Washington Qualified Personnel Residence Trust (PRT) is a legal arrangement that allows individuals to transfer their personal residence or vacation home to a trust, while still retaining the right to live in the property for a specified term. The main purpose of a PRT is to potentially reduce estate taxes and protect the property from creditors, while also allowing the granter to continue living in the home. A Washington PRT One Term Holder is a specific type of PRT that designates a single individual as the term holder. This means that only one person can occupy the residence for the agreed-upon term, which is typically a certain number of years. The Washington PRT One Term Holder provides various benefits for both the granter and the beneficiaries. One key advantage is the potential reduction in the granter's taxable estate. By transferring the residence to the trust, the value of the property is removed from the estate, potentially resulting in significant tax savings upon the granter's passing. Additionally, any future appreciation in the property's value will also pass to the beneficiaries without being subjected to estate taxes. Another advantage of a Washington PRT One Term Holder is the protection it offers against creditors. Once the property is transferred to the trust, it becomes separate from the granter's personal assets and may be shielded from any creditors' claims. This can provide peace of mind for individuals concerned about potential lawsuits or financial liabilities. It is important to note that there are other variations of Washington Qualified Personnel Residence Trusts, including: 1. Washington PRT Multiple Term Holders: This type of PRT allows for more than one individual to serve as term holders. It is suitable for families or multiple individuals who wish to occupy the residence for different periods, with each term holder having a designated period of exclusive occupancy. 2. Washington PRT Remainder Interest Trust: Instead of having a designated term holder, this type of PRT allows for the entire term to be designated as the remainder interest. This means that no specific term holder is identified, but rather the beneficiary has the right to occupy the property upon the expiration of the term. In Washington state, the rules and regulations surrounding Parts may differ from other states. Therefore, it is crucial to consult with an experienced estate planning attorney to ensure compliance with the specific requirements of Washington law when establishing a Washington Qualified Personnel Residence Trust.

Washington Qualified Personal Residence Trust One Term Holder

Description

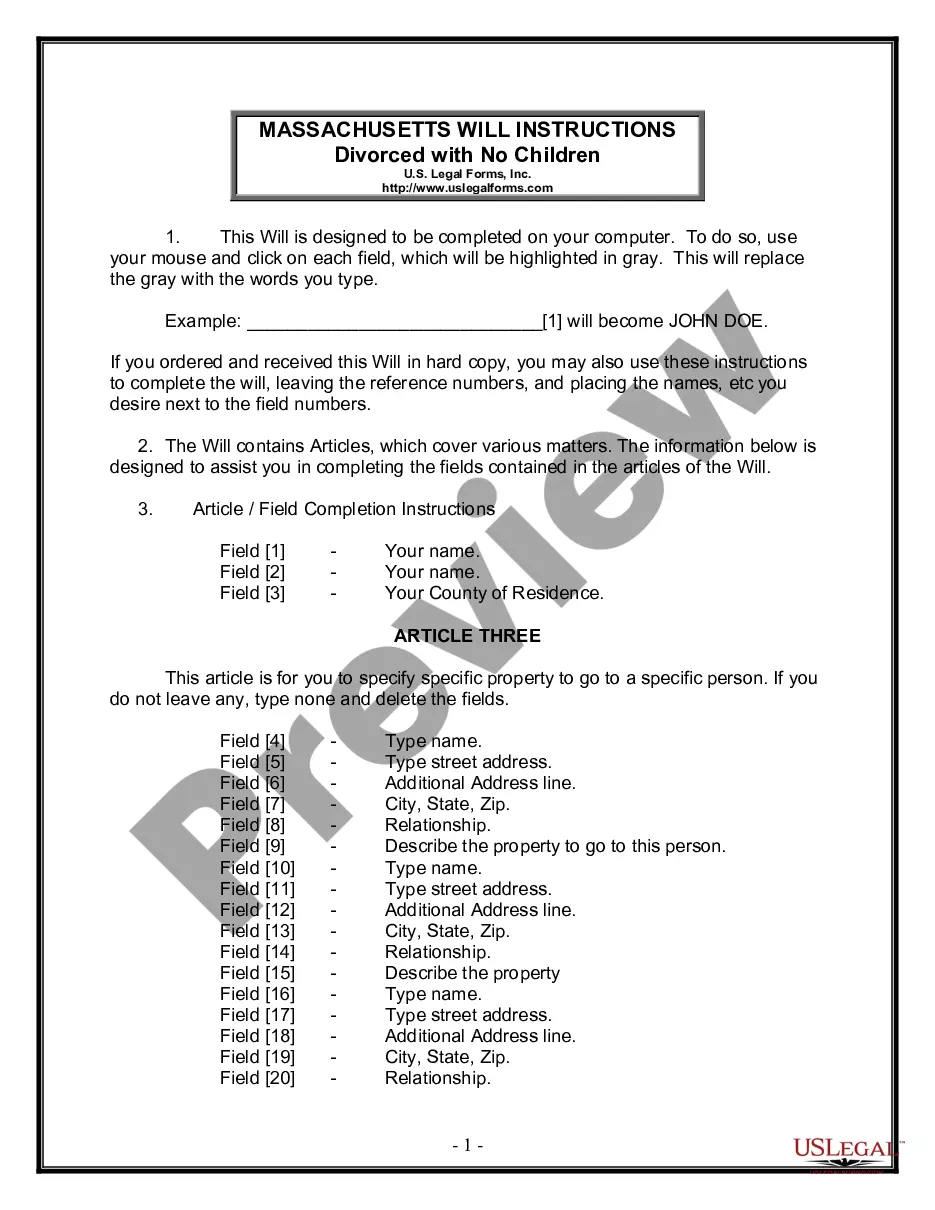

How to fill out Washington Qualified Personal Residence Trust One Term Holder?

You may devote several hours on the Internet searching for the legal file web template that suits the state and federal requirements you require. US Legal Forms offers a huge number of legal forms that are reviewed by professionals. You can easily obtain or produce the Washington Qualified Personal Residence Trust One Term Holder from our assistance.

If you have a US Legal Forms bank account, you are able to log in and then click the Down load switch. After that, you are able to complete, modify, produce, or signal the Washington Qualified Personal Residence Trust One Term Holder. Every legal file web template you purchase is your own for a long time. To get another copy for any purchased form, proceed to the My Forms tab and then click the related switch.

If you are using the US Legal Forms site for the first time, stick to the straightforward instructions below:

- Initially, make certain you have selected the correct file web template for your county/city of your liking. See the form outline to ensure you have chosen the appropriate form. If available, utilize the Review switch to search from the file web template at the same time.

- If you would like find another variation in the form, utilize the Search area to get the web template that meets your requirements and requirements.

- Upon having identified the web template you want, click on Purchase now to continue.

- Find the pricing strategy you want, type your qualifications, and register for a merchant account on US Legal Forms.

- Full the purchase. You should use your Visa or Mastercard or PayPal bank account to purchase the legal form.

- Find the structure in the file and obtain it in your product.

- Make adjustments in your file if required. You may complete, modify and signal and produce Washington Qualified Personal Residence Trust One Term Holder.

Down load and produce a huge number of file web templates making use of the US Legal Forms Internet site, that provides the most important variety of legal forms. Use professional and condition-distinct web templates to deal with your company or personal requires.

Form popularity

FAQ

The sale of the residence without any reinvestment of the proceeds in a new residence will cause the QPRT status to terminate as to all of the assets.

A qualified personal residence trust (QPRT) is a trust to which a person (called the settlor, donor, or grantor) transfers his personal residence. The grantor reserves the right to live in the house for a period of years; this retained interest reduces the current value of the gift for gift tax purposes.

There are two options upon early termination. The trust agreement may allow that the trust will terminate and the property or its sales proceeds be given back to you.

The biggest benefit of a QPRT is that it removes the value of your primary or second home and its appreciation from your taxable estate. Continued use of the property. With your home in a QPRT, you can still live in the property rent-free and enjoy any income tax deductions associated with it.

A QPRT is typically considered a Grantor Trust for income tax purposes. Most QPRTs do not generate any income and an income tax return is not typically required.

The biggest benefit of a QPRT is that it removes the value of your primary or second home and its appreciation from your taxable estate. Continued use of the property. With your home in a QPRT, you can still live in the property rent-free and enjoy any income tax deductions associated with it. Gift tax benefits.

A life estate with remainder to charity is normally created for one or two lives. However, it may be created for a term of years. Alternatively, it is possible to create a qualified personal residence trust (QPRT) and to create a life estate agreement for a term of years with a remainder to family.

Because there's no limit on how long the QPRT must run, it's not uncommon to see QPRTs that were created 10 to 15 years ago finally expire today.

A qualified personal residence trust (QPRT) is a specific type of irrevocable trust that allows its creator to remove a personal home from their estate for the purpose of reducing the amount of gift tax that is incurred when transferring assets to a beneficiary.

Unwinding a QPRT All you have to do is enter into a lease agreement that pays fair market rent. After the QPRT expiration term, the grantor must pay rent if they continue to reside in the property.