Vermont Franchisee Closing Questionnaire

Description

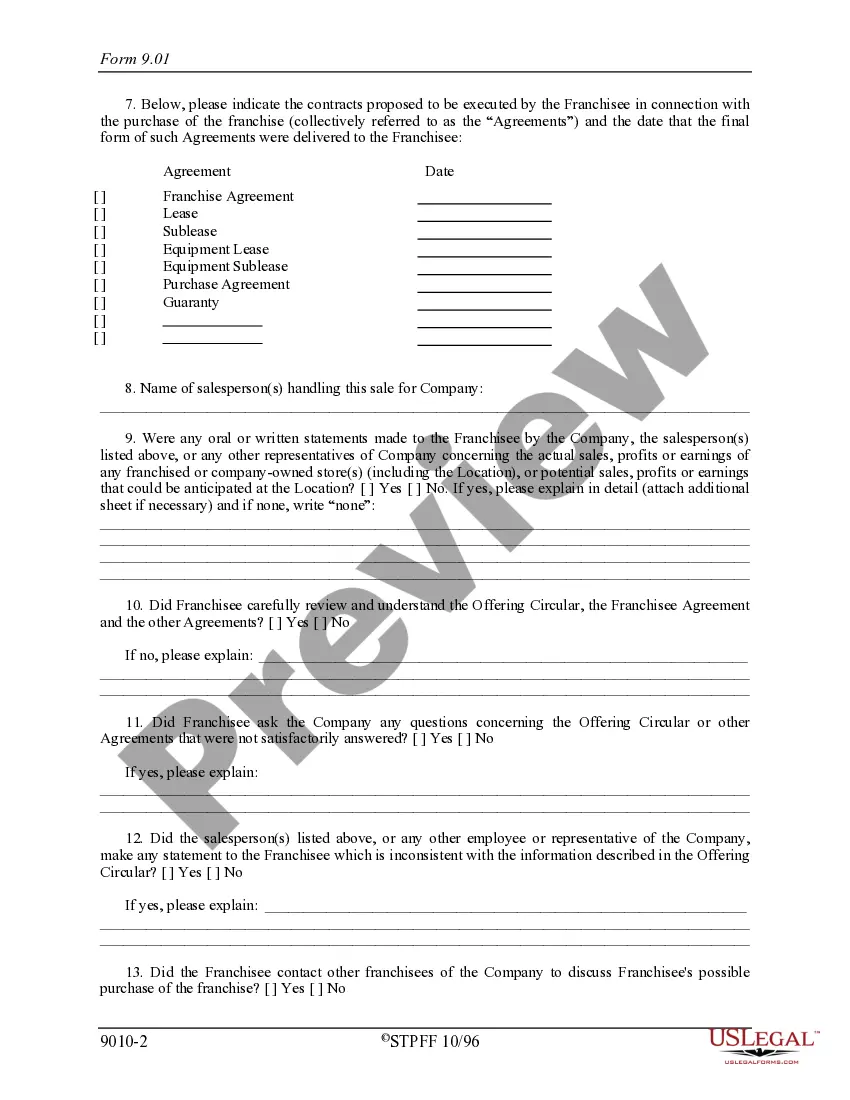

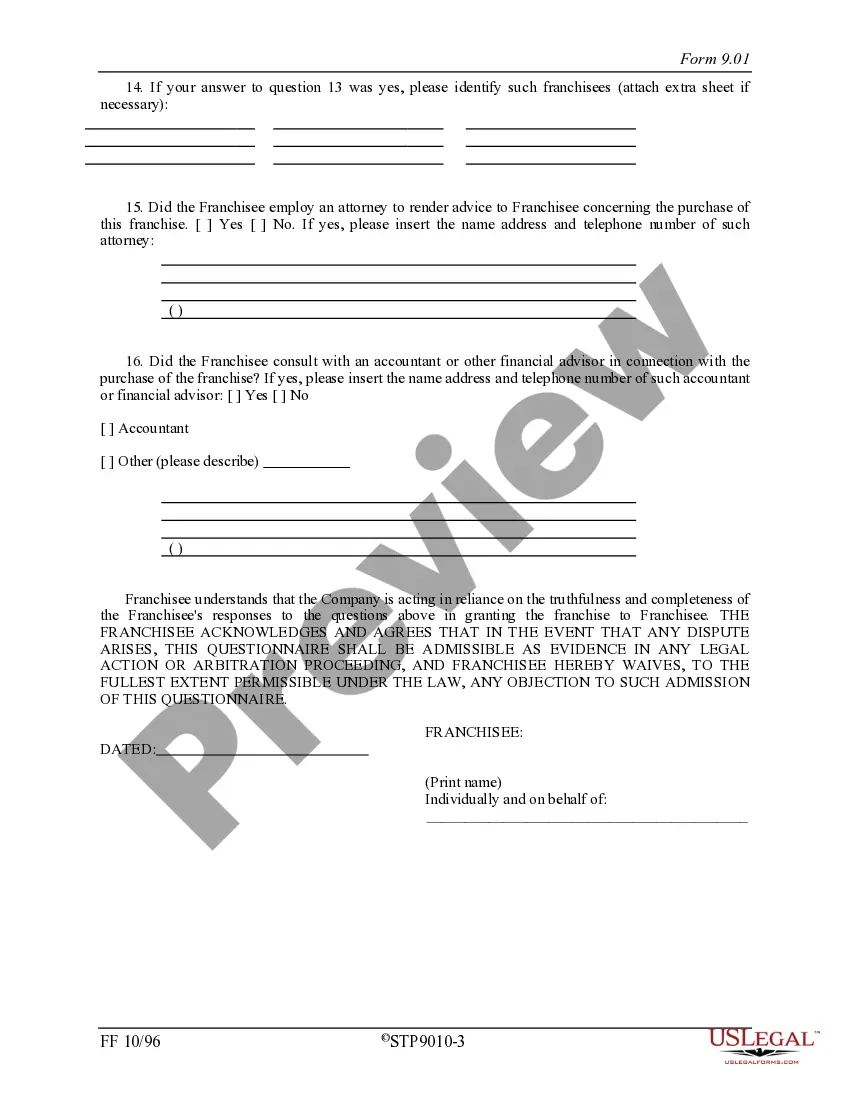

How to fill out Franchisee Closing Questionnaire?

It is possible to spend several hours on the Internet trying to find the authorized papers web template which fits the federal and state specifications you require. US Legal Forms gives a large number of authorized kinds that are examined by experts. It is possible to acquire or printing the Vermont Franchisee Closing Questionnaire from the services.

If you already possess a US Legal Forms bank account, it is possible to log in and click the Acquire key. Following that, it is possible to complete, edit, printing, or signal the Vermont Franchisee Closing Questionnaire. Every authorized papers web template you get is the one you have forever. To get an additional copy of the obtained kind, check out the My Forms tab and click the related key.

If you work with the US Legal Forms internet site for the first time, follow the easy directions beneath:

- Initially, make sure that you have selected the proper papers web template for the area/town of your choice. Browse the kind explanation to ensure you have picked the right kind. If available, utilize the Review key to look with the papers web template as well.

- In order to find an additional model of the kind, utilize the Research field to find the web template that suits you and specifications.

- Once you have identified the web template you need, click on Get now to carry on.

- Pick the prices prepare you need, key in your credentials, and register for a free account on US Legal Forms.

- Comprehensive the deal. You may use your credit card or PayPal bank account to cover the authorized kind.

- Pick the formatting of the papers and acquire it to the system.

- Make changes to the papers if required. It is possible to complete, edit and signal and printing Vermont Franchisee Closing Questionnaire.

Acquire and printing a large number of papers themes making use of the US Legal Forms Internet site, which offers the largest selection of authorized kinds. Use professional and state-particular themes to deal with your organization or personal requirements.

Form popularity

FAQ

All you have to do is fill out a Schedule C when you file your annual personal tax return. The IRS Schedule C is a form that you attach to your main individual tax return on Form 1040. Essentially, it just gives you a way to tell the IRS about the profit or loss from your business.

Email: tax.business@vermont.gov Contact us with questions regarding Business Registration, Meals & Rooms Tax, Sales & Use Tax, Withholding, Miscellaneous Taxes, myVTax Support, Local Option Tax, Nonprofits and Exempt Organizations.

Register Your New Business To register your business with the Vermont Department of Taxes please select Sign Up on the myVTax homepage. Note that you are only required to register with the Vermont Department of Taxes if your business will collect any of the following taxes: Sales and Use Tax. Meals and Rooms Tax.

Summary. While franchisees may not have total control over their business, the franchise model offers numerous benefits. The franchise agreement outlines the rights and responsibilities of both parties, setting the parameters for the relationship and the level of control the franchisee will have.

Craig Bolio, Commissioner, Department of Taxes.

Tax Rate. The Vermont Sales and Use Tax is 6%. To determine tax due, multiply the sales amount by 6% (or 7% if the sale is subject to local option tax), and round up to the nearest whole cent ing to the following rules: Tax computation must be carried to the third decimal place, and.