Washington Transfer under the Uniform Transfers to Minors Act - Multistate Form

Description

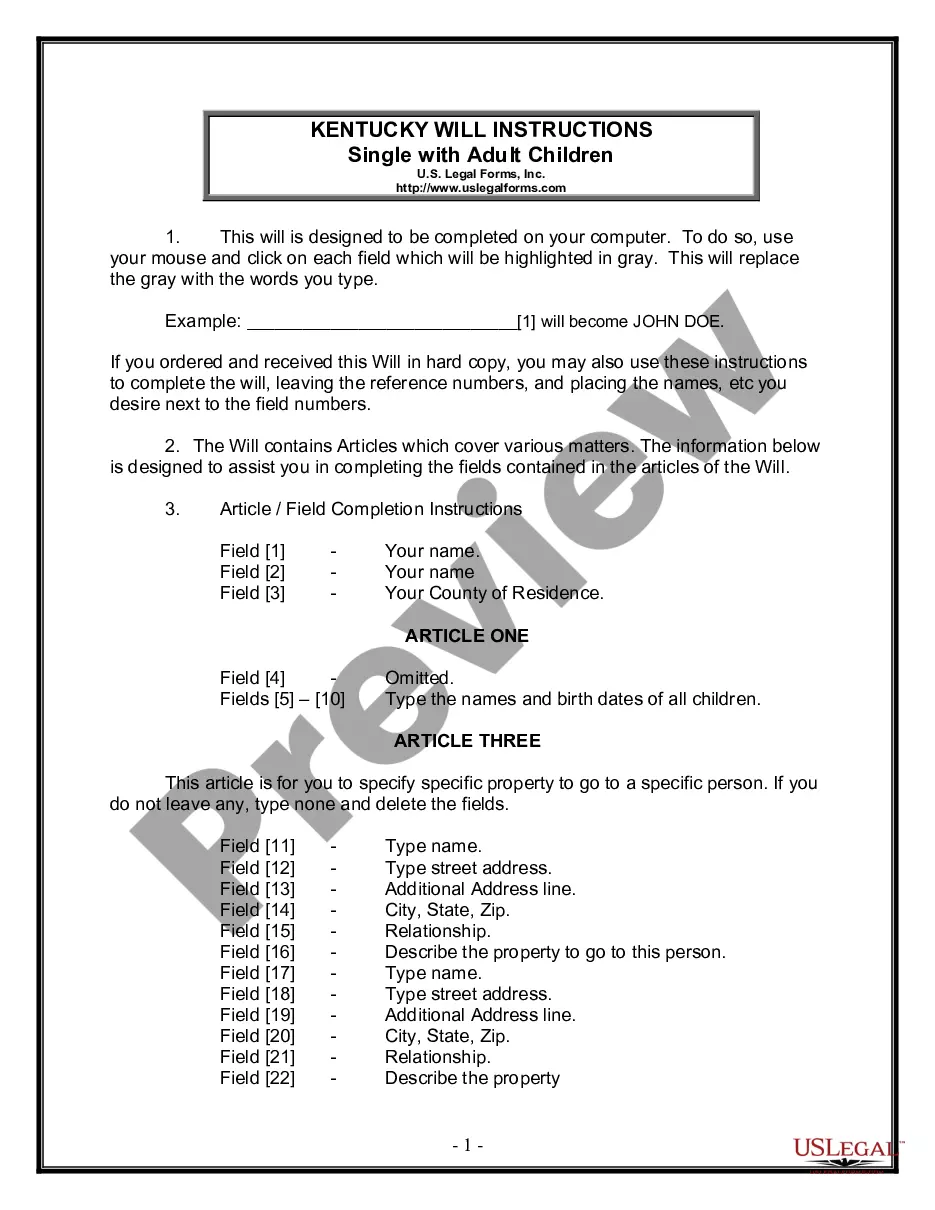

How to fill out Transfer Under The Uniform Transfers To Minors Act - Multistate Form?

If you have to total, download, or produce lawful file web templates, use US Legal Forms, the greatest selection of lawful types, which can be found on the web. Make use of the site`s easy and convenient research to obtain the papers you need. Numerous web templates for company and specific functions are categorized by groups and says, or keywords and phrases. Use US Legal Forms to obtain the Washington Transfer under the Uniform Transfers to Minors Act - Multistate Form with a few mouse clicks.

If you are previously a US Legal Forms customer, log in in your account and click the Download button to find the Washington Transfer under the Uniform Transfers to Minors Act - Multistate Form. You can even accessibility types you earlier saved from the My Forms tab of your own account.

If you use US Legal Forms the first time, follow the instructions under:

- Step 1. Ensure you have chosen the shape to the right metropolis/country.

- Step 2. Use the Review solution to check out the form`s information. Do not forget to read the information.

- Step 3. If you are unsatisfied with all the form, use the Search discipline at the top of the display to find other types of your lawful form design.

- Step 4. After you have discovered the shape you need, select the Acquire now button. Pick the pricing program you like and include your accreditations to sign up to have an account.

- Step 5. Process the transaction. You can utilize your credit card or PayPal account to complete the transaction.

- Step 6. Find the structure of your lawful form and download it on the system.

- Step 7. Complete, edit and produce or signal the Washington Transfer under the Uniform Transfers to Minors Act - Multistate Form.

Each and every lawful file design you purchase is yours permanently. You possess acces to each form you saved with your acccount. Click on the My Forms segment and decide on a form to produce or download once again.

Remain competitive and download, and produce the Washington Transfer under the Uniform Transfers to Minors Act - Multistate Form with US Legal Forms. There are millions of specialist and condition-specific types you may use to your company or specific needs.

Form popularity

FAQ

The Uniform Transfers to Minors Act (UTMA) allows an adult to transfer assets to a minor by opening a custodial account for them. This type of account is managed by an adult ? the custodian ? who holds onto the assets until the minor reaches a certain age, usually 18 or 21.

What this means to you: When you open an account we ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver's license or other identifying documents. Only one Custodian per account. List in order of succession.

Transferring a UTMA account to a child is simple. You can do so with most financial or investment institutions. You can also consult a tax or business lawyer to help you set up the legal structure, although most financial institutions can do this for you.

UTMA withdrawals and tax rules UTMA accounts have no withdrawal limits. However, the funds belong to the minor from the moment of transfer, so the funds can only be used for the direct benefit of the minor.

A UTMA account is similar to a UGMA account except that transfer of assets in the account may be delayed by the custodian until the minor reaches the age of 21 (per Washington State Law, age of 25 in some other states).

The Washington Uniform Transfers to Minors Act (UTMA) provides that an adult may establish an account for the benefit of a minor under the age of 25, and appoint an adult custodian to manage the account.

The Uniform Gift to Minors Act (UGMA) was created to provide a means by which title to property could be passed to minors by use of a custodian. The nature of property which could be transferred under the UGMA was limited to securities, cash or other personal property.

Depending on the state a UTMA account is handed over to a child when they reach either age 18 or age 21. In some jurisdictions, at age 18 a UTMA account can only be handed over with the custodian's permission, and at 21 is transferred automatically.