Vermont Expense Reimbursement Request

Description

How to fill out Expense Reimbursement Request?

You might invest time on the web trying to discover the proper legal document format that meets the state and federal requirements you need.

US Legal Forms provides a vast array of legal templates that can be evaluated by professionals.

It's easy to download or print the Vermont Expense Reimbursement Request from our service.

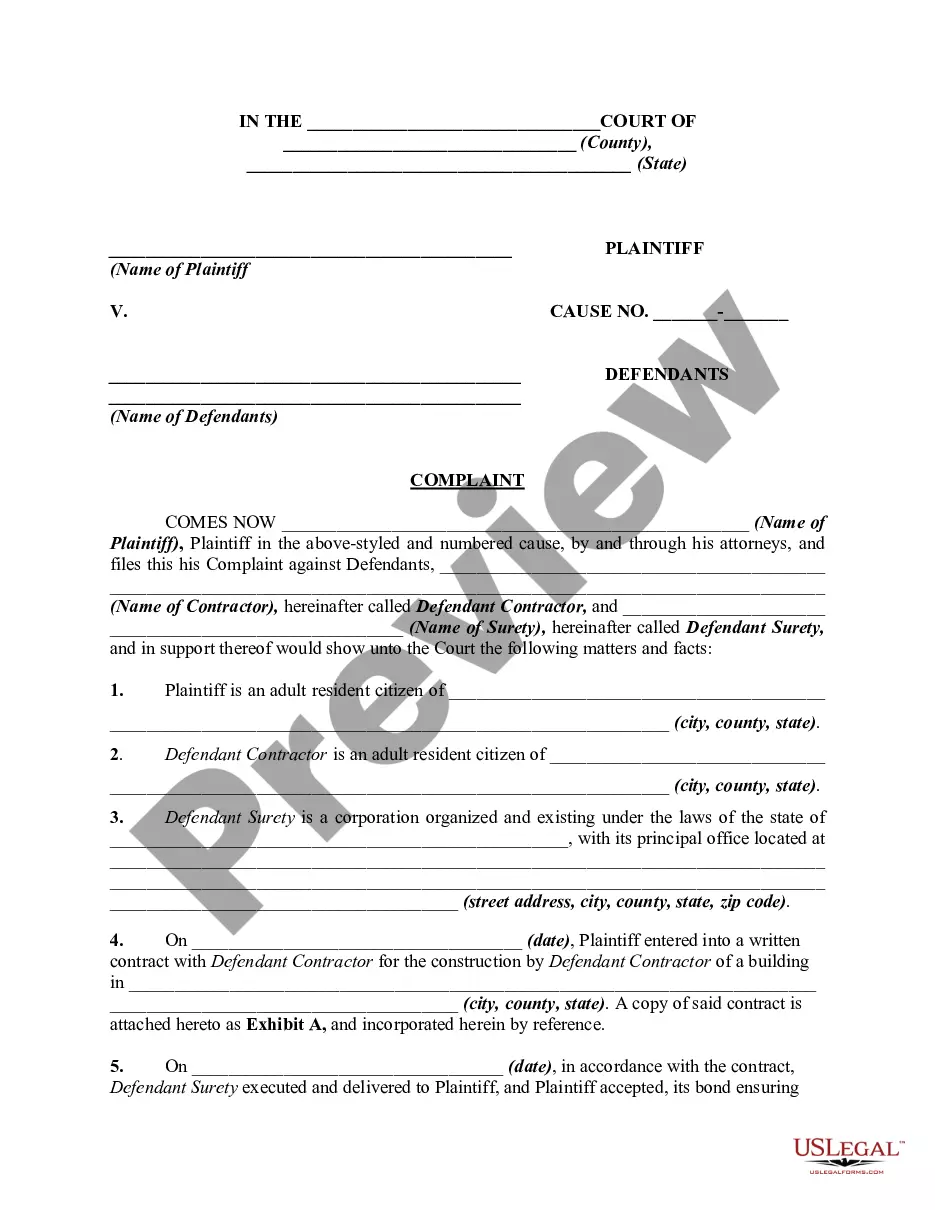

If available, utilize the Preview option to browse through the document format as well.

- If you have a US Legal Forms account, you can sign in and click on the Obtain option.

- After that, you can complete, modify, print, or sign the Vermont Expense Reimbursement Request.

- Every legal document format you purchase is yours indefinitely.

- To obtain another version of a purchased form, visit the My documents tab and click the relevant option.

- If you are using the US Legal Forms site for the first time, follow the simple instructions listed below.

- First, ensure that you have chosen the correct document format for the region/city of your choice.

- Review the form information to confirm that you have selected the right form.

Form popularity

FAQ

That typically means 5-20 days after the expenses were approved they would hit your account. Certainly make sure the expenses were approved by your manager (or whomever signs off) before calling out the payroll group. A company should never try to make money off the float of reimbursements to employees.

Travel expenses, and reimbursement of employees' travel expenses, are considered a legitimate business expense that can be deducted from a company's income taxes. For this reason, it can be advantageous to both employers and employees to have a reimbursement policy for travel expenses.

I would like to inform you that on // (Date), I visited (Location). The reason behind the visit was (Professional work/ Meeting/ Any other). For which, I request you to kindly reimburse the ticket amount of (Amount) which I had spent for traveling to the mentioned place.

I want to state that I visited (Location) for (Personal/ Professional work). This visit was done on // (Date). Therefore, I request you to kindly reimburse the amount of the expense of (Amount) which I spent.

This visit was done on // (Date). Therefore, I request you to kindly reimburse the amount of the expense of (Amount) which I spent. I am attaching a copy of the (cab booking/ hotel reservation/ ticket/ invoice/ boarding pass) for your reference.

How to record reimbursementsKeep your receipts. It's important to keep an accurate record of your expenses.Add reimbursement costs to client bill. Add up all expenses for the project and add this amount to the client's bill.Bill client up to agreed-upon limits. Issue the bill promptly.Know before you go.

Handling Reimbursable Expenses There are two ways to handle reimbursements: Assign money for the initial expense. Temporarily overspending, then using the reimbursement to cover it.

bystep guide to employee expense reimbursementForm a policy for the expense reimbursement process.Determine what expenses employees can claim.Create a system for collecting employee expense claims.Verify the legitimacy of expenses.Pay reimbursements within a specified timeframe.

Reimburse without cash advance They have to record expenses and cash paid to the employees. The journal entry is debiting expense and credit cash. The transaction will record the expense on income statement and cash paid to the employees.

The cost of work-related travel, including transportation, lodging, meals, and entertainment that meet the criteria outlined in IRS Publication 463, Travel, Entertainment, Gift, and Car Expenses, are generally reimbursable expenses.