Washington Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption

Description

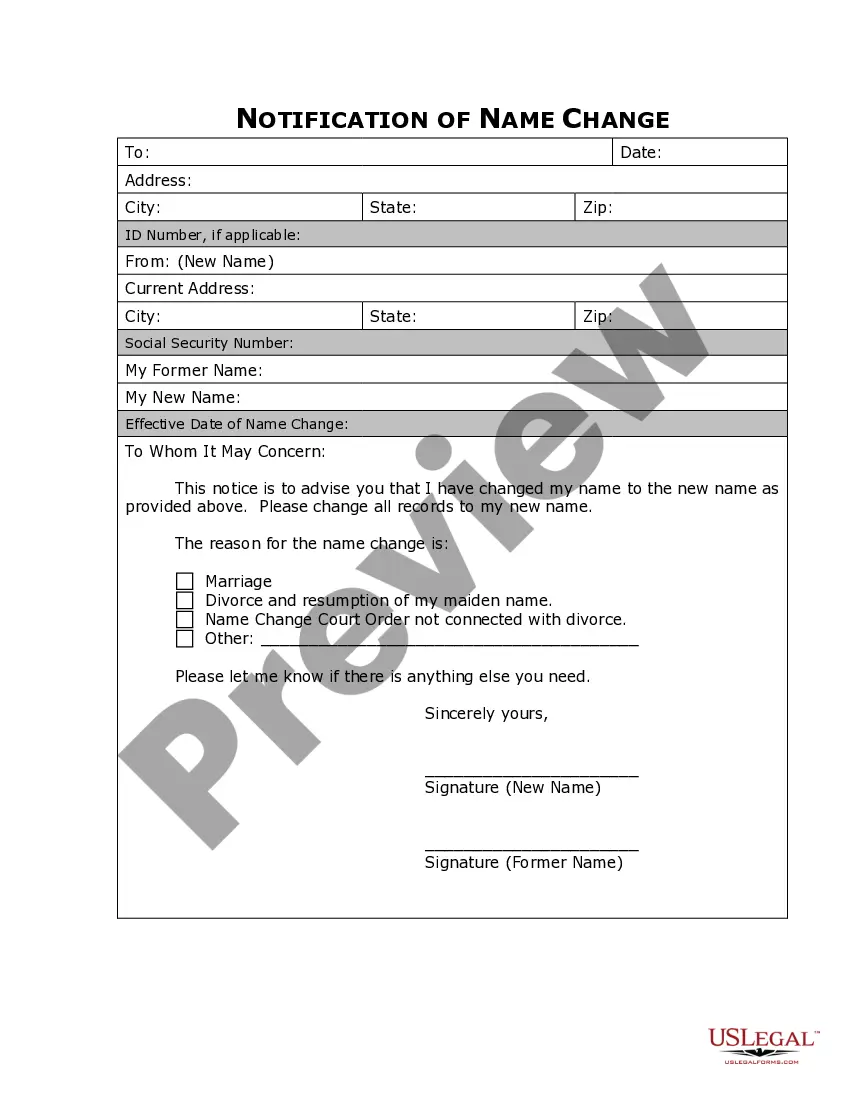

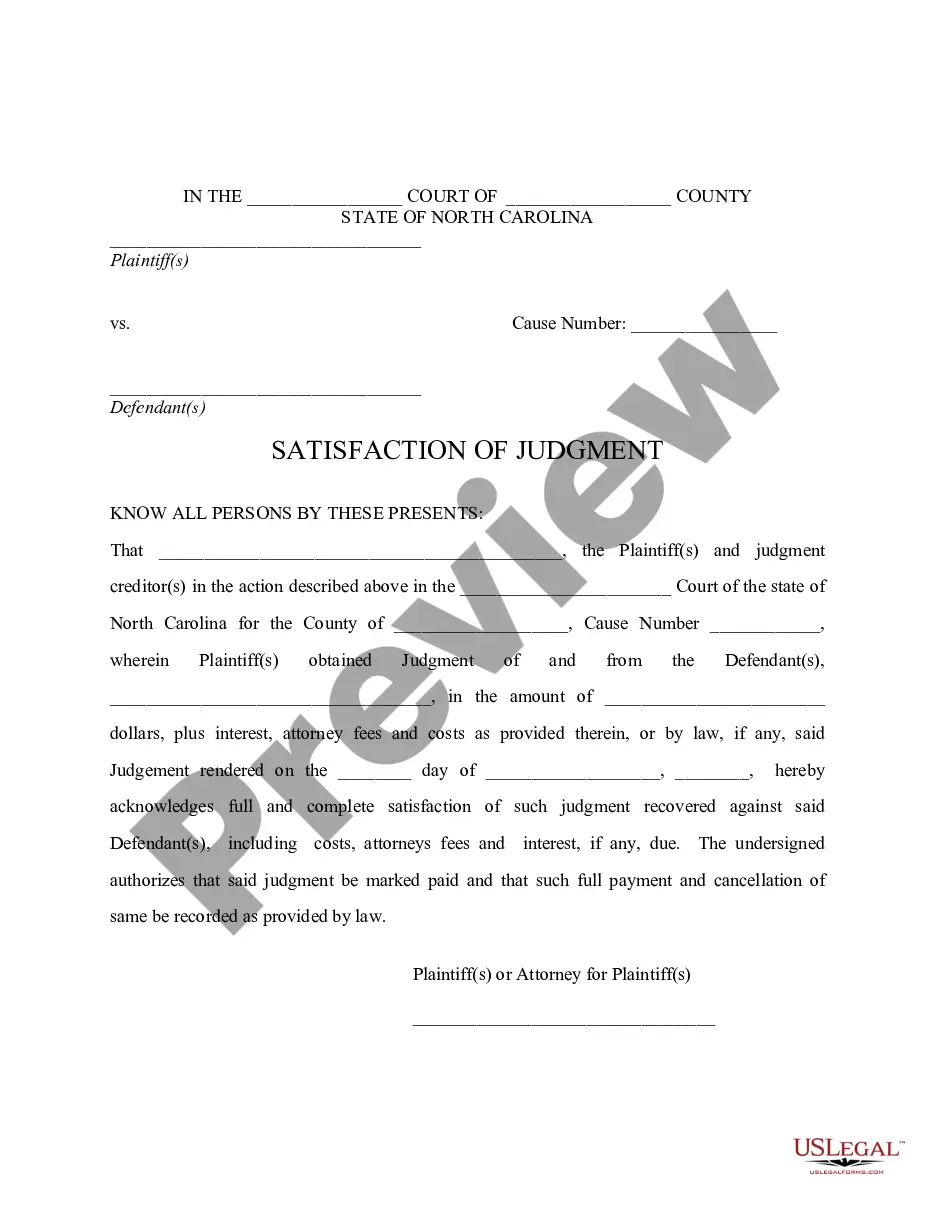

How to fill out Certification Of No Information Reporting On Sale Or Exchange Of Principal Residence - Tax Exemption?

If you wish to obtain, download, or print official document templates, utilize US Legal Forms, which offers the most extensive collection of legal forms available online.

Take advantage of the website's user-friendly and efficient search feature to find the documents you require.

Various templates for corporate and personal needs are organized by categories and regions, or keywords.

Step 4. Once you have located the form you need, select the Purchase now button. Choose your preferred pricing plan and enter your details to sign up for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment. Step 6. Choose the format of the legal document and download it to your device.

- Use US Legal Forms to access the Washington Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and hit the Download button to obtain the Washington Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption.

- You can also retrieve forms you have previously downloaded in the My documents section of your account.

- If this is your first experience with US Legal Forms, adhere to the guidelines below.

- Step 1. Ensure you have selected the form for your correct city/state.

- Step 2. Utilize the Review option to examine the content of the form. Do not forget to read the description.

- Step 3. If the form does not meet your satisfaction, take advantage of the Search field at the top of the screen to find additional types of the legal document template.

Form popularity

FAQ

An exemption certificate is a document that allows certain purchases to be made without the imposition of sales tax. It typically applies to specific buyers or circumstances that qualify for exemption, such as non-profits or government entities. Providing an exemption certificate can streamline transactions and ensure compliance with tax laws. If you are dealing with real estate and tax exemptions, the Washington Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption can offer considerable advantages.

Washington does not have an inheritance tax. Washington does have an estate tax. During a general election in November 1981, the voters repealed an inheritance tax and enacted an estate tax. The change from an inheritance tax to an estate tax became effective January 1, 1982.

Exemptions. The sale or exchange of the following assets are exempt from the Washington capital gains tax: Real estate.

How to Avoid the Estate TaxGive gifts to family.Set up an irrevocable life insurance trust.Make charitable donations.Establish a family limited partnership.Fund a qualified personal residence trust.

In contrast, the outcome is a big win for taxpayers in Washington. The imposition of a 7% tax on capital gains is not inconsequential considering many taxpayers move to Washington because of their lack of income tax. Of course, the state will continue litigating the validity of the tax.

The threshold for the estate tax in Washington is $2.193 million as of 2021. So if a person's estate is equal to less than $2.193 million, then it won't be taxed by Washington state upon the person's death.

The 2020 Washington State estate tax exemption is currently $2,193,000 per person, the same rate as 2019. The law states that the Washington State exemption increases based on the consumer price index for the Seattle-Tacoma-Bremerton area.

Washington state has no gift tax or limit on lifetime gifting, so gifts while you're alive can reduce estate taxes after you pass. In addition to the $16,000 annual gift allowance, an individual may give away $12.06 million over their lifetime free of any gift tax (see Can You Gift Too Much?).

1. A gain of up to $250,000 for those who file as single and $500,000 for those who are married and file jointly is excluded from any tax (note: Washington state does not have a state tax, so gain on sale of a home here is state-tax neutral). 2.

Capital gains tax (CGT) is payable when you sell an asset that has increased in value since you bought it. The rate varies based on a number of factors, such as your income and size of gain. Capital gains tax on residential property may be 18% or 28% of the gain (not the total sale price).