Washington Shareholder Agreement to Sell Stock to Other Shareholder

Description

How to fill out Shareholder Agreement To Sell Stock To Other Shareholder?

Are you currently in a position where you require documentation for either business or personal reasons almost every day.

There are numerous legal document templates accessible online, but finding ones you can trust is challenging.

US Legal Forms offers a wide array of document templates, including the Washington Shareholder Agreement to Sell Stock to Other Shareholder, which are designed to comply with state and federal regulations.

Select the pricing plan you prefer, complete the necessary information to create your account, and pay for the transaction with your PayPal or credit card.

Choose a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Washington Shareholder Agreement to Sell Stock to Other Shareholder at any time if required. Just click on the needed form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and prevent errors. The service provides professionally crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Afterward, you can obtain the Washington Shareholder Agreement to Sell Stock to Other Shareholder template.

- If you do not possess an account and wish to start using US Legal Forms, follow these steps.

- Find the form you require and ensure it is for the correct city/area.

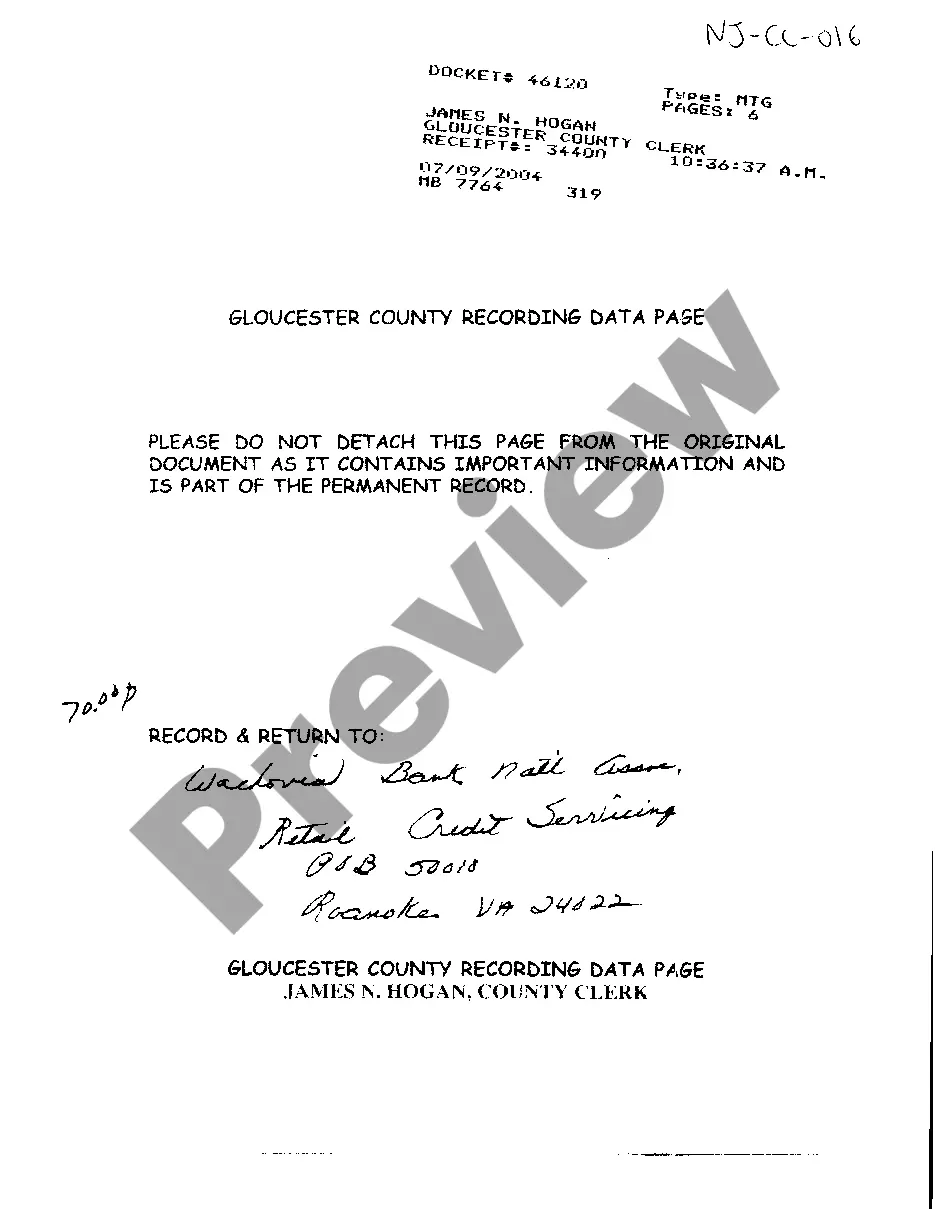

- Use the Preview button to review the document.

- Check the description to confirm that you have selected the right form.

- If the form is not what you are looking for, use the Search field to find the form that suits your needs.

- Once you have the correct form, click Acquire now.

Form popularity

FAQ

Creating a shareholder agreement involves gathering input from all shareholders to address their needs and concerns. Start drafting the Washington Shareholder Agreement to Sell Stock to Other Shareholder by specifying key issues such as ownership structure, share valuation, and what happens in case of disputes. Utilizing legal resources like uslegalforms can simplify your creation process by providing easy-to-use templates.

Yes, you can write your own Washington Shareholder Agreement to Sell Stock to Other Shareholder. However, creating a comprehensive and enforceable agreement can be challenging without legal expertise. It's often wise to use platforms like uslegalforms to access templates and resources that guide you through the process, ensuring that all vital elements are included.

In Washington, a shareholder agreement does not legally need to be notarized to be valid. However, having it notarized can provide an added layer of security and proof of the agreement's authenticity. It's advisable to consider notarization when drafting your Washington Shareholder Agreement to Sell Stock to Other Shareholder for enhanced credibility.

To write a Washington Shareholder Agreement to Sell Stock to Other Shareholder, begin by clearly defining the terms of the agreement. Include details such as the roles and responsibilities of each shareholder, the process for selling shares, and any restrictions on transfer. It's essential to ensure that the agreement complies with local laws and regulations, so consulting a legal professional may be beneficial.

Shareholders can sell their shares by following the process laid out in a Washington Shareholder Agreement to Sell Stock to Other Shareholder. This typically involves notifying the company and other shareholders of the intention to sell the shares, completing necessary paperwork, and possibly obtaining approval. Using platforms like uslegalforms can streamline the documentation process.

While shareholders generally have the ability to sell their shares, a Washington Shareholder Agreement to Sell Stock to Other Shareholder may impose certain restrictions. These restrictions often require that the seller first offer the shares to existing shareholders or obtain approval for the sale. It’s important to review your agreement to understand any limitations.

Yes, shareholder approval is often required to sell shares, especially in corporate settings governed by a Washington Shareholder Agreement to Sell Stock to Other Shareholder. The agreement should specify the voting rights and procedures needed for approval. Adhering to these requirements ensures transparency and maintains trust among shareholders.

Whether you can force a shareholder to sell hinges on the terms established in a Washington Shareholder Agreement to Sell Stock to Other Shareholder. The agreement might include clauses that allow for forced sales under certain conditions, such as misconduct or financial turmoil. Consulting legal assistance can clarify your options based on your specific agreement.

Shareholders may compel another shareholder to sell in specific situations defined in a Washington Shareholder Agreement to Sell Stock to Other Shareholder. Common triggers for forced sales include failure to meet obligations or a shareholder's death or incapacity. It is vital to have clear terms in the agreement to avoid disputes and ensure a smooth transition.

Yes, a shareholder can transfer or give up their shares to another individual under a Washington Shareholder Agreement to Sell Stock to Other Shareholder. This process typically requires proper documentation and adherence to the terms outlined in the agreement. Additionally, ensure compliance with any corporate bylaws or state laws that may apply.