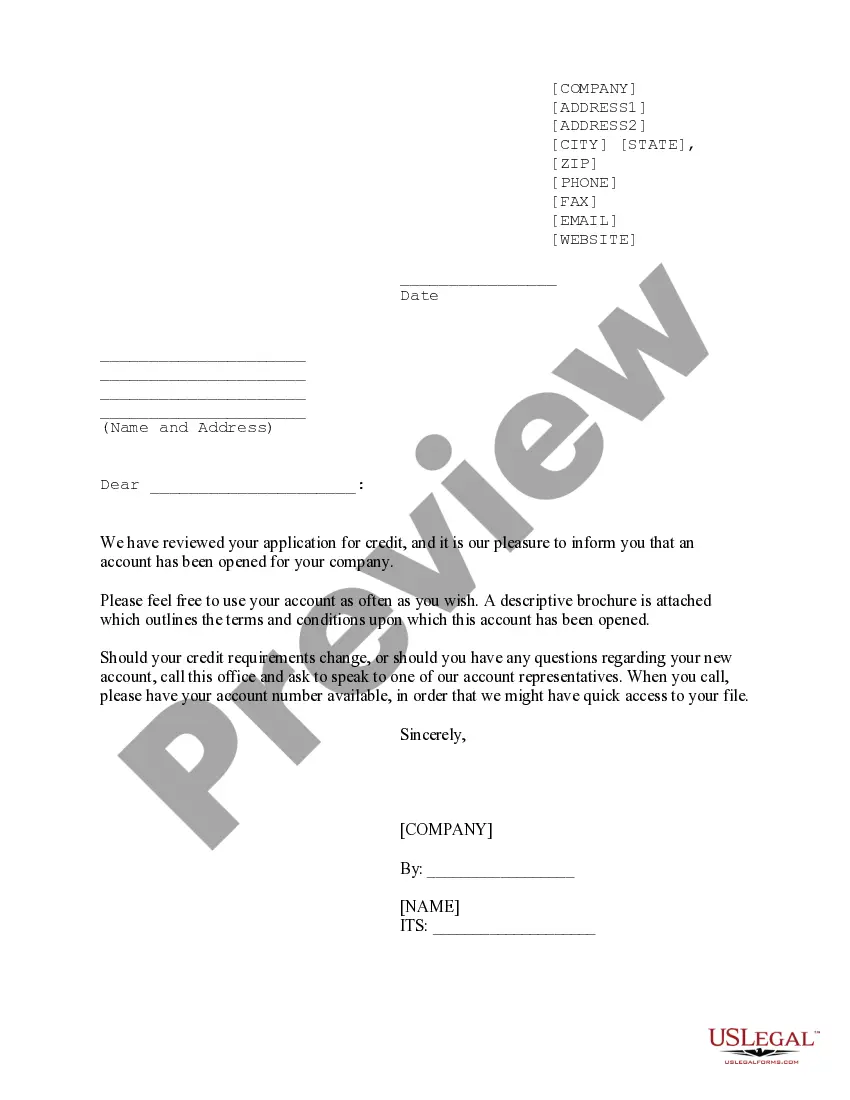

Vermont Credit Approval Form

Description

How to fill out Credit Approval Form?

Finding the appropriate authorized document template can be quite a challenge.

Certainly, there are numerous formats obtainable online, but how will you discover the legal form you need.

Utilize the US Legal Forms website. This service offers thousands of templates, including the Vermont Credit Approval Form, which can be utilized for business and personal purposes.

You can preview the form using the Preview button and read the form description to ensure it is the right one for you.

- All the forms are reviewed by experts and adhere to federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to retrieve the Vermont Credit Approval Form.

- Use your account to browse the legal forms you have previously acquired.

- Visit the My documents tab in your account and obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have selected the correct form for your region.

Form popularity

FAQ

Non-residents must use the Form IN-113 to file income taxes in Vermont. This form accommodates individuals who earn income in the state but reside elsewhere. Properly completing the IN-113 ensures compliance with Vermont tax laws. Don't forget, resources available on the US Legal platform can help you navigate these forms effectively.

The real property tax credit may be available to New York State residents who have household gross income of $18,000 or less, and pay either real property taxes or rent for their residence(s). If all members of the household are under age 65, the credit can be as much as $75.

The credit amount in the new program is 10% of the fair market rent for an apartment of your family size in your county.

The SPAN is the School Property Account Number, an 11-digit identification number unique to your property. Find it on your property tax bill.

All of the following must apply:You paid rent in California for at least 1/2 the year.The property was not tax exempt.Your California income was:You did not live with someone who can claim you as a dependent.You or your spouse/RDP were not given a property tax exemption during the tax year.30-Dec-2021

California's renter tax credit has remained unchanged for 43 years. It could soon increase. A proposal in the state Senate would increase California's renters' tax credit from $60 to $500 for eligible single tax filers, and more for those who are married or are single with dependents.

The Landlord Certificate informs the Vermont Department of Taxes of the names of each renter along with the number of months rented and whether the rent was subsidized.

The SPAN is the School Property Account Number, an 11-digit identification number unique to your property. Find it on your property tax bill.

The credit amount in the new program is 10% of the fair market rent for an apartment of your family size in your county.

Check if you qualify Your California income was: $43,533 or less if your filing status is single or married/registered domestic partner (RDP) filing separately. $87,066 or less if you are married/RDP filing jointly, head of household, or qualified widow(er)