Washington Revocable Trust for Lottery Winnings

Description

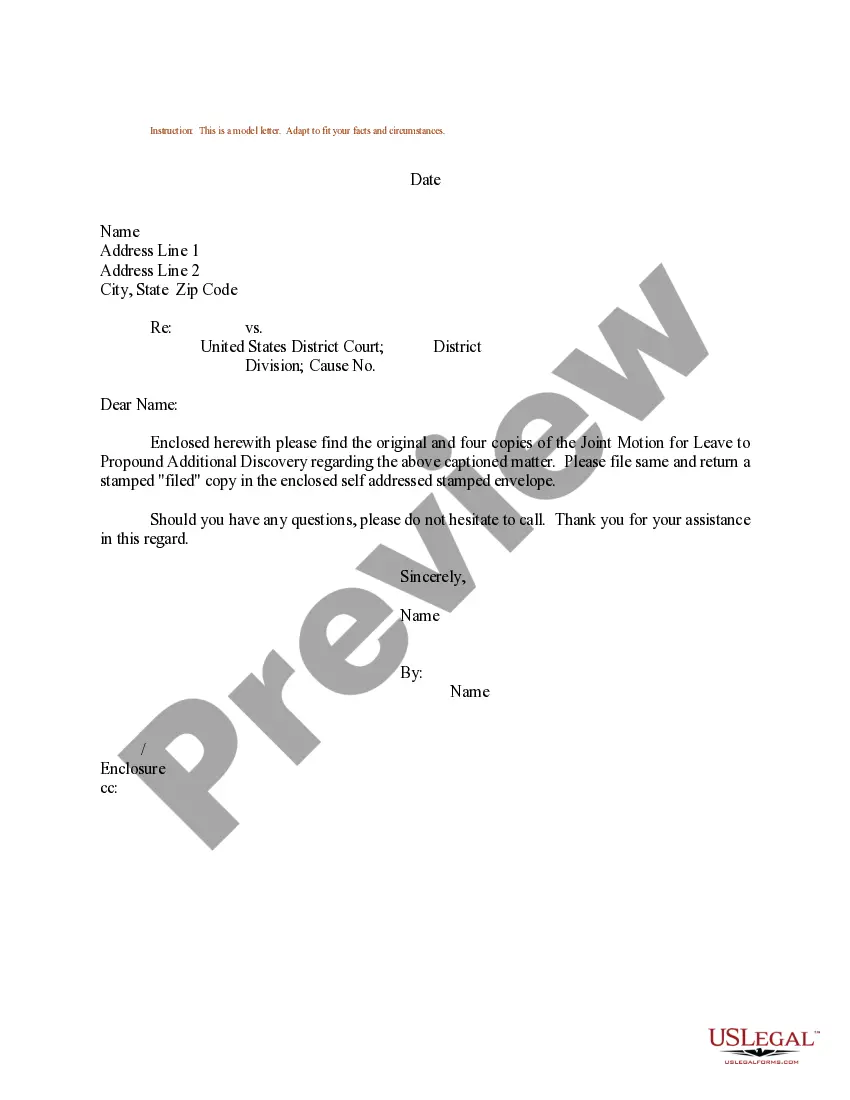

How to fill out Revocable Trust For Lottery Winnings?

Finding the appropriate legal document template can be a challenge.

Certainly, there are numerous templates accessible online, but how can you find the legal form you require? Use the US Legal Forms website.

The service offers a multitude of templates, such as the Washington Revocable Trust for Lottery Winnings, which can be utilized for business and personal needs.

If the form does not meet your requirements, use the Search field to find the appropriate form. Once you are confident that the form is acceptable, click the Get Now button to obtain the form. Choose the pricing plan you prefer and enter the necessary information. Create your account and complete your purchase using your PayPal account or credit card. Select the file format and download the legal document template to your device. Finally, complete, edit, print, and sign the received Washington Revocable Trust for Lottery Winnings. US Legal Forms is the largest library of legal forms where you can find various document templates. Utilize the service to download professionally created documents that comply with state standards.

- All the forms are reviewed by experts and adhere to state and federal requirements.

- If you are currently registered, Log In to your account and click the Download button to obtain the Washington Revocable Trust for Lottery Winnings.

- Utilize your account to search through the legal forms you have acquired previously.

- Visit the My documents tab of your account and download another copy of the document you require.

- If you are a new client of US Legal Forms, here are simple steps you should follow.

- First, ensure you have selected the correct form for your city/region. You can review the form using the Review button and read the form description to confirm it is suitable for you.

Form popularity

FAQ

A common loophole for gift tax involves utilizing a Washington Revocable Trust for Lottery Winnings to distribute your assets strategically. This type of trust allows you to create specific conditions around gifting, which can provide some tax advantages. By carefully managing how and when gifts are made, you can potentially avoid exceeding federal gift tax limits. Consulting with a financial advisor can help you navigate this complex area effectively.

As of 2023, you can give up to $17,000 per recipient per year without triggering any gift tax. If you use a Washington Revocable Trust for Lottery Winnings, you can plan your distributions to maximize this limit. This enables you to share your winnings with multiple family members while keeping tax implications at bay. Always consult with a tax expert when planning significant gifts to ensure compliance with tax laws.

Sharing lottery winnings with family without incurring taxes can be achieved by using a Washington Revocable Trust for Lottery Winnings. This trust allows for the distribution of funds to beneficiaries while minimizing tax liabilities. Keeping within the annual exclusion limit for gifts is another effective strategy. Always ensure compliance with IRS regulations to avoid any unforeseen tax consequences.

To avoid gift tax on lottery winnings, you can utilize strategic planning such as distributing your winnings through a Washington Revocable Trust for Lottery Winnings. This trust can help you legally allocate funds to beneficiaries without incurring gift tax. Additionally, staying below the annual gift exclusion limit can also be a helpful tactic. Make sure to keep accurate records of these transactions to support your arrangements.

In the United States, generally, all lottery winnings are subject to federal taxes, regardless of the amount. However, certain states have differing tax regulations which may provide some exemptions. For those utilizing a Washington Revocable Trust for Lottery Winnings, there may be strategies to minimize tax impacts effectively. It's advisable to consult a tax professional to explore your specific circumstances.

When a trust wins the lottery, it means the prize is awarded to the trust rather than an individual. This arrangement can offer numerous benefits, such as protecting the assets, simplifying the transfer to beneficiaries, and potentially mitigating tax implications. Establishing a Washington Revocable Trust for Lottery Winnings allows you to manage the prize in a way that aligns with your long-term wishes and financial goals. Additionally, it can provide peace of mind as you handle substantial funds responsibly.

Opening a trust for your lottery winnings is a straightforward process. First, you need to consult with a legal professional experienced in trusts and estate planning. After that, you can create a Washington Revocable Trust for Lottery Winnings, where you outline the terms and conditions for managing and distributing your lottery prize. This type of trust provides flexibility and can help protect your winnings from taxes and creditors.

The best investment for lottery winnings often depends on your financial goals and risk tolerance. Generally, a diversified portfolio that includes stocks, bonds, and real estate can provide long-term growth. You might also consider utilizing a Washington Revocable Trust for Lottery Winnings to manage your investments efficiently. Speaking with a financial advisor can help you craft a tailored investment strategy.

The best trust to set up if you win the lottery is a Washington Revocable Trust for Lottery Winnings. This trust provides flexibility and control over your assets, ensuring they are distributed according to your wishes. It also offers privacy, shielding your financial information from public view. Consulting with estate planning professionals can help you establish this trust effectively.

The best account for lottery winnings often includes a high-yield savings account or investment account. Placing your winnings into a Washington Revocable Trust for Lottery Winnings can also be beneficial as it helps manage distributions and investments. This approach also allows for the possibility of higher returns while keeping your funds secure. Always evaluate your options to find what aligns with your financial goals.