Washington Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another

Description

How to fill out Promissory Note And Security Agreement With Regard To The Sale Of An Automobile From One Individual To Another?

If you require to finalize, download, or print authentic document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Employ the website's straightforward and convenient search feature to find the documents you need.

Various templates for professional and personal purposes are organized by categories and jurisdictions, or by keywords and terms.

Step 4. Once you have found the form you need, click the Get Now button. Choose the pricing plan you prefer and provide your information to register for an account.

Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finalize the payment.

- Utilize US Legal Forms to obtain the Washington Promissory Note and Security Agreement Pertaining to the Sale of a Vehicle from One Person to Another with just a few clicks.

- If you are a returning US Legal Forms user, Log In to your account and click the Download button to acquire the Washington Promissory Note and Security Agreement Pertaining to the Sale of a Vehicle from One Person to Another.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these instructions.

- Step 1. Ensure you have selected the form for the correct city/state.

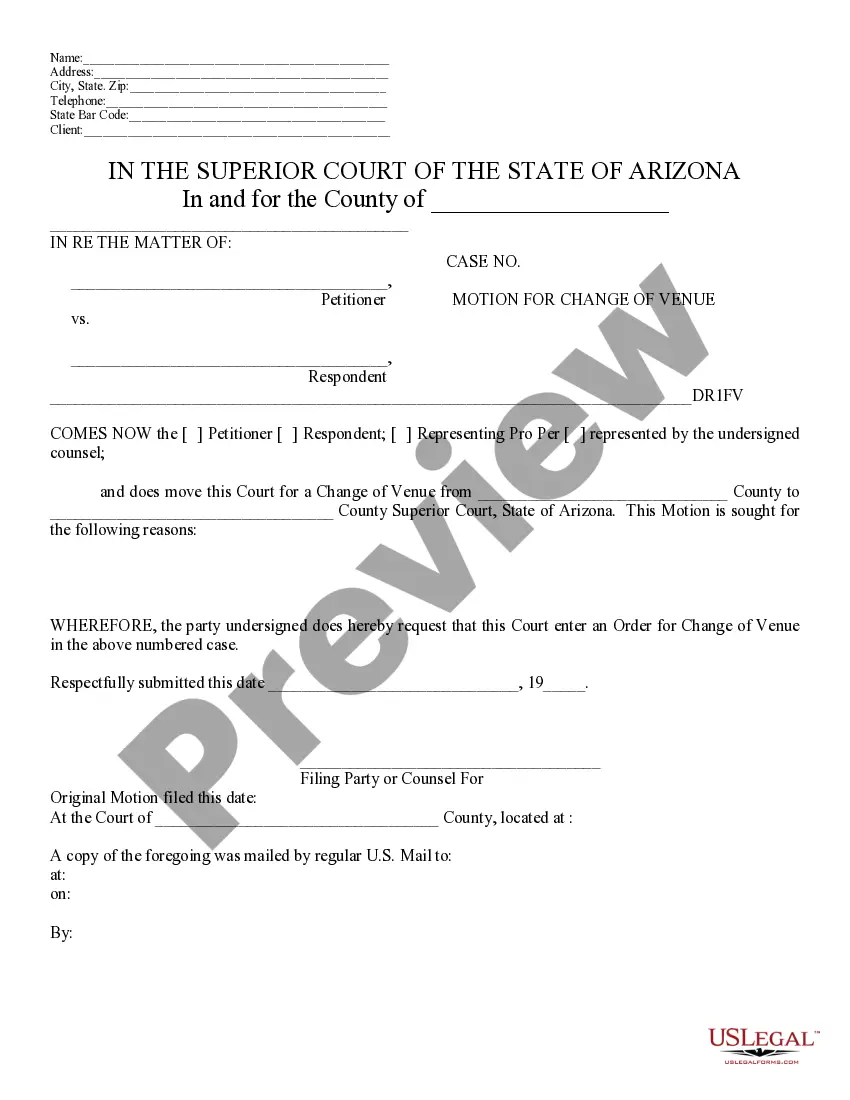

- Step 2. Use the Preview option to review the content of the form. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

In Washington state, a promissory note does not legally require notarization to be valid; however, having it notarized can strengthen its enforceability in case of disputes. Notarization serves as a way to verify the identities of the parties involved. Therefore, while it is not mandatory, it is a good practice to have a notarized Washington Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another.

In the context of a Washington Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another, recording a security agreement can enhance your protection. While it may not be mandatory to record such agreements, doing so provides public notice of your interest in the vehicle, which can be crucial if disputes arise. By registering the agreement, you safeguard your rights and prevent potential claims from other creditors. For a seamless experience, consider using the US Legal Forms platform, which offers templates and guidance for properly recording your security agreements.

A security agreement typically includes details such as the names of the parties, the description of the collateral, payment terms, and conditions for default. It is essential that these elements are clearly defined to avoid misunderstandings. For a reliable template, look for a Washington Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another on uslegalforms, which includes all necessary components.

No, a security agreement and a lien are related but distinct concepts. A security agreement is a contract that establishes a borrower’s obligation, while a lien provides a legal claim against the collateral. In the context of a Washington Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another, the agreement outlines repayment, while the lien protects the lender's interest in the vehicle until the debt is settled.

Writing a security contract agreement begins by clearly identifying the parties involved and the collateral being used. You should also specify the payment terms, interest rate, and any risks involved. For guidance tailored to your needs, consider using a Washington Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another available on uslegalforms.

A security agreement does not always need to be notarized, but having it notarized can provide added legal protection and clarity. In the case of a Washington Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another, notarization can help prevent disputes about the document’s authenticity, enhancing its enforceability.

A promissory note is the document that sets forth the terms of a loan's repayment. A promissory note can be secured with a pledge of collateral, which is something of value that can be seized if a borrower defaults.

In general, the promissory note is your written promise to repay the loan and a security agreement is used when collateral is given for the loan.

Promissory Notes. Homeowners usually think of their mortgage as an obligation to repay the money they borrowed to buy their residence. But actually, it's a promissory note they also sign, as part of the financing process, that represents that promise to pay back the loan, along with the repayment terms.

A promissory note can be used for different types of loans such as a mortgage, student loan, car loan, business loan or personal loan.