This contract deals specifically with construction cranes, but could be used in preparation of most any heavy equipment maintenance agreement. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Washington Contract with Self-Employed Independent Contractor for Maintenance of Heavy Equipment

Description

How to fill out Contract With Self-Employed Independent Contractor For Maintenance Of Heavy Equipment?

It is feasible to invest hours online looking for the authentic document template that satisfies the state and federal requirements you require.

US Legal Forms offers thousands of authentic forms that can be evaluated by professionals.

You can download or print the Washington Contract with Self-Employed Independent Contractor for Maintenance of Heavy Equipment from the service.

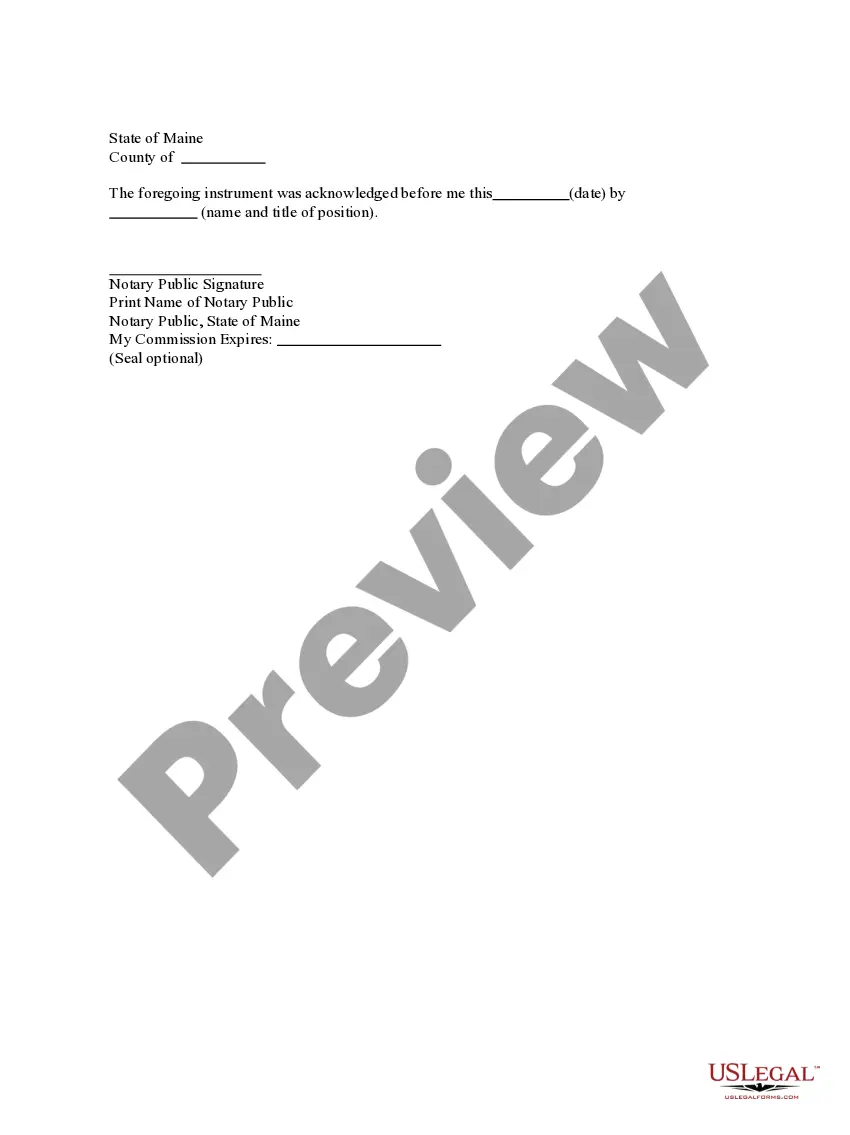

If available, use the Review option to examine the document template as well.

- If you already possess a US Legal Forms account, you can Log In and select the Acquire option.

- After that, you can complete, modify, print, or sign the Washington Contract with Self-Employed Independent Contractor for Maintenance of Heavy Equipment.

- Every authentic document template you buy is yours permanently.

- To obtain another copy of any purchased form, go to the My documents section and click on the relevant option.

- If this is your first time using the US Legal Forms site, follow the simple instructions below.

- First, ensure you have selected the correct document template for your state/city of choice.

- Check the form description to confirm you have chosen the appropriate form.

Form popularity

FAQ

Yes, independent contractors in Washington generally need work authorization to legally operate. When engaging a self-employed independent contractor for the maintenance of heavy equipment, it’s crucial to ensure they have the proper permits and licenses. This not only complies with state regulations but also protects both parties in a Washington Contract with Self-Employed Independent Contractor for Maintenance of Heavy Equipment. Using a reliable platform like USLegalForms can help you draft and verify contracts, ensuring all legal requirements are met effectively.

Filling out an independent contractor agreement involves several key steps. First, you should clearly outline the scope of work, payment terms, and duration of the contract. Additionally, specify any necessary insurance or liability requirements. When creating a Washington Contract with Self-Employed Independent Contractor for Maintenance of Heavy Equipment, it may be beneficial to use platforms like uslegalforms to simplify the process and ensure that all legal bases are covered.

The 2 year contractor rule refers to a specific guideline in Washington that helps determine whether a worker qualifies as an independent contractor or an employee. Essentially, if a contractor provides services for the same business consistently for more than two years without interruption, they may be considered an employee under state law. Understanding this rule is essential when drafting a Washington Contract with Self-Employed Independent Contractor for Maintenance of Heavy Equipment, as it ensures compliance with legal standards and protects both parties.

Yes, OSHA regulations apply to independent contractors if they work in environments that fall under OSHA's jurisdiction. This is crucial to consider when executing a Washington Contract with Self-Employed Independent Contractor for Maintenance of Heavy Equipment. Complying with these regulations can ensure safety and legal compliance on job sites.

Yes, independent contractors in Washington State are generally required to have a business license. Having this license ensures that you can legally operate under a Washington Contract with Self-Employed Independent Contractor for Maintenance of Heavy Equipment. Always check local regulations as they can vary by city.

Independent contractors usually do not need to obtain workers' compensation unless they are in specific industries. However, if the contractor has employees, workers' comp coverage becomes mandatory. When entering into a Washington Contract with Self-Employed Independent Contractor for Maintenance of Heavy Equipment, it’s wise to consider these factors for your own protection and compliance.

You typically need a business license in Washington State before starting any business activities. This includes signing a Washington Contract with Self-Employed Independent Contractor for Maintenance of Heavy Equipment. It’s important to complete this process in advance to avoid potential legal issues down the line.

Writing a contract for an independent contractor involves outlining the scope of work, payment terms, and timelines. You should also include clauses related to confidentiality and termination. Utilizing resources like USLegalForms can provide templates specifically for Washington Contract with Self-Employed Independent Contractor for Maintenance of Heavy Equipment, ensuring you cover essential elements effectively.

In Washington State, independent contractors typically need a business license to operate legally. It’s crucial for complying with state regulations, especially for those entering into a Washington Contract with Self-Employed Independent Contractor for Maintenance of Heavy Equipment. You should check local requirements as some cities may have additional licensing rules.

As an independent contractor, having a business account can simplify your financial transactions. It allows you to easily track income and expenses associated with your Washington Contract with Self-Employed Independent Contractor for Maintenance of Heavy Equipment. Additionally, it can enhance your professionalism in dealing with clients and tax preparation.