Washington Private Annuity Agreement with Payments to Last for Life of Annuitant

Description

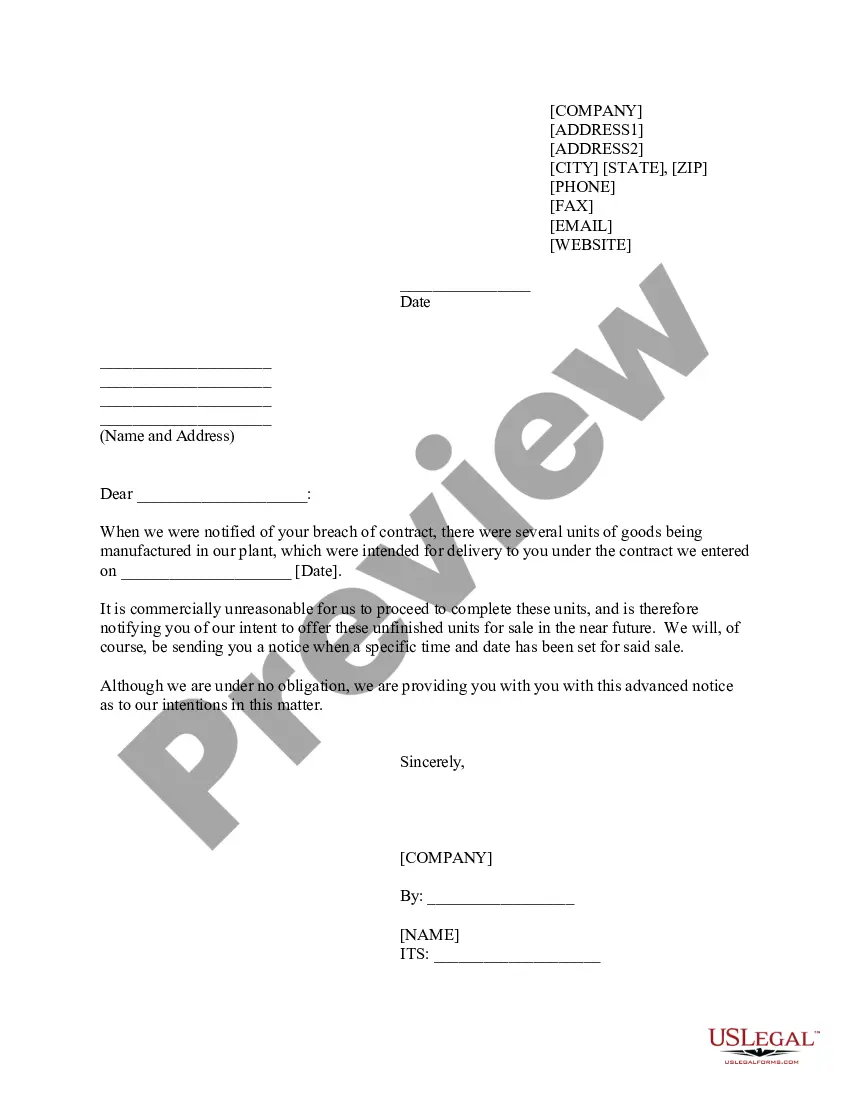

How to fill out Private Annuity Agreement With Payments To Last For Life Of Annuitant?

If you desire to complete, acquire, or download sanctioned document templates, utilize US Legal Forms, the leading collection of legal forms available online. Leverage the site's straightforward and user-friendly search to locate the documents you require. Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Employ US Legal Forms to find the Washington Private Annuity Agreement with Payments to Endure for the Lifetime of the Annuitant with just a few clicks.

If you are currently a US Legal Forms subscriber, Log In to your account and then click the Download button to retrieve the Washington Private Annuity Agreement with Payments to Endure for the Lifetime of the Annuitant. You can also access forms you previously saved within the My documents tab of your account.

Every legal document template you obtain is yours indefinitely. You have access to every form you saved in your account. Click the My documents section and select a form to print or download again.

Be proactive and download, and print the Washington Private Annuity Agreement with Payments to Endure for the Lifetime of the Annuitant using US Legal Forms. There are numerous professional and state-specific forms you can utilize for your business or personal needs.

- Step 1. Ensure you have selected the form suitable for the correct city/region.

- Step 2. Use the Review option to examine the form's details. Don’t forget to review the information.

- Step 3. If you are dissatisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal form design.

- Step 4. Once you have identified the form you need, click on the Purchase now button. Choose your preferred pricing plan and provide your credentials to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Washington Private Annuity Agreement with Payments to Endure for the Lifetime of the Annuitant.

Form popularity

FAQ

Upon the death of the annuitant in a Washington Private Annuity Agreement with Payments to Last for Life of Annuitant, the taxation may vary based on beneficiary designations. Typically, the total value of any remaining payments becomes part of the deceased's estate, which may incur income tax depending on the structure of the annuity and its beneficiaries. Thus, it is crucial to consult a tax professional to navigate your specific situation effectively. Proper planning can optimize the inheritance for your beneficiaries.

The taxation of a Washington Private Annuity Agreement with Payments to Last for Life of Annuitant primarily depends on the distribution received. Generally, the payments are partially taxed, with the return of your principal not subject to tax. Additionally, any interest portion you receive will be taxed as ordinary income. Understanding these tax implications ensures you make informed financial decisions.

The annuity payout option that offers lifetime payments while ensuring a minimum payment period is often referred to as a 'guaranteed period annuity'. With the Washington Private Annuity Agreement with Payments to Last for Life of Annuitant, you can protect your investment by ensuring a fixed number of payments even if you pass away before the minimum term ends. This approach combines the security of lifetime payments with the additional comfort of knowing that payments will continue for a specified duration. Consider this option if you wish to leave a legacy for your heirs while enjoying lifetime income.

An annuity arrangement that stops payments upon the death of the annuitant is known as a 'life only' annuity. The Washington Private Annuity Agreement with Payments to Last for Life of Annuitant is an alternative that provides enduring payments throughout the annuitant's life, avoiding the pitfall of losing benefits at death. Therefore, if you seek a secure income stream, this option would be highly beneficial. It’s important to compare these choices when planning your finances.

A lifetime payout annuity is a financial product that provides regular payments to the annuitant for as long as they live. The Washington Private Annuity Agreement with Payments to Last for Life of Annuitant ensures that you receive these payments without worrying about outliving your funds. This agreement offers peace of mind, especially in planning for retirement and managing long-term financial needs. Understanding this option can help you make informed decisions about your financial future.

The annuity whose payments cease upon the death of the annuitant is known as a life-only annuity. This is a key feature of a Washington Private Annuity Agreement with Payments to Last for Life of Annuitant, which focuses on lifetime benefits while addressing the immediate need for income. Understanding these types helps you choose the best financial strategy.

An immediate annuity settlement typically stops when the annuitant passes away. This arrangement contrasts with a Washington Private Annuity Agreement with Payments to Last for Life of Annuitant, which is structured to provide sustained support throughout the annuitant’s life. Consider how these options align with your financial goals when making your decisions.

The payout option that ensures lifetime payments to the annuitant is called a lifetime annuity. This type of agreement is foundational in a Washington Private Annuity Agreement with Payments to Last for Life of Annuitant, as it guarantees regular income for the annuitant’s lifetime, providing financial security. You enjoy peace of mind knowing that your payments will continue as long as you are alive.

Upon the death of the annuitant, the tax implications of private annuities can vary based on several factors, including the structure of the agreement. Generally, if you have a Washington Private Annuity Agreement with Payments to Last for Life of Annuitant, any remaining payments might not be taxable as income to beneficiaries, but estate tax considerations may apply. It's wise to consult with a tax professional to navigate these complexities effectively.

The annuity that will cease payments upon the death of the annuitant is known as a term certain annuity. These agreements guarantee payments for a specified period but do not continue beyond the annuitant's life. In the context of a Washington Private Annuity Agreement with Payments to Last for Life of Annuitant, this type is distinct as it extends lifetime benefits specifically designed for the annuitant.