Washington Independent Contractors is a group of individuals or businesses that are hired to provide services or labor to another company or individual but are not employees of the company. They are responsible for their own taxes, insurance, and benefits, and are not covered by the same laws and regulations that apply to employees. Washington Independent Contractors can include freelancers, subcontractors, service providers, consultants, and other independent workers. They are typically self-employed and can choose to work for multiple clients at once. The types of Washington Independent Contractors can vary depending on the type of services they provide, including graphic designers, web developers, writers, photographers, virtual assistants, bookkeepers, and more.

Washington Independent Contractors

Description

How to fill out Washington Independent Contractors?

Preparing official paperwork can be a real burden if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you find, as all of them comply with federal and state laws and are verified by our experts. So if you need to fill out Washington Independent Contractors, our service is the perfect place to download it.

Obtaining your Washington Independent Contractors from our catalog is as easy as ABC. Previously authorized users with a valid subscription need only log in and click the Download button once they find the correct template. Afterwards, if they need to, users can pick the same blank from the My Forms tab of their profile. However, even if you are unfamiliar with our service, registering with a valid subscription will take only a few minutes. Here’s a quick instruction for you:

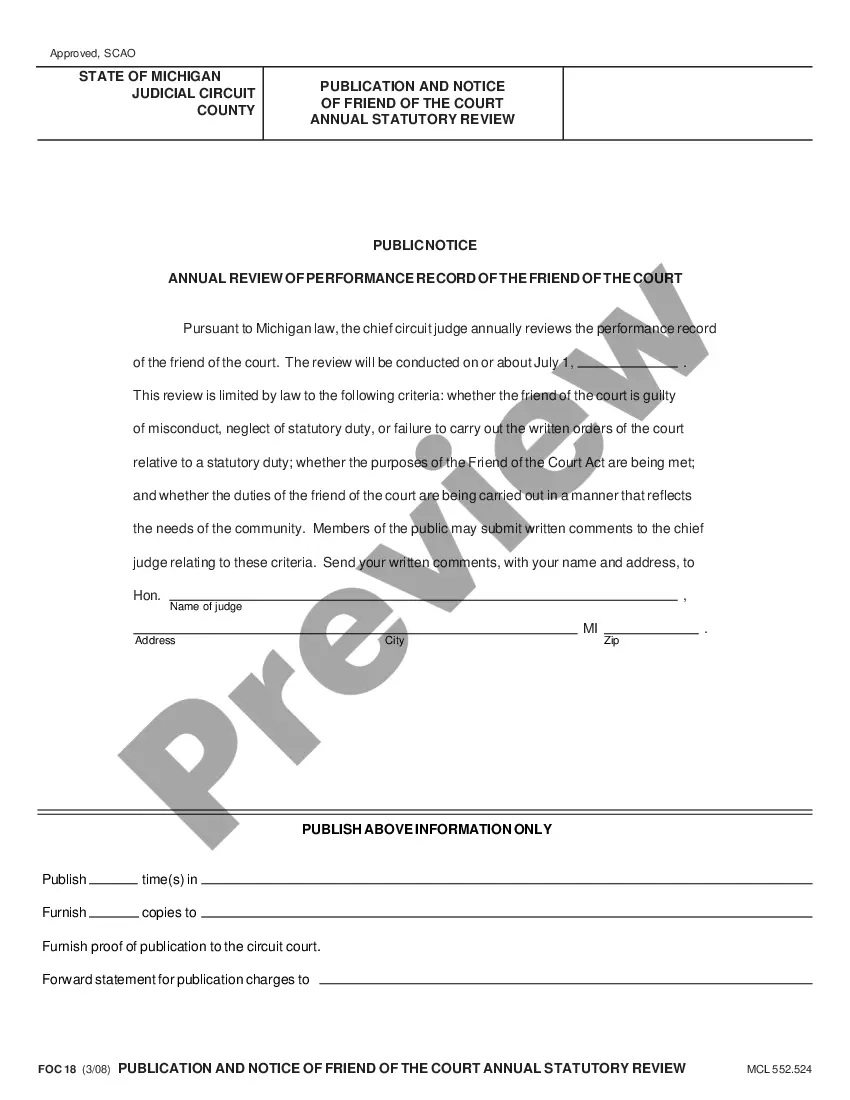

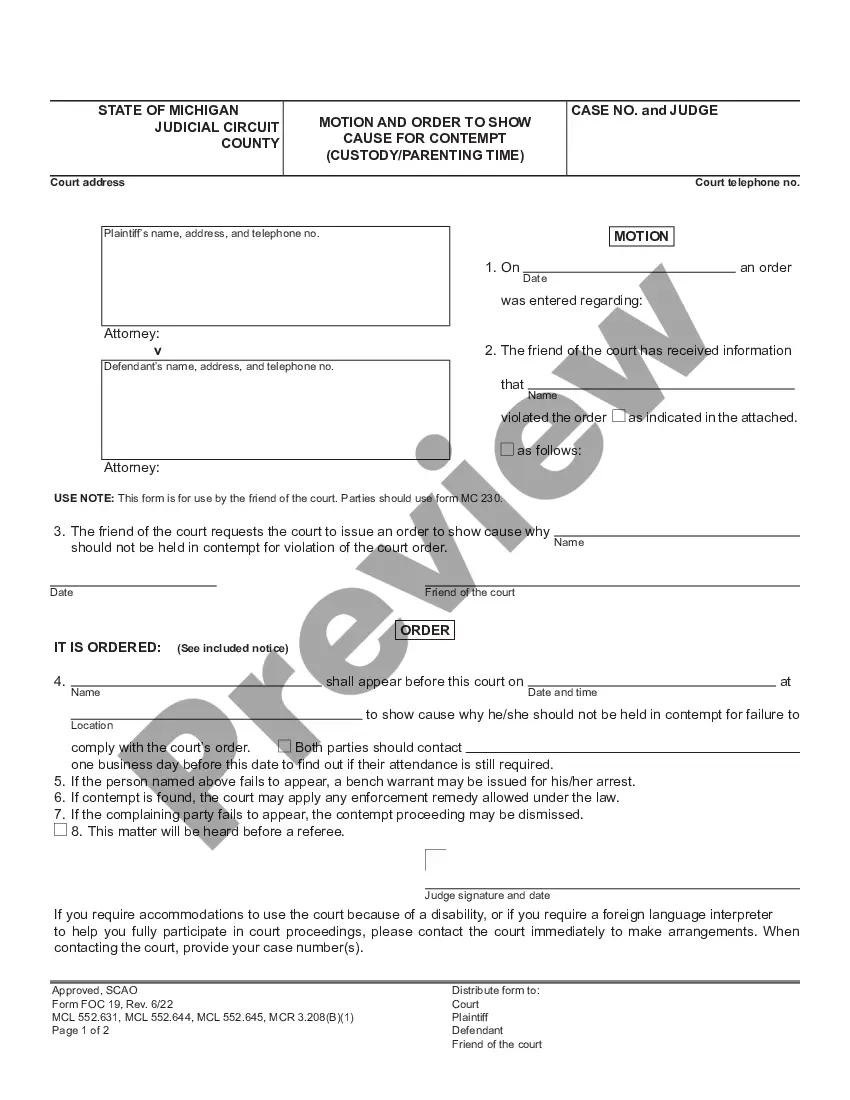

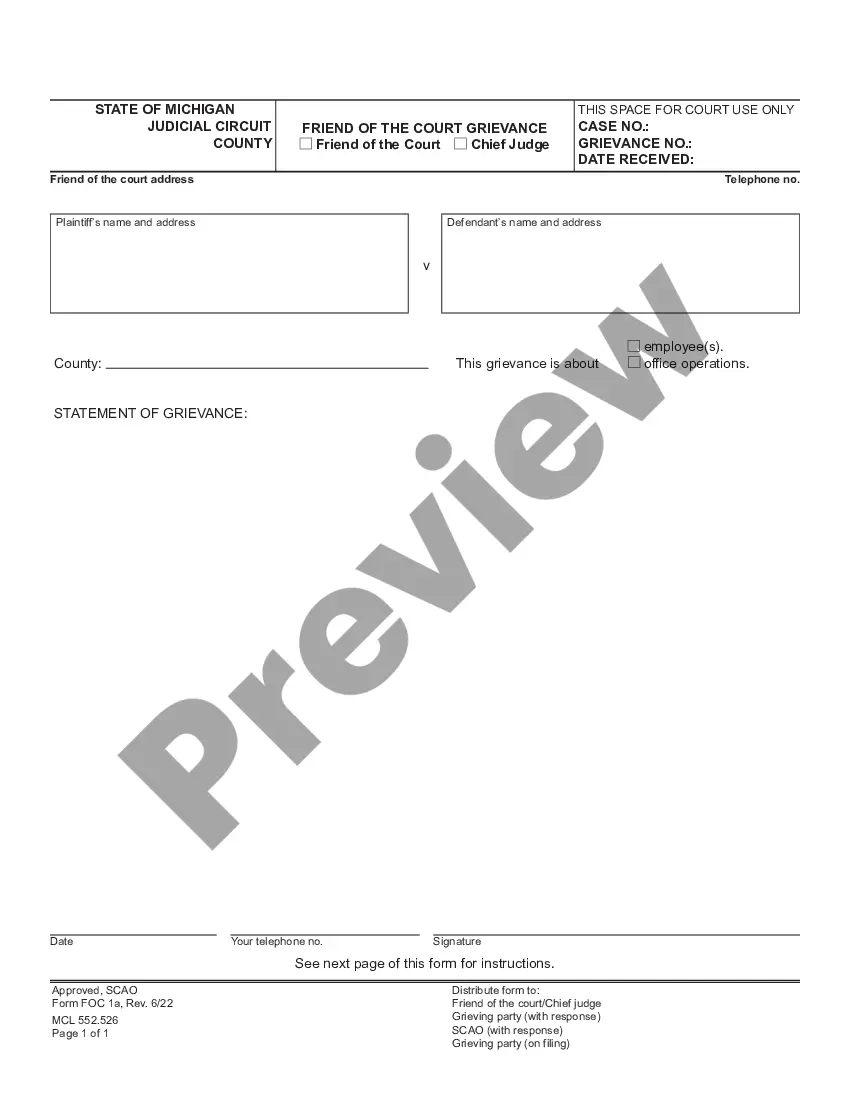

- Document compliance check. You should attentively examine the content of the form you want and check whether it satisfies your needs and meets your state law requirements. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). If there are any inconsistencies, browse the library through the Search tab on the top of the page until you find a suitable template, and click Buy Now when you see the one you need.

- Account creation and form purchase. Register for an account with US Legal Forms. After account verification, log in and choose your preferred subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Select the file format for your Washington Independent Contractors and click Download to save it on your device. Print it to fill out your paperwork manually, or take advantage of a multi-featured online editor to prepare an electronic copy faster and more effectively.

Haven’t you tried US Legal Forms yet? Sign up for our service today to get any formal document quickly and easily whenever you need to, and keep your paperwork in order!

Form popularity

FAQ

Independent Contractors. All workers in Washington are entitled to workers' compensation unless they fit strict exemption definitions. Make sure you understand your business' requirements for covering workers, including independent contractors.

A 1099 worker is an independent contractor whom you pay for a specific task, while a W-2 employee is a person who receives a regular wage or salary for performing a role in your company.

Registering your business Independent contractors must register with the Department of Revenue unless they: Make less than $12,000 a year before expenses; Do not make retail sales; Are not required to pay or collect any taxes administered by the Department of Revenue.

An independent contractor works independently. An employee works under the control of the employer. An independent contractor must personally perform the task. An employee can delegate tasks.

The law further states that independent contractor status is evidenced if the worker: (1) has a substantial investment in the business other than personal services, (2) purports to be in business for himself or herself, (3) receives compensation by project rather than by time, (4) has control over the time and place

The individual: Is customarily engaged in an independently established trade, occupation, profession, or business of the same nature as that involved in the service contract, or. Has a principal place of business that is eligible for a federal income tax business deduction; and.

The Washington state self employment tax covers both Social Security and Medicare payments when you're a solo worker. The total is 15.3%, with 12.4% covering the part of Social Security and 2.9% covering your Medicare.

RCW 49.44. 160. ?Misclassify" and "misclassification" means to incorrectly classify or label a long-term public employee as "temporary," "leased," "contract," "seasonal," "intermittent," or "part-time," or to use a similar label that does not objectively describe the employee's actual work circumstances. RCW 49.44.