Vermont Change of company name

Description

How to fill out Change Of Company Name?

US Legal Forms - one of many largest libraries of legal forms in America - delivers a wide array of legal document templates you are able to down load or produce. Utilizing the site, you can find a large number of forms for company and individual functions, categorized by classes, suggests, or key phrases.You can get the most recent models of forms just like the Vermont Change of company name within minutes.

If you already have a membership, log in and down load Vermont Change of company name from the US Legal Forms collection. The Acquire button will show up on each form you perspective. You gain access to all earlier acquired forms from the My Forms tab of the profile.

If you wish to use US Legal Forms the very first time, listed below are simple recommendations to obtain started:

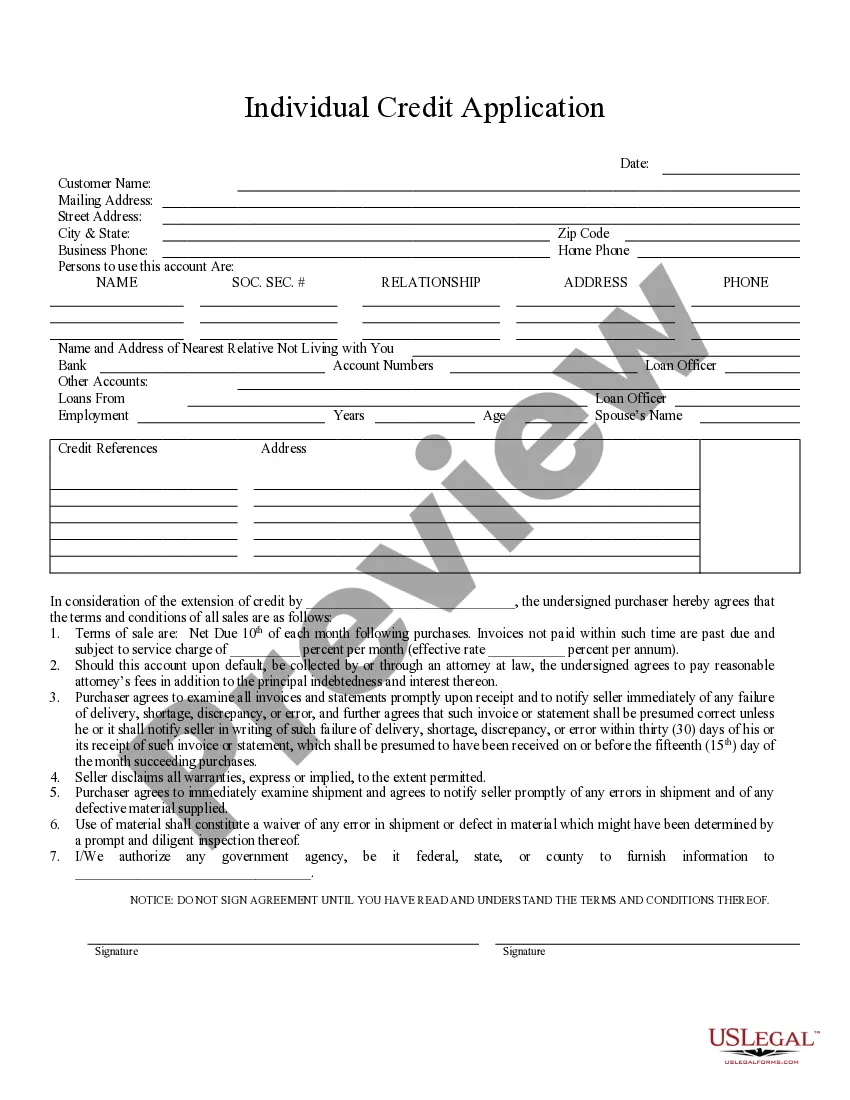

- Be sure you have chosen the correct form for the city/state. Click the Review button to review the form`s content. See the form explanation to actually have selected the appropriate form.

- In case the form does not suit your demands, make use of the Look for field at the top of the monitor to find the one that does.

- In case you are satisfied with the shape, validate your decision by simply clicking the Purchase now button. Then, select the prices program you like and offer your accreditations to sign up on an profile.

- Process the transaction. Use your Visa or Mastercard or PayPal profile to finish the transaction.

- Pick the file format and down load the shape on your own device.

- Make alterations. Fill out, modify and produce and indication the acquired Vermont Change of company name.

Each and every format you included in your money does not have an expiry date and is your own forever. So, in order to down load or produce another duplicate, just proceed to the My Forms area and click around the form you will need.

Get access to the Vermont Change of company name with US Legal Forms, probably the most substantial collection of legal document templates. Use a large number of expert and state-particular templates that meet your company or individual requirements and demands.

Form popularity

FAQ

An assumed business name is simply an additional business name under which the registrant(s) have the legal authority to do business as ? and incur the same liabilities as would doing business in the individual name(s) of the registrants(s).

Vermont does not have a statewide basic business license. Businesses may need to register with the Vermont Secretary of State or the Department of Taxes for business taxes, sales tax, or payroll taxes.

Online filing normally takes less than 1 business day. Please allow 7-10 business days for the processing of any filings received by mail. Online filing is the preferred method.

Vermont does not have a statewide basic business license. Businesses may need to register with the Vermont Secretary of State or the Department of Taxes for business taxes, sales tax, or payroll taxes.

Amendment Filing Instructions Click VT Sec of State Online Services on the left menu. From the dropdown menu, click Business Amendments. Follow prompts and enter all required and updated information. Click Submit on the final page.

The filing fee is state specific with the lowest cost being $40 (in Kentucky) and the most expensive cost being $500 (in Massachusetts). Most states' filing fees hover between $50 and $100.

Vermont LLC Cost. The fee for forming a Vermont LLC is $125. You'll also need to pay $35 every year to file Vermont's Annual Report.

Benefits of starting a Vermont LLC: Quick and simple creation, management, regulation, administration and compliance. File your taxes easily and discover potential advantages for tax treatment. Protect your personal assets from your business liability and debts. Low cost to file ($125)