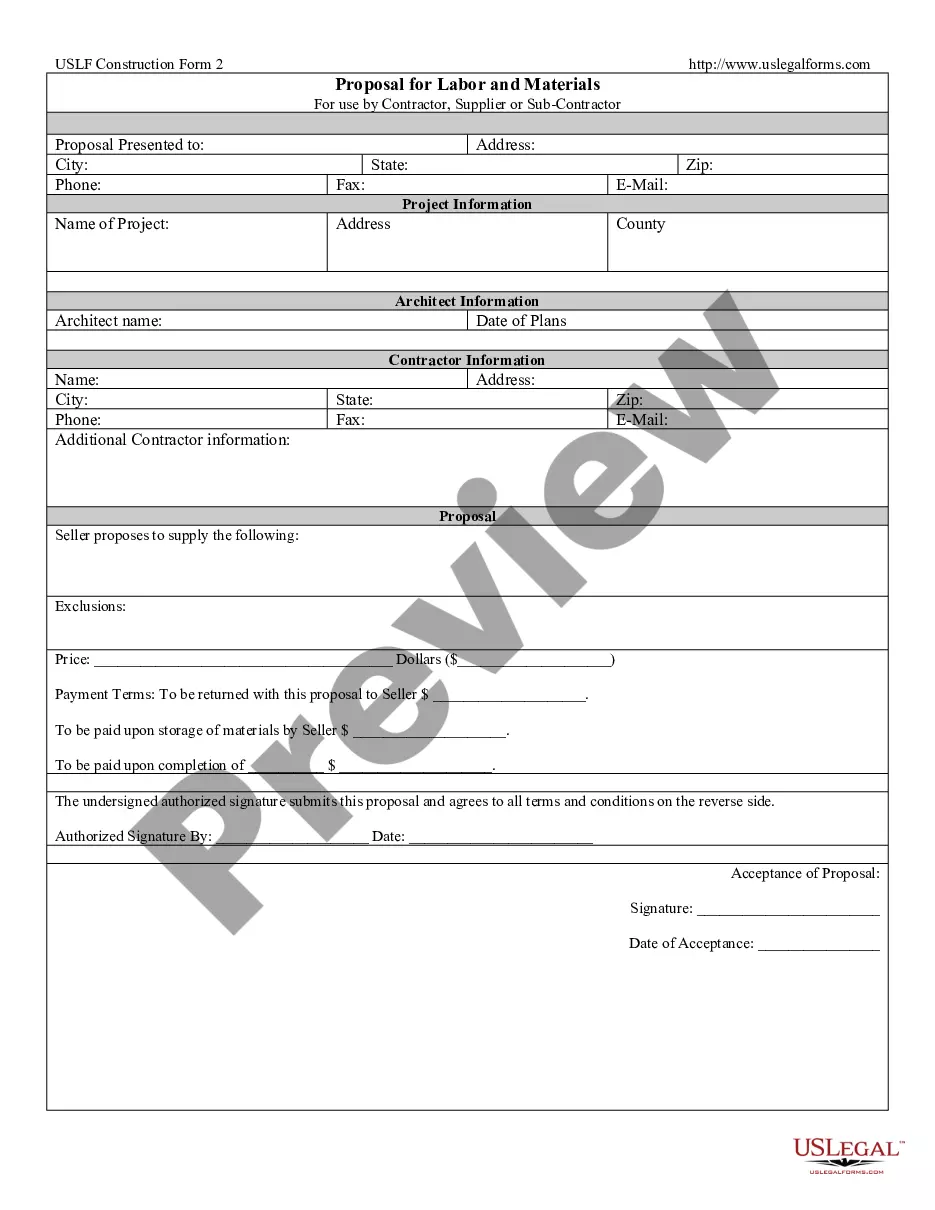

Vermont Personal Property - Schedule B - Form 6B - Post 2005

Description

How to fill out Personal Property - Schedule B - Form 6B - Post 2005?

You may invest several hours on-line attempting to find the legitimate record web template which fits the federal and state needs you want. US Legal Forms gives thousands of legitimate forms that happen to be evaluated by experts. It is simple to down load or printing the Vermont Personal Property - Schedule B - Form 6B - Post 2005 from my services.

If you already have a US Legal Forms account, you are able to log in and click the Acquire key. After that, you are able to total, change, printing, or signal the Vermont Personal Property - Schedule B - Form 6B - Post 2005. Each legitimate record web template you acquire is the one you have forever. To have an additional version associated with a acquired form, proceed to the My Forms tab and click the related key.

Should you use the US Legal Forms site for the first time, adhere to the basic directions under:

- First, ensure that you have chosen the right record web template for the county/metropolis of your choosing. Read the form explanation to make sure you have chosen the proper form. If readily available, utilize the Review key to look with the record web template as well.

- If you want to find an additional edition of the form, utilize the Look for discipline to get the web template that suits you and needs.

- When you have discovered the web template you desire, just click Purchase now to continue.

- Select the costs prepare you desire, enter your accreditations, and sign up for a merchant account on US Legal Forms.

- Complete the transaction. You can use your charge card or PayPal account to purchase the legitimate form.

- Select the structure of the record and down load it to your gadget.

- Make modifications to your record if possible. You may total, change and signal and printing Vermont Personal Property - Schedule B - Form 6B - Post 2005.

Acquire and printing thousands of record themes while using US Legal Forms site, which offers the largest collection of legitimate forms. Use expert and status-particular themes to deal with your organization or individual requires.

Form popularity

FAQ

Vermont Property Tax Breaks for Retirees Your property must qualify as a homestead (as of April 1), and you must have filed a Homestead Declaration for the current year's grand list. You must have been domiciled in Vermont for all of 2022. You must not have been claimed as a dependent on a 2022 tax return.

How to File Tax YearMaximum Household Income2023$128,0002022$134,8002021$136,9002020$138,5004 more rows

Retail sales of tangible personal property are always subject to Vermont Sales Tax unless specifically exempted by Vermont law.

No Vermont exclusion is available when a net capital loss is reported, even if the sale of farm or standing timber resulted in a capital gain. The general exclusion amount for tax year 2021 is $5,000 or the actual amount of net adjusted capital gains, whichever is less.

In 2018, the legislature created a Vermont personal income tax exemption for Social Security beneficiaries who are below certain income thresholds, known as Act 11. The law eliminates or reduces the Vermont tax imposed on federally taxable Social Security benefits for nearly 40,000 income-eligible taxpayers.

Vermont Property Tax Breaks for Retirees Your property must qualify as a homestead (as of April 1), and you must have filed a Homestead Declaration for the current year's grand list. You must have been domiciled in Vermont for all of 2022. You must not have been claimed as a dependent on a 2022 tax return.

Vermont allows taxpayers to exclude the first $10,000 of retirement income from certain other retirement systems. Income received from a contributory annuity, pension, endowment, or retirement system of the U.S. government or a state government is eligible for a reduction in tax.

Vermont Retirement Taxes It taxes most forms of retirement income at rates ranging from 3.35% to 8.75%. This includes Social Security retirement benefits and income from most types of retirement accounts. The only type of retirement income that's exempt from Vermont taxes is federal railroad retirement benefits.

Vermont is not tax-friendly toward retirees. Social Security income is partially taxed. Withdrawals from retirement accounts are fully taxed. Wages are taxed at normal rates, and your marginal state tax rate is 3.35%.

In Vermont, the maximum value of exempt property is $125,000.