Washington Agreement to Compromise Debt by Returning Secured Property

Description

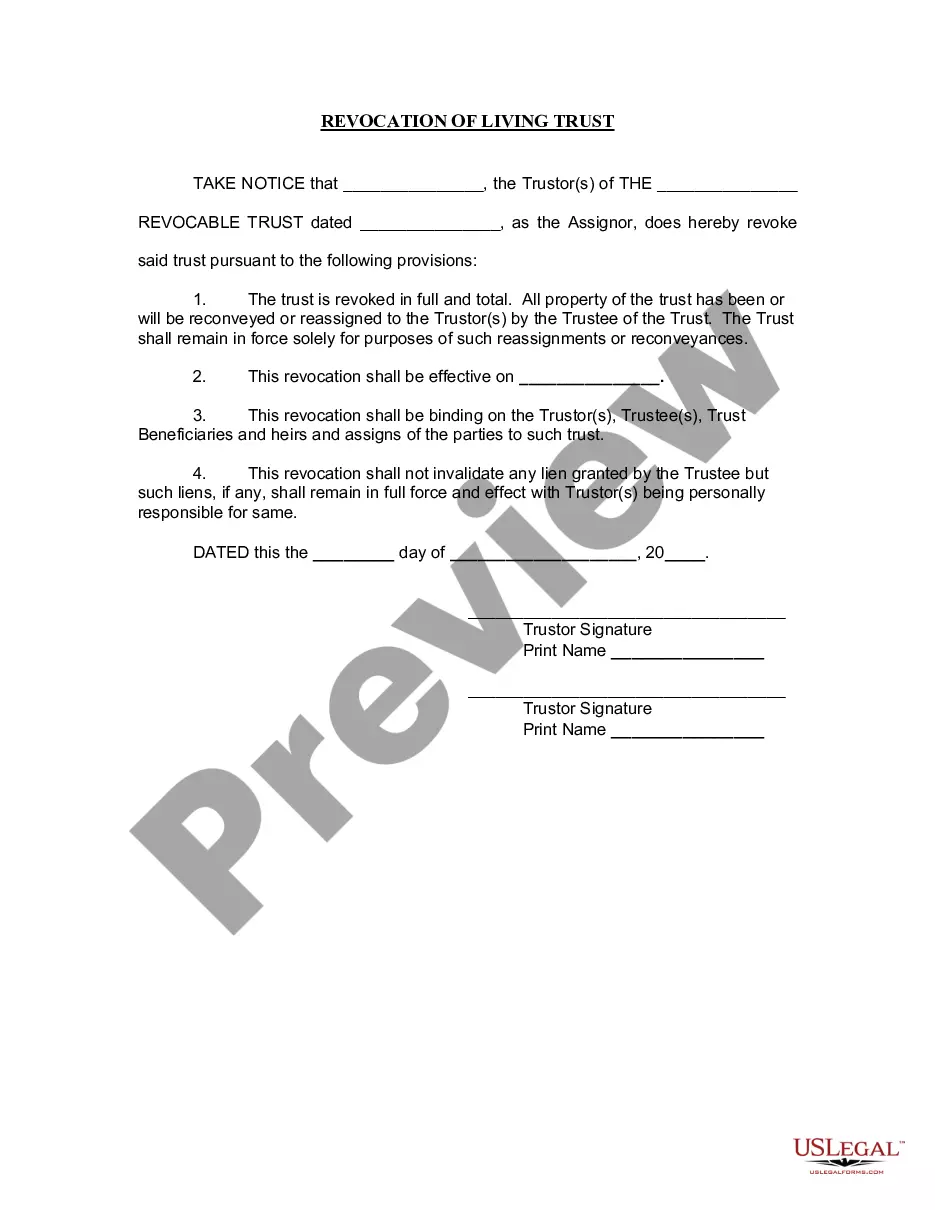

How to fill out Agreement To Compromise Debt By Returning Secured Property?

Selecting the appropriate legal document template can be a challenge.

Certainly, there are numerous templates accessible online, but how do you find the legal document you need.

Utilize the US Legal Forms website. The platform offers a vast array of templates, such as the Washington Agreement to Resolve Debt by Returning Secured Property, which can be utilized for business and personal purposes.

Initially, ensure you have chosen the appropriate document for your city/state. You can browse the form using the Preview button and review the form description to confirm it is suitable for you.

- All templates are reviewed by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and then click the Download button to obtain the Washington Agreement to Resolve Debt by Returning Secured Property.

- Use your account to view the legal documents you have previously acquired.

- Go to the My documents section of your account and retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple steps to follow.

Form popularity

FAQ

To write a settlement agreement, first define the parties involved and clearly state the dispute being settled. Then, outline the terms, including any payment amounts and deadlines. Be sure to mention that the agreement pertains to a Washington Agreement to Compromise Debt by Returning Secured Property, if relevant. Having a professional review your agreement can help ensure it meets legal standards and protects your interests.

Writing a good debt settlement letter involves clear communication of your intent to settle. Start with your personal information, the creditor's details, and a reference to the debt you wish to address. Clearly state your proposed settlement amount, express your willingness to resolve the matter, and mention the Washington Agreement to Compromise Debt by Returning Secured Property if it applies. Providing a reasonable offer can encourage a productive response from the creditor.

To write a debt settlement agreement, begin by outlining the parties involved, the total debt amount, and the agreed-upon settlement. Include payment terms, such as due dates and any other conditions. Be sure to specify that this agreement reflects a Washington Agreement to Compromise Debt by Returning Secured Property, if applicable. Seeking templates from reliable sources, like USLegalForms, can help streamline this process.

In Washington state, the statute of limitations for most debt collection claims is three years. This timeframe begins from the date of your last payment or acknowledgment of the debt. After this period, creditors may lose the right to sue you for repayment. Understanding the Washington Agreement to Compromise Debt by Returning Secured Property can provide additional options to manage your debt within this timeline.

Deciding to settle your debt or go to court requires careful consideration. Generally, settling through a Washington Agreement to Compromise Debt by Returning Secured Property can be a more straightforward and less intimidating path. It generally saves time and avoids the potential for lengthy litigation, allowing you to focus on rebuilding your financial life. Ultimately, determining the best route should involve analyzing your situation, possibly with the help of professionals.

Debt settlement can be a good idea in certain situations, especially if you are struggling to meet your obligations. Engaging in a Washington Agreement to Compromise Debt by Returning Secured Property can effectively reduce your debt burden while allowing you to retain some of your secured assets. This option can prevent lingering issues related to debt collection and help you achieve financial stability sooner. Assess your personal circumstances thoughtfully to determine if this approach fits your needs.

A reasonable amount to settle a debt varies based on the total owed, the creditor, and your financial situation. Generally, settling for a fraction of the total balance can be feasible, and a Washington Agreement to Compromise Debt by Returning Secured Property may allow you to negotiate this effectively. Creditors often prefer settling rather than pursuing long-term collection efforts, which provides you an opportunity to propose a realistic amount that aligns with your budget. Consider discussing your options with financial advisors to ensure a fair deal.

Whether you should dispute or settle debt often depends on your specific situation. A Washington Agreement to Compromise Debt by Returning Secured Property can provide a viable option for settling your debt instead of engaging in disputes that may take longer and require more effort. By opting for a settlement, you can potentially regain control of your financial circumstances while avoiding the complexities of a dispute. It's essential to assess your options carefully and consider seeking professional advice.

A claim on the property of another as security for a debt refers to a legal right that a creditor has over a borrower's property until the debt is repaid. In the context of the Washington Agreement to Compromise Debt by Returning Secured Property, this claim can be critical when negotiating debt relief. This type of arrangement may allow individuals to return property to satisfy their debts without incurring additional penalties. Understanding this concept helps you navigate the complexities of debt resolution more effectively.

In Washington, the statute of limitations for collecting most debts is three years. After this period, a debt collector cannot legally pursue the debt, allowing consumers to find relief through options like the Washington Agreement to Compromise Debt by Returning Secured Property. You have the right to know when a debt becomes too old to be enforced. It's crucial to understand this timeline to take necessary action and protect yourself from aggressive collection tactics.