Washington Revocable Trust for Asset Protection

Description

How to fill out Revocable Trust For Asset Protection?

If you wish to obtain, acquire, or print approved document templates, utilize US Legal Forms, offering the largest selection of legal forms available online.

Use the site's straightforward and user-friendly search to find the documents you require.

Numerous templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. After locating the form you need, select the Purchase now option. Choose the pricing plan you prefer and provide your credentials to register for an account.

Step 5. Process the payment. You can use your Visa or MasterCard or PayPal account to complete the transaction.

- Use US Legal Forms to obtain the Washington Revocable Trust for Asset Protection with just a few clicks.

- If you are an existing US Legal Forms user, Log In to your account and click the Download option to retrieve the Washington Revocable Trust for Asset Protection.

- You can also access forms you have previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your correct city/state.

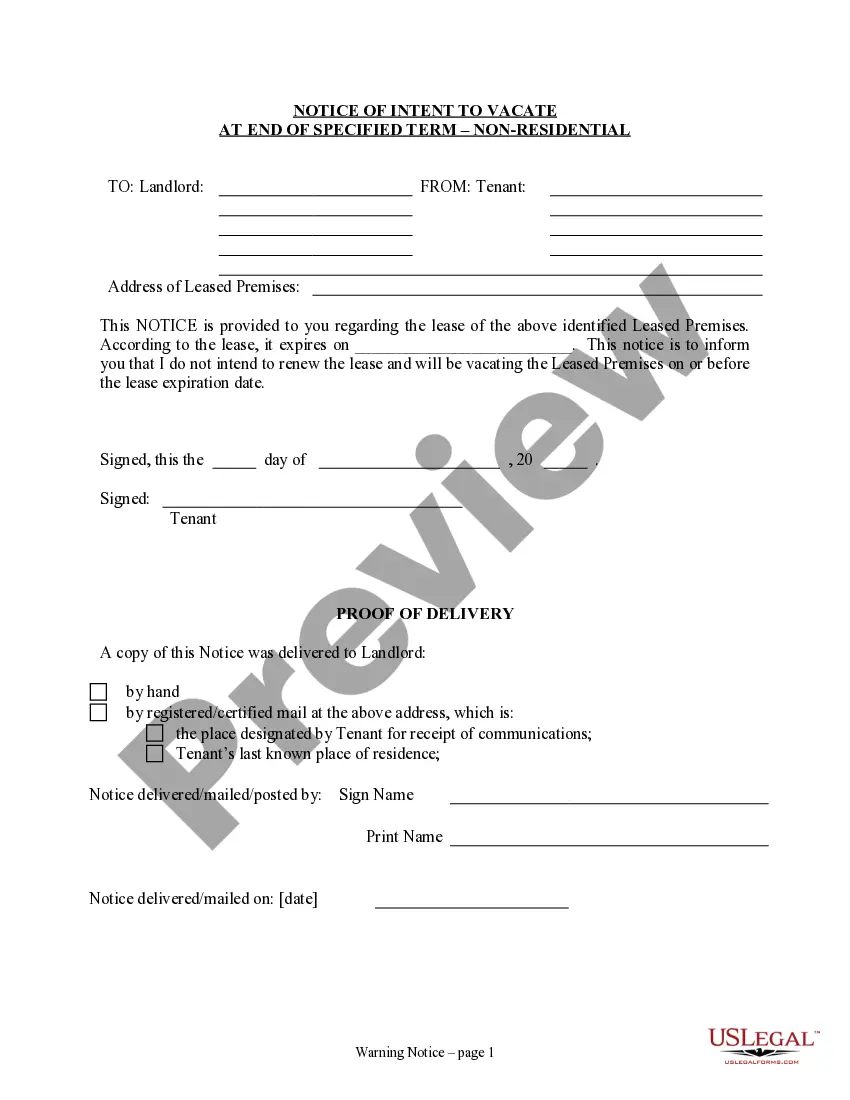

- Step 2. Use the Review option to browse through the form's details. Do not forget to read the description.

- Step 3. If you are not content with the form, utilize the Search field at the top of the screen to find alternative versions of the legal document template.

Form popularity

FAQ

A revocable trust protects assets by allowing you to maintain control over them while designating how they will be distributed upon your death. With the Washington Revocable Trust for Asset Protection, you can specify beneficiaries and conditions, which helps shield your assets from probate. Additionally, since you can modify or dissolve the trust at any time, it provides both flexibility and assurance that your assets will be handled according to your wishes. US Legal Forms can assist you in setting up a revocable trust that aligns with your asset protection goals.

When considering the best trust for asset protection, many individuals turn to the Washington Revocable Trust for Asset Protection. This type of trust allows individuals to manage their assets while retaining flexibility and control. It can safeguard your assets against creditors, ensuring your estate is protected during your lifetime and after your passing. For tailored legal assistance, consider using US Legal Forms to establish a Washington Revocable Trust that meets your specific needs.

While a Washington Revocable Trust can simplify estate management, it does not provide strong asset protection against claims, lawsuits, or creditors. This means that assets in a revocable trust could still be vulnerable in certain legal situations. It's important to understand that more complex structures, like irrevocable trusts, may be necessary for enhanced protection. Consulting with an SEO specialist or legal advisor specific to this topic can help you find the best solution.

In certain cases, a nursing home may have the right to access assets in a trust, including your house. However, a properly established Washington Revocable Trust for Asset Protection can provide some safeguards. To protect your home from nursing home costs, it is crucial to consult with a legal professional who can guide you on structuring the trust appropriately. This approach ensures that your wishes are met.

In Washington state, certain assets can be protected during lawsuits, which is a key point for anyone considering a Washington Revocable Trust for Asset Protection. Generally, primary residences, retirement accounts, and life insurance policies can offer some degree of protection. However, understand that trust assets may not always be exempt from claims, so it is wise to consult a legal expert for tailored advice.

Choosing between a will and a Washington Revocable Trust for Asset Protection ultimately depends on your specific goals. A will is a straightforward document that directs how assets are distributed but requires probate, which can be time-consuming. In contrast, a revocable trust can help avoid probate, provide greater privacy, and allow for smoother management of assets during your lifetime. Evaluate your priorities before deciding.

Deciding whether to put your house in a Washington Revocable Trust for Asset Protection depends on your individual situation. Placing your home in a trust can provide benefits like avoiding probate, which simplifies the transfer of assets after your passing. Additionally, it can maintain privacy regarding your estate. However, analyze your needs and consult a legal professional before making this choice.

Placing your house in a Washington Revocable Trust for Asset Protection can have some drawbacks. One major concern is the potential for losing certain tax benefits, such as the capital gains tax exemption when selling the property. Furthermore, you may face additional administrative responsibilities, as the trust will need to manage property taxes and insurance. Carefully weigh these factors before making a decision.

When considering a Washington Revocable Trust for Asset Protection, it is essential to recognize that certain assets are commonly excluded. For example, retirement accounts like 401(k)s and IRAs usually shouldn't be placed in a revocable trust due to tax implications. Additionally, vehicles owned outright may be better kept outside the trust to avoid complications with title transfers. Always consult an expert to clarify asset-specific guidelines.

One disadvantage of a family trust, including a Washington Revocable Trust for Asset Protection, is potential family disputes. Disagreements about asset distribution and management can lead to conflicts among family members. Clear communication and well-defined terms can help alleviate misunderstandings and ensure everyone is on the same page.