Washington Security Agreement involving Sale of Collateral by Debtor

Description

How to fill out Security Agreement Involving Sale Of Collateral By Debtor?

If you require thorough, acquire, or print out valid document templates, utilize US Legal Forms, the largest collection of legal forms available online. Take advantage of the site's straightforward and user-friendly search to locate the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to access the Washington Security Agreement regarding Sale of Collateral by Debtor in just a few clicks.

If you are already a US Legal Forms user, Log In to your account and click on the Obtain button to access the Washington Security Agreement regarding Sale of Collateral by Debtor. You can also find forms you have previously downloaded in the My documents tab of your account.

Each legal document template you download is yours permanently. You have access to every form you downloaded in your account. Click the My documents section and select a form to print or download again.

Obtain and download, and print the Washington Security Agreement regarding Sale of Collateral by Debtor with US Legal Forms. There are thousands of professional and state-specific forms you can use for your business or personal needs.

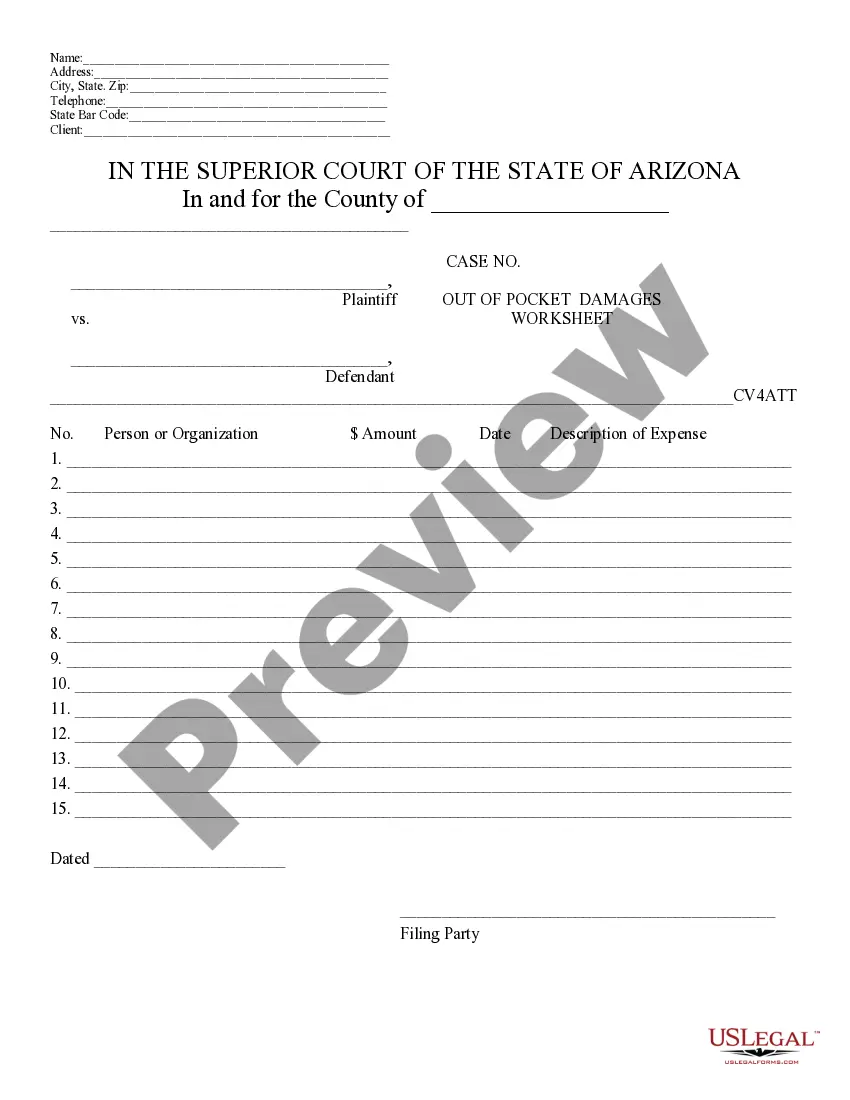

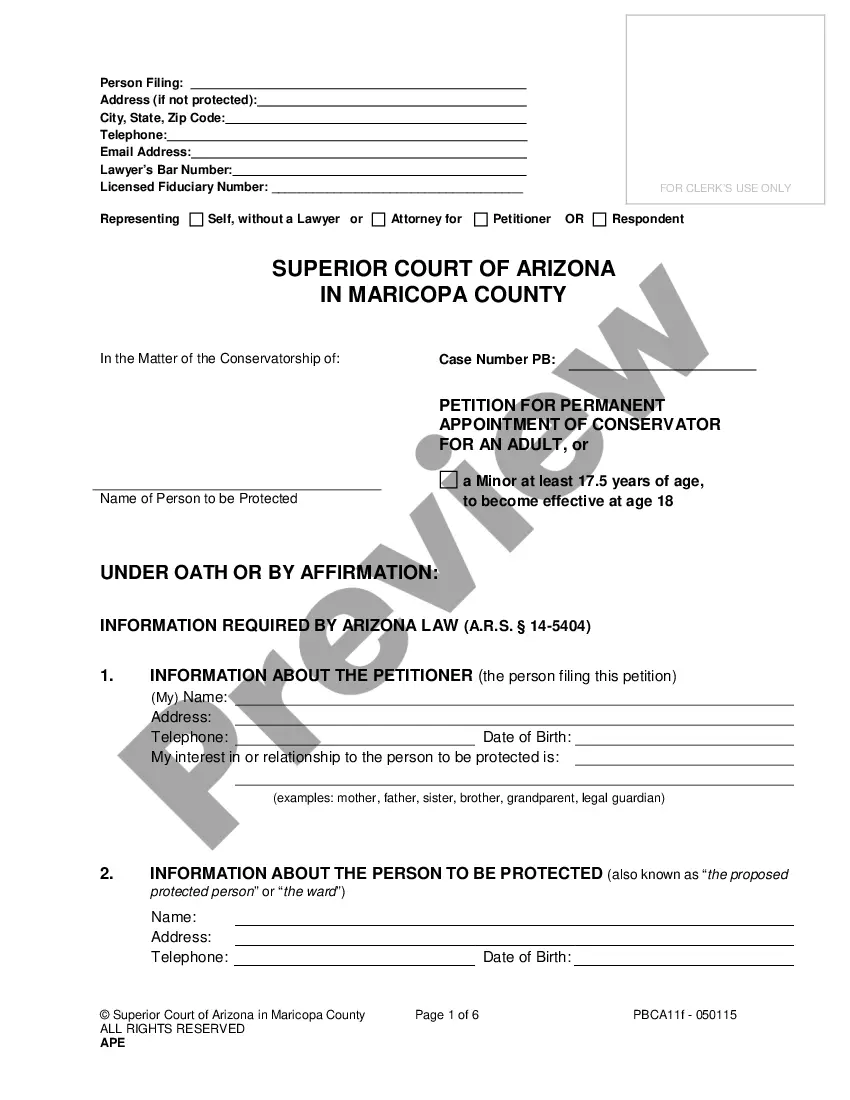

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form's content. Do not forget to read the summary.

- Step 3. If you are not satisfied with the form, use the Search section at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, click the Acquire now button. Choose the payment plan you prefer and enter your details to create an account.

- Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the payment.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Washington Security Agreement regarding Sale of Collateral by Debtor.

Form popularity

FAQ

A security agreement provides a legal framework for a lender to secure their interests in a borrower's collateral. In a Washington Security Agreement involving Sale of Collateral by Debtor, this means that if the borrower defaults, the lender can reclaim the specified assets. This agreement clearly defines the obligations of both parties, ensuring both understand their rights and responsibilities. By outlining these terms, it helps prevent disputes in the future, providing peace of mind for all involved.

The description of collateral in a Washington Security Agreement involving Sale of Collateral by Debtor must be precise and clear, allowing anyone to identify the collateral easily. The description may include specific items, types of items, or classes of property and should encompass any present and future items related to the agreement. Clear collateral descriptions help mitigate disputes and ensure proper enforcement of interests.

If a secured party claims a security interest in collateral that has been sold by the debtor, the right to the collateral may depend on the specific terms of the Washington Security Agreement involving Sale of Collateral by Debtor. Typically, the secured party retains an interest in the sale proceeds, provided they properly secured their claim prior to the sale. The debtor must disclose the sale to the secured party so that obligations can be fulfilled.

A collateral security interest generally remains effective even if the collateral is moved to another state, as long as it was perfected in the original state. However, under a Washington Security Agreement involving Sale of Collateral by Debtor, the secured party should file appropriate financing statements in the new state to maintain enforceability against third parties. Failing to do this could risk losing rights over the collateral, so it's crucial to stay informed about the requirements in both states.

Writing a security agreement requires clarity and attention to detail, especially in the context of a Washington Security Agreement involving Sale of Collateral by Debtor. You should clearly define the parties involved, describe the collateral, specify the rights and duties of both the debtor and secured party, and include any necessary legal language to ensure enforceability. Using a platform like US Legal Forms can simplify this process, guiding you through the essential elements needed for a legally sound agreement.

When collateral is sold as part of a Washington Security Agreement involving Sale of Collateral by Debtor, the rights of the secured party remain intact, provided that the security agreement allows for such a sale. The debtor must inform the secured party about the sale, and any proceeds from the sale may also be subject to the security interest. Understanding the implications of selling collateral helps prevent potential disputes between the debtor and secured party.

Yes, in a Washington Security Agreement involving Sale of Collateral by Debtor, the debtor must have rights in the collateral for the security interest to attach. These rights may include ownership or any other interest that allows the debtor to sell or use the collateral. It's crucial for the debtor to clearly understand their rights to ensure compliance with the agreement and protection of both parties involved.

The process for making a security interest enforceable under a Washington Security Agreement involving Sale of Collateral by Debtor involves attachment and perfection. Attachment occurs when the secured party has given value, the debtor has rights in the collateral, and the parties have created a security agreement. After attachment, the security interest can be perfected, which typically means that the secured party has taken the necessary steps to protect their interest against third parties.

Creating a security contract involves outlining the agreement details, such as the parties involved and the collateral being secured. It's important to specify the events that may trigger enforcement of the contract. For those looking at a Washington Security Agreement involving Sale of Collateral by Debtor, utilizing resources from uslegalforms can simplify the process and ensure you include all pertinent information.

To create a security agreement, start with a clear description of the collateral involved. Include the terms of the agreement, such as the rights and responsibilities of both parties. When dealing with a Washington Security Agreement involving Sale of Collateral by Debtor, it's advisable to use templates available on platforms like uslegalforms, which can guide you through the necessary steps.