Vermont Investors Rights Agreement

Description

How to fill out Investors Rights Agreement?

You can spend hours on-line searching for the legitimate file template which fits the federal and state requirements you require. US Legal Forms gives 1000s of legitimate types that happen to be examined by pros. You can easily acquire or produce the Vermont Investors Rights Agreement from the services.

If you currently have a US Legal Forms profile, you may log in and then click the Acquire button. Afterward, you may full, edit, produce, or indicator the Vermont Investors Rights Agreement. Every single legitimate file template you get is your own property permanently. To get one more version for any purchased kind, visit the My Forms tab and then click the related button.

If you work with the US Legal Forms internet site for the first time, keep to the simple guidelines under:

- Initial, be sure that you have chosen the best file template for your county/area that you pick. Look at the kind description to make sure you have chosen the right kind. If available, utilize the Preview button to appear throughout the file template too.

- If you would like get one more version of your kind, utilize the Search discipline to discover the template that suits you and requirements.

- After you have identified the template you desire, click on Get now to move forward.

- Pick the costs program you desire, enter your accreditations, and register for a merchant account on US Legal Forms.

- Full the deal. You can use your charge card or PayPal profile to purchase the legitimate kind.

- Pick the file format of your file and acquire it to your gadget.

- Make adjustments to your file if needed. You can full, edit and indicator and produce Vermont Investors Rights Agreement.

Acquire and produce 1000s of file templates making use of the US Legal Forms site, that provides the largest assortment of legitimate types. Use specialist and express-certain templates to take on your small business or individual demands.

Form popularity

FAQ

Key elements of a VC term sheet Money raised. Your investor will likely require that you raise a minimum amount of money before they disburse their funds. ... Pre-money valuation. ... Non-participating liquidation preference. ... conversion to common. ... Anti-dilution provisions. ... The pay-to-play provision. ... Boardroom makeup. ... Dividends.

No-Shop/Confidentiality Provision = Binding Everything in a term sheet can be broken down into two parts in terms of what's binding: a ?No-Shop?/confidentiality provision, and everything else. Most term sheets have a No-Shop/confidentiality provision.

Keep your VC pitch short, easy to scan and packed with valuable information A clear explanation of the problem your product or service is solving. The size of your market and potential competitors. Growth models. Evidence that your team can pull it off.

Founders who receive a term sheet need to understand, from a legal perspective, how to manage the process. Key provisions of a VC term sheet include: investment structure, key economic terms, shareholder agreements, due diligence, exclusivity and closing.

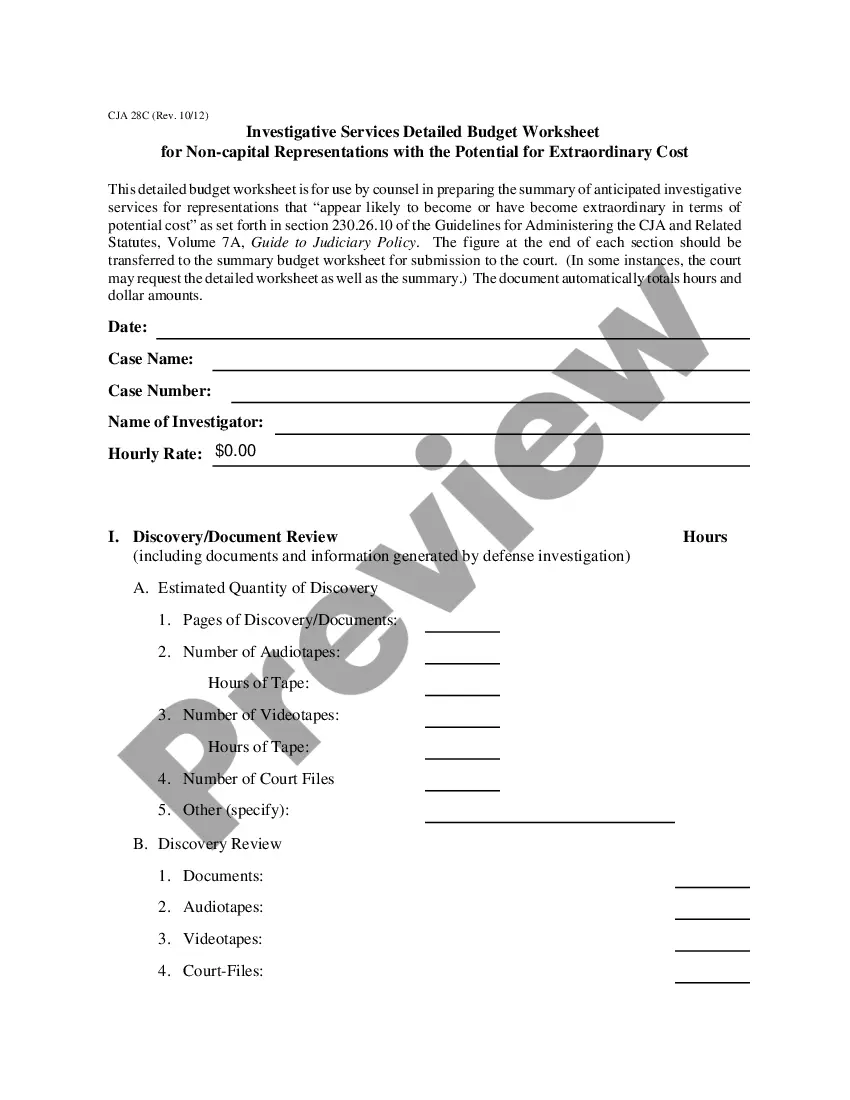

An Investor Rights Agreement (IRA) is an agreement between an investor and a company that contractually guarantees the investor certain rights including, but not limited to, voting rights, inspection rights, rights of first refusal, and observer rights.

[?DPA Triggering Rights? means (i) ?control? (as defined in the DPA); (ii) access to any ?material non-public technical information? (as defined in the DPA) in the possession of the Company; (iii) membership or observer rights on the Board of Directors or equivalent governing body of the Company or the right to ...

But no matter who the investor is, a term sheet will always contain six key components, including: A valuation. An estimate of what a company is worth as an investment opportunity. ... Securities being issued. ... Board rights. ... Investor protections. ... Dealing with shares. ... Miscellaneous provisions.