Vermont Plan of Merger between Micro Component Technology, Inc., MCT Acquisition, Inc. and Aseco Corporation

Description

How to fill out Plan Of Merger Between Micro Component Technology, Inc., MCT Acquisition, Inc. And Aseco Corporation?

If you wish to total, obtain, or printing authorized document web templates, use US Legal Forms, the biggest collection of authorized kinds, which can be found on the Internet. Utilize the site`s simple and convenient search to discover the paperwork you will need. Different web templates for company and personal reasons are sorted by types and says, or keywords and phrases. Use US Legal Forms to discover the Vermont Plan of Merger between Micro Component Technology, Inc., MCT Acquisition, Inc. and Aseco Corporation with a number of click throughs.

In case you are currently a US Legal Forms customer, log in to your profile and click on the Obtain button to have the Vermont Plan of Merger between Micro Component Technology, Inc., MCT Acquisition, Inc. and Aseco Corporation. You can even accessibility kinds you earlier acquired from the My Forms tab of your respective profile.

If you work with US Legal Forms the very first time, follow the instructions below:

- Step 1. Ensure you have selected the shape to the correct town/land.

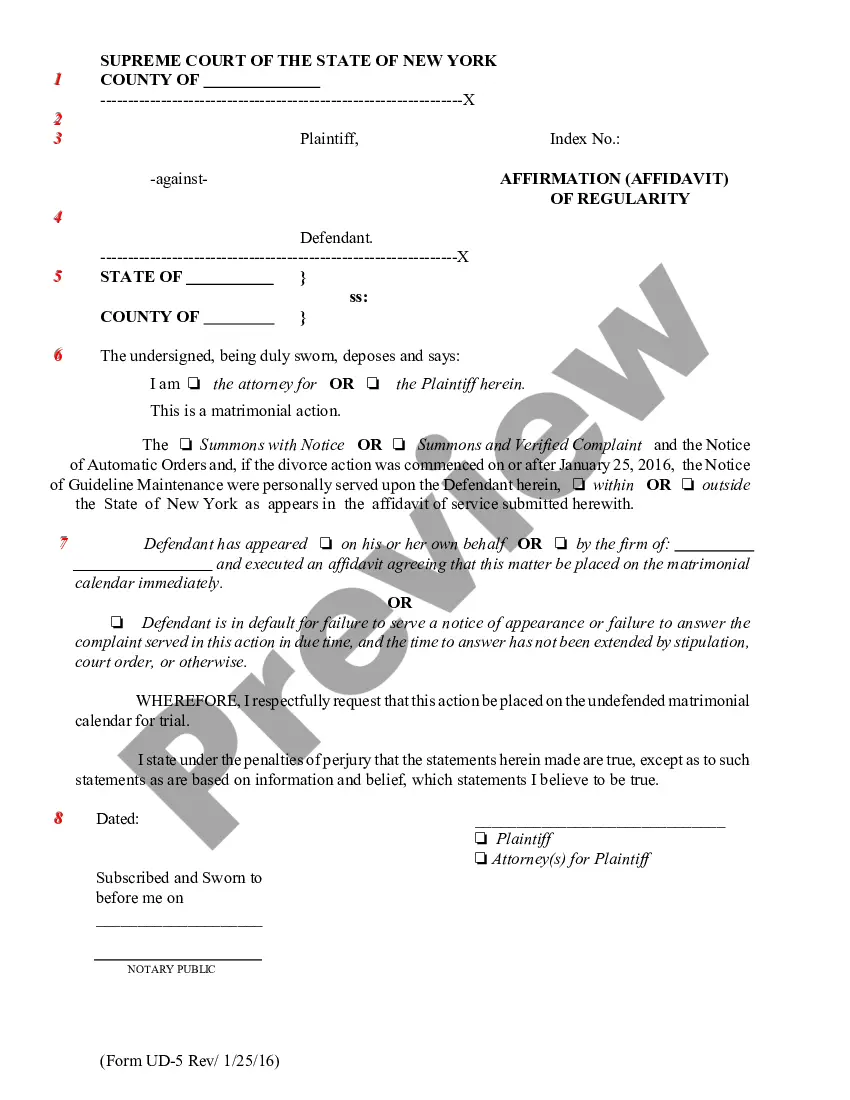

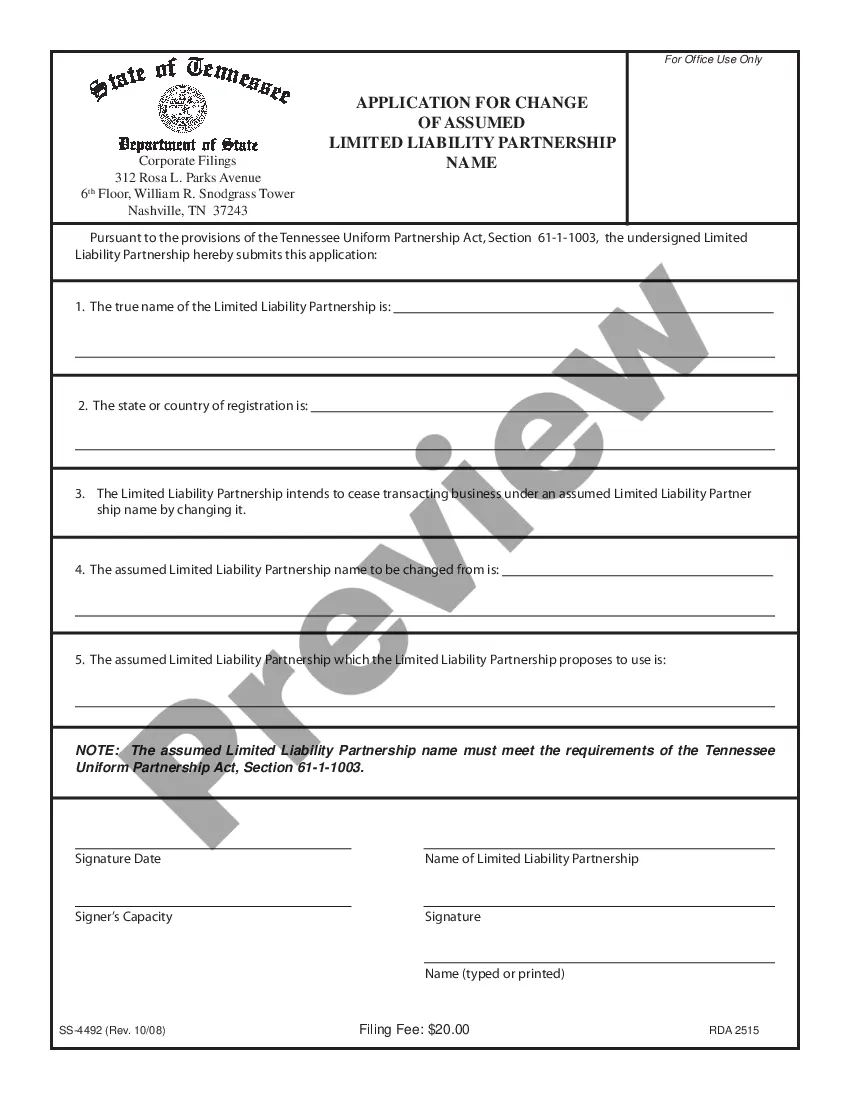

- Step 2. Use the Preview option to look through the form`s information. Don`t forget about to read the outline.

- Step 3. In case you are unhappy together with the type, take advantage of the Research discipline towards the top of the display to find other models of the authorized type template.

- Step 4. When you have found the shape you will need, select the Buy now button. Opt for the prices strategy you choose and add your qualifications to register for an profile.

- Step 5. Approach the transaction. You should use your bank card or PayPal profile to accomplish the transaction.

- Step 6. Find the file format of the authorized type and obtain it on your own product.

- Step 7. Total, modify and printing or indicator the Vermont Plan of Merger between Micro Component Technology, Inc., MCT Acquisition, Inc. and Aseco Corporation.

Each authorized document template you buy is your own for a long time. You have acces to each type you acquired with your acccount. Click on the My Forms portion and choose a type to printing or obtain again.

Contend and obtain, and printing the Vermont Plan of Merger between Micro Component Technology, Inc., MCT Acquisition, Inc. and Aseco Corporation with US Legal Forms. There are thousands of expert and condition-certain kinds you may use for your company or personal demands.