Washington Guide for Protecting Deceased Persons from Identity Theft

Description

How to fill out Guide For Protecting Deceased Persons From Identity Theft?

If you want to obtain, acquire, or print official document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site’s simple and convenient search to find the documents you need.

Various templates for business and personal purposes are categorized by types and states, or keywords. Use US Legal Forms to locate the Washington Guide for Safeguarding Deceased Individuals from Identity Theft in just a few clicks.

Every legal document template you obtain is yours indefinitely. You have access to every form you downloaded in your account. Click on the My documents section and choose a form to print or download again.

Compete and acquire, and print the Washington Guide for Safeguarding Deceased Individuals from Identity Theft with US Legal Forms. There are numerous professional and state-specific forms you can utilize for your business or personal needs.

- If you are currently a US Legal Forms user, Log In to your account and click the Download button to find the Washington Guide for Safeguarding Deceased Individuals from Identity Theft.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Make sure you have selected the form for the correct city/state.

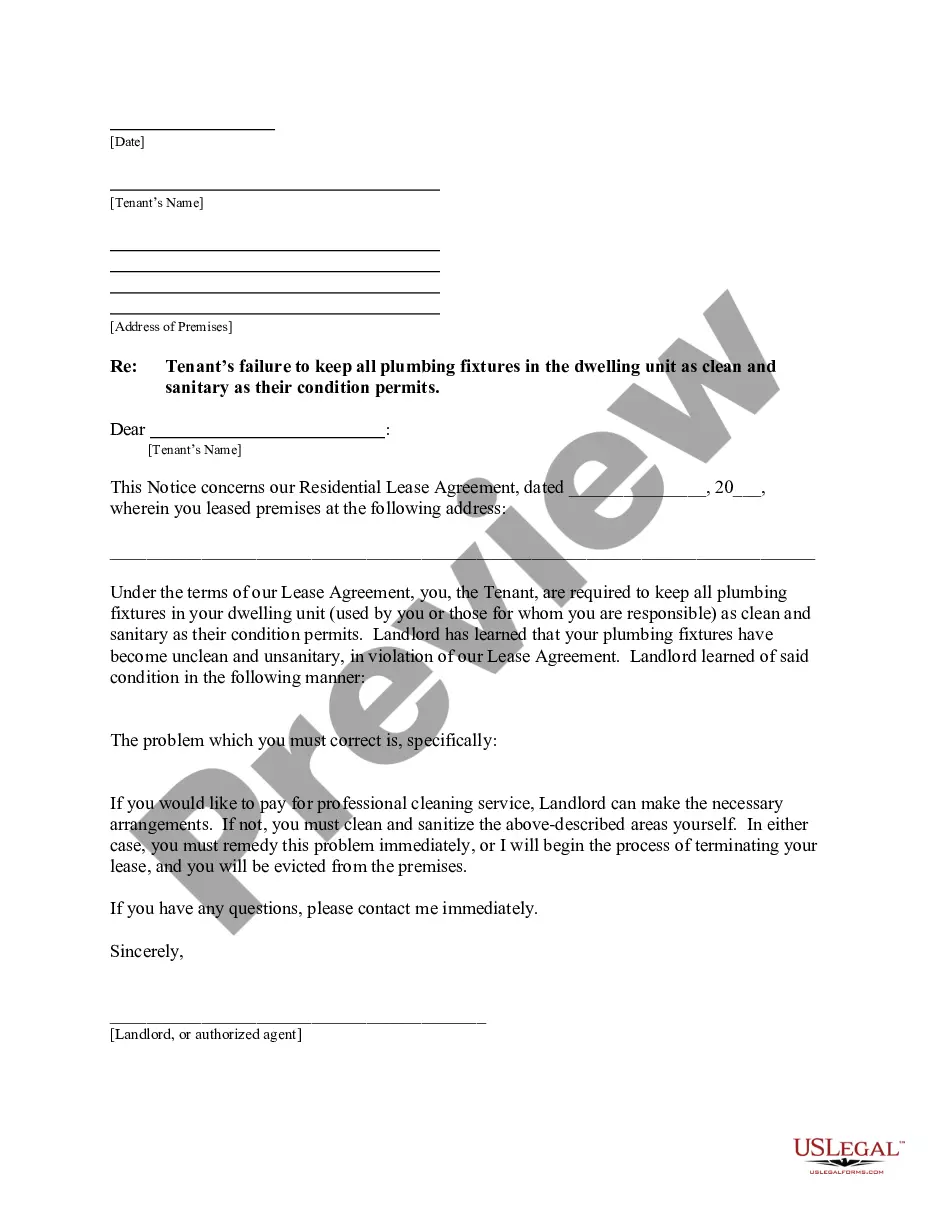

- Step 2. Use the Preview option to review the form’s details. Don’t forget to check the information.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other versions of the legal form template.

- Step 4. After you have found the form you need, click the Purchase now button. Choose the payment plan you prefer and enter your details to register for an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Washington Guide for Safeguarding Deceased Individuals from Identity Theft.

Form popularity

FAQ

Identity thieves typically use this data to fraudently open credit card accounts or even to commit crimes in another's name. Washington identity theft laws charge the crime as a felony, with sentences of up to 10 years in prison and fines of up to $20,000 for the most serious offenses.

How to protect yourself from identity theft Avoid sharing personal information on social media. ... Don't access personal accounts over unsecured wireless networks. ... Protect your accounts with strong passwords and multifactor authentication.

Avoid listing birth date, maiden name, or other personal identifiers in obituaries as they could be useful to ID thieves. Report the death to the Social Security Administration by calling 800-772-1213. Order multiple certified copies of the death certificate with and without cause of death.

Identity theft can happen to anyone, but you can reduce the risk of becoming a victim by taking some simple steps to protect your personal information. Keep Your Personal Information Secure. ... Monitor Your Credit Reports, Bank and Credit Accounts. ... Ask Questions Before You Share Your Information.

The theft of property worth $750 or less is a gross misdemeanor under state law. If the property is worth between $750 and $5,000, or if it is an access device (credit card, ATM card, etc.), the crime is theft in the second degree, which is a Class C felony.

Ing to RCW 9.35. 020(1), it is a crime to knowingly use, possess, or obtain the ?means of identification? or the ?financial information? of another person with the intent to then commit a crime.

So, shredding your loved one's documents rather than throwing them away is the only way to guarantee the safety of your loved one's identity. Furthermore, it can take years before fraud is flagged on a dead person's file, letting fraudsters open credit accounts, loans, and file for tax returns.

File a report with the Federal Trade Commission (FTC). If you report your identity theft to the FTC within two business days of discovering it, you will only be liable to pay $50 of any unauthorized use of your bank and credit accounts (under federal law).

Send a written notice to all financial institutions where the deceased had an account instructing them to close all individual accounts and remove the deceased's name from joint accounts: As soon as you receive the certified copies of the death certificate, send a letter and a certified copy to each of the financial ...

Even after someone dies, it's still possible for criminals to use their information to illegally open credit cards, apply for loans, file fraudulent tax returns, and buy goods and services. In some cases, thieves intentionally steal the identity of someone who has died ? a practice known as ghosting.