Washington Direct Deposit Form for Stimulus Check

Description

How to fill out Direct Deposit Form For Stimulus Check?

US Legal Forms - one of the largest repositories of legal templates in the United States - offers a range of legal document formats that you can download or print.

Using the platform, you can locate thousands of templates for business and personal use, organized by categories, states, or keywords.

You can find the latest versions of documents such as the Washington Direct Deposit Form for Stimulus Check in mere minutes.

Read the document description to make sure you have chosen the right one.

If the document does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you already have an account, Log In to download the Washington Direct Deposit Form for Stimulus Check from the US Legal Forms library.

- The Download button will appear next to every document you view.

- You have access to all previously acquired documents from the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple instructions to get started.

- Ensure you have selected the appropriate document for your state/region.

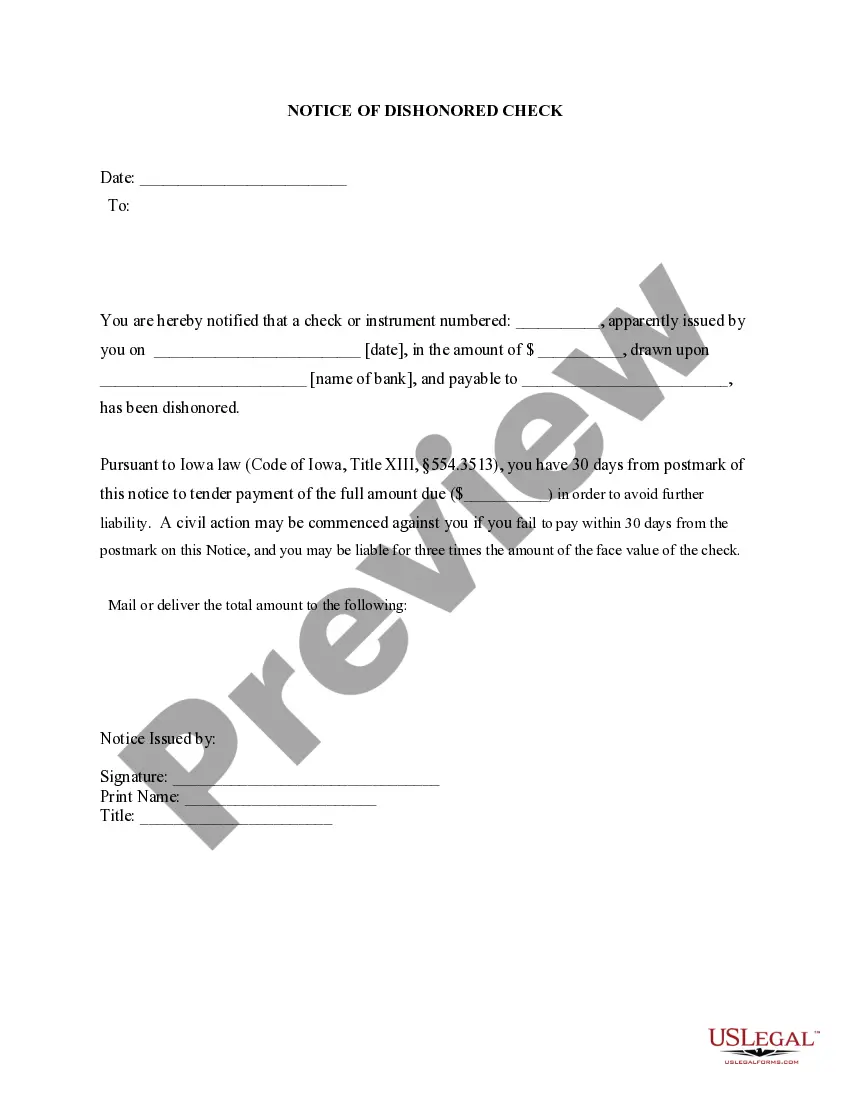

- Click the Preview button to review the document's content.

Form popularity

FAQ

Yes, the IRS is in the process of distributing $2.4 billion in unclaimed stimulus payments to approximately one million taxpayers. These funds represent critical financial support for many individuals who may have missed previous distributions. You can make the process easier by using a Washington Direct Deposit Form for Stimulus Check, which ensures your payment reaches you directly. Make sure to check your status to secure your share.

Absolutely, the IRS is indeed sending out automatic payments to one million taxpayers who qualify. This initiative aims to ensure that deserving individuals receive their funds without unnecessary delays. By completing a Washington Direct Deposit Form for Stimulus Check, you can streamline the process and ensure your payment arrives quickly and securely. Staying informed is key to receiving your stimulus assistance.

Yes, the IRS is automatically reaching out to one million people who have unclaimed $1,400 stimulus checks. This automatic process helps individuals who may not have filed for the payment yet. To facilitate smoother transactions, consider using a Washington Direct Deposit Form for Stimulus Check when filling out your information. Timely submission can substantially assist in the collection of your owed amounts.

Yes, the IRS is gearing up to send $1,400 payments to one million eligible individuals. These payments may be a result of unclaimed funds from previous stimulus distributions. If you are among those yet to receive your payment, using a Washington Direct Deposit Form for Stimulus Check can help in receiving your funds more quickly. Be proactive to check your eligibility and take action where necessary.

Yes, you can still claim your $1400 stimulus check if you were eligible but did not receive it. You can do this by filing your tax return and claiming the recovery rebate credit. Furthermore, utilizing the Washington Direct Deposit Form for Stimulus Check will make it easier for the IRS to process your claim and send your funds directly into your account.

You can check your eligibility for the recovery rebate credit by reviewing the IRS guidelines available on their website. They provide a detailed criterion related to income and filing status. If you qualify, using the Washington Direct Deposit Form for Stimulus Check when filing your taxes can simplify your experience and ensure quicker payments.

To find the status of your $1400 stimulus check, visit the IRS 'Get My Payment' tool online. By entering your information, you can track your payment in real-time. If you encounter issues, the Washington Direct Deposit Form for Stimulus Check can help ensure you receive future payments directly to your bank account.

If you have not received your stimulus check, the first step is to determine your eligibility. You can do this by checking the IRS website or contacting the IRS directly. If you find out you qualify, consider filing a claim for your payment or using the Washington Direct Deposit Form for Stimulus Check to expedite future payments.

Eligibility for the 2025 stimulus check typically involves meeting specific income thresholds and filing your taxes. You should use the Washington Direct Deposit Form for Stimulus Check if you qualify, as this ensures prompt payment delivery to your bank account. Regular updates from the IRS will outline qualification criteria, so it’s crucial to stay informed. Various resources, including uslegalforms, can help you navigate these requirements.

Applying for the stimulus check in 2025 will likely require the Washington Direct Deposit Form for Stimulus Check and relevant financial data. Make sure to keep updated with IRS announcements regarding application processes. If you need assistance, platforms like uslegalforms can provide guidance in filling out necessary forms accurately. Stay informed about eligibility criteria to ensure a smooth application.