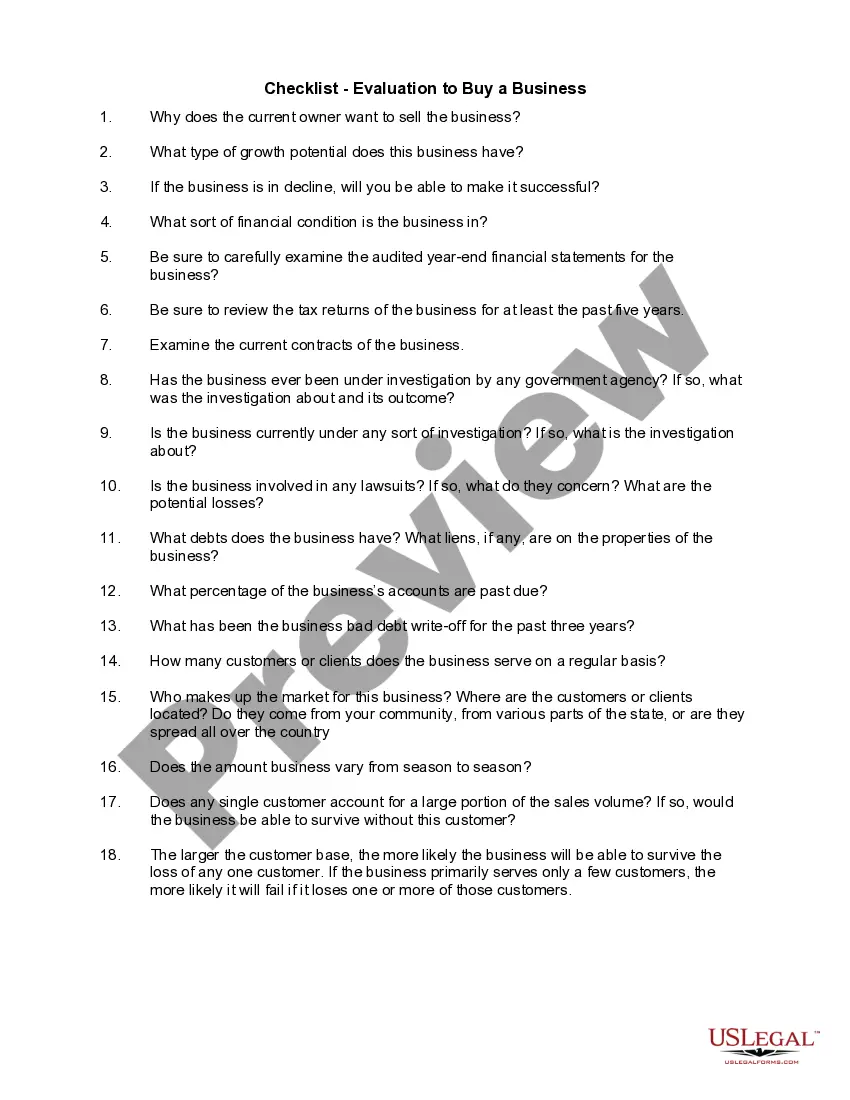

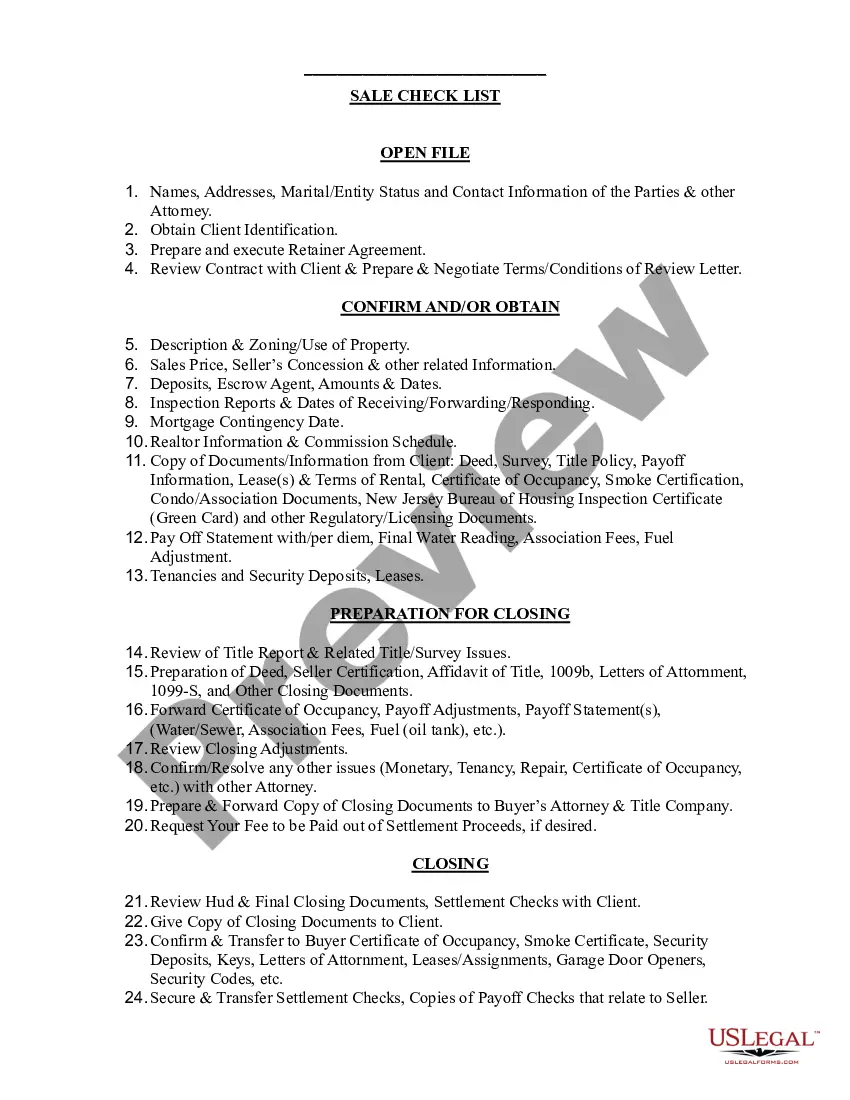

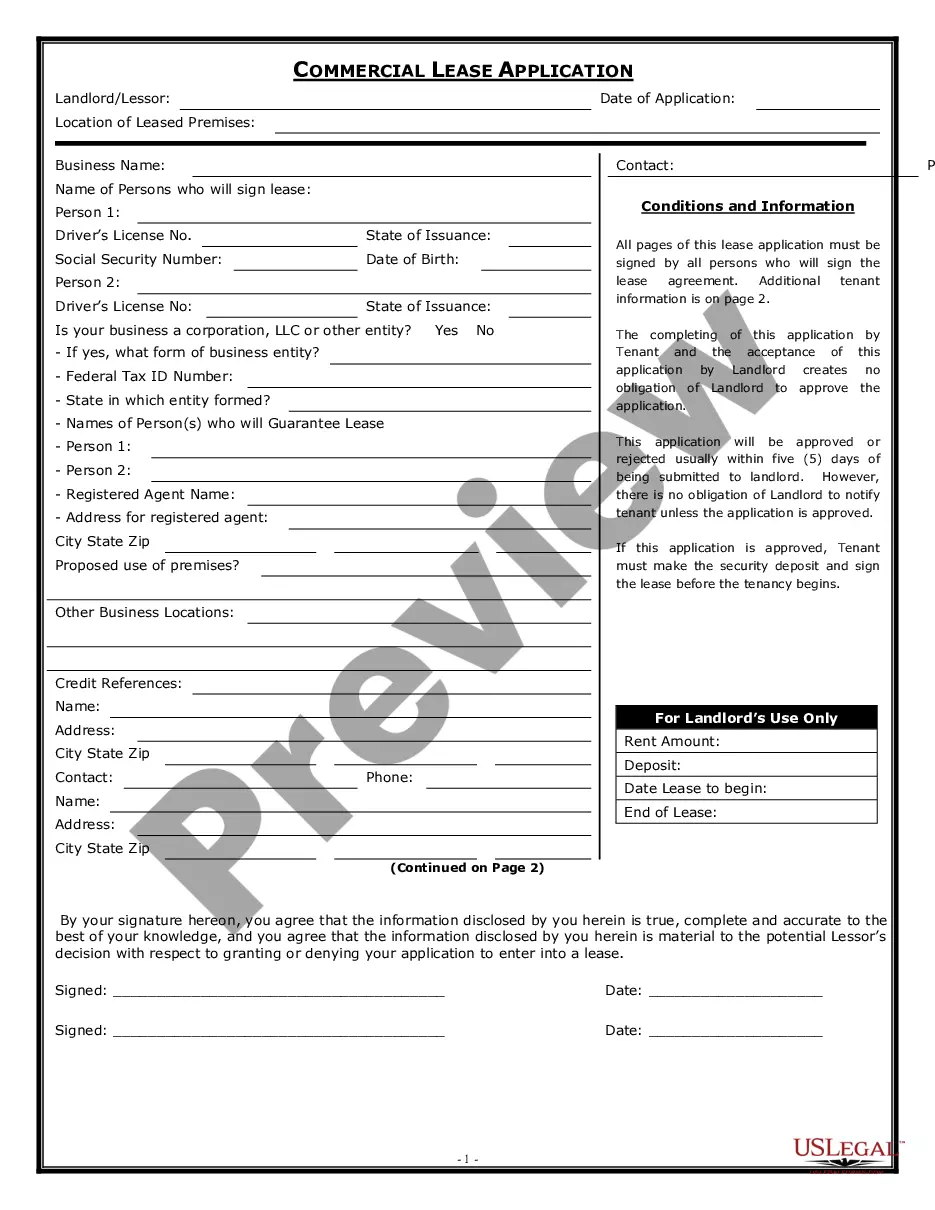

Washington Checklist - Sale of a Business

Description

How to fill out Checklist - Sale Of A Business?

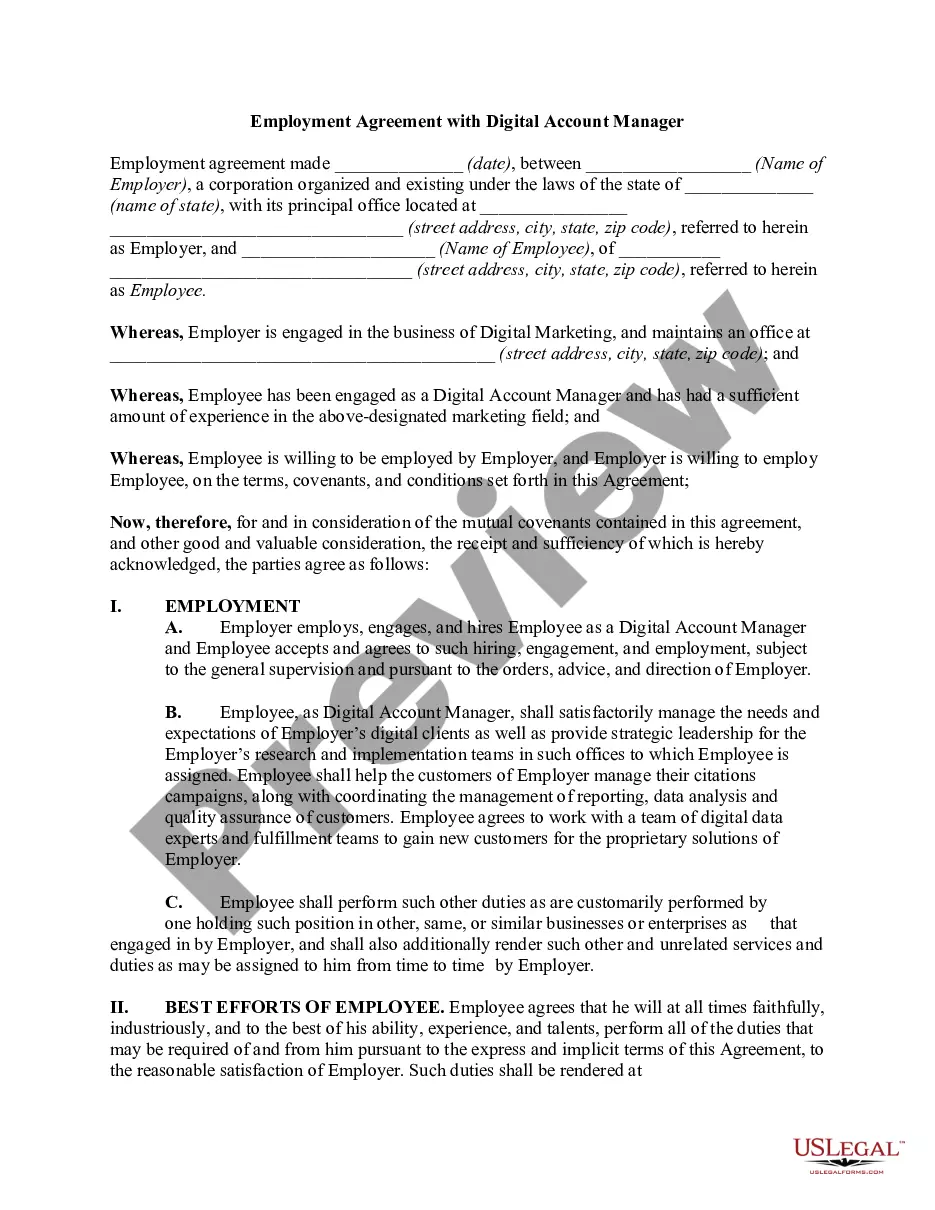

You can devote multiple hours online searching for the legal document template that meets both state and federal requirements you need.

US Legal Forms provides thousands of legal documents that can be examined by professionals.

It is easy to download or print the Washington Checklist - Sale of a Business from my service.

If available, take advantage of the Preview option to view the document template as well.

- If you already possess a US Legal Forms account, you can Log In and select the Acquire option.

- Then, you can complete, modify, print, or sign the Washington Checklist - Sale of a Business.

- Every legal document template you acquire is yours permanently.

- To have an additional backup of any purchased form, visit the My documents tab and click the corresponding option.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the region/city you choose.

- Check the form description to confirm that you have selected the correct form.

Form popularity

FAQ

1 (a) Purpose. Bulk Sales Act is designed to prevent the defrauding of creditors by the secret sale in bulk of substantially all of a merchant's stock of goods.

Steps to Take to Close Your BusinessFile a Final Return and Related Forms.Take Care of Your Employees.Pay the Tax You Owe.Report Payments to Contract Workers.Cancel Your EIN and Close Your IRS Business Account.Keep Your Records.

The bulk transfer law is designed to prevent a merchant from defrauding his or her creditors by selling the assets of a business and neglecting to pay any amounts owed the creditors. The law requires notice so that creditors may take whatever legal steps are necessary to protect their interests.

The Unified Business Identifier (UBI) is a 9-digit number issued to individuals and companies doing business in the State of Washington. The applicant must have this number prior to applying for assisted living facility licensure and/or contract.

Services to individuals and businesses things like haircuts, medical bills, consultant fees, etc. are not personal property, and most services are not subject to sales tax.

The Bulk Transfer law gave creditors the right to notice of a pending sale of assets, an opportunity to object if no such notice was given and the opportunity to invalidate the sale as applies to those creditors. Its purpose was to protect those who may have extended credit in reliance on the assets of the business.

You need to report the income of such sales under this classification. The Wholesaling B&O tax rate is 0.484 percent (0.00484) of your gross receipts. If you are selling items at wholesale you must receive a reseller permit from the buyer.

An asset sale involves the purchase of individual assets and liabilities. Asset sales, like most transactions, are generally cash-free, debt-free transactions. The seller retains its cash and long-term debt obligations and stays in control of the legal entity.

7 Steps to Dissolving a Washington Corporation:Submit a Revenue Clearance Certificate Application.Wait for processing.Fill out Articles of Dissolution.Attach the certificate.Submit Articles of Dissolution.Wait for processing.Inform your registered agent.

How to Dissolve a Washington Corporation or LLCSubmit a Revenue Clearance Certificate Application.Wait for processing.Fill out Articles of Dissolution.Attach the certificate.Submit Articles of Dissolution.Wait for processing.Inform your registered agent.