance can simplify this process and ensure compliance.

When managing a California Charitable Remainder Inter Vivos Unitrust Agreement, filing a tax return is often necessary. Generally, the trust itself must file a return if it has gross income of $600 or more. This is important to ensure compliance with federal tax laws and to properly report income generated by the trust's assets. Consulting a tax professional can provide clarity on your specific obligations.

The two types of California Charitable Remainder Inter Vivos Unitrust Agreements are the standard CRUT and the Net Income CRUT. The standard CRUT offers payments based on a fixed percentage of the trust's annual value, leading to potentially higher payouts. In contrast, the Net Income CRUT allows payments based on the trust's income, which can be advantageous if you want flexibility in payout management. Each type caters to different financial strategies, so it's essential to evaluate both.

The primary difference between a charitable remainder trust and a Charitable Remainder Unitrust (CRUT) lies in how they calculate payouts. A CRUT provides variable payments based on the annual valuation of the trust's assets, while a charitable remainder annuity trust offers fixed payments. Both serve different needs and goals for donors, so understanding these distinctions is crucial. Ultimately, choosing the right option is essential to maximize benefits.

The payout from a California Charitable Remainder Inter Vivos Unitrust Agreement typically ranges from 5% to 7% of the trust’s assets, calculated annually. The exact rate depends on what you specify when setting up the trust, ensuring it meets your income needs. However, this payout can vary based on the trust's performance and asset value over time. Thus, proper planning is essential.

A California Charitable Remainder Trust (CRUT) is a specialized financial tool that provides you with a stream of income while benefiting a charitable organization. With this structure, you donate assets to the trust, which generates income for you for a certain period, after which the remaining assets go to the charity. This approach also offers tax advantages, making it a win-win for you and the charity. In essence, it balances your financial goals with philanthropic interests.

To establish a California Charitable Remainder Inter Vivos Unitrust Agreement, you need to draft a trust document that meets state requirements. Engaging legal assistance is crucial for filling out the necessary paperwork accurately. Additionally, you must include a qualified charity as a beneficiary in the agreement. This way, you set your intentions and ensure compliance with legal standards.