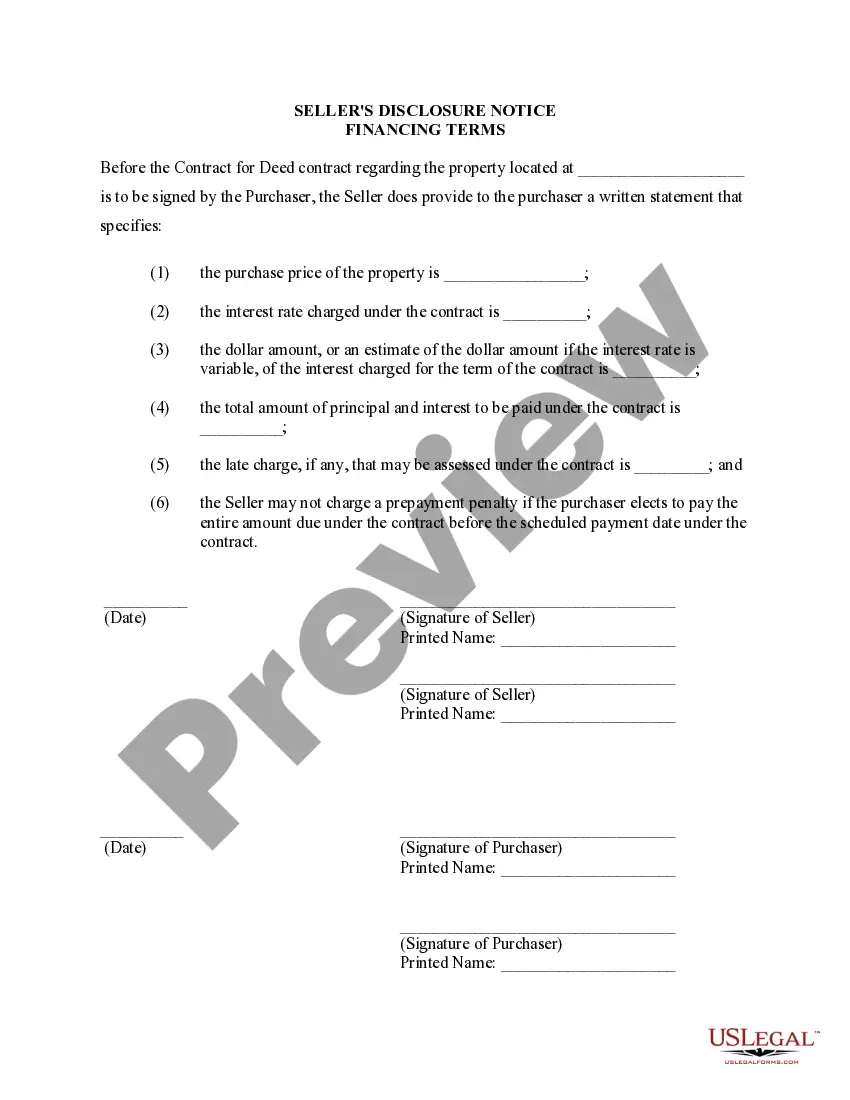

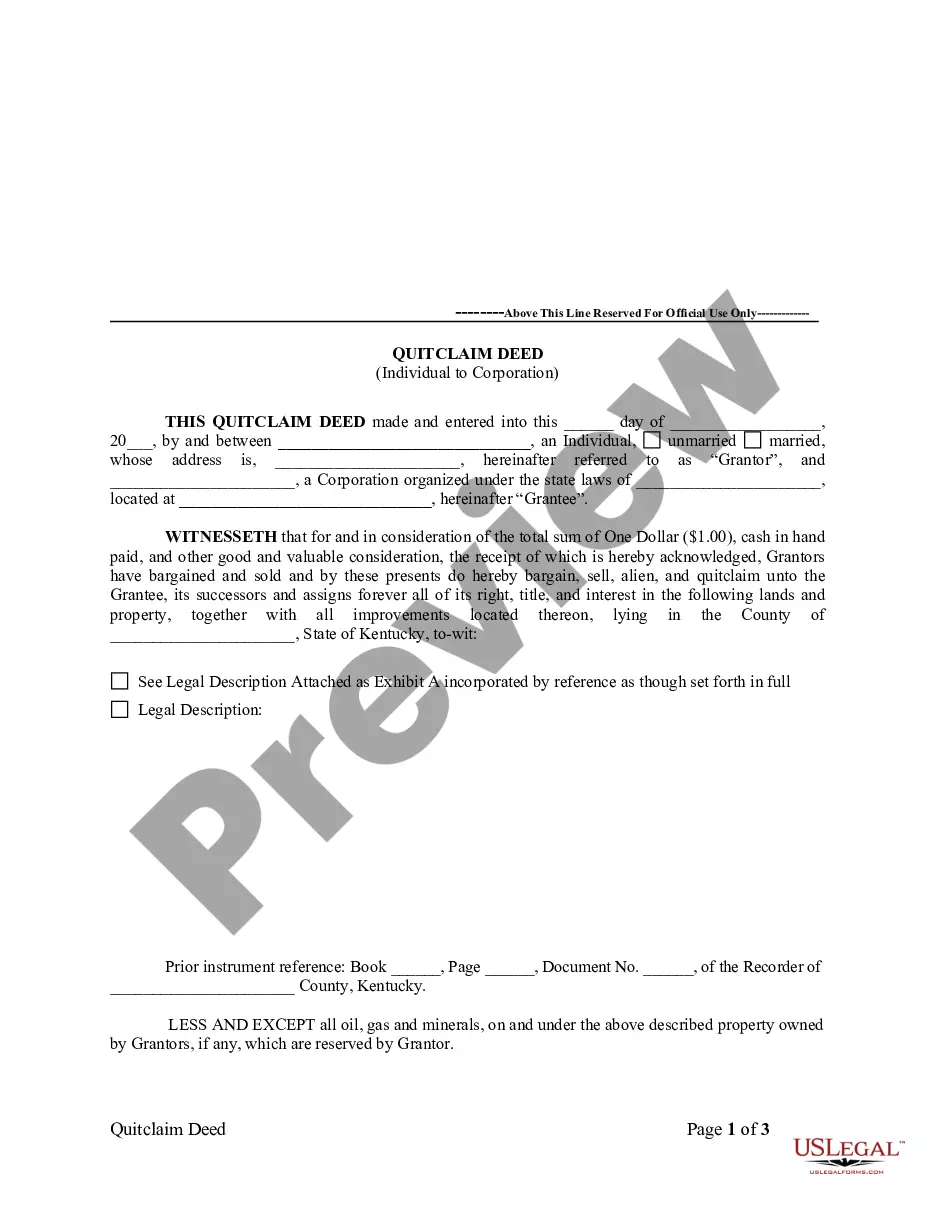

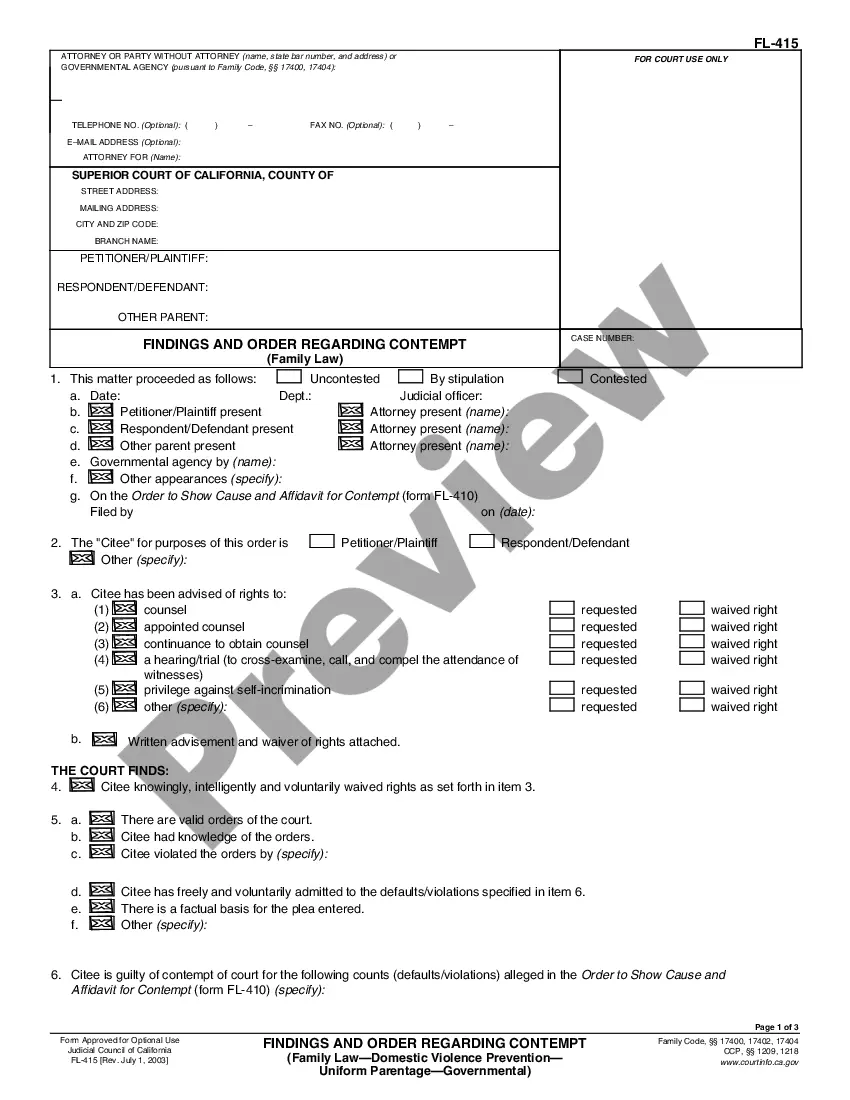

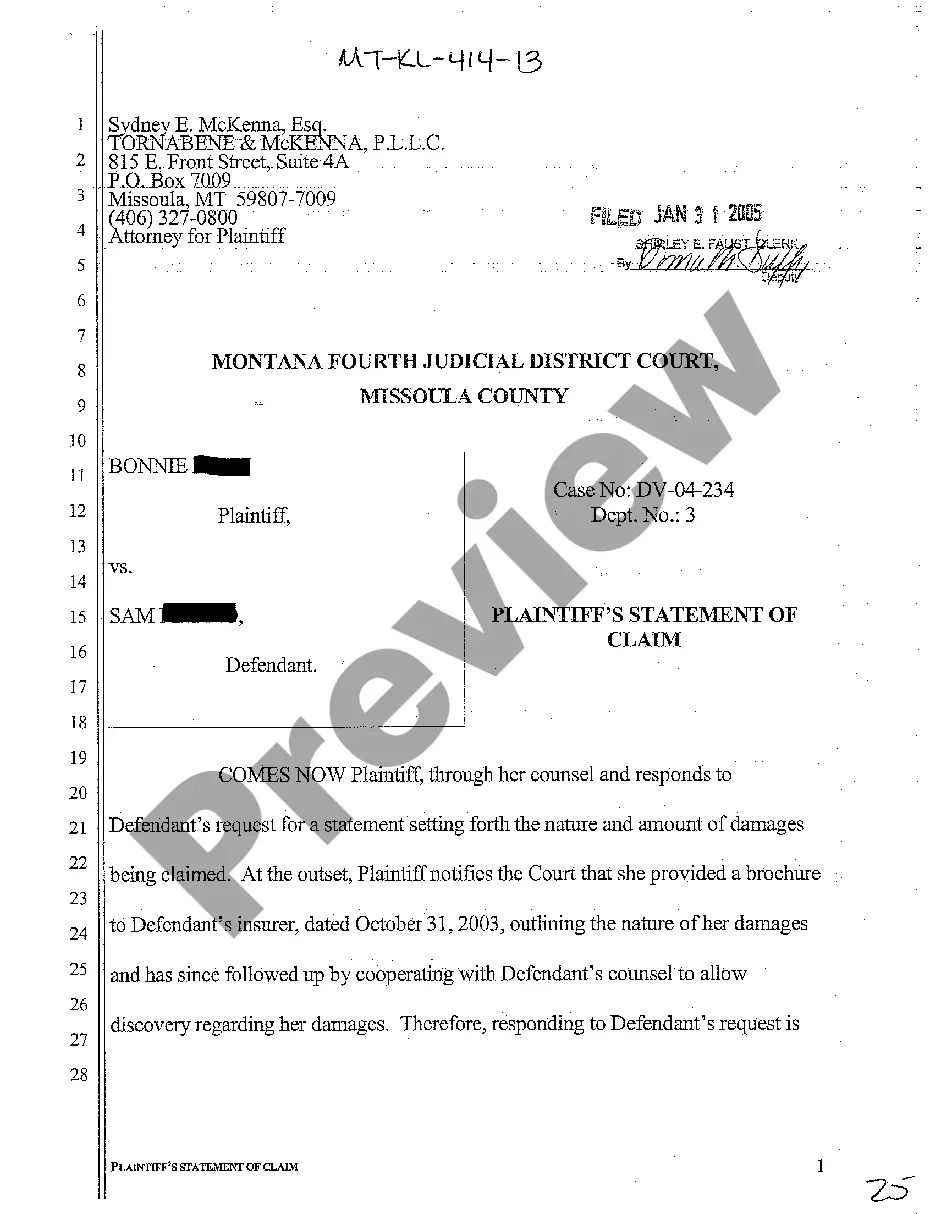

Washington Retrospective Rating Business and Industry Category Guide is a guide used by employers in Washington State to determine their business and industry classification for workers' compensation retrospective rating plans. The guide is divided into four categories: (1) Manufacturing and Processing; (2) Construction and Building; (3) Trade and Services; and (4) Other. Each category is further broken down into sub-categories. For example, Manufacturing and Processing is divided into sub-categories such as Automotive Manufacturing, Chemical Manufacturing, and Metal Manufacturing. The guide also provides information on the expected risk of injury associated with each business and industry classification. This information can be used by employers to help determine the best retrospective rating plan for their business.

Washington Retrospective Rating Business and Industry Category Guide

Description

How to fill out Washington Retrospective Rating Business And Industry Category Guide?

If you’re searching for a way to appropriately complete the Washington Retrospective Rating Business and Industry Category Guide without hiring a legal representative, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reputable library of formal templates for every individual and business scenario. Every piece of documentation you find on our online service is designed in accordance with nationwide and state laws, so you can be certain that your documents are in order.

Follow these straightforward instructions on how to obtain the ready-to-use Washington Retrospective Rating Business and Industry Category Guide:

- Ensure the document you see on the page corresponds with your legal situation and state laws by checking its text description or looking through the Preview mode.

- Type in the document title in the Search tab on the top of the page and select your state from the dropdown to find another template if there are any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Sign up for the service and choose the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The blank will be available to download right after.

- Choose in what format you want to get your Washington Retrospective Rating Business and Industry Category Guide and download it by clicking the appropriate button.

- Import your template to an online editor to complete and sign it quickly or print it out to prepare your hard copy manually.

Another great thing about US Legal Forms is that you never lose the paperwork you acquired - you can find any of your downloaded blanks in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

Retrospective Premium Adjustment means the amount necessary to periodically adjust the Deposit Premium, or prior Retrospective Premiums if any, to the newly calculated Retrospective Premium amount.

Retrospective rating plan premium is the sum of basic premium, converted losses, plus the excess loss premium and retrospective development premium elective elements if you chose them. This sum is multiplied by the applicable tax multiplier shown in the Schedule.

A Retro Plan is a risk sharing program whereas the insurance company issues a policy with both a minimum and maximum premium for the policy along with a rating formula. The actual, or final, premium is determined at the end of the policy period by the using the formula based on the rating factors and the actual losses.

Most of the time retro plans have a maximum premium limitation, which caps the amount of premium the insured must pay. This is necessary because many insureds would not be interested in a plan that did not place a limit on a possible loss. The maximum premium tends to be about 1.20 times the standard premium.

Retrospective rating is simply another way of calculating your premium, after the fact or ?retroactively.? A Retro coverage period lasts 12 months and can begin any calendar quarter.

Within the principle of insurance, retrospective rating establishes the reasonable cost of insurance by using losses incurred during the term of that insurance and adding the insurance carrier's expenses and the taxes on premiums.

A retrospective premium is a payment made by a policyholder to an insurance company that is not based on a fixed amount but, rather, on the claims made during a policy period. The policyholder, however, still makes an initial payment to the insurance company prior to paying the retrospective premium.

Retrospective rating combines actual losses with graded expenses to produce a premium that more accurately reflects the current experience of the insured. Adjustments are performed periodically, after the policy has expired.