This office lease clause is used to respond to various changes that might occur within the tenant's office building or shopping center.

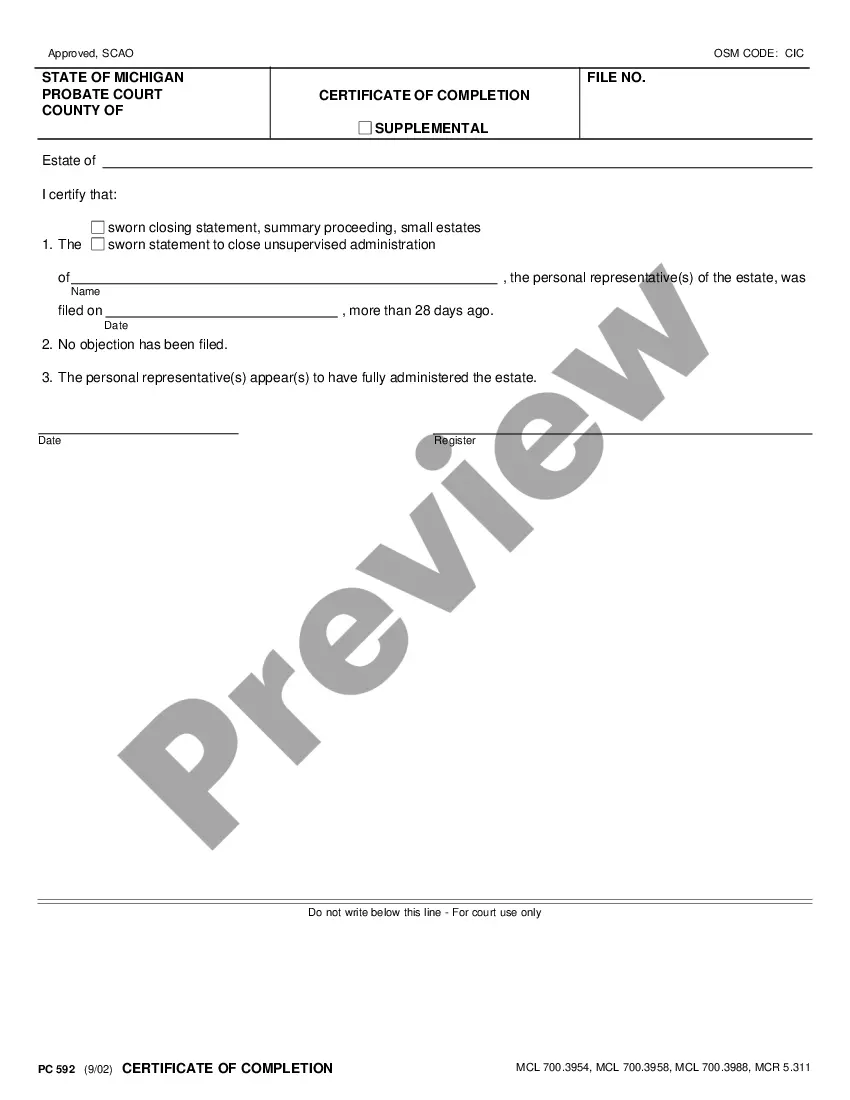

Vermont Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share

Description

How to fill out Measurement Representations And Proportionate Share Adjustment Of Tenants Proportionate Tax Share?

You may invest time on the web trying to find the legal document template that meets the state and federal demands you want. US Legal Forms supplies 1000s of legal varieties that are reviewed by experts. You can actually down load or print out the Vermont Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share from our assistance.

If you already possess a US Legal Forms accounts, you may log in and click the Down load key. Following that, you may comprehensive, modify, print out, or indication the Vermont Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share. Every legal document template you buy is the one you have for a long time. To acquire one more backup associated with a obtained form, check out the My Forms tab and click the corresponding key.

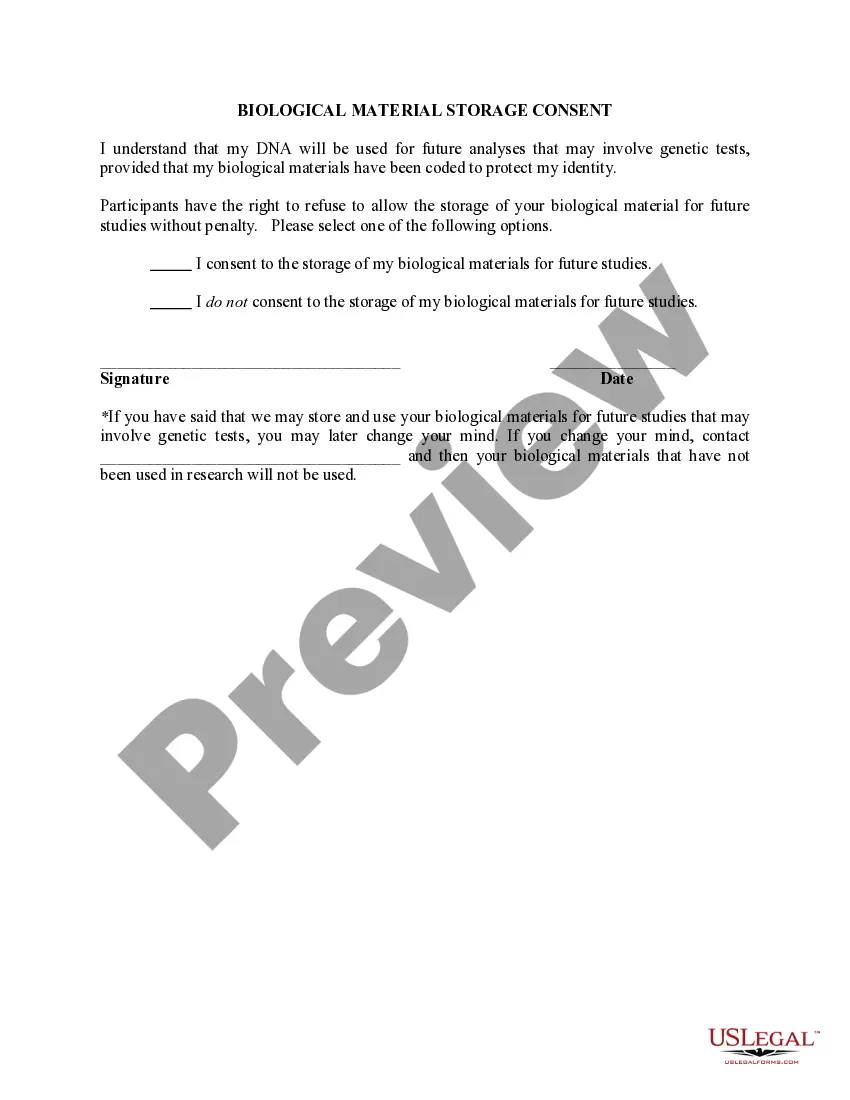

If you work with the US Legal Forms web site initially, stick to the straightforward recommendations listed below:

- First, make sure that you have selected the correct document template for your state/area that you pick. Read the form outline to ensure you have selected the proper form. If available, take advantage of the Review key to search with the document template also.

- If you would like find one more version of the form, take advantage of the Look for field to get the template that suits you and demands.

- Upon having identified the template you would like, simply click Purchase now to carry on.

- Choose the prices strategy you would like, enter your references, and register for a merchant account on US Legal Forms.

- Complete the deal. You can use your bank card or PayPal accounts to pay for the legal form.

- Choose the file format of the document and down load it for your device.

- Make adjustments for your document if possible. You may comprehensive, modify and indication and print out Vermont Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share.

Down load and print out 1000s of document themes making use of the US Legal Forms web site, that provides the largest assortment of legal varieties. Use specialist and express-particular themes to deal with your company or specific demands.

Form popularity

FAQ

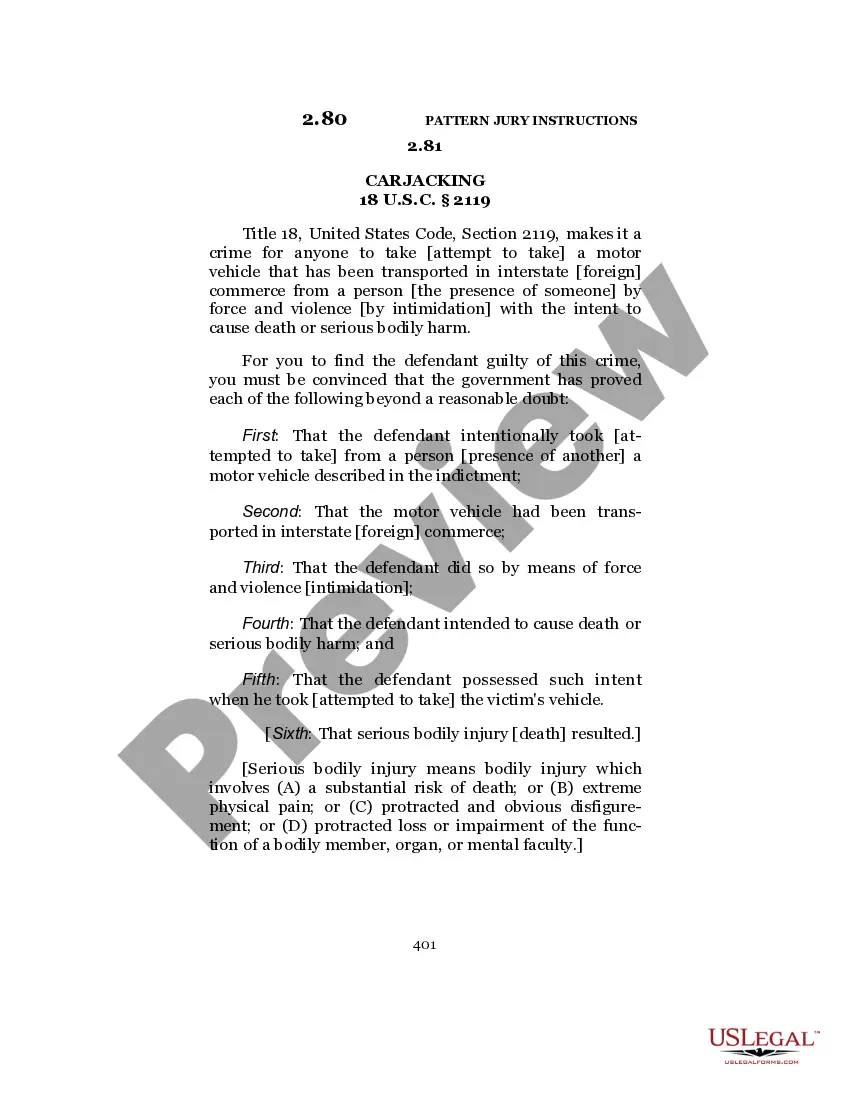

More Definitions of Tenant's Proportion Tenant's Proportion is 18.562% and means the sum derived by dividing the Rentable Area of the Premises by the Rentable Area of the Building and multiplying by one hundred (100).

Proportionate Share If the Premises are a part of a multiple tenancy complex, the responsibility of the Lessee for costs are determined by taking a percentage of the total cost of the expenses based upon the rentable floor space in said complex occupied by the Lessee.

In general, the tenant's proportionate share is determined by taking the building's rentable square footage and dividing it by the tenant's rentable square footage. Local industry customs usually provide the landlord with the guiding principles for: Measuring the building.

The pro-rata share is the percentage of expenses shared by the tenant for the shopping center or office building. In most leases, the pro-rata share is calculated as a fraction of the tenant's demised square footage divided by the total square footage of the shopping center or the building.