Vermont Document Organizer and Retention

Description

How to fill out Document Organizer And Retention?

If you wish to finalize, download, or print legal document templates, utilize US Legal Forms, the finest collection of legal documents, readily available online.

Utilize the site's simple and handy search to locate the files you require.

A selection of templates for business and personal purposes is organized by categories and states, or keywords.

Step 4. Once you have identified the form you need, click the Purchase now button. Choose the payment plan you prefer and provide your details to sign up for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment. Step 6. Choose the format of the legal form and download it to your device. Step 7. Fill in, review, and print or sign the Vermont Document Organizer and Retention. Each legal document template you acquire is yours permanently. You have access to every form you downloaded in your account. Click the My documents section and select a form to print or download again. Compete and download, and print the Vermont Document Organizer and Retention with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- Use US Legal Forms to acquire the Vermont Document Organizer and Retention in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Vermont Document Organizer and Retention.

- You can also access forms you previously downloaded from the My documents tab of your account.

- If you are using US Legal Forms for the first time, refer to the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Preview option to review the form’s details. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form format.

Form popularity

FAQ

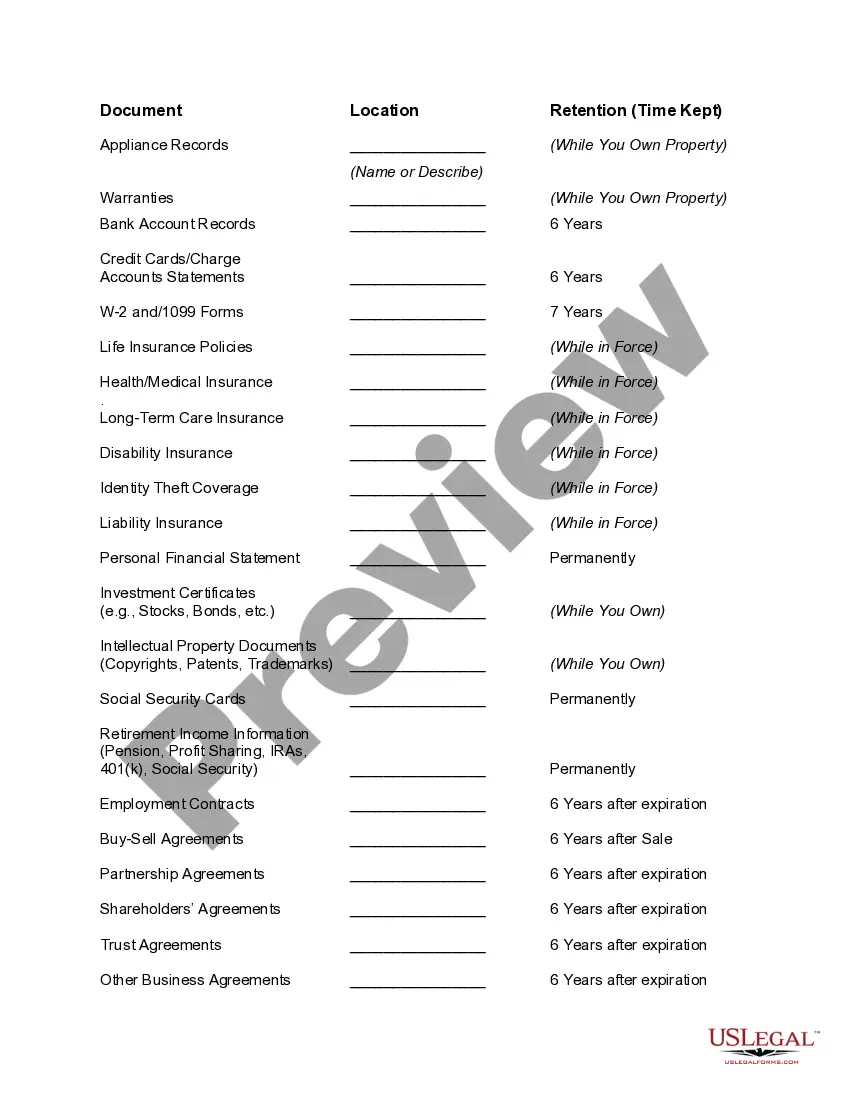

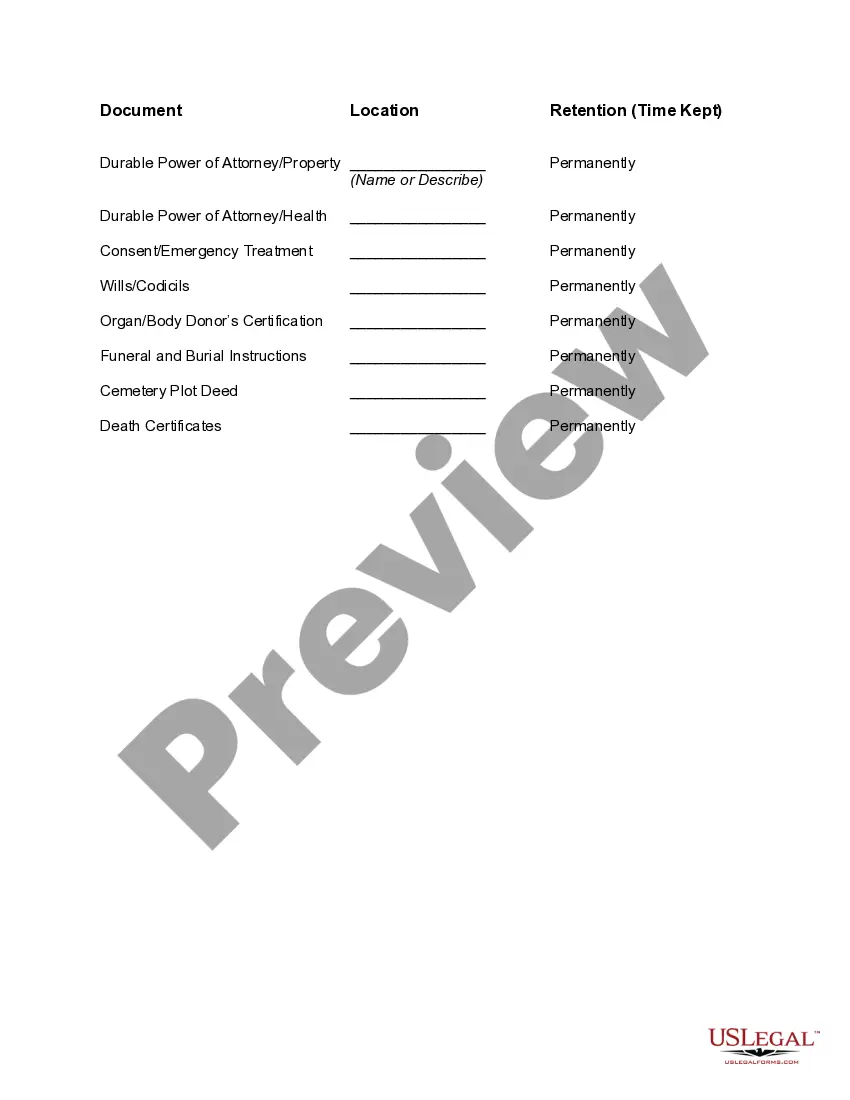

A retention period (associated with a retention schedule or retention program) is an aspect of records and information management (RIM) and the records life cycle that identifies the duration of time for which the information should be maintained or "retained," irrespective of format (paper, electronic, or other).

To be on the safe side, McBride says to keep all tax records for at least seven years. Keep forever. Records such as birth and death certificates, marriage licenses, divorce decrees, Social Security cards, and military discharge papers should be kept indefinitely.

There are different health and safety records retention periods to be aware of, but as a rule of thumb, most health and safety records should be kept for five years. Risk assessment records should be kept as long as the particular process or activity that the record refers to is still being performed.

Records typically fall into four categories: those securing property such as titles or shares; those that mark certain crucial events such as businesses incorporations; those used for assessing operations; and those collected or retained in compliance with government regulation.

Records Retention Guideline #4: Keep everyday paperwork for 3 yearsMonthly financial statements.Credit card statements.Utility records.Employment applications (for businesses)Medical bills (in case of insurance disputes)

A comprehensive document retention policy would have directed the company to its relevant documents. Any policy should also state the names of the custodian(s) of the information and should list the types of servers and backup tapes that are used.

6.2 Retention times for specific records are defined in Table 1, unless otherwise specified quality records shall be retained for 10 years. In no case shall the retention time be less than seven years after final payment on the associated contract.

The records must be maintained at the worksite for at least five years. Each February through April, employers must post a summary of the injuries and illnesses recorded the previous year. Also, if requested, copies of the records must be provided to current and former employees, or their representatives.

Accounting and Tax Records For that reason, you should keep most income tax records for seven years. Depending on the nature of your business, it may also be wise to retain insurance policies permanently since claims can occasionally arise from acts that occurred many years in the past.

(also disposition standard), n. The length of time records should be kept in a certain location or form for administrative, legal, fiscal, historical, or other purposes.