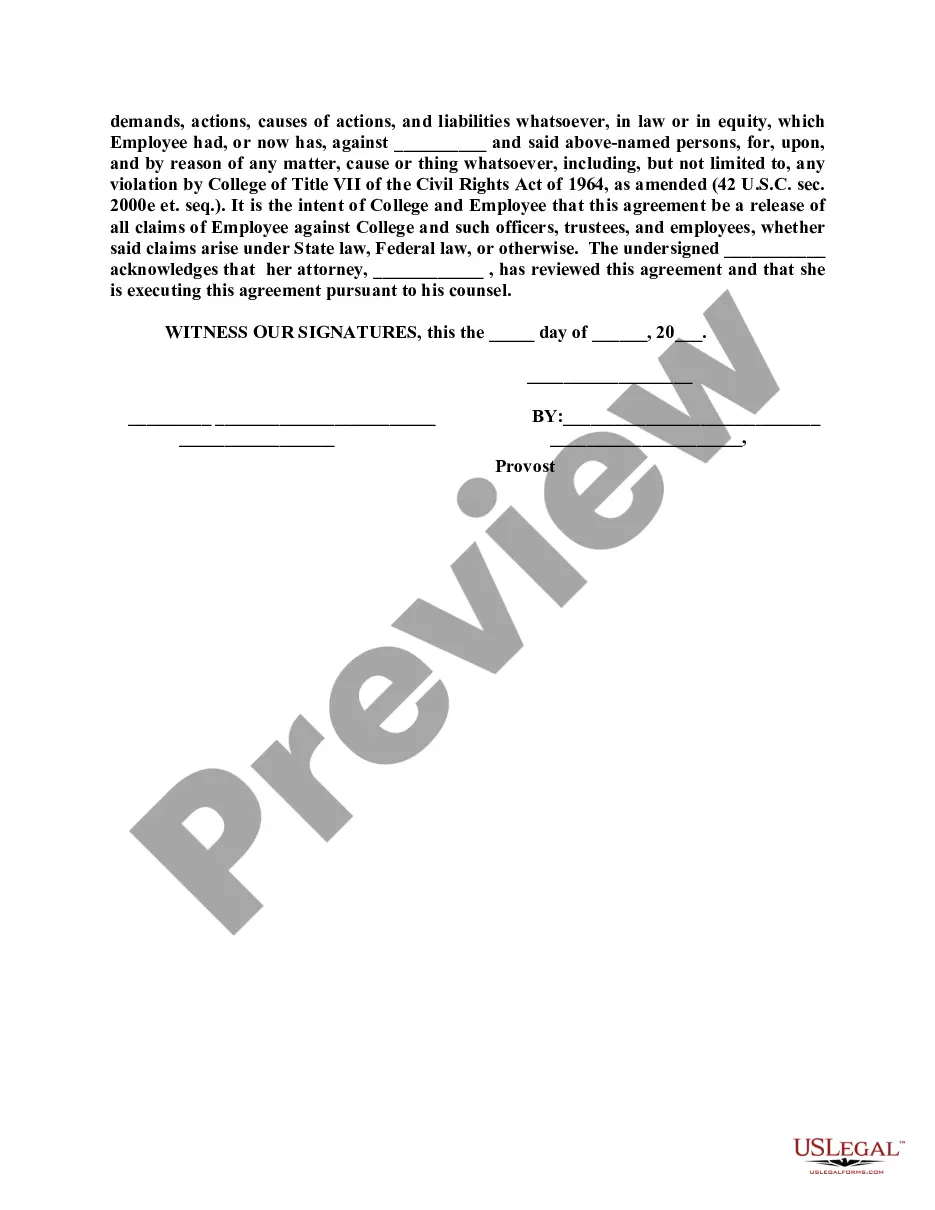

Washington Severance Agreement between Employee and College

Description

How to fill out Severance Agreement Between Employee And College?

Finding the right legal document template can be challenging.

Certainly, there are many templates accessible online, but how do you locate the legal form you need.

Utilize the US Legal Forms website.

Firstly, ensure that you have selected the correct form for your area/state.

- The service provides numerous templates, such as the Washington Severance Agreement between Employee and College, which you can utilize for professional and personal purposes.

- All documents are reviewed by experts and adhere to federal and state regulations.

- If you are already registered, Log In to your account and click the Obtain button to download the Washington Severance Agreement between Employee and College.

- Use your account to search for the legal forms you have acquired previously.

- Visit the My documents tab of your account to get another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple guidelines you should adhere to.

Form popularity

FAQ

Don't wait to apply for benefits, even if you're not sure about your current eligibility. Get your claim in the system so you can receive the maximum benefits you are eligible for. Report your severance pay when you file the claim, and your unemployment compensation will be calculated for you.

There is no single definition of an appropriate severance package, as they vary greatly by industry and company. However, severance packages typically include pay through the termination date and any accrued vacation time, unreimbursed business expenses, and an additional lump sum.

A. To be eligible for benefits, a person must have worked at least 680 hours during his or her base year and must have lost a job through no fault of his or her own.

Employees are entitled to 1 week's severance pay for each completed and continuous year of service with the same employer.

In most cases, severance pay isn't required by law, but some companies have established policies for offering it. The typical formula for a severance package is one or two weeks of pay for each year of service.

A. Severance payments do not usually affect your unemployment benefits. However, pay in lieu of notice or continuation pay with full benefits that are guaranteed can affect your benefits. Report any separation-related payment you receive or are entitled to receive to the claims center.

Q. Is it legal for a worker to be fired from their job without any notice? A. The law does not require employers to give a worker notice before terminating their job.

How to Deliver the Severance Agreement to Outgoing StaffStep One: Provide Time For Consideration.Step Two: Provide a List of Competitors for the Non-Compete Agreement.Step Three: The Release of Waiver.Step Four: Understand the Special Rules.

Amount and Duration of Unemployment Benefits in Washington State. The ESD determines your weekly benefit amount by averaging your wages from the two highest quarters in your base period and multiplying that number by . 0385. The minimum weekly benefit amount is $188, and the maximum weekly benefit is $790.

You may qualify for unemployment benefits if you were fired through no fault of your own, such as not having the skills to do the job. You may not qualify if you were fired for misconduct or gross misconduct.