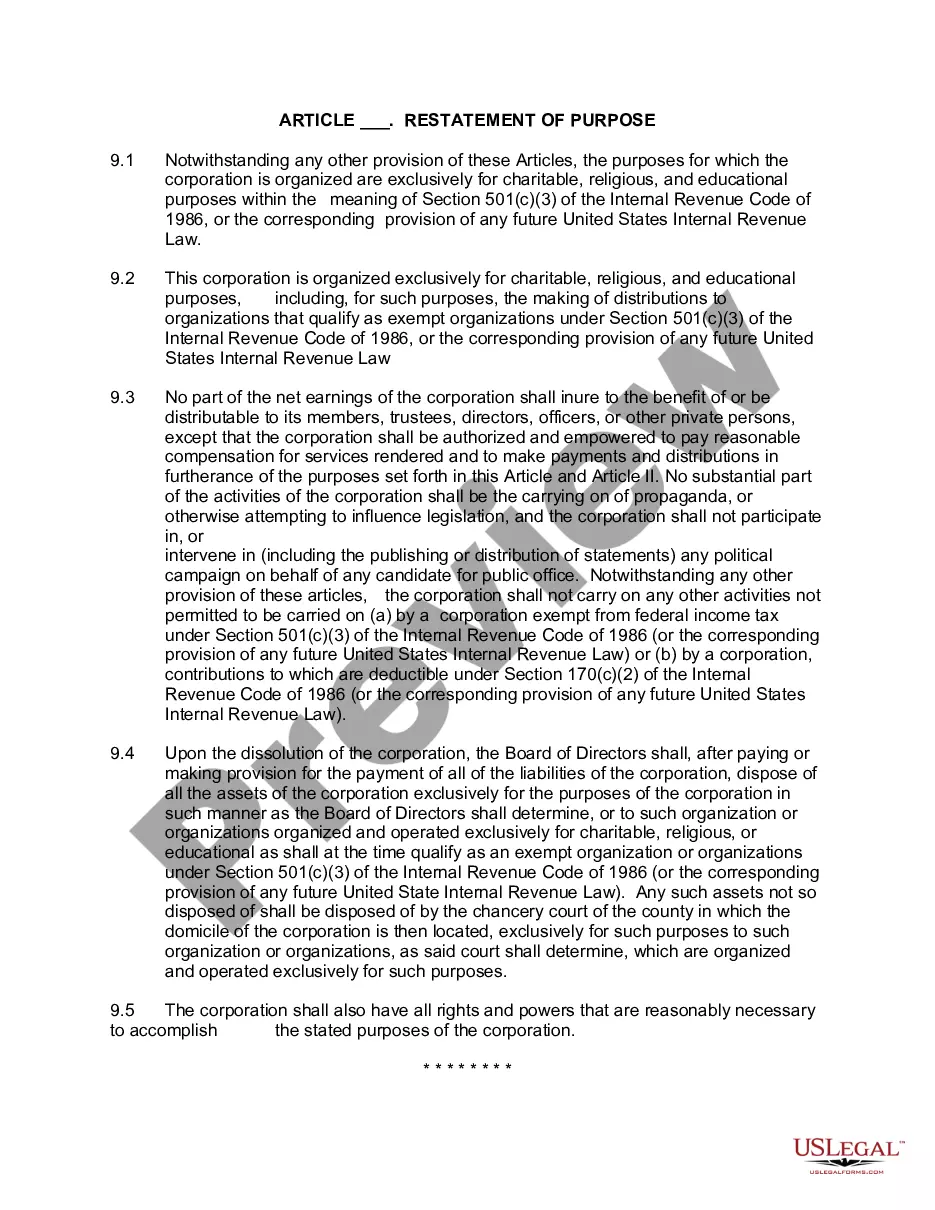

Washington Bylaw Provision For Obtaining Federal Nonprofit Status Article Restatement of Purpose

Description

How to fill out Bylaw Provision For Obtaining Federal Nonprofit Status Article Restatement Of Purpose?

You might spend time online attempting to locate the legitimate document template that fulfills the state and federal criteria you need.

US Legal Forms offers a vast array of legal forms that have been reviewed by experts.

You can download or print the Washington Bylaw Provision For Obtaining Federal Nonprofit Status Article Restatement of Purpose from our platform.

For those who wish to find another version of the form, use the Search section to locate the template that fits your needs and demands.

- If you already possess a US Legal Forms account, you can sign in and select the Download button.

- After that, you can complete, modify, print, or sign the Washington Bylaw Provision For Obtaining Federal Nonprofit Status Article Restatement of Purpose.

- Each legal document template you acquire is yours permanently.

- To acquire another copy of any purchased form, navigate to the My documents section and click on the appropriate option.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have picked the correct document template for the region/city of your choice.

- Review the form description to confirm that you have chosen the right one.

Form popularity

FAQ

Crafting a purpose statement for a nonprofit involves clearly articulating your organization's mission and goals. Focus on the impact you wish to make in the community and outline specific objectives. Be sure to align this statement with the Washington Bylaw Provision For Obtaining Federal Nonprofit Status Article Restatement of Purpose, as it provides a foundational framework for your organization's purpose.

To provide proof of nonprofit status, you can present your IRS determination letter, which confirms your organization’s tax-exempt status. This letter serves as legal documentation of your nonprofit's eligibility and compliance with federal regulations. Consider consulting resources related to the Washington Bylaw Provision For Obtaining Federal Nonprofit Status Article Restatement of Purpose for proper documentation procedures and additional guidance.

Amending bylaws refers to making specific changes to existing provisions, while revising bylaws involves a broader review and potential overhaul of the entire document. When you amend, you modify sections without altering the entire structure; however, revising can also include restatement to reflect updated goals or policies. Both actions should align with the Washington Bylaw Provision For Obtaining Federal Nonprofit Status Article Restatement of Purpose to ensure your organization remains compliant.

The IRS generally requires a minimum of three board members for every nonprofit, but does not dictate board term length.

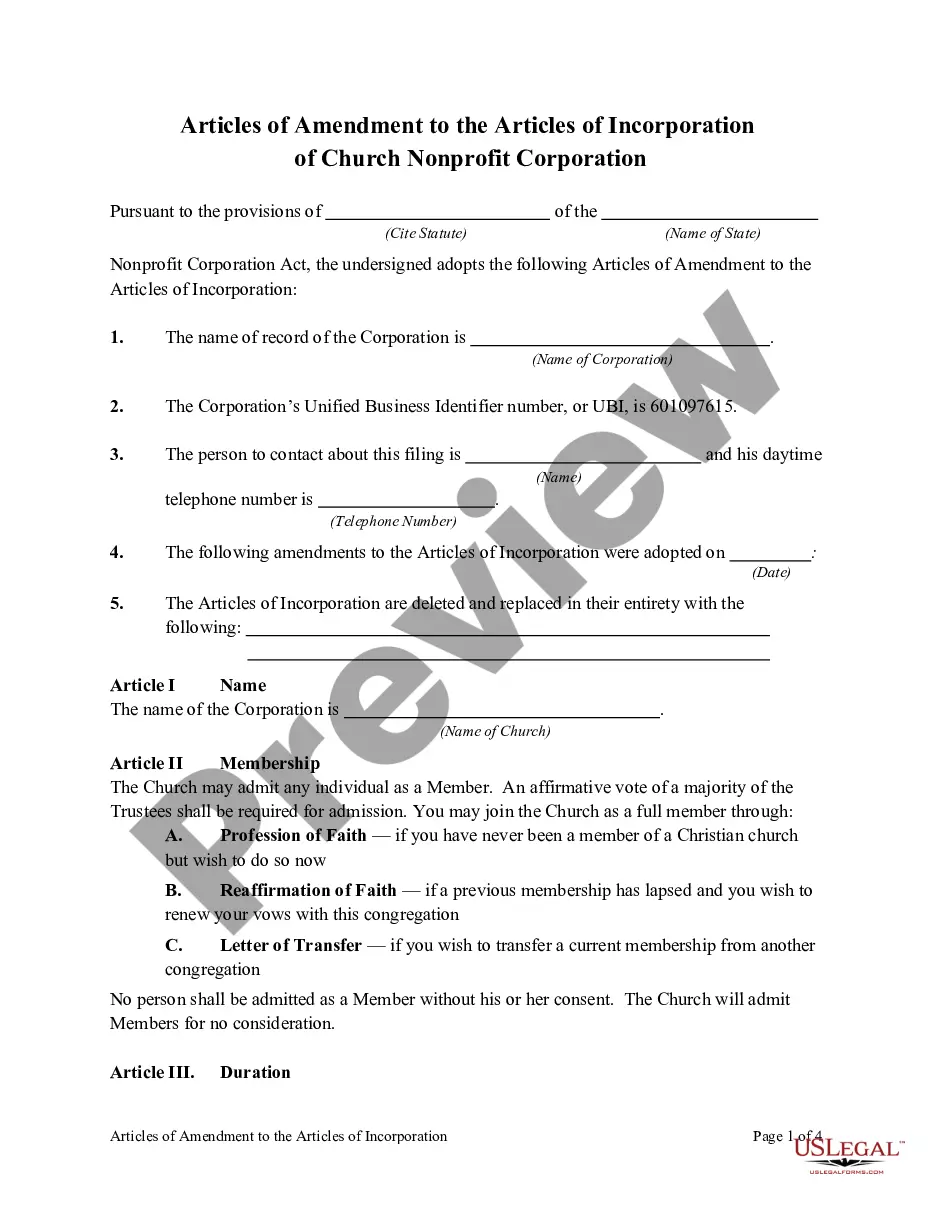

To start a 501(c)(3) nonprofit corporation in Washington you must:Step 1: Name Your Washington Nonprofit.Step 2: Choose Your Registered Agent.Step 3: Select Your Board Members & Officers.Step 4: Adopt Bylaws & Conflict of Interest Policy.Step 5: File the Articles of Incorporation.Step 6: Get an EIN.More items...?

In Washington, nonprofit corporations must have at least one director. See RCW 24.03. 100. Many other states require a minimum of three directors.

What to include in nonprofit bylawsGeneral information. This section should outline some basic information about your nonprofit, including your nonprofit's name and your location.Statements of purpose.Leadership.Membership.Meeting and voting procedures.Conflict of interest policy.Committees.The dissolution process.More items...?

Follow these steps to form your own nonprofit 501(c)(3) corporation.Choose a name.File articles of incorporation.Apply for your IRS tax exemption.Apply for a state tax exemption.Draft bylaws.Appoint directors.Hold a meeting of the board.Obtain licenses and permits.

Board of Directors: Under state law, only one director is needed; however, you will need at least three directors if you are seeking tax-exempt status. Usually the number of directors is described as a range, with a minimum number and maximum number of directors given.

The simple answer is that most authors agree that a typical nonprofit board of directors should comprise not less than 8-9 members and not more than 11-14 members. Some authors focusing on healthcare organizations indicate a board size up to 19 members is acceptable, though not optimal.