Washington Notice of Meeting to Pass on Resolution to Incorporate Non-Profit Association

Description

How to fill out Notice Of Meeting To Pass On Resolution To Incorporate Non-Profit Association?

If you need to total, obtain, or generate legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Make use of the site's straightforward and user-friendly search to find the documents you require.

Various templates for business and personal purposes are organized by category and state, or keywords.

Step 4. Once you have found the form you need, click on the Buy now button. Choose the payment plan you prefer and enter your details to register for an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the purchase.

- Use US Legal Forms to acquire the Washington Notice of Meeting to Pass on Resolution to Incorporate Non-Profit Association with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Obtain button to download the Washington Notice of Meeting to Pass on Resolution to Incorporate Non-Profit Association.

- You can also access forms you've previously saved in the My documents section of your account.

- If you are a first-time user of US Legal Forms, follow the instructions below.

- Step 1. Make sure you have selected the form for the correct city/state.

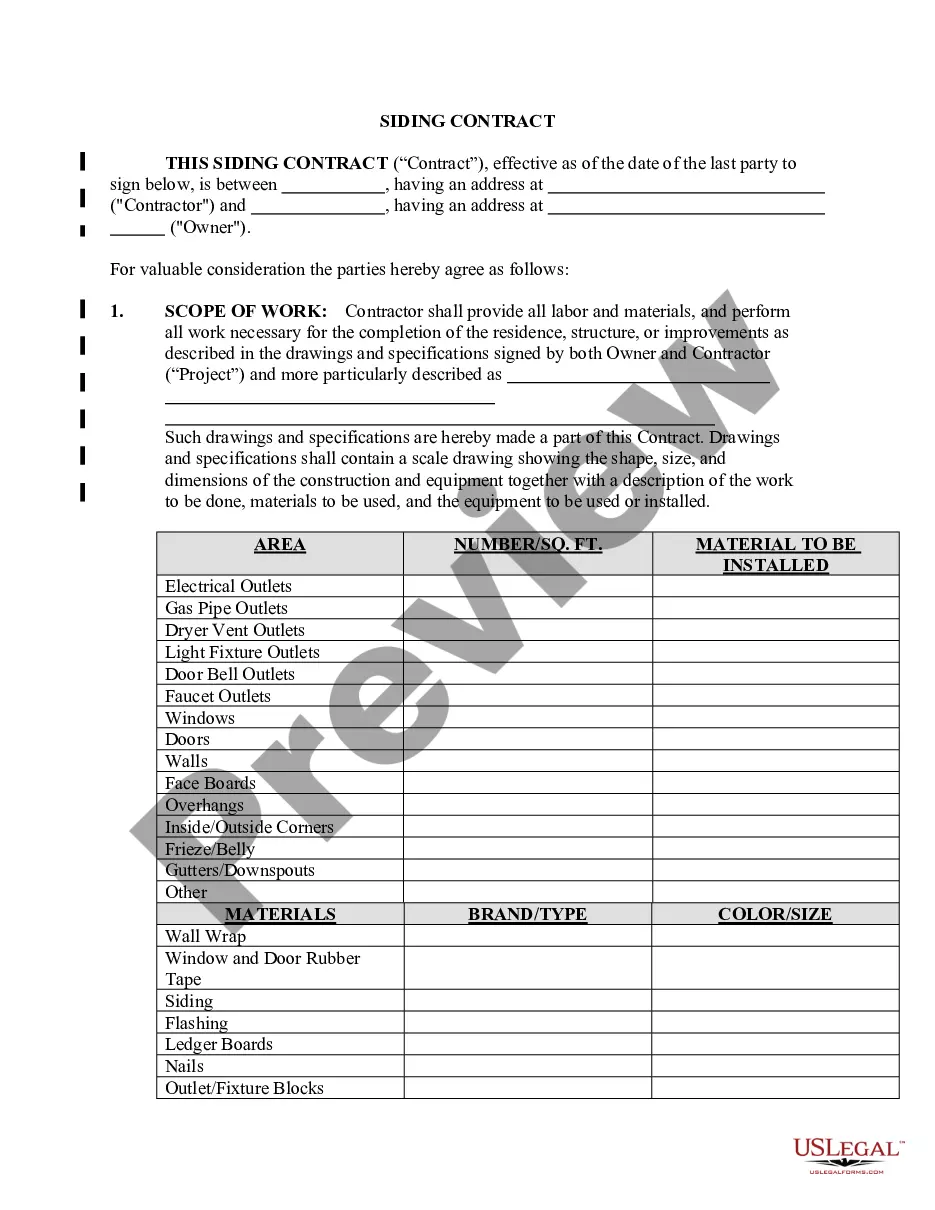

- Step 2. Use the Preview option to review the form's contents. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to locate other types of legal document templates.

Form popularity

FAQ

In general, the SEC guidelines permit resolutions only from shareholders who have continuously held at least $2,000 of the company's stock for a year or longer. If a shareholder meets these requirements, then the board can choose to bring up the resolution for a vote at the next shareholder meeting.

How To Start A Nonprofit In WashingtonChoose your WA nonprofit filing option.File the WA nonprofit articles of incorporation.Get a Federal EIN from the IRS.Adopt your nonprofit's bylaws.Apply for federal and/or state tax exemptions.Apply for required state licenses.Open a bank account for your WA nonprofit.More items...

The Washington State Department of Commerce requires nonprofit organizations that conduct taxable business activities to apply for a business license before they can begin doing business within the state.

In Washington, nonprofit corporations must have at least one director. See RCW 24.03. 100. Many other states require a minimum of three directors.

How to Start a Nonprofit in WashingtonName Your Organization.Recruit Incorporators and Initial Directors.Appoint a Registered Agent.Prepare and File Articles of Incorporation.File Initial Report.Obtain an Employer Identification Number (EIN)Store Nonprofit Records.Establish Initial Governing Documents and Policies.More items...

To start a 501(c)(3) nonprofit corporation in Washington you must:Step 1: Name Your Washington Nonprofit.Step 2: Choose Your Registered Agent.Step 3: Select Your Board Members & Officers.Step 4: Adopt Bylaws & Conflict of Interest Policy.Step 5: File the Articles of Incorporation.Step 6: Get an EIN.More items...?

Nonprofit corporations often deal with government agencies on issues of public concern, which may involve applying for grants, loans or other governmental approvals. In many situations, the government agency requires a corporate resolution to verify the board's approval for making the government application.

IRS 557 provides details on the different categories of nonprofit organizations. Public charities, foundations, social advocacy groups, and trade organizations are common types of nonprofit organization.

Two or more offices may be held by the same individual, except the president may not also serve as secretary or treasurer.

Labeling a vote a resolution means that the board believed the issue was important enough to separate it from standard voting issues. A resolution is considered an official board action and it requires a quorum. Board directors must document all official board actions, including resolutions, in their meeting minutes.