Vermont Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus

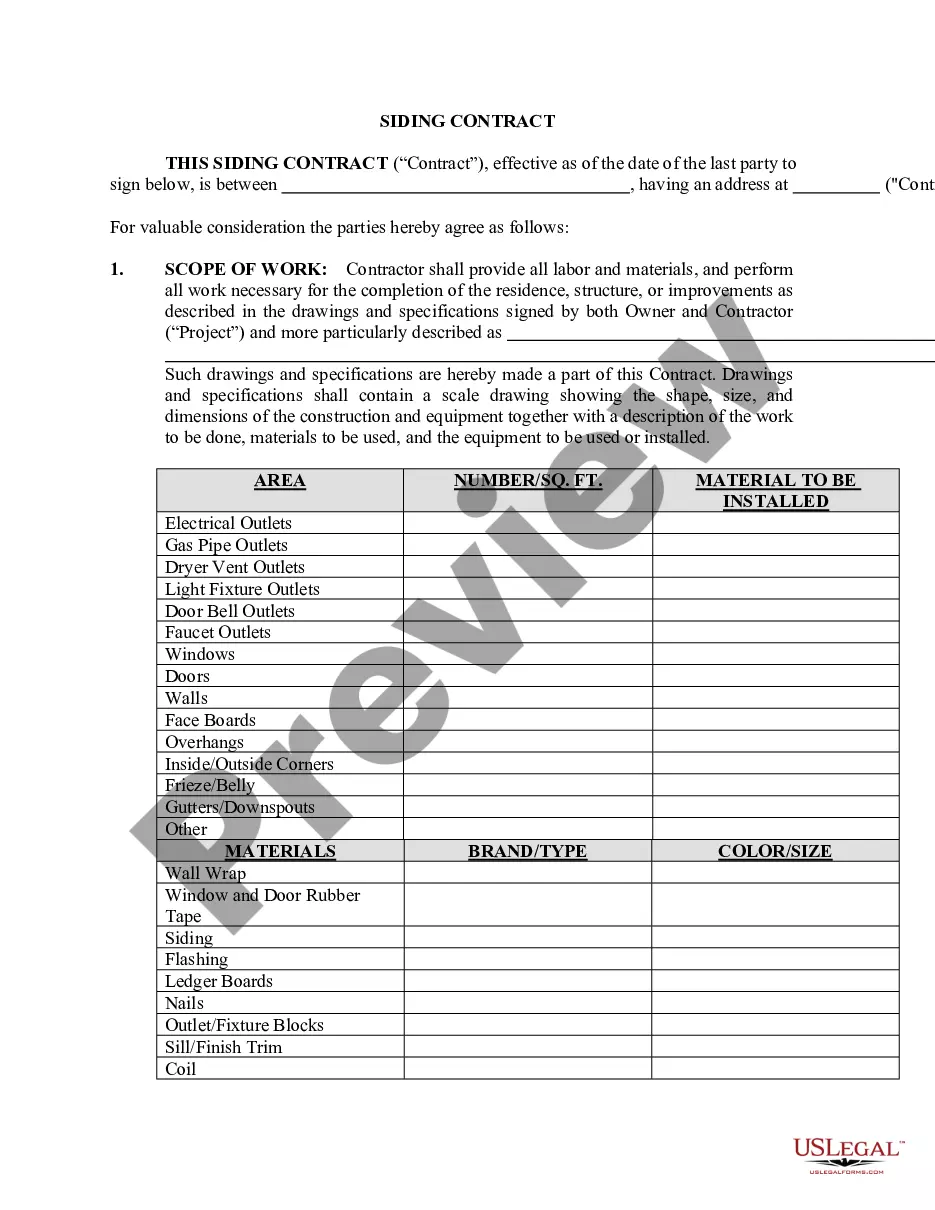

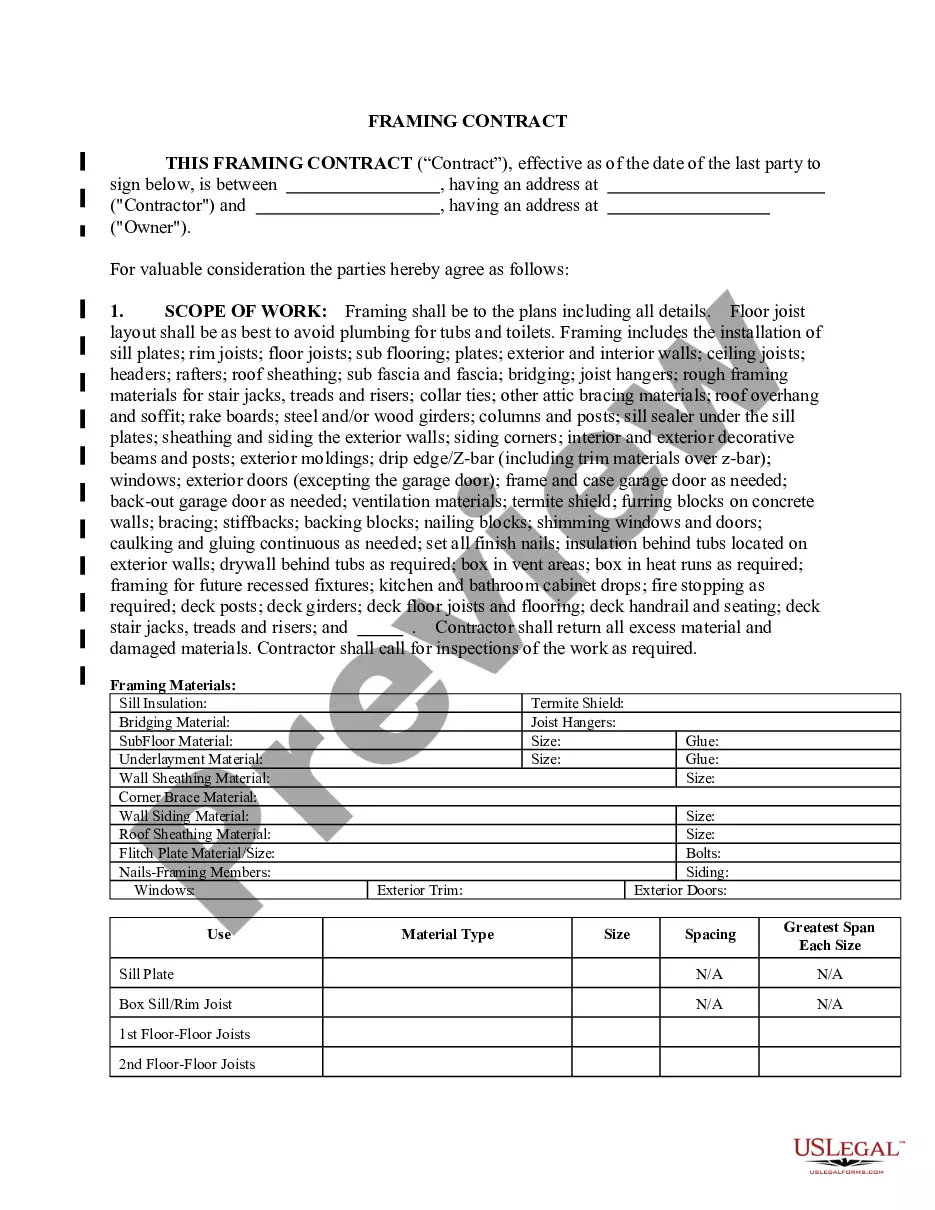

Description

How to fill out Approval Of Amendment To Articles Of Incorporation To Permit Certain Uses Of Distributions From Capital Surplus?

Are you presently in a place where you will need paperwork for either company or personal uses nearly every day? There are plenty of lawful file layouts available on the Internet, but discovering types you can rely isn`t simple. US Legal Forms delivers 1000s of develop layouts, such as the Vermont Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus, which are composed to satisfy federal and state specifications.

If you are previously acquainted with US Legal Forms web site and also have a merchant account, basically log in. Next, you may down load the Vermont Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus template.

If you do not provide an account and would like to begin to use US Legal Forms, adopt these measures:

- Obtain the develop you want and ensure it is for your right metropolis/state.

- Utilize the Preview switch to review the form.

- Look at the information to ensure that you have selected the appropriate develop.

- If the develop isn`t what you`re looking for, make use of the Lookup industry to find the develop that meets your needs and specifications.

- Whenever you find the right develop, simply click Purchase now.

- Choose the rates strategy you want, submit the specified details to produce your account, and buy the transaction utilizing your PayPal or bank card.

- Pick a convenient data file format and down load your version.

Locate all the file layouts you possess purchased in the My Forms food list. You can get a more version of Vermont Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus any time, if possible. Just click on the necessary develop to down load or produce the file template.

Use US Legal Forms, the most substantial variety of lawful varieties, to conserve some time and steer clear of blunders. The service delivers professionally produced lawful file layouts which can be used for a range of uses. Make a merchant account on US Legal Forms and initiate generating your lifestyle easier.

Form popularity

FAQ

To amend your initial Articles of Organization for an Indiana LLC, you'll need to file Articles of Amendment with the Indiana Secretary of State, Business Services Division. In addition, you must pay the $30 paper filing fee or $20 online filing fee, depending on how you choose to submit your form.

Amendment Filing Instructions Click VT Sec of State Online Services on the left menu. From the dropdown menu, click Business Amendments. Follow prompts and enter all required and updated information. Click Submit on the final page.

Complete and file the Certificate of Amendment with the Department of State. The completed Certificate of Amendment, together with the statutory filing fee of $60, should be forwarded to: New York Department of State, Division of Corporations, One Commerce Plaza, 99 Washington Avenue, Albany, NY 12231.

The inhabitants of this State shall have liberty in seasonable times, to hunt and fowl on the lands they hold, and on other lands not enclosed; and in like manner to fish in all boatable and other waters (not private property) under proper regulations, to be hereafter made and provided by the General Assembly.

Not only is it required by state law to update your California Articles of Incorporation, but there are many other reasons why it's imperative that you do so. For example, properly amending your Articles of Incorporation can ensure that your corporation continues to: Receive the benefits of being a registered entity.

To amend (change, add or delete) provisions contained in the Articles of Incorporation, it is necessary to prepare and file with the California Secretary of State a Certificate of Amendment of Articles of Incorporation in compliance with California Corporations Code sections 900-910.